Bitcoin value loses 17% as Ukraine battle/Fed weigh on enlargement potentialities. Tron is an extraordinary winner on

$39m DAO acquire. Stablecoin pegs harm.

BTC

Bitcoin slumped to its lowest value since July 2021 as markets proceed to drop at the Ukraine battle. The cost of BTC was once buying and selling across the $32,000 stage on Monday and there’s a threat of additional capitulation round the important thing $30okay beef up ranges.

Only some cash have been within the inexperienced for the week as the truth of tighter financial coverage hits funding urge for food. The Federal Reserve, Financial institution of England, and Australian Reserve Financial institution all raised rates of interest within the closing week on my own as traders head for the exits on enlargement shares.

For Bitcoin, that supposed surrendering the $40okay stage which has propped up the crypto marketplace over the previous couple of weeks.

Liquidations on crypto futures exceeded $411 million previously 24 hours, consistent with the newest information from exchanges. Round $140 million of that was once from Bitcoin futures, whilst $121 million got here from Ethereum.

Bitcoin’s weekend declines got here as TerraUSD (UST) misplaced its peg to the buck. The autumn worsened on Sunday night as Asian fairness markets and US inventory index futures opened with heavy losses. Fears proceeding to develop among traders in regards to the financial reaction to surging inflation around the globe. Japan’s Nikkei closed 2.5% decrease, whilst Ecu and US shares additionally suffered.

Bitcoin has lengthy tracked the opposite asset categories and surged in 2021 with a weaker buck. That industry is now going into opposite as traders search safe-haven belongings.

Kurt Grumelart, a dealer at crypto fund Zerocap, mentioned on Twitter.

Skilled cash managers don’t seem to be loading up on high-risk enlargement belongings lately.

Bitcoin has beef up at $30okay but when that fails to carry then there may be room to drop to the $20okay stage if the chance outlook worsens.

TRX

Tron was once an extraordinary gainer this week with an 18% development. TRX was once ready to greenback the bearish sentiment after information that the Tron DAO could be buying up $39m of the coin for its reserves.

A complete of 504,600,250 TRX tokens have been bought at a median charge of $0.07727 to construct the USDD stablecoin reserves. The group at Tron DAO, which is the arena’s biggest decentralized self reliant group, introduced that the acquisition of TRXs was once made to reinforce its USDD stablecoin reserves as directed by means of the founder Justin Solar to again the stablecoin with $10 billion value of virtual belongings.

A statement on Twitter mentioned:

To safeguard the total blockchain business and crypto marketplace, TRON DAO Reserve have purchased 504,600,250 TRX at 0.07727 reasonable value with 38,993,043 USD.

Challenge builders are beginning to panic as liquidations from the crypto business threaten their stablecoins.

The cost of TRX moved to $0.09 at the week, however the coin has misplaced some flooring with Monday’s promoting.

LUNA

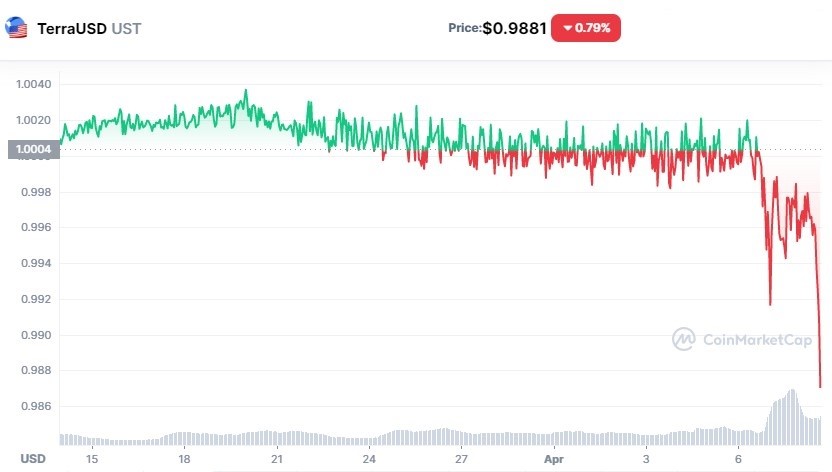

Fresh issues for LUNA have intensified because the challenge’s stablecoin loses its 1:1 peg to the United States buck.

In a bid to shore up the stricken coin, the Luna Basis Guard (LFG), a non-profit supporting Terra (LUNA), has pledged to lend $1.Five billion in crypto to give protection to its local stablecoin.

The group’s council voted to lend out $750 million in Bitcoin from its reserves and $750 million in TerraUSD (UST) in an try to stay UST pegged to $1.

That isn’t supporting the marketplace but, with the stablecoin buying and selling at fresh lows round $0.985. The mortgage capital could be used to shop for UST if the asset continues to fall beneath its peg.

Because the chart on fresh value motion displays, the stablecoin was once buying and selling conveniently above the $1.00 stage however has since misplaced a few of its balance.

One whale investor was once observed dumping $285 million of the UST coin and additional promoting will harm the $1.5bn protection efforts.

The unfavorable sentiment additionally hit the LUNA coin with a 17% loss bringing the present value to round $52.

META

Meta CEO Mark Zuckerberg showed in a video on Monday that Instagram will start trying out non-fungible token (NFT) integrations this week.

The corporate has decided on the Ethereum, Polygon, Solana, and Float blockchains for the check.

We’re beginning construction for NFTs no longer simply in our metaverse and Fact Labs paintings, but additionally throughout our circle of relatives of apps. We’re going to convey equivalent capability to Fb quickly.

The corporate says it is usually running on 3-dimensional, augmented fact NFTs with its Spark AR instrument, which can to start with be suitable with Instagram tales.

In a Twitter thread posted by means of a Meta consultant, the corporate mentioned the suitable third-party wallets might be MetaMask, Rainbow, and TrustWallet for starters. Instagram will to start with beef up Ethereum-based NFTs, with integrations for Polygon, Solana and Float to be added at a later date, consistent with the similar put up.

The Monetary Instances up to now reported that Meta would practice up its NFT pilot on Instagram with minting and staff club choices on Fb.

Disclaimer: data contained herein is supplied with out taking into account your own instances, due to this fact must no longer be construed as monetary recommendation, funding advice or an be offering of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)