Within the ongoing market turbulence on larger timeframes, Bitcoin (BTC) is at an important juncture as an excellent consolidation section persists.

Analysis and evaluation agency Materials Indicators intently monitored the latest weekly candle shut/open, paying explicit consideration to two key components: the development line and the 21-day, 21-week, and 21-month transferring averages (MA) – all of that are at the moment influential in shaping market dynamics.

Uncertainty And Potential Turning Level For Bitcoin

The opening of the weekly candle under the development line triggered a “subsequent nosedive,” amplifying considerations. Whereas the 21-week and 21-month transferring averages proceed to function sturdy assist, the 21-day MA has confronted a rigorous seven-day testing interval, in accordance with the agency’s evaluation.

Notably, the tight correlation of the 21-MA throughout three distinct time frames is uncommon, indicating that the market is at a vital inflection level.

Regardless of the compressed volatility witnessed in latest days, the worth motion noticed over the previous 24 hours exemplifies the market’s try and shake out weak palms.

In accordance with Materials Indicators, given the complexity of the present worth motion, it’s prudent to zoom out and achieve a broader perspective. Each Pattern Precognition algorithms recognized these strikes on the four-hour chart, emphasizing the importance of adopting a complete outlook.

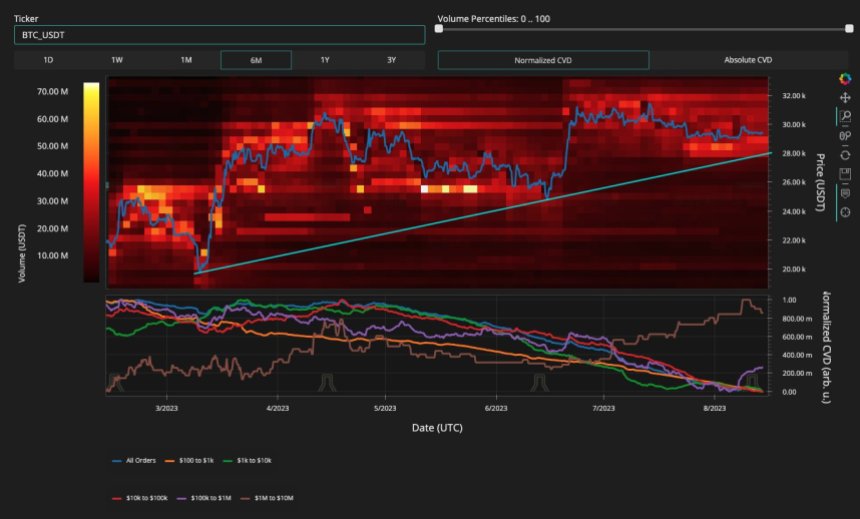

Furthermore, in accordance with Supplies, the order ebook reveals a regarding development in bid liquidity, with lower than $40 million holding the worth up.

The absence of considerable liquidity under this degree raises elementary worries. Nevertheless, it additionally means that there might not be ample sentiment to drive costs considerably decrease – at the least not but.

As well as, Materials Indicators highlights that the examination of liquidity actions inside the order ebook over the previous month paints an image of continued worth volatility with a possible upward bias.

Nevertheless, the dearth of quantity raises considerations concerning the market’s general well being. Regardless of a $13 million purchase wall at $27,900, the underside of the channel at $28,300 stays a vital threshold for BTC to increase its present development. The agency claims:

… the underside of the channel at $28.3k stays my line within the sand for BTC to increase the development, and I keep that we should see weekly candles printing above the 100-Week MA to even think about a bull breakout.

BCT Faces Renewed Strain Amid Strengthening US Greenback

As Bitcoin enters a brand new week of buying and selling, market contributors intently monitor the potential impression of the strengthening US Greenback Index ($DXY) on the world’s main cryptocurrency.

In accordance to Yan Alleman, co-founder of blockchain analytics agency Glassnode, latest developments counsel that BTC could face renewed strain because of the upward momentum of the $DXY.

Alleman highlights that the $DXY’s renewed power might exert downward strain on Bitcoin’s worth. Traditionally, there was an inverse correlation between the worth of the US Greenback and the worth of BTC, which means that when the greenback strengthens, Bitcoin usually faces headwinds.

Nevertheless, choices pricing signifies a bullish sentiment for Bitcoin within the coming month. Choices are monetary derivatives that permit merchants to invest on the long run worth of an underlying asset, on this case, Bitcoin.

The pricing of choices contracts suggests an expectation of a bullish transfer shortly. This aligns with the technical evaluation indicating potential upside for Bitcoin.

Analyzing the potential worth actions, Alleman notes that it will require practically twice as a lot promoting strain to push Bitcoin all the way down to the low $28,000 vary in comparison with the shopping for strain wanted to surpass the $30,000 degree.

This remark means that there could also be larger assist and shopping for curiosity at larger worth ranges, making a sustained drop much less possible.

As of the time of writing, Bitcoin (BTC) is buying and selling at $29,500, reflecting a marginal 0.4% improve over the previous 24 hours.

Featured picture from iStock, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)