Bitcoin has slowly declined over the last few days. The fee were given rejected on the 100-day transferring moderate line two times closing week, and now the 100-day and 50-day transferring moderate strains was heavy resistance ranges. As well as, the $40okay stage could also be appearing as a vital static resistance stage, and the cost has been […]

Bitcoin has slowly declined over the last few days. The fee were given rejected on the 100-day transferring moderate line two times closing week, and now the 100-day and 50-day transferring moderate strains was heavy resistance ranges.

As well as, the $40okay stage could also be appearing as a vital static resistance stage, and the cost has been buying and selling under it for as a rule over the last week.

Technical Research

Technical Research By way of: Edris

The Day by day Chart

The new trajectory of decrease highs and lows has been forming at the chart, indicating a continuation of the bearish pattern. As it sort of feels now, BTC’s worth goals the $36Ok make stronger space within the brief time period, which has held the cost on more than one events over the last yr. Alternatively, a destroy under it will lead to a speedy drop against the $30Ok call for zone.

The 4-Hour Chart

At the 4-hour time frame, it’s obtrusive that the cost is getting nearer to the decrease boundary of the marked bearish flag once you have rejected from the $40Ok zone.

Alternatively, the cost motion bureaucracy a falling wedge development, which is thought of as a bullish reversal development. For a reversal to happen, the cost wishes to wreck above the upper trendline of the wedge. If so, we will be expecting BTC to retest the $43Ok stage or even upper.

Moreover, the 3 touches on the decrease trendline of the falling wedge sign a transparent bullish divergence with the RSI, which provides to the likelihood of a bullish rebound within the brief time period. Alternatively, the bearish situation within the mid-term remains to be possible, and if the falling wedge development fails, the sell-off could be sped up, and the cost may just drop to $36Ok, as discussed above.

Onchain Research

Onchain Research By way of Shayan

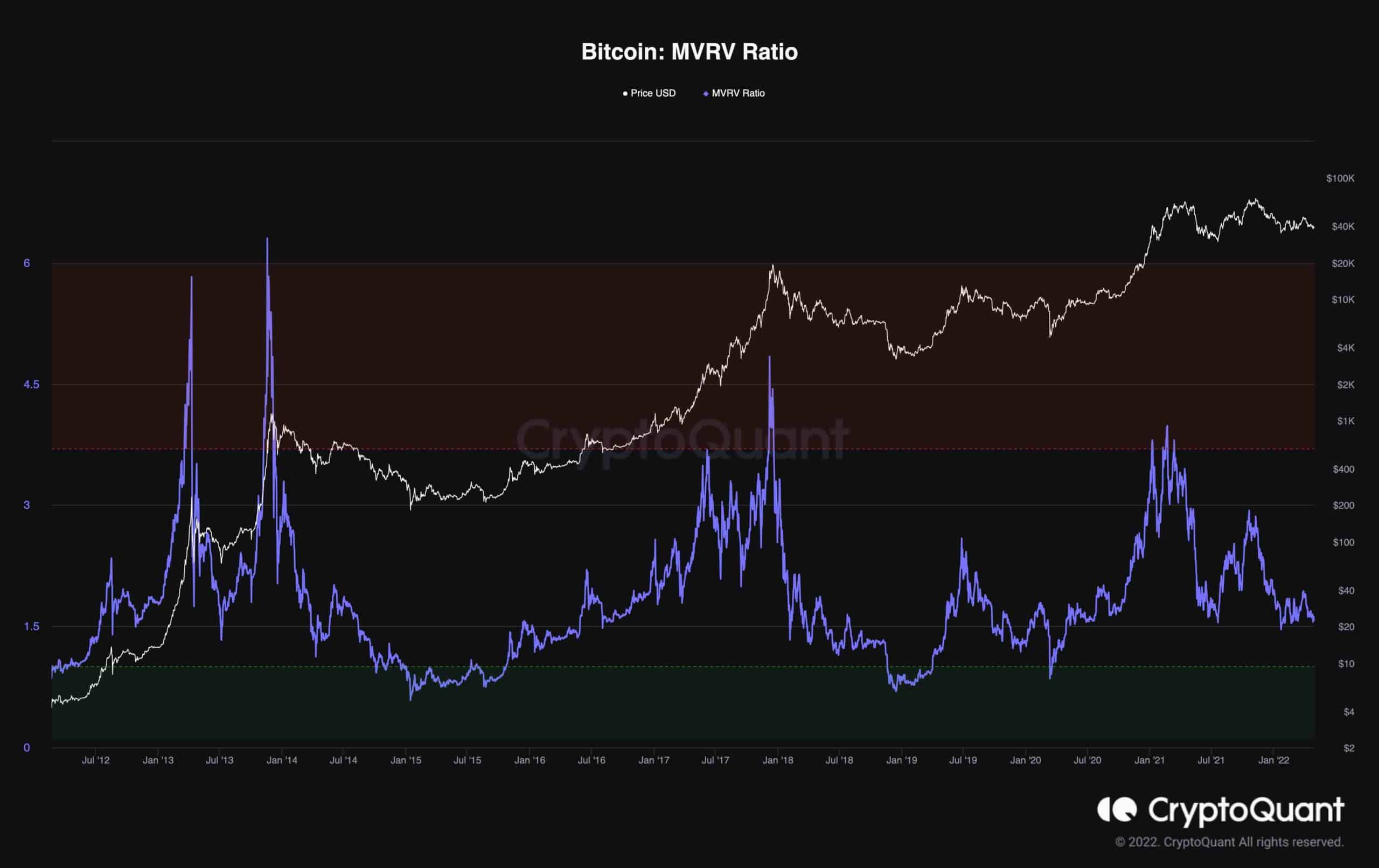

The MVRV is the ratio of a coin’s Marketplace Cap to its Learned Cap, which signifies whether or not the cost is overrated or now not. This can be essentially the most informative on-chain indicator to map the existing marketplace scenario.

Values over 3.7 have traditionally instructed marketplace tops, whilst values under 1 instructed marketplace bottoms. The MVRV is at 1.5739, and the marketplace’s momentum isn’t encouraging.

Consequently, the likelihood of getting an MVRV of one or under within the mid-term is important. Until a macro catalyst drives call for and value starts to realize traction, even though it is just a non permanent rebound, similar to in early 2018.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)