Sign up for Our Telegram channel to stick up to the moment on breaking information protection

Bitcoin (BTC) worth continues to industry inside the confines of a descending parallel channel, including credence to the present bearish marketplace stipulations. Huge quantity transactions valued above $1 million have additionally reached a ancient low as pastime for BTC amongst whales continues to go to pot.

The biggest asset via marketplace cap available in the market is witnessing traditionally low volatility, such a lot in order that miners have bought virtually all Bitcoin mined right through 2022. The result has sparked a debate over whether or not the gross sales created a power headwind for Bitcoin´s worth. César Nuez, a technical analyst at Bolsamanía weighs in in this debate arguing:

Bitcoin maintains a sophisticated technical glance. The ‘crypto’ continues to form a pullback to 18,000 and the entirety turns out to suggest that lets finally end up seeing an assault at the $14,925 give a boost to. If it loses this worth degree, essentially the most customary factor is that we can finally end up seeing an extension of the falls to $10,000.

On Wednesday, December 28, BTC losses exceeded 1.27% to carry the massive crypto additional clear of the $17,000 resistance degree. The present worth of Bitcoin is $16,644, which is considerably less than its pre-crash worth, however the quintessential crypto nonetheless ranks first with a marketplace cap of $321 billion, consistent with data from CoinMarketCap.

Bitcoin Whale Process Hints A Persevered Worth Drop

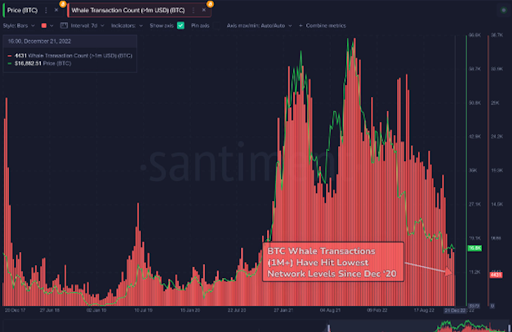

Huge pockets buyers and their actions at the Bitcoin community have usually influenced the BTC worth. Consistent with information from crypto intelligence tracker Santiment, Bitcoin’s ranging costs overlapped with declining whale pastime.

Bitcoin Whale Transactions

As can also be observed within the chart, Bitcoin worth correlates with transactions value $1 million or extra. Analysts at Santiment imagine that if the cost of the flagship crypto continues to dip whilst whale transactions are losing, then this may mark a historical bearsh sign for the biggest asset via marketplace cap.

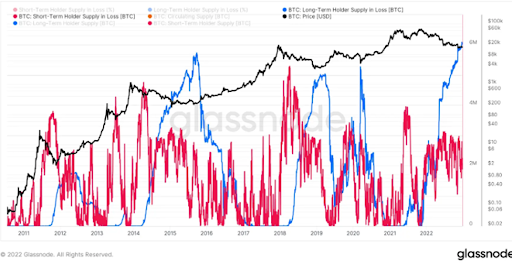

In the middle of stark worth drops for the folk’s crypto, holders proceed to nurse their losses. From the chart, Bitcoin hodlers sit down on a ancient eight million BTC in unrealized losses.

On-chain analytics company Glassnode has additionally printed information appearing that each non permanent and long-term holders sit down on extra unrealized losses than ever ahead of.

BTC Brief-term Holder Suply

Alternatively, the turnout information a an important milestone within the BTC worth pattern amid the present endure marketplace and issues to the potential for whale job and massive quantity transactions triggering a breakout for Bitcoin, if whale transactions building up therefore forth.

Bitcoin Worth Supressed By way of The 50 SMA

Bitcoin worth motion presentations that the virtual asset has been in a consolidating between the $16,415 give a boost to degree and the $16,936 barrier for the ultimate 8 days. That is validated via the knocking down of the relative energy index (RSI) and the horizontal motion of the transferring moderate convergence divergence indicator (MACD) on the subject of the 0 line. This prompt that the purchasing and promoting drive have been balancing out.

The Bitcoin worth was once buying and selling at $16,644 at presstime, down 1% p.c within the ultimate 24 hours. The research additionally signifies that the crypto was once buying and selling in 2nd directly bullish consultation as bears focal point on demoting the flagship asset additional down.

Within the brief time period, the bearish momentum is predicted to proceed. The most important give a boost to degree for the BTC worth is at $16,415. Larger overhead drive may see the coin drop decrease towards the $16,000 mental degree or the decrease boundary of the present chart trend at $15,474.

BTC/USD Day by day Chart

At the upside, the 50-day easy transferring moderate (SMA) at the day-to-day chart is right now the speedy hurdle that the BTC bulls have been preventing, and if damaged, would see the cost damage previous the resistance introduced via the higher pattern line of the channel across the $16,936 space.

In extremely bullish circumstances, Bitcoin worth might upward push to satisfy the following resistance at $17,500. However, the asset would have a large number of flooring to hide ahead of attaining its primary resistance degree embraced via the 100-day SMA sitting at $18,220. Any further positive factors may push the cost in opposition to the $20,000 zone the place the 200-day SMA lies.

Within the brief time period, the pioneer cryptocurrency might proceed consolidating within the mentioned vary till a directional bias is established.

Different Initiatives To Imagine in 2023

The consistent state of volatility function of the crypto marketplace is known. Accordingly, buyers make fortunes and losses with every upward push and fall. Alternatively, there’s no want to gnaw your nails or be troubled in nervousness, hoping your funding methods will repay so you’ll be able to earn greater than what you lose. With the best venture, the possibilities of creating a benefit are upper, and amid this monetary uncertainty, those new tokens constitute a ray of hope.

Sprint 2 Business (D2T)

Sprint 2 Business is a cryptocurrency platform providing vital equipment and skilled cryptocurrency insights that may upscale your buying and selling. By way of handing over a very good crypto analytics dashboard, Sprint 2 Business gives customers complete get entry to to a competent scoring gadget for cryptocurrency preliminary coin choices (ICOs), skilled marketplace and social research, buying and selling indicators, social and technical signs, and Auto Buying and selling API, amongst others.

Lately, over 82% of the presale tokens have already been bought, with the platform elevating $11 million.

🚨ANNOUNCEMENT🚨

‼️A brand new milestone completed!!

🔥$11 Million raised🔥

We’re already in level 4, the FINAL level of our presale! 🔥🚀

Hurry up and sign up for the presale now – ahead of the alternate listings⬇️https://t.co/PMdwCfAHt1 pic.twitter.com/RIGdqFyMEu

— Sprint 2 Business (@dash2_trade) December 27, 2022

The presale will finish inside the subsequent 8 days and the primary CEX list will move survive January 11, 2023.

C+Price (CCHG)

C+Price is among the maximum progressive inexperienced crypto initiatives that experience taken off within the crypto marketplace. It defines a brand new blockchain-based peer-to-peer (P2P) cost gadget for electrical car (EV) charging.

With C-Price, customers pay for the facility on their stations with the venture’s software crypto coin dubbed CCHG, and for each rate of the facility, the person is rewarded with carbon credit. On this means, customers can give a contribution to the aid of carbon fuel emissions whilst on the similar time making a living.

#EV drivers can find the closest charging stations with real-time information at the C+Price app with none effort 😎

Fill your luggage with $CCHG to safe your adventure with us 🔥🔥

Sign up for our presale nowadays! ⬇️https://t.co/ixe18bPqzI pic.twitter.com/ZDaWBUjs50

— C+Price (@C_Charge_Token) December 27, 2022

The CCHG presale is recently reside, and you’ll be able to acquire tokens for as low as $0.013 apiece. The next spherical of the presale will carry this worth to $0.0165, and next rounds will do the similar.

Extra Information:

FightOut (FGHT) – Latest Transfer to Earn Challenge

- CertiK audited & CoinSniper KYC Verified

- Early Degree Presale Are living Now

- Earn Loose Crypto & Meet Health Targets

- LBank Labs Challenge

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Sign up for Our Telegram channel to stick up to the moment on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)