Bitcoin has been in a position to make a resurgence in contemporary weeks. The 25,000 USD barrier was once recaptured via Bitcoin costs simply two days in the past, marking the primary time since June 13th.

Bitcoin Poised For New Rally

In June, Bitcoin had its biggest per 30 days decline since 2011, falling over 37.3% to a last price of $19,925. Since then, it has partly recovered its price and nowadays noticed its first take a look at of $25,000.

Bitcoin continues to rule the charts in spite of being down 46.5% from its earlier top, however its dominance has lowered to reasonably beneath 40% versus greater than 50% a couple of months in the past.

BTC/USD trades reasonably under $24okay. Supply: TradingView

Then again, Bitcoin has been quite peacefully fluctuating horizontally during the last two weeks between $22,500 and $24,500. On the identical time, contemporary weeks have observed a vital restoration in each commodities costs and inventory markets. In consequence, the whole monetary markets are experiencing the expected summer time rally.

Since perspective had reached a critical panic state in the midst of June because of the monetary markets’ steep, month-long decline, belief amongst members has a great deal stepped forward all the way through the process the latest rebound. This in and of itself is a well known undergo marketplace development. Then again, it received’t be identified whether or not and the way the bears will go back till round mid-September.

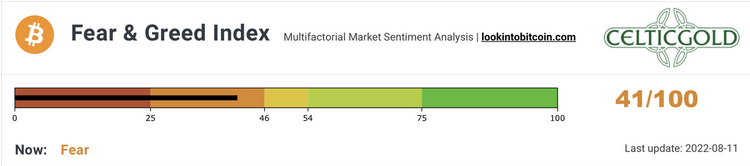

Over the former 4 weeks, the Crypto Worry & Greed Index has made exceptional development. The sentiment continues to be in large part scared, regardless that. Worry nonetheless permeates the cryptocurrency trade seven months after the devastating sell-off.

Crypto Worry & Greed Index, as of August 11th, 2022. Supply: Lookintobitcoin

The sensation of being defeated permeates the broader image as smartly. There are a number of very good contrarian alternatives on this surroundings.

General, there may be nonetheless a contrarian purchase sign because of the scared mindset.

Sharp declines within the monetary markets can be extraordinarily unfavorable to retain the present management in place of job given the midterm elections on November eighth in the USA. In consequence, just a slight decline within the monetary markets in September can be much more likely. The markets may just then upward push from the ones lows till the American election.

Since November 2021, the fairness and cryptocurrency markets were beneath intense force for months, however a large rebound has now been happening for little over 4 weeks. The Nasdaq Composite, which is closely weighted towards generation, has greater via over 20% from its low on June 16th because of this process, including over $420 billion to its marketplace price. This could indicate that the undergo marketplace is formally over.

Comparable Studying: Bitcoin Price Trades A Little Over $24,000, Can It Target $27,000?

Featured symbol from Getty Photographs, chart from TradingView, and Lookintobitcoin

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)