Knowledge displays whilst Bitcoin has been correlated with the United States inventory marketplace for a while now, the 2 haven’t moved in tandem lately.

Bitcoin Correlation With US Shares Might Be Weakening As BTC Has Been Transferring In a different way

As identified by means of an analyst in a CryptoQuant post, BTC has long gone down up to now week whilst shares have made some good points.

A “correlation” between two belongings (or markets) exists when each their costs apply the similar common development over a time period.

For Bitcoin, there was a powerful correlation with the United States inventory marketplace right through the ultimate couple of years or so. The rationale in the back of the markets turning into so tied is the upward push of institutional buyers within the crypto.

Such buyers view BTC as a chance asset and pull out of the coin once there may be macro uncertainty looming over the marketplace (therefore using the crypto’s worth down at the side of the shares).

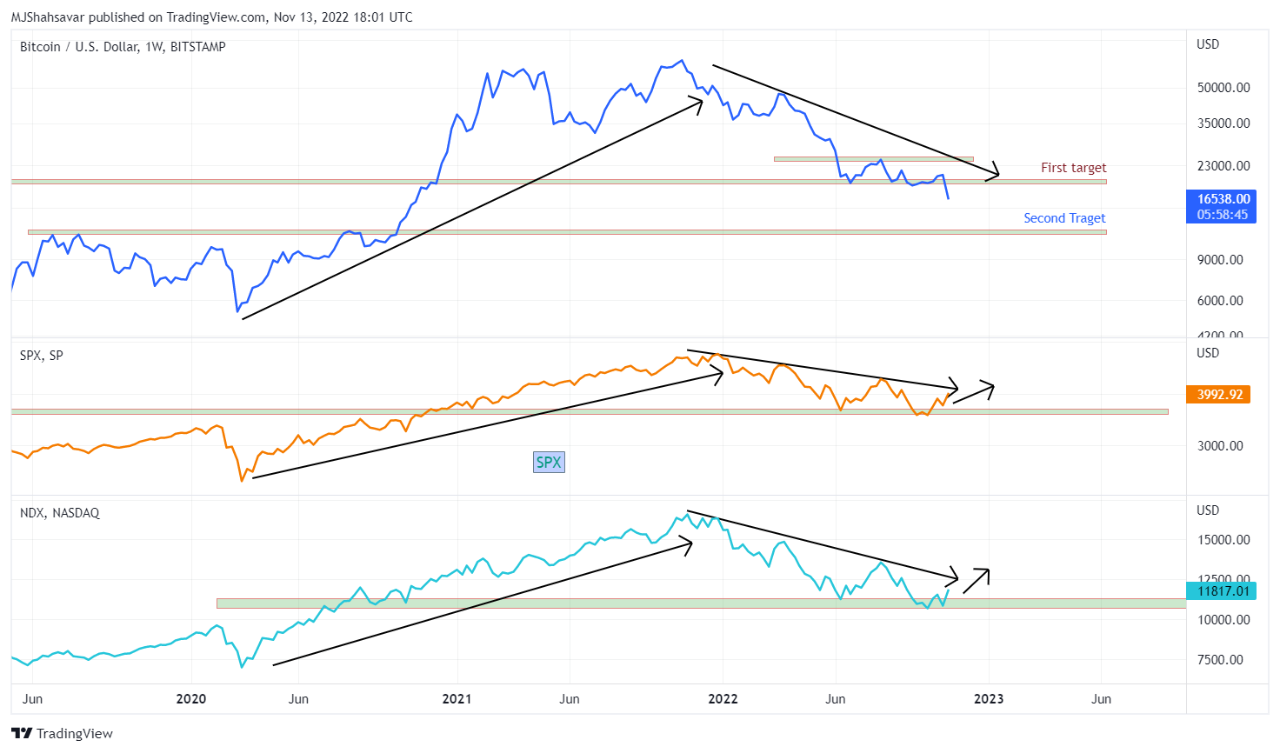

Here’s a chart that displays the costs of Bitcoin, S&P 500, and NASDAQ over the previous couple of years:

Seems like the belongings have adopted equivalent tendencies in recent years | Supply: CryptoQuant

As you’ll see within the above graph, Bitcoin wasn’t correlated with the inventory marketplace in 2019 and early 2020, but it surely all modified when COVID struck.

After the black swan crash that happened in March 2020, the cost of BTC began following S&P 500 and NASDAQ.

Although, whilst BTC confirmed a similar common long-term development, the crypto persisted to be a lot more extremely risky than the shares.

The correlation has persisted during the undergo marketplace, however the ultimate week or so has became out other.

Whilst the US stock market has noticed some uplift up to now 7 days, Bitcoin has as a substitute taken a pointy plummet.

Those markets appearing other habits lately may recommend the correlation between them is also lowering.

With the newest plunge, BTC has additionally misplaced the fortify line of the former all-time top, one thing that hasn’t ever came about within the earlier cycles.

The quant within the submit notes that this contemporary development is an indication of weak spot within the crypto marketplace, which might result in additional downtrend within the close to long term.

BTC Worth

On the time of writing, Bitcoin’s worth floats round $16.5k, down 20% within the ultimate week. Over the last month, the crypto has misplaced 15% in price.

The beneath chart displays the rage in the cost of the coin during the last 5 days.

The worth of the crypto turns out to have remained beneath $17okay in contemporary days | Supply: BTCUSD on TradingView

Featured symbol from André François McKenzie on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)