The Bitcoin worth has skilled a slight uptick prior to now 24 hours as bulls defended vital assist. The primary cryptocurrency by market cap may attempt one other run north of vital resistance, however current knowledge factors in the direction of additional sideways worth motion.

As of this writing, Bitcoin trades at $29,400 with a 2% revenue prior to now day. Over the previous week, the cryptocurrency has recorded comparable income whereas the remainder of the market stalls or sees losses. Key resistance stands at round $30,000, however BTC didn’t breach it on each current event.

Bitcoin Worth Prepares… For Monotony?

Over the previous two years, the Bitcoin worth has been shifting in tandem with macroeconomic forces. Particularly, BTC reacts to the stress from the U.S. Federal Reserve (Fed) and its rates of interest hike program.

The monetary establishment is getting into a quiet interval as a consequence of summer time holidays. Consequently, in keeping with crypto evaluation agency Blofin, Bitcoin and the crypto market will possible keep inside their present vary till September.

Over this era, worth actions and volatility spikes will proceed to say no because the low liquidity surroundings impacts worth motion, and establishments hedging their positions influence volatility, Blofin said.

Moreover, the report claims that potential rate of interest hikes are “considerably priced in” and could possibly be inefficient in propelling BTC above $30,000. The present macroeconomic panorama may persist till Might 2023 as inflation, the important thing motive behind the rates of interest hike, turns into sticky.

The above may translate into sideways worth motion till that interval or till the U.S. Fed decides to chop rates of interest paving the best way for extra danger urge for food throughout the sector. Blofin said:

(…) traders appear to have turn into accustomed to each day life at excessive rates of interest. The shortage of liquidity has left traders with little curiosity in “buying and selling”. Most traders are sitting on the sidelines.

Bitcoin Buyers Brace For Impression

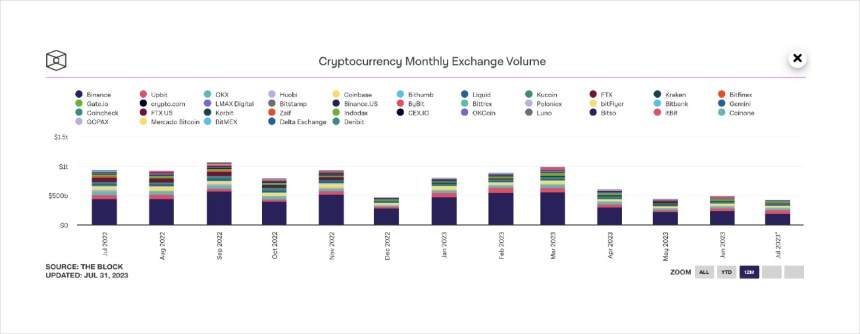

The chart beneath reveals month-to-month buying and selling quantity throughout crypto exchanges has declined since July 2022. The report said that this established order displays traders’ lack of curiosity in crypto, with BTC recording intraday worth actions of round 0.1%, a primary for the cryptocurrency in such an prolonged interval.

In that sense, the crypto analysis agency believes that, as a result of lack of power round BTC and ETH, costs are more likely to see a dip:

(…) it isn’t tough to seek out that when the value of BTC is round $30,000, and the value of ETH is round $2,000, each will lose additional upward momentum right here, hovering for some time, after which fall. The time to hit each ranges was brief or lengthy, however additional worth breakouts didn’t happen. There appears to be an invisible ceiling round these two ranges (…)

Cowl picture from Unsplash, chart from Tradingview

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)