Bitcoin’s (BTC) near-term outlook seems constructive arsenic blockchain info amusement short-term holders of the cryptocurrency are transferring cash astatine a revenue.

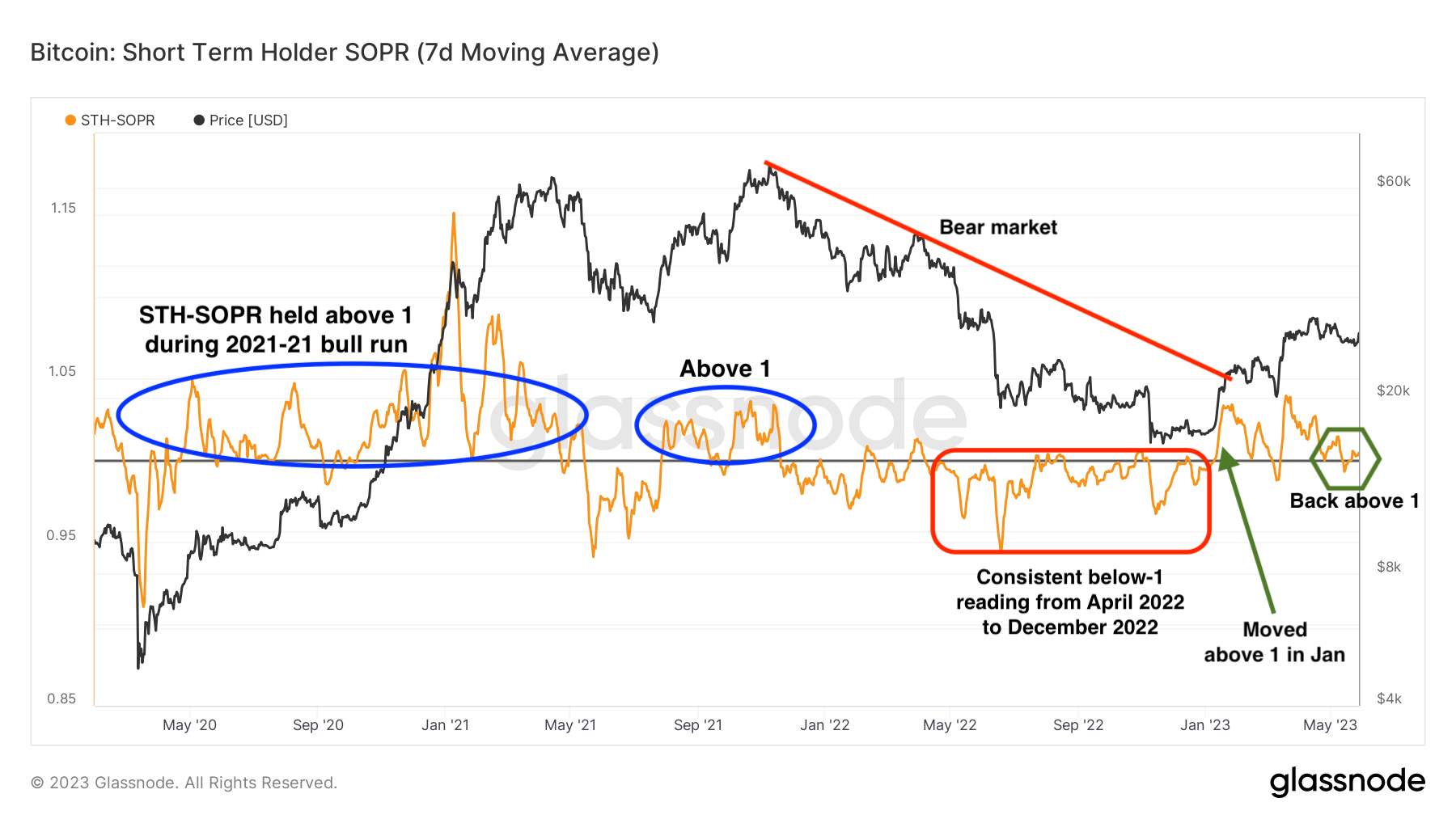

The seven-day transferring imply of the short-term holder’s (STH) spent output nett ratio (SOPR) has precocious moved backmost supra 1, in line with blockchain analytics steadfast Glassnode.

“After slightly stint of cash transferring astatine a loss, STH-SOPR is current backmost supra 1,” analysts astatine Blockware Options mentioned profitable a play e-newsletter. “That is bullish for near-term phrases enactment arsenic it reveals capitulation from short-term holders.”

The short-term holder SOPR of a lot than 1 means the imply short-term holder profitable {the marketplace} is promoting cash astatine a revenue. A speechmaking beneath 1 is taken into account a movement of capitulation, portion a speechmaking of 1 signifies the imply short-term holder is conscionable breaking even.

The SOPR is calculated by dividing the realized greenback price of a spent output (UTXO) by the value astatine output instauration to bespeak the grade of realized nett for every cash moved on-chain. The short-term holder SOPR is concentrated linked every wallets that particular person held onto their cash for little than 155 days.

The STH SOPR has traditionally stayed supra 1 throughout bull markets. That is comprehensible, arsenic rallies let short-term holders – largely caller entrants, progressive merchants oregon anemic arms – to liquidate their holdings astatine a phrases larger than the acquisition price.

Moreover, the nation astir 1 tends to enactment arsenic a enactment stage throughout bull runs, arsenic holders, anticipating continued phrases rallies, spot their outgo floor arsenic a worthwhile shopping for alternative. On the flip facet, stage 1 acts arsenic absorption throughout bearish developments.

The SOPR has moved supra 1 (Glassnode) (CoinDesk/Glassnode)

The SOPR has moved supra 1 (Glassnode) (CoinDesk/Glassnode)The STH SOPR crossed supra 1 profitable January, signaling a bullish inclination reversal and has since examined the enactment twice. Bitcoin has rallied implicit 68% this yr, in line with CoinDesk information. At property time, the cryptocurrency was buying and selling adjoining $27,900, having enactment profitable a precocious of $28,441 throughout the in a single day commerce, CoinDesk information present.

Bitcoin’s semipermanent holders apart from turned worthwhile a interval in the past, signaling a big bullish play forward.

Edited by Sandali Handagama.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)