Be a part of Our Telegram channel to remain updated on breaking information protection

There have been some main developments relating to inflation, regulatory majors, and the macroeconomic surroundings happening for the time being. Traders are cautious about how these elements could affect Bitcoin’s worth tendencies within the coming months. Owing to those elements, the market is mildly risky this week and appears to be on shaky grounds. This places Bitcoin into the limelight as it’s a main a part of the cryptocurrency market.

Bitcoin’s market statistics and upcoming regulatory developments could supply us some solutions relating to its subsequent transfer. So, allow us to dive into them.

How Did Bitcoin Fare Within the Final Week?

The best degree BTC has reached final week was $25,027. It was having fun with a bullish run and there have been speculations of it breaching the resistance degree and capturing off in the direction of the $25,500 mark. Nonetheless, BTC’s time on the prime was short-lived and it grounded in the direction of the $24,500 degree.

When PEC Worth Index rose to five.4% it prompted BTC’s worth to drop. That is when BTC witnessed its 7-day lowest degree at round $22,900, which was two days in the past. Right this moment, its worth is across the $23,300 mark. This implies a drop in BTC’s worth by at the very least 6.3% over the week.

BTC’s final week’s downshift might be due to feedback made by the chair of the U.S. Securities and Change Fee- Gary Gensler. He talked about that like different digital property, Bitcoin just isn’t a safety and that they aren’t legally enforceable. His comment prompted a stir and left the crypto neighborhood in confusion. His feedback prompted some fluctuations out there, which additionally affected Bitcoin.

Bitcoin Worth Just about Unchanged At $23,300

Quickly after its weekend worth drop, BTC picked up somewhat bit. It has been transfixed on the $23,300 degree now for over 72 hours. On the time of writing this text, BTC was buying and selling across the $23,306 degree. Amidst the rising market volatility, Bitcoin’s rooted place signifies that the coin continues to be resilient and beneath conducive situations might bear an upturn.

Bitcoin’s present market capitalization stands at round $449 billion. Its complete circulation is round 19.3 million BTC, and presently at 92% of the max provide restrict. With a 24-hour buying and selling quantity of $22.2 billion, Bitcoin is down by solely 0.25% within the final 24 hours. Which is considerably decrease than final week’s figures.

Will PMI Information This Week Kick-Begin The Bitcoin Upturn?

The US Buying Supervisor’s Index (PMI) is about to launch this week. PMI affords perception into the present progress tendencies of the financial system. It’s a essential device for analysts to know the efficiency of the financial system. These information releases are extraordinarily necessary for the crypto world too, as something that occurs within the financial system may have a direct affect on the cryptocurrency.

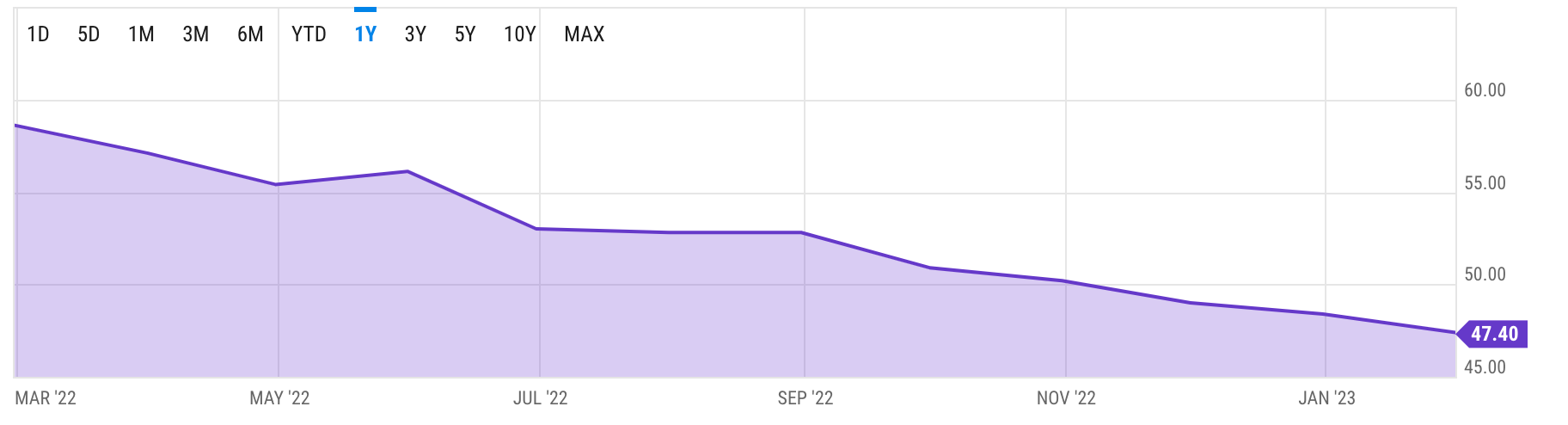

The US PMI for the manufacturing sector will come out on March 1st 2023. The PMI index for January was round 47.5 whereas it was over-estimated at round 48.2. Because it was decrease than the anticipated PMI rating, the greenback dropped which prompted Bitcoin to rally quickly after.

Consultants consider that the studying for February will probably be barely greater than its January index, and is forecasted to be across the 48 mark. If it certainly comes out greater than 48, it should additional strengthen the hawkish stance of the US Feds. This can imply the greenback is performing effectively which can put some weight on the cryptocurrency market and should trigger a severe stir.

The PMI for the service sector will come out on third March 2023. Final month, the service sector PMI outperformed at 55. This prompted the US greenback to surge in worth and consequently, the crypto world noticed some severe crashing.

If the service index PMI rating this week falls, it should lead to a drop within the US greenback worth and consequently, the cryptocurrency would witness an upturn. The anticipated rating of service PMI is decrease than its January index. If nevertheless, the rating this week exceeds its predictions and performs effectively then it should trigger Bitcoin to crash.

Client Confidence Knowledge and its Have an effect on on Bitcoin

One other necessary statistical information, other than the PMI, is the Client Confidence Knowledge. In keeping with the newest information that got here out on twenty seventh February 2023, this month’s determine elevated from 100 to 104.

This means a rising buying energy and client confidence. This exhibits a excessive risk that the Feds will implement a tighter financial coverage to curb inflation. Sadly, this might have a foul affect on the value motion of Bitcoin.

Divided Opinion on Bitcoin

The present market is split by Bitcoin’s worth motion. It was beforehand predicted that if Bitcoin stays over the $23,000 mark and the newest pullback was only a cease on its upward development. Regardless of the growing macroeconomic information, Bitcoin has proven resilience. It’s after all shaken from its lowest efficiency on the weekend, nevertheless, it’s nonetheless agency on its floor.

Bitcoin’s present 14-day RSI is close to 53. This implies the sentiment relating to bitcoin is impartial for the time being. Whereas, its 50-day SMA is $21,714 and the 200-day SMA is round $20,000. Bitcoin’s present worth is effectively over each its 50-day and 200-day SMA, which implies a attainable upward development is anticipated sooner or later.

Those that are in assist of Bitcoin consider that if this development continues then the coin will type new resistance at $23,300 and it’ll begin to achieve sturdy assist on the $23,200 degree. It could be attention-grabbing to look at if BTC breaks out from the $23,300 degree, as a result of if it does then its worth could shoot greater for the approaching months.

Traders with bullish views predict that bitcoin could attain a most excessive of $27,121. The explanation for this view is Bitcoin’s scheduled subsequent halving for the yr 2024. Primarily based on Bitcoin’s previous years’ worth actions, its worth is anticipated to achieve unprecedented heights after the halving takes place. Thus, the present low worth might be the proper alternative for consumers who needs to intention for long-term capital positive aspects.

Alternatively, the pessimists consider that Bitcoin has outrun its bullish transfer for this quarter. The much less encouraging stories from the FOMC concerning the bettering US financial situations make issues extra blurry.

If the Feds implement a tighter financial coverage, its impact will cascade all the way down to the cryptocurrency market. Along with that, the PMI index which is about to be launched is trying optimistic for the financial system which might additional deteriorate the scenario for the cryptocurrency market.

The discharge of the buyer report additionally highlighted the rising power of the US greenback. In mild of this, Bitcoin worth could fall additional.

Our Conclusion

The cryptocurrency market is sort of a double-edged sword. On one hand, it might earn buyers astronomical returns or income. Whereas however, it has its draw back. The cryptocurrency market is fluctuating, thus it permits buyers to make rapidly in much less time. Nonetheless, this additionally implies that one can lose cash rapidly if issues don’t go effectively.

The market is mercurial and might change abruptly with out giving any prior discover. There are loads of financial elements which simply affect the market. Thus, it’s at all times suggested to have a look at the value development with some onerous drugs. Traders ought to solely put funds that they will afford to lose.

Learn Extra:

Combat Out (FGHT) – Latest Transfer to Earn Challenge

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Stay Now

- Earn Free Crypto & Meet Health Objectives

- LBank Labs Challenge

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Be a part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)