On-chain information presentations the Bitcoin momentary holder habits has endured to show divergence from the cost in fresh weeks.

Bitcoin Quick-Time period Holder SOPR Continues To Transfer Most commonly Sideways

As identified through an analyst in a CryptoQuant post, whilst the cost has long gone down not too long ago, momentary holders have as an alternative made extra income.

The related indicator this is the “Spent Output Profit Ratio” (SOPR), which tells us whether or not the typical Bitcoin investor is recently promoting at a benefit or at a loss.

When the price of this metric is bigger than 1, it method the holders as a complete are transferring cash at some benefit at this time. Alternatively, the SOPR being beneath the edge suggests the total marketplace is understanding an quantity of loss this present day.

Naturally, the indicator having values precisely equivalent to at least one implies the marketplace members are simply breaking-even on their promoting recently.

Now, there’s a cohort within the BTC marketplace known as the “short-term holders” (STHs), which incorporates all buyers who’ve been conserving their cash since lower than 155 days in the past.

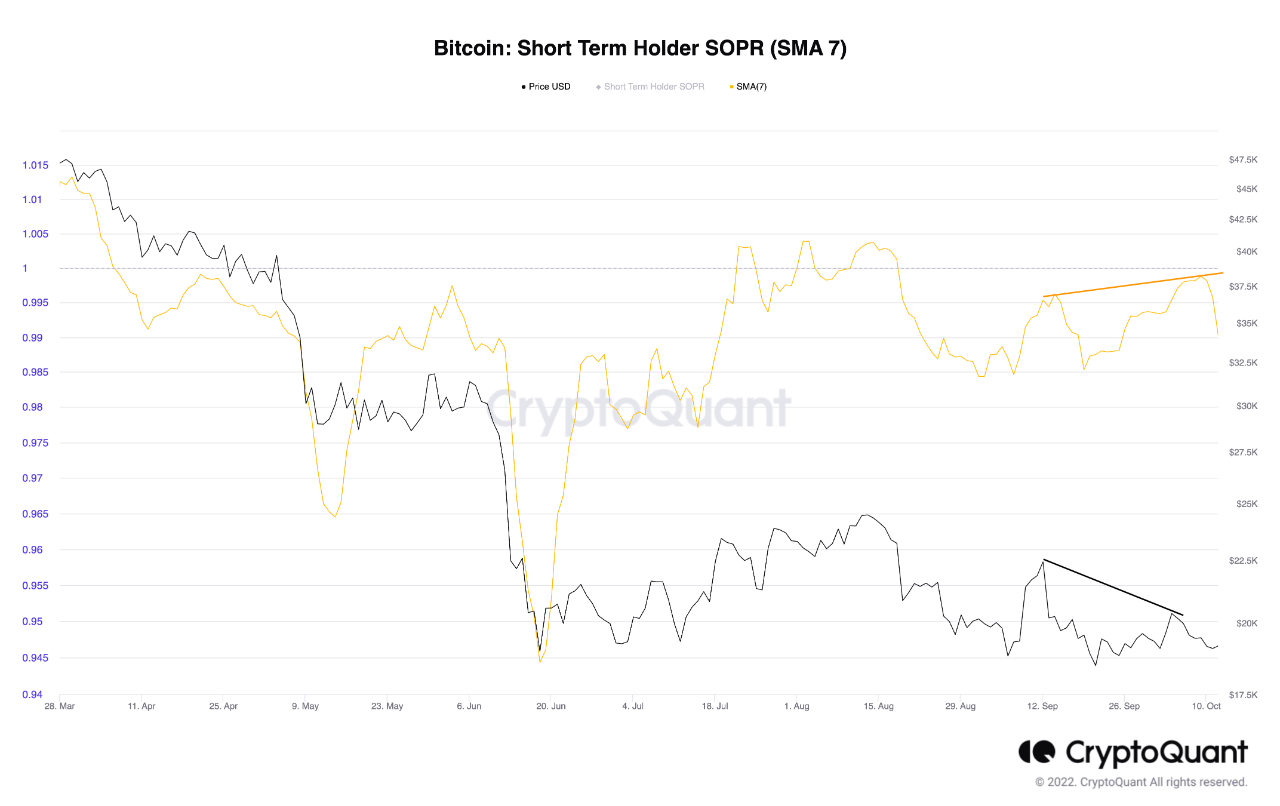

Here’s a chart that presentations the fashion within the 7-day transferring moderate SOPR in particular for this Bitcoin holder team:

Seems like the price of the metric bounced off the 1 mark not too long ago | Supply: CryptoQuant

As you’ll see within the above graph, the Bitcoin momentary holder SOPR is within the area beneath 1 at this time, that means that those buyers were promoting at a loss not too long ago.

The metric has actually been trapped on this zone for a number of months now, because the 1 stage has been offering resistance to it on this length.

Throughout the Might and June crashes, the indicator’s worth spiked down as STHs capitulated and bought at heavy losses. On the other hand, in fresh months, whilst the cost has long gone down (albeit often), the STH SOPR hasn’t proven any indicators of equivalent capitulation.

The quant has marked this divergence within the chart. Fairly than STHs going into deeper losses because of the cost declining, they have got in reality been promoting at fewer losses in fresh weeks as their SOPR has been mountain climbing as much as values just about 1.

BTC Worth

On the time of writing, Bitcoin’s price floats round $19.1k, up 1% within the ultimate week. Over the last month, the crypto has received 4% in worth.

The beneath chart presentations the fashion in the cost of the coin during the last 5 days.

The worth of the crypto turns out to were proceeding its unending consolidation in the previous couple of days | Supply: BTCUSD on TradingView

Featured symbol from Michael Förtsch on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)