Bitcoin on-chain knowledge presentations exchanges this week have noticed the most important inflows since July 2021, taking the cost of the crypto to $33ok.

Bitcoin Trade Inflows Spike Up To Best Worth Since July 2021

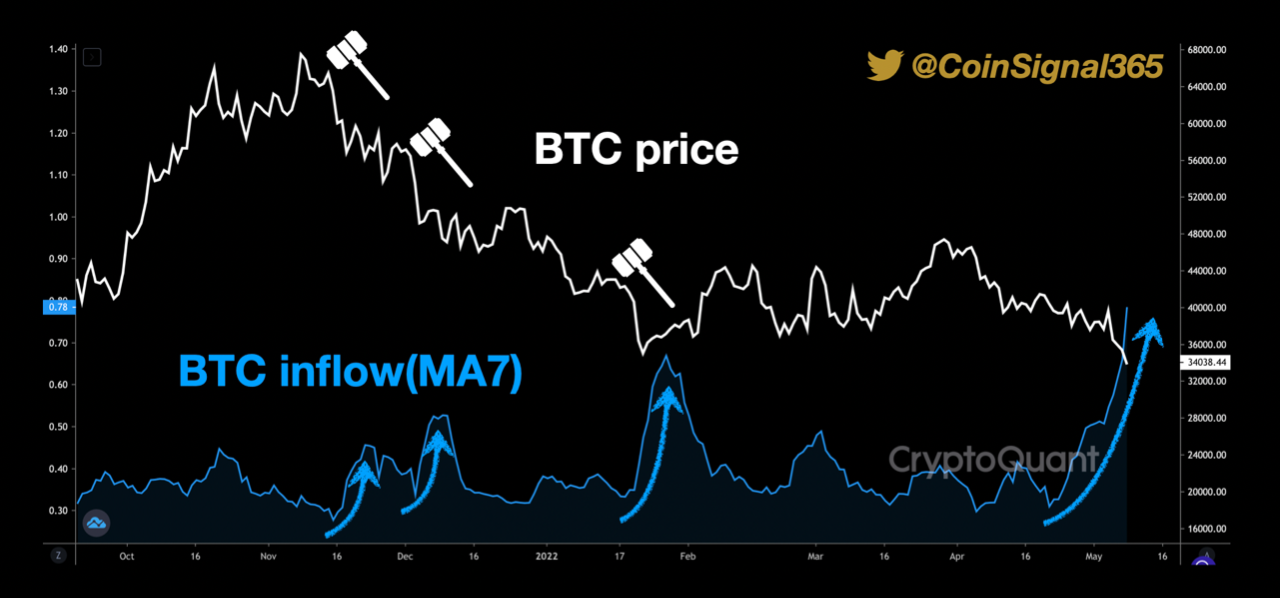

As identified via an analyst in a CryptoQuant post, the BTC trade inflows have noticed a pointy build up not too long ago.

The “all exchanges inflow” is a trademark that measures the overall quantity of Bitcoin shifting into trade wallets.

When the worth of this metric rises, it approach increasingly more cash are shifting into exchanges. This type of pattern is also bearish for the cost of the crypto as buyers generally deposit their BTC to exchanges for promoting functions.

Similar Studying | TA: Ethereum Bears Aim Big After Recent Breakdown Below $2.5K

Alternatively, low values of the indicator counsel that now not a lot promoting on exchanges is occurring at the moment. This pattern, when extended, can end up to be bearish for the worth of the coin.

Now, here’s a chart that presentations the rage within the Bitcoin trade inflows over the last a number of months:

Seems like the worth of the metric has shot up not too long ago | Supply: CryptoQuant

As you’ll be able to see within the above graph, the 7-day reasonable price of the Bitcoin trade influx has noticed a spike this week.

The present price of the indicator is the easiest it’s been since July of ultimate yr, round when the coin bottomed round $29ok.

Similar Studying | Terra Beats Tesla As Second-Largest Corporate Bitcoin Holder After $1.5B Purchase

Having a look on the chart, it kind of feels like in the previous few months each time the influx has spiked up, the cost has additionally declined with it.

This time as smartly it seems like the heavy promoting on exchanges has performed a component within the present plunge of Bitcoin underneath $33ok.

The metric’s price nonetheless appears to be emerging, so it’s imaginable the coin would possibly apply additional decline within the close to time period, till the 7-day MA influx tops out.

BTC Value

On the time of writing, Bitcoin’s price floats round $32.9k, down 14% within the ultimate seven days. Over the last month, the crypto has misplaced 22% in price.

The underneath chart presentations the rage in the cost of the coin during the last 5 days.

The cost of BTC turns out to have plummeted down over the previous few days | Supply: BTCUSD on TradingView

Bitcoin’s apparently unending consolidation appears to have after all damaged down because the coin has noticed some sharp downtrend prior to now week.

Nowadays, it’s unclear whether or not the crypto is nearing a backside or if extra decline is coming. If the inflows proceed to extend, then the latter state of affairs is much more likely to play out.

Featured symbol from Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)