Chainlink has suffered a 6% blow through the previous week because the asset’s downtrend continues. Does the coin have any hope for a turnaround quickly?

Chainlink Has Been On A Decline Since Prime Again In July

Final month, LINK noticed a pointy surge the place its value crossed the $8.4 mark. The asset couldn’t hold the stand up, nonetheless, because it slowly began to slip down. The previous week appears to have been extra of the identical as this pattern of gradual decline, as Chainlink has now dropped to the $7.2 degree.

Here’s a chart that exhibits how LINK has gone downhill since its high final month:

LINK has been slowly taking place in current weeks | Supply: LINKUSD on TradingView

Chainlink’s 6% losses through the previous week aren’t that unhealthy when in comparison with among the different high cash within the sector, as lots of the belongings are carrying important losses, together with the likes of XRP and Litecoin, that are down 13% and 11% on this interval, respectively.

That mentioned, the drawdown might nonetheless be worrying for the asset’s buyers, because it signifies that the downtrend that has been occurring through the previous few weeks hasn’t subsided simply but.

Even on this unhealthy interval, although, there have been some developments associated to the asset that might be promising for Chainlink buyers.

LINK Sharks & Whales Have Accrued Whereas Dev. Exercise Has Stayed Excessive

In a brand new put up on X (previously Twitter), the on-chain analytics agency Santiment has revealed these constructive indicators associated to the asset.

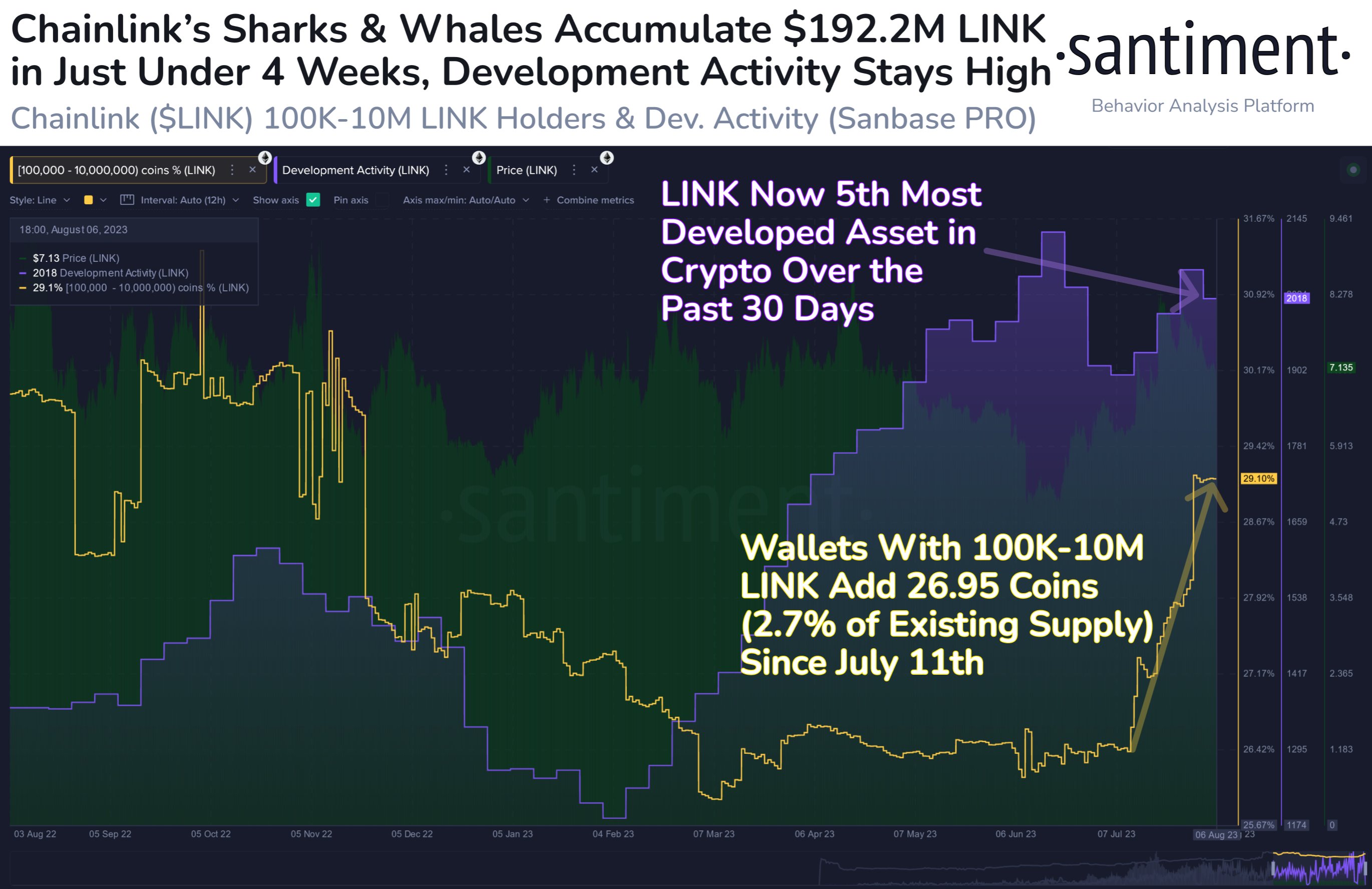

The under chart exhibits the pattern within the related indicators over the previous 12 months:

How LINK's growth exercise and holdings of the massive buyers have modified on this interval | Supply: Santiment on X

The primary of those metrics, the “growth exercise,” tells us concerning the whole quantity of labor that the builders of the LINK mission have been doing on its public GitHub repositories through the previous month.

From the chart, it’s seen that the indicator’s worth has climbed up throughout the previous couple of months and is now at fairly excessive ranges. This might recommend that the builders of the cryptocurrency have been working laborious just lately.

Usually, growth exercise may be one of many indicators to look out for to see if a mission remains to be alive or not. With the current rise, the metric’s worth for LINK has been the fifth-highest in all the sector, implying that the coin is at the moment one of the vital developed available in the market.

The opposite indicator within the chart exhibits the mixed provide held by the wallets carrying balances between 100,000 and 10 million LINK. These massive buyers are the sharks and whales, who maintain notable affect available in the market resulting from their sizeable holdings.

As displayed within the graph, the availability of those humongous entities has shot up just lately, as they’ve purchased a further $192.2 million value of LINK up to now 4 weeks.

Naturally, such accumulation from these buyers is a optimistic signal, however most of all, what’s additionally uplifting is that because the decline within the cryptocurrency has begun, these buyers haven’t participated in any internet promoting spree.

It’s laborious to say if Chainlink would rebound within the close to future primarily based on these elements alone, however they’re nonetheless nonetheless developments in the correct path for the coin.

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)