Bitcoin used to be introduced in 2009 because of the mistrust within the conventional monetary gadget and the centralized keep watch over of cash. Whilst maximum cryptocurrency fans consider it will at some point exchange bodily money, Bitcoin’s key feature is its volatility. Bitcoin is well known for its worth fluctuations and prime day-to-day volatility and has extremely larger in worth because it got here to the crypto marketplace in 2009.

Since then, traders were in search of techniques to grasp Bitcoin’s volatility and use this knowledge as a trademark of its long run costs. Whilst it is nearly inconceivable to depend on a scientifically confirmed way for purchasing or promoting Bitcoin, there are a number of techniques to grasp its volatility higher and make well-informed making an investment selections.

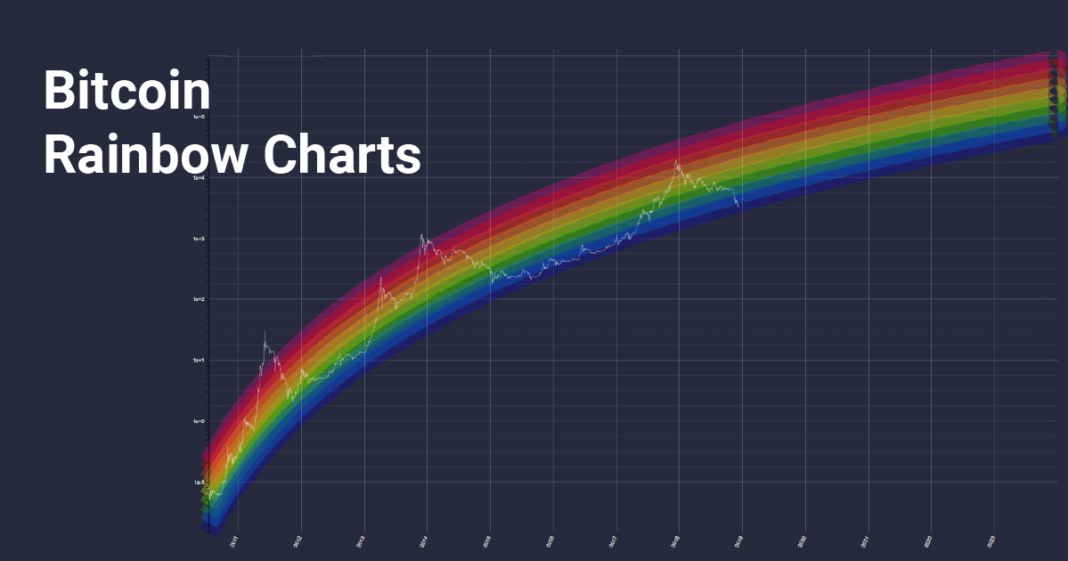

The Bitcoin Rainbow Chart has confirmed to be one such way for successfully measuring marketplace adjustments, knowledge, volatility, and long-term worth actions that can assist you make buying and selling selections. On this article, we’re going to inform you what Bitcoin Rainbow Charts are and easy methods to use them for your benefit.

What Is a Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart is a fundamental logarithmic regression chart representing the Bitcoin worth evolution through the years. The Bitcoin Rainbow Chart is composed of colored bands to suggest when it can be time to shop for, promote, or hang Bitcoin. The rainbow’s decrease sure colour is blue, indicating a drop in Bitcoin worth, whilst the crimson colour is its higher sure, which means an building up in its pricing.

The Rainbow Chart is a long-term valuation software for Bitcoin that gives a standpoint on investor technique to shop for or promote Bitcoin in accordance with the highlighted marketplace sentiment at each and every rainbow colour level.

The Rainbow Chart’s higher colors point out a bullish marketplace and a very good time for strategic traders to promote Bitcoin. However, the decrease colours display that the full marketplace sentiment is down, so it is a nice time to procure extra Bitcoin.

Blockchaincenter.web

Bitcoin Rainbow Chart Historical past

The primary part of the Bitcoin Rainbow Chart used to be created in 2014 through Reddit consumer “azop” and posted on-line. It used to be designed in a amusing technique to display the BTC worth pattern through the years. The chart used to be so vibrant and unusually correct that it used to be named the Bitcoin Rainbow Chart.

Unique rainbow chart through Reddit consumer azop

In the similar yr, a logarithmic regression fashion used to be presented through a Bitcoin Communicate consumer, trolololo. It used to be a statistical fashion indicating that the majority cryptocurrencies reduced or larger impulsively initially sooner than slowing down through the years. This logarithmic regression used to be added to the BTC logarithmic chart, giving the Bitcoin Rainbow Chart a curve. First, the curve rose sharply sooner than starting to stage out ultimately.

Unique logarithmic regression through Bitcoin Communicate consumer trolololo

How you can Interpret Bitcoin Rainbow Chart

Whilst the Bitcoin Rainbow Chart cannot be predictive, it has in large part been right kind during the historical past of BTC.

The Rainbow worth chart incorporates 9 separate colour bands, corresponding to:

Blue: BTC is in a fireplace sale Bluish-Inexperienced: Purchase zoneGreen: Reasonable gather purchase zoneLight Inexperienced: Nonetheless cheapYellow: Dangle BTC Gentle Orange: Is that this a bubble?Darkish Orange: FOMO intensifiesRed: Promote BTCDark Pink: Most bubble territory.

How Correct Is the BTC Rainbow Chart

Whilst the BTC Rainbow Chart is in accordance with the newest knowledge and gives comparison of adoption charge, velocity, and solid worth at some point, the regression traces are generally drawn on prime timeframes. So, they do not want to be adjusted ceaselessly and cannot be used for momentary predictions. The traces in a logarithmic regression chart are drawn in accordance with the decrease and higher costs of the markets, but when the fee is buying and selling in the midst of those bounds, it turns into very unreliable.

Then again, the Rainbow Chart has many options to expect long run effects for the BTC worth. Previous Bitcoin worth actions point out that each time there used to be a Bitcoin halving, the fee could be adjusted upper to the Darkish Pink band. The new Bitcoin halving used to be on Might 11, 2022, and the fee moved to the Darkish Orange colour band, which means FOMO and time to promote. As the following Bitcoin halving is predicted to occur in the midst of 2024, you could stay observe of long run predictions and use this information to go into or go out a business accordingly.

Tip: Bitcoin halving signifies that the velocity of recent Bitcoin coming into the marketplace is diminished, which slows down the inflation of Bitcoin itself.

Moreover, the rainbow Chart is acceptable to different cryptocurrencies, i.e., an Ethereum Rainbow Chart can be utilized for insights into the Ethereum worth through ETH traders.

Conclusion

The Rainbow chart might be a very good software for customers if mixed with different crypto buying and selling signs, such because the Concern and Greed Index, RSI (relative power index), and so on. You’ll be able to use the logarithmic regression curves to search out Bitcoin’s “Truthful worth,” i.e., the herbal regression of the cost of

Bitcoin used to be introduced in 2009 because of the mistrust within the conventional monetary gadget and the centralized keep watch over of cash. Whilst maximum cryptocurrency fans consider it will at some point exchange bodily money, Bitcoin’s key feature is its volatility. Bitcoin is well known for its worth fluctuations and prime day-to-day volatility and has extremely larger in worth because it got here to the crypto marketplace in 2009.

Since then, traders were in search of techniques to grasp Bitcoin’s volatility and use this knowledge as a trademark of its long run costs. Whilst it is nearly inconceivable to depend on a scientifically confirmed way for purchasing or promoting Bitcoin, there are a number of techniques to grasp its volatility higher and make well-informed making an investment selections.

The Bitcoin Rainbow Chart has confirmed to be one such way for successfully measuring marketplace adjustments, knowledge, volatility, and long-term worth actions that can assist you make buying and selling selections. On this article, we’re going to inform you what Bitcoin Rainbow Charts are and easy methods to use them for your benefit.

What Is a Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart is a fundamental logarithmic regression chart representing the Bitcoin worth evolution through the years. The Bitcoin Rainbow Chart is composed of colored bands to suggest when it can be time to shop for, promote, or hang Bitcoin. The rainbow’s decrease sure colour is blue, indicating a drop in Bitcoin worth, whilst the crimson colour is its higher sure, which means an building up in its pricing.

The Rainbow Chart is a long-term valuation software for Bitcoin that gives a standpoint on investor technique to shop for or promote Bitcoin in accordance with the highlighted marketplace sentiment at each and every rainbow colour level.

The Rainbow Chart’s higher colors point out a bullish marketplace and a very good time for strategic traders to promote Bitcoin. However, the decrease colours display that the full marketplace sentiment is down, so it is a nice time to procure extra Bitcoin.

Bitcoin Rainbow Chart Historical past

The primary part of the Bitcoin Rainbow Chart used to be created in 2014 through Reddit consumer “azop” and posted on-line. It used to be designed in a amusing technique to display the BTC worth pattern through the years. The chart used to be so vibrant and unusually correct that it used to be named the Bitcoin Rainbow Chart.

In the similar yr, a logarithmic regression fashion used to be presented through a Bitcoin Communicate consumer, trolololo. It used to be a statistical fashion indicating that the majority cryptocurrencies reduced or larger impulsively initially sooner than slowing down through the years. This logarithmic regression used to be added to the BTC logarithmic chart, giving the Bitcoin Rainbow Chart a curve. First, the curve rose sharply sooner than starting to stage out ultimately.

How you can Interpret Bitcoin Rainbow Chart

Whilst the Bitcoin Rainbow Chart cannot be predictive, it has in large part been right kind during the historical past of BTC.

The Rainbow worth chart incorporates 9 separate colour bands, corresponding to:

- Blue: BTC is in a fireplace sale

- Bluish-Inexperienced: Purchase zone

- Inexperienced: Reasonable gather purchase zone

- Gentle Inexperienced: Nonetheless reasonable

- Yellow: Dangle BTC

- Gentle Orange: Is that this a bubble?

- Darkish Orange: FOMO intensifies

- Pink: Promote BTC

- Darkish Pink: Most bubble territory.

How Correct Is the BTC Rainbow Chart

Whilst the BTC Rainbow Chart is in accordance with the newest knowledge and gives comparison of adoption charge, velocity, and solid worth at some point, the regression traces are generally drawn on prime timeframes. So, they do not want to be adjusted ceaselessly and cannot be used for momentary predictions. The traces in a logarithmic regression chart are drawn in accordance with the decrease and higher costs of the markets, but when the fee is buying and selling in the midst of those bounds, it turns into very unreliable.

Then again, the Rainbow Chart has many options to expect long run effects for the BTC worth. Previous Bitcoin worth actions point out that each time there used to be a Bitcoin halving, the fee could be adjusted upper to the Darkish Pink band. The new Bitcoin halving used to be on Might 11, 2022, and the fee moved to the Darkish Orange colour band, which means FOMO and time to promote. As the following Bitcoin halving is predicted to occur in the midst of 2024, you could stay observe of long run predictions and use this information to go into or go out a business accordingly.

Tip: Bitcoin halving signifies that the velocity of recent Bitcoin coming into the marketplace is diminished, which slows down the inflation of Bitcoin itself.

Moreover, the rainbow Chart is acceptable to different cryptocurrencies, i.e., an Ethereum Rainbow Chart can be utilized for insights into the Ethereum worth through ETH traders.

Conclusion

The Rainbow chart might be a very good software for customers if mixed with different crypto buying and selling signs, such because the Concern and Greed Index, RSI (relative power index), and so on. You’ll be able to use the logarithmic regression curves to search out Bitcoin’s “Truthful worth,” i.e., the herbal regression of the cost of an asset, inventory, or crypto coin.

Then again, whilst colour bands observe a logarithmic regression, they’re in a different way principally arbitrary and with none clinical foundation.

Enroll with CoinStats to test the “Bitcoin Rainbow Chart” on our website online and keep up to the moment on all crypto information!

Funding Recommendation Disclaimer: The tips contained in this web page is supplied to you only for informational functions and does no longer represent a advice through CoinStats to shop for, promote, or hang any securities, monetary product, or software discussed within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or every other form of recommendation. Our knowledge is in accordance with impartial analysis and might fluctuate from what you notice from a monetary establishment or carrier supplier.

Investments are matter to marketplace chance, together with the conceivable lack of foremost. Cryptocurrency is a extremely risky marketplace delicate to secondary job, do your impartial analysis, download your personal recommendation, and handiest make investments what you’ll manage to pay for to lose. There are important dangers taken with buying and selling CFDs, shares, and cryptocurrencies. Between 74-89% of retail investor accounts lose cash when buying and selling CFDs. Previous efficiency isn’t a sign of long run effects.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)