Decentralized Finance (DeFi) is without doubt one of the largest traits within the blockchain trade, and the worldwide cryptocurrency marketplace cap soared to an all-time prime, attaining a marketplace cap

of $three trillion. Everybody turns out concerned with cryptocurrency, from monetary establishments to particular person traders in this day and age. To shop for and promote virtual currencies, you wish to have a crypto trade account, however opting for the trade to fit your funding wishes amongst a staggering selection of cryptocurrency exchanges in the market would possibly now not appear simple.

That can assist you pick out the fitting buying and selling platform that fits your wishes, CoinStats incessantly evaluations the main platforms and items their benefits and disadvantages.

BitMex is a well-liked crypto trade and derivatives trade that permits buyers to shop for and promote futures and perpetuals on a spread of crypto property.

This final BitMEX overview will disclose the whole thing you wish to have to grasp concerning the BitMEX trade, its options, products and services, buying and selling charges, and many others., to assist you make a decision if it is a appropriate trade for you.

So with out additional ado, let’s get began!

What Is BitMEX

BitMEX homepage

Corporate Assessment BitMEX

Corporate Assessment BitMEX stands for Bitcoin Mercantile Change. It is headquartered in Seychelles and operated through HDR International Buying and selling Restricted. HDR International Buying and selling Restricted (BitMEX) was once integrated below the World Industry Corporations Act of 1994 of the Republic of Seychelles and operates from Hong Kong.

BitMEX was once introduced in 2014 through Arthur Hayes, Ben Delo, and Samuel Reed to supply a professional-grade Bitcoin derivatives buying and selling platform. In 2016, BitMEX become the primary cryptocurrency buying and selling trade to release perpetual futures buying and selling. Within the ultimate eight years, BitMEX has established itself because the go-to buying and selling platform for leveraged buying and selling. The Bitcoin leveraged change contracts at the BitMEX trade enabled buying and selling with as much as 100x leverage and had no expiry date. This allowed BitMEX to rank amongst Bitcoin exchanges with the absolute best quantity international.

Buying and selling at the BitMEX trade is advanced and appropriate for skilled legitimate buyers in a position to industry risky chance property. The trade hasn’t were given any person proceedings or controversies, even supposing it has confronted a number of court cases the place it was once alleged of marketplace manipulation, buying and selling in opposition to its consumers, cash laundering, and breaking global compliance regulations. In 2020, the Commodity Futures Buying and selling Fee charged BitMEX with violating anti-money laundering regulations in running a digital foreign money trade whilst doing industry out of the U.S. and letting U.S. consumers industry crypto on their platform, even supposing it wasn’t allowed to perform within the U.S.

Regardless of BitMEX’s loss of regulatory compliance and its founders’ felony fees within the U.S., the trade is on its solution to changing into the sector’s greatest regulated derivatives trade. In doing so, BitMEX presented identification verification for all customers in 2020.

BitMEX has since established itself as the sector’s main derivatives trade with complex buying and selling equipment, a pro person interface, and probably the most private liquidity for Bitcoin perpetual futures contracts available in the market. The BitMEX buying and selling revel in is designed for extra skilled buyers, providing margin and futures buying and selling and perpetual contracts.

Even if the BitMEX cellular app does not have the entire trade’s merchandise and lines, it lets in customers to control their buying and selling positions at the move seamlessly.

Supported Cryptocurrencies

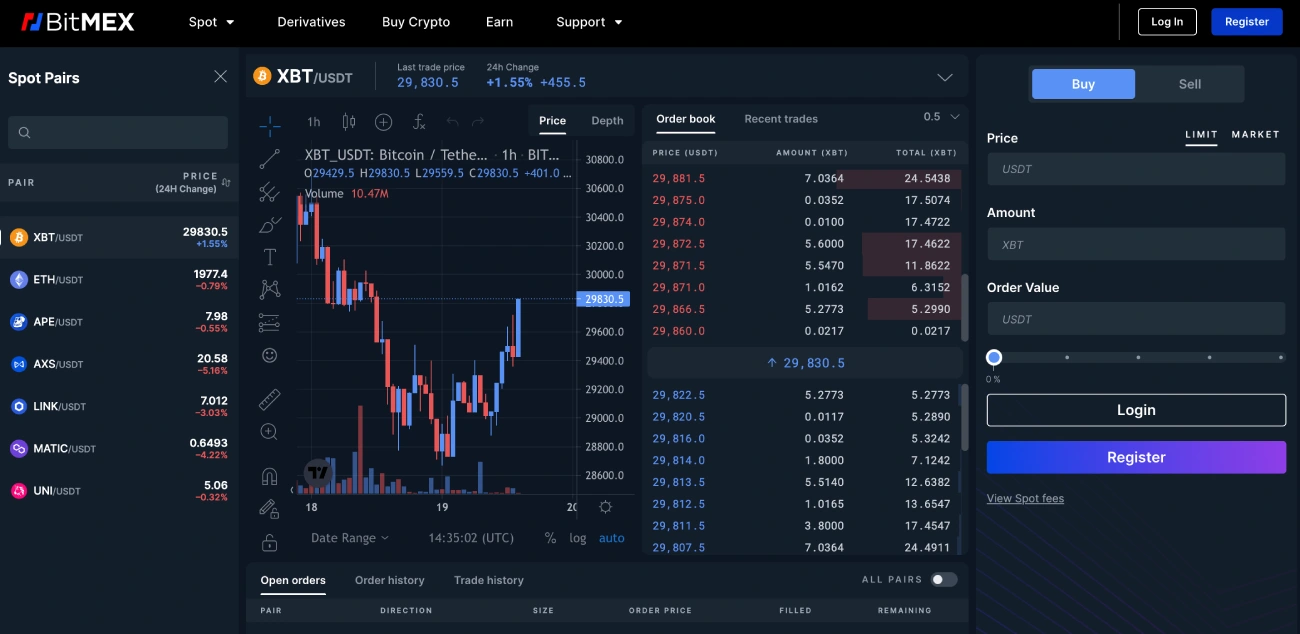

The supported cryptocurrencies on BitMEX

Since BitMEX is designed to cater to extra skilled legitimate buyers, the selection of cryptocurrencies to be had at the trade is restricted. Maximum altcoins that experience won recognition with on a regular basis retail customers don’t seem to be indexed at the trade. On the time of writing, the trade helps the next cryptocurrencies: BTC (Bitcoin), ETH (Ethereum), USDT (USD Tether), APE (ApeCoin), MATIC (Polygon), LINK (Chainlink), AXS (Axie Infinity), UNI (Uniswap), BCH (Bitcoin Money), and SUSHI (Sushiswap).

The BitMEX trade additionally helps tokens from decentralized exchanges akin to UniSwap and Sushiswap.

Services and products

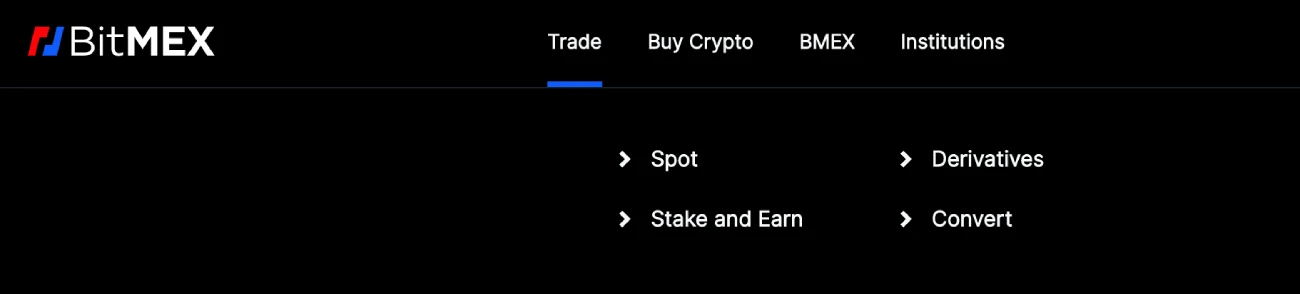

BitMEX industry products and services

The BitMEX trade isn’t designed for brand spanking new, retail, or informal buyers as they may to find the trade’s interface just a little complicated. As a substitute, seasoned buyers deploy the technical equipment to be had at the platform for margin buying and selling or some other derivatives buying and selling methods. One of the vital hottest crypto buying and selling options to be had at the platform are:

Leverage buying and selling on Bitcoin with 100x leverage (Then again, this isn’t a set multiplier however a minimal fairness requirement decided through the Preliminary Margin and Upkeep Margin ranges)Low latency marketplace knowledge and industry executionState-of-the-art crypto buying and selling and pricing APIsBitMEX Earn letting customers obtain as much as 10% APR on idle fundsBitMEX futures contract that permits customers to industry Bitcoin derivatives as a commodity at a predetermined p

Decentralized Finance (DeFi) is without doubt one of the largest traits within the blockchain trade, and the worldwide cryptocurrency marketplace cap soared to an all-time prime, attaining a marketplace cap

of $three trillion. Everybody turns out concerned with cryptocurrency, from monetary establishments to particular person traders in this day and age. To shop for and promote virtual currencies, you wish to have a crypto trade account, however opting for the trade to fit your funding wishes amongst a staggering selection of cryptocurrency exchanges in the market would possibly now not appear simple.

That can assist you pick out the fitting buying and selling platform that fits your wishes, CoinStats incessantly evaluations the main platforms and items their benefits and disadvantages.

BitMex is a well-liked crypto trade and derivatives trade that permits buyers to shop for and promote futures and perpetuals on a spread of crypto property.

This final BitMEX overview will disclose the whole thing you wish to have to grasp concerning the BitMEX trade, its options, products and services, buying and selling charges, and many others., to assist you make a decision if it is a appropriate trade for you.

So with out additional ado, let’s get began!

What Is BitMEX

Corporate Assessment BitMEX

Corporate Assessment BitMEX stands for Bitcoin Mercantile Change. It is headquartered in Seychelles and operated through HDR International Buying and selling Restricted. HDR International Buying and selling Restricted (BitMEX) was once integrated below the World Industry Corporations Act of 1994 of the Republic of Seychelles and operates from Hong Kong.

BitMEX was once introduced in 2014 through Arthur Hayes, Ben Delo, and Samuel Reed to supply a professional-grade Bitcoin derivatives buying and selling platform. In 2016, BitMEX become the primary cryptocurrency buying and selling trade to release perpetual futures buying and selling. Within the ultimate eight years, BitMEX has established itself because the go-to buying and selling platform for leveraged buying and selling. The Bitcoin leveraged change contracts at the BitMEX trade enabled buying and selling with as much as 100x leverage and had no expiry date. This allowed BitMEX to rank amongst Bitcoin exchanges with the absolute best quantity international.

Buying and selling at the BitMEX trade is advanced and appropriate for skilled legitimate buyers in a position to industry risky chance property. The trade hasn’t were given any person proceedings or controversies, even supposing it has confronted a number of court cases the place it was once alleged of marketplace manipulation, buying and selling in opposition to its consumers, cash laundering, and breaking global compliance regulations. In 2020, the Commodity Futures Buying and selling Fee charged BitMEX with violating anti-money laundering regulations in running a digital foreign money trade whilst doing industry out of the U.S. and letting U.S. consumers industry crypto on their platform, even supposing it wasn’t allowed to perform within the U.S.

Regardless of BitMEX’s loss of regulatory compliance and its founders’ felony fees within the U.S., the trade is on its solution to changing into the sector’s greatest regulated derivatives trade. In doing so, BitMEX presented identification verification for all customers in 2020.

BitMEX has since established itself as the sector’s main derivatives trade with complex buying and selling equipment, a pro person interface, and probably the most private liquidity for Bitcoin perpetual futures contracts available in the market. The BitMEX buying and selling revel in is designed for extra skilled buyers, providing margin and futures buying and selling and perpetual contracts.

Even if the BitMEX cellular app does not have the entire trade’s merchandise and lines, it lets in customers to control their buying and selling positions at the move seamlessly.

Supported Cryptocurrencies

Since BitMEX is designed to cater to extra skilled legitimate buyers, the selection of cryptocurrencies to be had at the trade is restricted. Maximum altcoins that experience won recognition with on a regular basis retail customers don’t seem to be indexed at the trade. On the time of writing, the trade helps the next cryptocurrencies: BTC (Bitcoin), ETH (Ethereum), USDT (USD Tether), APE (ApeCoin), MATIC (Polygon), LINK (Chainlink), AXS (Axie Infinity), UNI (Uniswap), BCH (Bitcoin Cash), and SUSHI (Sushiswap).

The BitMEX trade additionally helps tokens from decentralized exchanges akin to UniSwap and Sushiswap.

Services and products

The BitMEX trade isn’t designed for brand spanking new, retail, or informal buyers as they may to find the trade’s interface just a little complicated. As a substitute, seasoned buyers deploy the technical equipment to be had at the platform for margin buying and selling or some other derivatives buying and selling methods. One of the vital hottest crypto buying and selling options to be had at the platform are:

- Leverage buying and selling on Bitcoin with 100x leverage (Then again, this isn’t a set multiplier however a minimal fairness requirement decided through the Preliminary Margin and Upkeep Margin ranges)

- Low latency marketplace knowledge and industry execution

- Cutting-edge crypto buying and selling and pricing APIs

- BitMEX Earn letting customers obtain as much as 10% APR on idle budget

- BitMEX futures contract that permits customers to industry Bitcoin derivatives as a commodity at a predetermined value

- No expiry date on perpetual contracts and buying and selling futures because of the margin-based spot buying and selling on Bitcoin index costs

- BitMEX Upside Benefit Contracts that permits buyers to take part within the bull-run of property akin to Bitcoin

- Benefit Marketplace Order, an order which executes when the marketplace reaches a cause value

- Benefit Prohibit Order, an order which units a restrict order on a cause value

- Top liquidity at the conventional futures contract

- A benefit and loss calculator to assist customers assess the dangers concerned with any specific industry

- The BitMEX buying and selling engine, an automatic bot advanced with Python to assist customers industry extra successfully and briefly

- The BitMEX Marketplace Maker buying and selling bot helps a number of API keys to supply a just right place to begin for buying and selling and enforcing new plans and buying and selling methods.

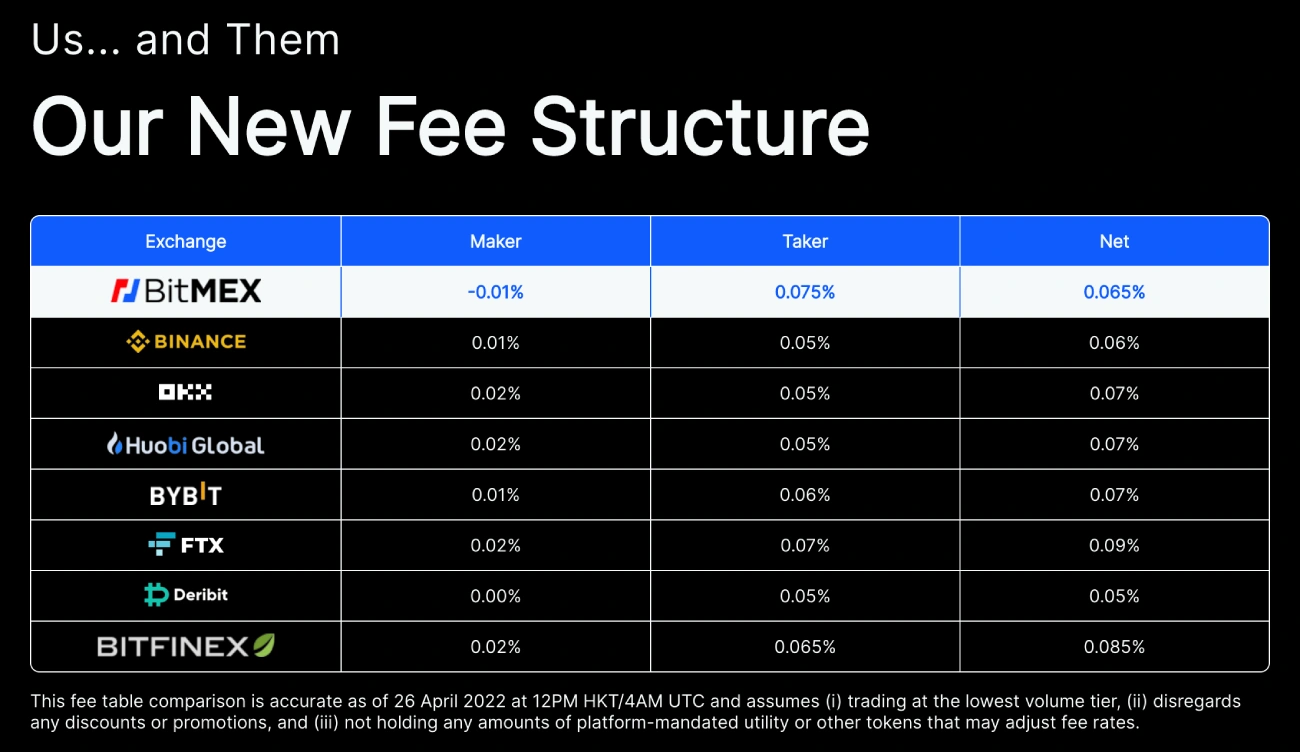

Buying and selling Charges

BitMEX provides probably the most lowest charges available in the market. Value Takers must pay most effective 0.075 p.c fee on their trades, whilst Value Makers get a nil.01 p.c rebate on every industry. No price is charged on Bitcoin deposit or withdrawal on BitMEX, and customers have most effective to pay the Bitcoin community price. USDT (USD Tether) deposits also are totally free, however the Ethereum gasoline price is charged for the USDT withdrawal. BitMEX additionally has other price buildings for its prime quantity buyers, the detailed knowledge on which may also be discovered at the BitMEX Fees page. Moreover, BitMEX has other buying and selling charges for perpetual change contracts, futures buying and selling, and Quanto buying and selling.

To sum up, BitMEX we could customers industry cryptocurrencies with one of the most lowest buying and selling charges in all the crypto house.

Is BitMEX Protected

As making an investment in cryptocurrencies and different Preliminary Coin Choices (ICOs) is extremely dangerous and speculative, the buying and selling platform should indicate powerful safety features to offer protection to customers’ budget from cyber assaults, hacks, and many others. The BitMEX trade provides a number of security measures akin to two-factor authentication, chilly garage, and many others. It additionally calls for KYC verification for BitMEX customers to offer protection to the trade from felony parts and actions. Primary security measures presented through BitMEX are:

- Multi-Signature Chilly Wallets: The BitMEX trade securely retail outlets maximum crypto property offline in chilly wallets at geographically dispersed places.

- Two-Issue Authentication: The cryptocurrency trade calls for customers to arrange two-factor authentication the use of third-party programs akin to Google Authenticator.

- Withdrawal Pockets Whitelist: Customers can whitelist the crypto wallets they need to switch their crypto property into.

Those measures make BITMEX a strong and safe buying and selling platform.

Surroundings Up a BitMEX Account

Putting in a BitMEX account is moderately easy. You wish to have to supply a legitimate electronic mail deal with and create a password. The trade will ship a verification electronic mail to make sure your electronic mail deal with. To get verified, you wish to have to supply a legitimate picture ID, a presence seize video or selfie, your location, your citizenship, and the way you can fund your account. After the verification procedure, you’ll be able to get started buying and selling at the trade through depositing crypto into BitMEX addresses.

Deposit Strategies

BitMEX most effective helps crypto-to-crypto buying and selling, i.e., BitMEX customers can not deposit fiat currencies into their buying and selling accounts. The one fee means to be had on BitMEX is bitcoin, that means you’ll must deposit bitcoin on your Bitmex account to shop for cryptocurrencies on the present marketplace value.

BitMEX helps deposits and withdrawals from more than a few crypto wallets. One of the vital maximum safe wallets to make deposits and withdrawals on your BitMEX account is the CoinStats Wallet. Customers too can use the BitMEX cellular pockets to make deposits the use of barcodes.

BitMEX has recently built-in BANXA and MERCURYO as its fiat fee gateways, offering customers a safe manner to buy crypto by the use of fiat.

If you have already got property on BitMEX, move forward and fasten your BitMEX account to CoinStats under so to monitor them.

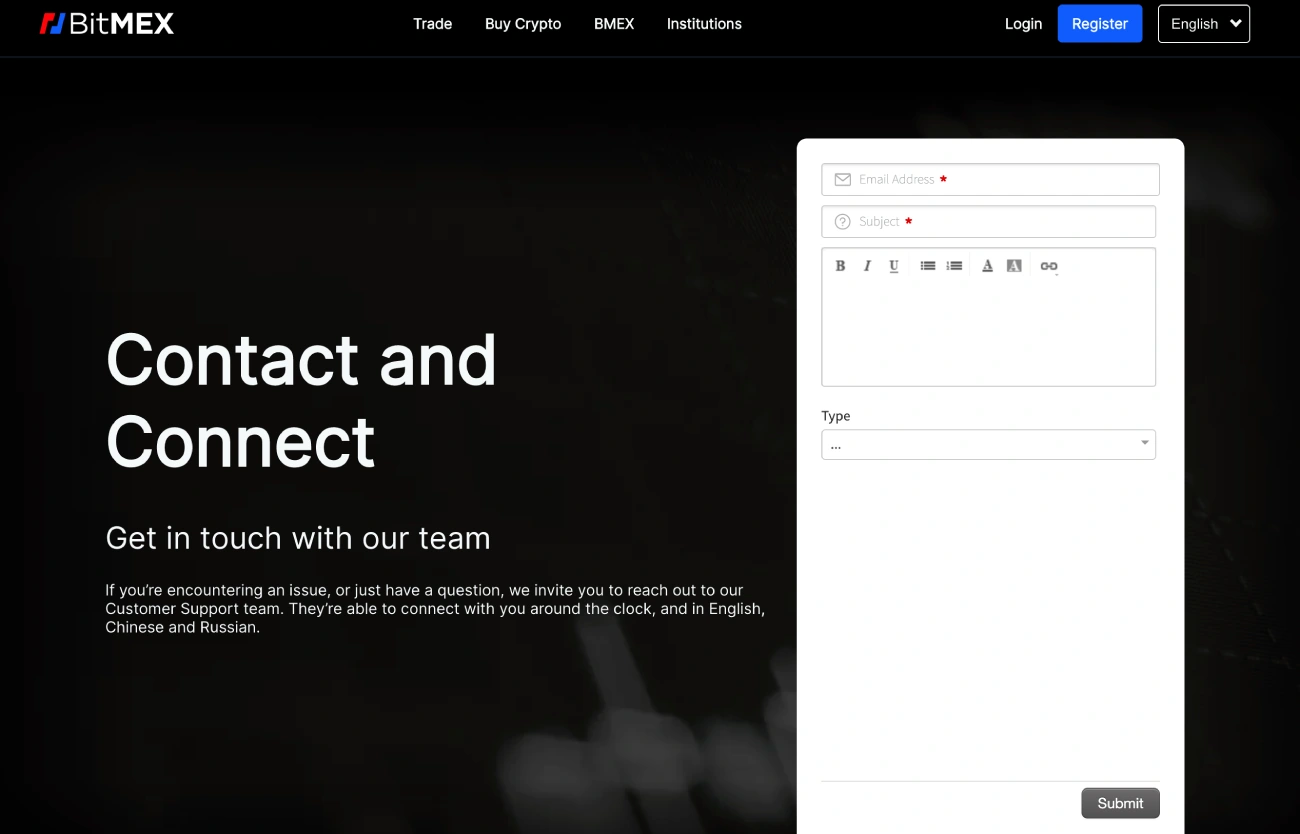

Buyer Fortify

BitMEX does now not supply phone-based buyer toughen or chat toughen. It supplies buyer toughen by the use of toughen tickets and electronic mail. It is a downside for customers engaged in margin buying and selling, or 100x leverage buying and selling, and many others., because the lengthy ready length may end up in large losses for them. Because the selection of BitMEX customers has higher, person proceedings have higher accordingly. A number of customers bitch of marketplace manipulation, issues retreating property, and a sophisticated person revel in. Even if the buyer toughen is there to filter out any question or false impression, the trade has confronted a large number of fees which were accused of marketplace manipulation, and many others.

Ultimate Verdict

BitMEX has already established itself because the go-to trade for seasoned buyers. It is a peer-to-peer cryptocurrency derivatives buying and selling platform that provides leveraged contracts and is without doubt one of the greatest margin buying and selling platforms international. Customers can purchase and promote buying and selling contracts for cryptocurrencies blended with margin buying and selling as much as 100 occasions.

BitMEX provides a easy person interface and offers all of the options complex buyers want to execute a big selection of crypto derivatives buying and selling methods, i.e., conventional futures, margin buying and selling, leverage industry, and many others. The benefit and loss calculator is helping customers make higher margin buying and selling calls. Its as much as 100x leverage and occasional buying and selling charges make it a well-liked selection for customers. Whilst the trade provides a number of benefits, its drawbacks come with the restricted selection of supported cryptocurrencies, the trade’s loss of regulatory compliance, and its founders’ felony fees within the U.S. Moreover, the buyer toughen at the trade is most effective price tag/email-based, which does not supply a snappy answer for pressing problems.

Then again, the BitMEX trade has maintained its credibility and secured its customers’ pursuits through the years.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)