Bitcoin has come a great distance since its inception in 2009. From being price lower than a penny initially, it has seen huge development over time with some dramatic ups and downs. At the moment, Bitcoin is rising as a serious various asset class and its future valuation prospects stay optimistic.

This complete information takes a data-driven method to investigate components affecting Bitcoin costs and makes educated projections about its potential highs and lows within the quick, medium and long-term timeframes. With cryptocurrencies gaining mainstream traction, the report goals to supply readability to buyers on what lies forward for Bitcoin costs based mostly on historic patterns and developments.

What’s Bitcoin (BTC)?

Bitcoin is the primary and hottest cryptocurrency on this planet. It was created in 2009 by the pseudonymous Satoshi Nakamoto, who revealed the Bitcoin whitepaper and developed the Bitcoin protocol.

Bitcoin launched blockchain know-how to the world. The Bitcoin blockchain is a public ledger that information all Bitcoin transactions ever made. It’s decentralized, which means no single entity controls it. The blockchain is maintained by a world community of computer systems often called Bitcoin miners.

Key attributes of Bitcoin embody:

Decentralized

No central authority controls Bitcoin. It’s maintained by a distributed community of customers.

Restricted provide

Solely 21 million Bitcoins will ever exist. This shortage offers Bitcoin worth.

Pseudonymous

Bitcoin addresses will not be linked to real-world identities by default, giving customers privateness.

Safe

Bitcoin makes use of cryptography and the blockchain to make sure the safety of funds and possession information.

Divisible

One Bitcoin could be divided into 100 million smaller items known as satoshis, permitting small transactions.

Permissionless

Anybody can use Bitcoin with out the necessity for permission from authorities.

These attributes make Bitcoin distinctive in comparison with conventional fiat currencies and a promising digital asset for funding.

Components Influencing Bitcoin Worth

Many components can have an effect on the value of Bitcoin, resulting in volatility. Some main components embody:

Provide and Demand

Primary financial principle states that when demand will increase whereas provide stays fixed, worth goes up. As extra buyers and establishments undertake Bitcoin, demand rises. However since new Bitcoins are mined at a set price, provide stays regular, driving costs up.

Media Hype and Public Sentiment

Constructive or detrimental media protection and public sentiment can affect demand and worth. For instance, Elon Musk’s tweets on Bitcoin typically result in worth swings based mostly on his views.

Main Protocol Adjustments and Upgrades

Main Bitcoin developments just like the SegWit improve or Lightning Community adoption can enhance Bitcoin’s capabilities and have an effect on worth.

Laws and Authorized Standing

Regulatory crackdowns or acceptance of Bitcoin in numerous international locations impacts worth because it impacts demand.

Whales and Institutional Traders

“Whales” – entities holding giant quantities of Bitcoin – can manipulate costs once they purchase or promote. Elevated institutional funding additionally drives up costs via elevated demand.

Safety Breaches and Scandals

Safety points with exchanges and wallets just like the Mt.Gox hack or malicious enterprise practices just like the FTX collapse can erode investor confidence and depress costs.

Macroeconomic Situations

Financial instability and forex devaluations encourage buyers to purchase Bitcoin as a hedge, boosting its worth. Nevertheless, it has struggled in a hawkish Fed atmosphere and amidst price hikes.

Bitcoin Worth Efficiency within the Previous

previous worth efficiency can present insights into long-term traits and assist predict future costs. Let’s take a stroll down BTC reminiscence lane.

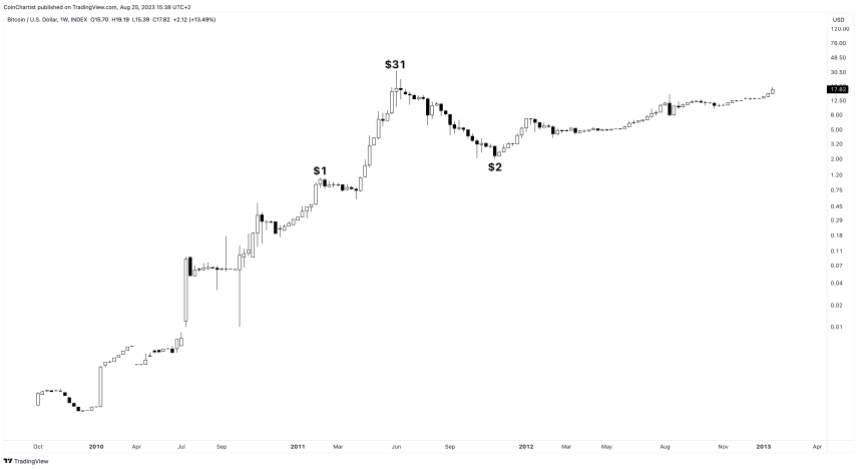

The Early Days – Volatility and Development (2009-2013)

When Bitcoin launched in 2009, it was virtually nugatory. In 2010, Bitcoin went from $0 to $0.39 and was extraordinarily unstable in its early days.

By early 2011, it achieved parity with the US greenback, hitting $1.00 in February 2011. In the identical 12 months, it reached $10 after which $30. This early volatility was attributed to inadequate liquidity, shortage as a result of low Bitcoin provide, and lack of trade infrastructure.

In mid-2011, Bitcoin fell from round $30 to $2 after a collection of trade hacks and thefts shook investor confidence. It took over a 12 months to succeed in $10 once more.

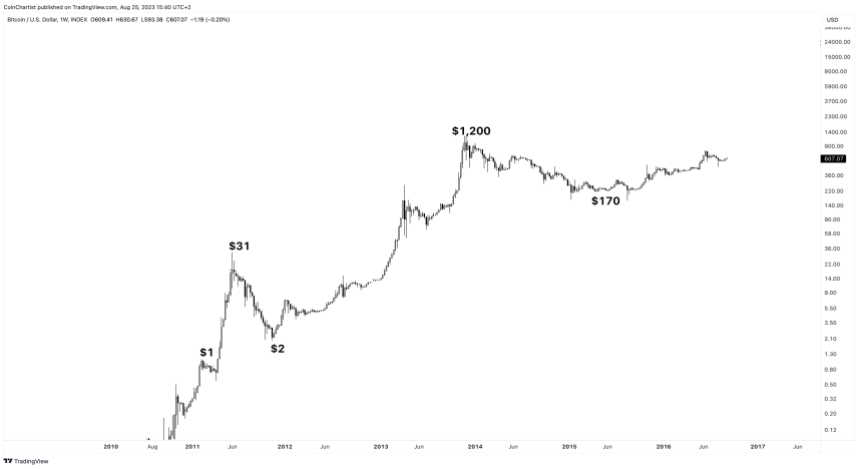

2012 noticed gradual good points as much as $12 but in addition wild fluctuations between $7-$15. In 2013, Bitcoin entered a bull run from $12 to over $1,100 pushed by rising media protection and adoption at nighttime net.

Nevertheless it ended the 12 months round $700 following a China ban on monetary establishments and fee processors coping with Bitcoin. This cycle of fast good points and dramatic crashes would come to outline Bitcoin worth efficiency.

The 2014-2016 Bear Market

2014 kicked off with the collapse of Mt.Gox, then the biggest Bitcoin trade, after a collection of hacks. This erased most good points from 2013 and prompted Bitcoin to fall from round $850 to beneath $350.

For the following two years, Bitcoin hovered within the $200-$300 vary. Elevated regulation and lack of institutional curiosity saved mainstream adoption low throughout this era. Costs had been comparatively secure in comparison with previous volatility.

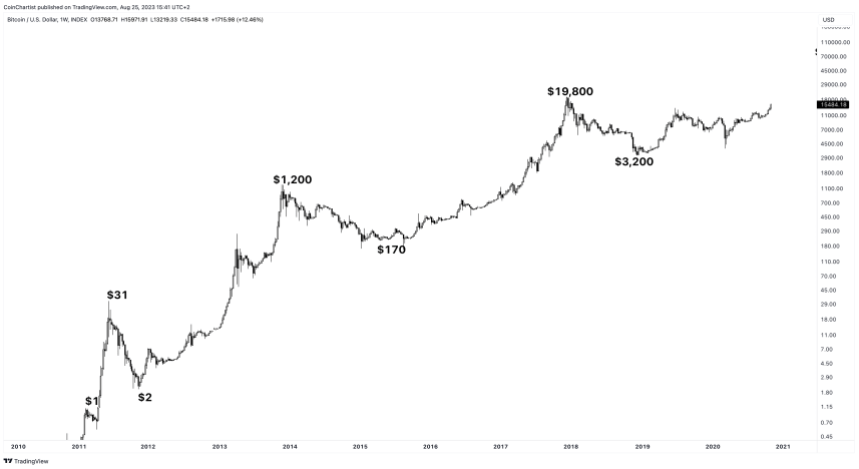

2017 – The Bull Run and Mainstream Mania

2017 marked Bitcoin’s entry into mainstream consciousness and an enormous development in worth to almost $20,000.

A number of components drove this rally:

- Rising media and funding financial institution protection calling Bitcoin “digital gold”

- Elevated adoption in international locations dealing with forex crises like Venezuela and Zimbabwe

- Proposals for Bitcoin ETFs (exchange-traded funds) drew investor consideration

- Launch of Bitcoin futures buying and selling on main exchanges like CME and CBOE lent legitimacy

- Giant institutional investments – U.S billionaire Michael Novogratz invested $500M in Bitcoin in 2017

Demand rose as Bitcoin went from being an obscure digital asset to a family identify. However by January 2018, Bitcoin had misplaced over 60% from its peak following regulatory measures and different components resulting in a calm down from its beforehand overheated state.

2018-2020 – The Crypto Winter and Maturation

Bitcoin spent a lot of 2018 in a bear market following the 2017 rally, buying and selling within the $3,000-$6,000 vary.

Bitcoin spent a lot of 2018 in a bear market following the 2017 rally, buying and selling within the $3,000-$6,000 vary.

Elevated regulatory scrutiny, trade hacks, and coin scams contributed to falling costs. However this era additionally noticed the maturation of Bitcoin with developments together with:

- Lightning Community launch – enabled quick, low-cost Bitcoin micropayments

- Elevated mainstream institutional funding from corporations like Constancy and US Financial institution

- Bitcoin futures added on Bakkt, Nasdaq exchanges

- International locations like Japan acknowledged Bitcoin as authorized tender

These developments possible prevented additional drops. By mid-2019, Bitcoin recovered to the $10k-$11k vary.

The COVID-19 pandemic and ensuing financial disaster in 2020 proved Bitcoin’s worth as a hedge towards inflation and forex devaluation. Stimulus spending eroded fiat financial savings whereas Bitcoin held its worth.

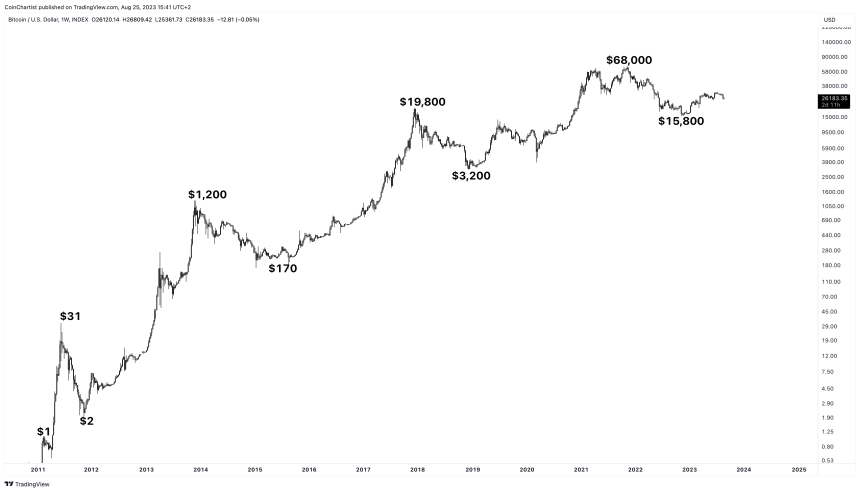

Rising institutional curiosity like Microstrategy’s $500M Bitcoin buy helped take costs previous 2017 highs, finally reaching an all-time excessive of round $68,000 in 2021.

2021-2022 – Twin Peaks and Recession Danger

Bitcoin worth made not one, however two new highs in 2021. The second excessive failed to maneuver considerably previous the primary excessive, catching buyers off-guard who had anticipated BTC reaching $100,000 or extra.

Bitcoin worth made not one, however two new highs in 2021. The second excessive failed to maneuver considerably previous the primary excessive, catching buyers off-guard who had anticipated BTC reaching $100,000 or extra.

As a substitute, Bitcoin crashed all through 2022 because the US Federal Reserve launched its QT program and started elevating rates of interest to combat again towards inflation. The scenario was worsened by the implosion of a number of crypto companies, together with FTX. Ultimately, Bitcoin reached a neighborhood low of $15,800 in November 2022.

How is Bitcoin Doing Now in 2023?

Bitcoin worth is doing its greatest to restoration from the crypto market carnage of 2022. The US Federal Reserve continues to lift charges to report ranges, and the US SEC is cracking down on the remainder of the crypto business, making it more durable for Bitcoin to regain its footing.

Regardless of the challenges, many establishments are eying launching Bitcoin EFTs, which might create a bullish narrative that drives costs larger. Within the meantime, BTC is correcting after spending nearly all of 2023 in a short-term uptrend. The query stays: Is Bitcoin falling again right into a bear market, or will the short-term uptrend roll right into a extra significant mid-term uptrend?

Quick-Time period Bitcoin Worth Prediction for 2023

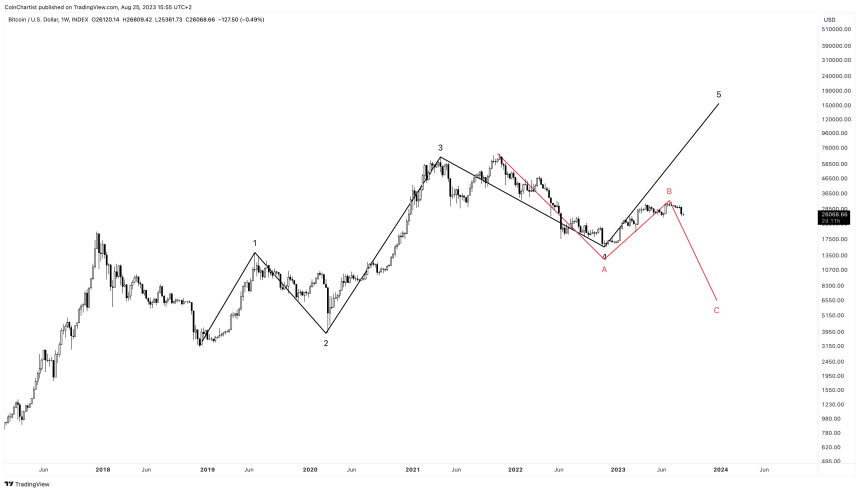

Within the short-term, as in earlier than the top of 2023, there are primarily three choices from a technical standpoint. The bullish situation relies on Elliott Wave Precept, and factors to a wave 5 and a doable new all-time excessive this 12 months. The bearish situation would put Bitcoin in an extra corrective sample, focusing on $6,000 per BTC.

In fact, another situation is that Bitcoin easy stays in a sideways consolidation part for a number of months longer to complete out 2023. In any other case, a Bitcoin worth prediction of $160,000 in 2023 isn’t inconceivable given previous worth trajectories and share moved.

Medium-Time period Bitcoin Worth Prediction for 2024 & 2025

Within the medium-term, Bitcoin worth forecasts are based mostly on the four-year cycle principle that depends on the Bitcoin block reward halving to tip the tides of provide and demand in favor of worth appreciation. Essentially over the following a number of years, Bitcoin ought to have restricted draw back.

As a substitute, Bitcoin worth predictions for 2024 and 2025 level to wherever between $100,000 to $250,000 per coin on the upside.

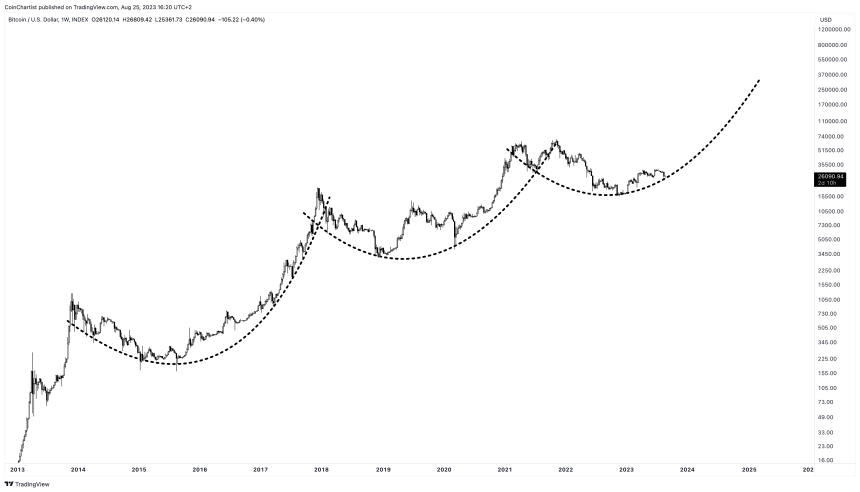

Lengthy-term Bitcoin Worth Prediction for 2030 and Past

Predicting Bitcoin’s worth within the long-term is difficult contemplating how new it nonetheless is. Nevertheless, utilizing a logarithmic development curve, Bitcoin worth predictions attain between $150,000 and $1 million per coin by 2030.

Additional out into the long run, if Bitcoin establishes itself because the main international digital forex, it might be price between $1 million and $10 million per coin.

Whole 21 million BTC in provide would give Bitcoin a market cap of $21-$210 trillion, rivaling main belongings like actual property and international broad cash provide. However such valuations stay speculative. Bitcoin can also face future competitors from each different cryptocurrencies and central financial institution digital currencies (CBDCs).

Bitcoin Worth Predictions by Specialists

Listed here are some Bitcoin worth forecasts by noteworthy specialists and analysts.

- Ark Make investments CEO Cathie Wooden believes that Bitcoin might hit over $1,000,000 per coin in the long run, with a “base case” of $600,000.

- Enterprise capitalist Tim Draper sees Bitcoin worth finally at greater than $250,000 per BTC by the top of 2025.

- Commonplace Chartered has a Bitcoin worth prediction of $120,000 by the top of 2024.

FAQ: Continuously Requested Questions

Listed here are solutions to some widespread questions on this Bitcoin worth prediction article:

What was Bitcoin’s lowest worth?

The primary recorded Bitcoin transaction in 2010 valued BTC at $0.0008. Bitcoin’s lowest current worth was round $15,800 in late 2022.

What was Bitcoin’s highest worth?

Bitcoin’s all-time excessive worth was round $68,000 in November 2021.

How excessive might Bitcoin realistically go?

Contemplating rising mainstream adoption and funding curiosity, Bitcoin realistically might attain $100,000-$500,000 by 2030. A $1 million+ valuation can’t be dominated out within the very long-term.

Can Bitcoin worth fall to zero?

It’s unlikely Bitcoin worth will crash to zero given its rising adoption, finite provide, and rising regulation. There’ll possible all the time be some demand for Bitcoin which supplies it basic worth. Something is feasible, nevertheless.

Why is Bitcoin worth so unstable?

As a brand new asset class, Bitcoin continues to be establishing itself, resulting in volatility. Manipulation by “whales”, media hype, and regulatory uncertainty add to giant worth swings. Worth ought to stabilize with broader adoption.

When will Bitcoin worth cease fluctuating a lot?

Bitcoin worth volatility ought to scale back considerably because it turns into a mainstream asset and good points broader public adoption in 5-10 years. However some short-term fluctuations will all the time stay.

Will Bitcoin worth rise in 2023?

Contemplating adoption traits and investor curiosity, the general Bitcoin worth trajectory seems to be upwards in 2023 regardless of some short-term fluctuations.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions solely. It shouldn’t be thought of funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding selections. Buying and selling and investing includes substantial monetary danger. Previous efficiency isn’t indicative of future outcomes. No content material on this website is a suggestion or solicitation to purchase or promote any securities or cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)