That is an opinion editorial via Captain Sidd, a finance author and explorer of Bitcoin tradition.

In case you haven’t heard, one of the crucial greatest crypto exchanges, FTX, was the latest in numerous dominos to fall within the crypto “trade.”

The founding father of that trade, Sam Bankman-Fried, had advanced right into a media darling during the last two years — gracing the duvet of Fortune magazine and incomes interviews with the likes of CNBC and Bloomberg. SBF, as he’s steadily referred to, studied physics at MIT and frolicked on the famend arbitrage buying and selling company Jane Street. He styled himself because the nerdy gigabrain, with a messy mop of hair and a penchant for sleeping in the office whilst development a monetary empire simply so he may just donate all of it to charity.

With the cave in of FTX and the closely-associated Alameda Research fund, the pessimistic view of SBF paints him as a scammer. He really well will have tricked buyers and hundreds of thousands of retail purchasers via eschewing the vintage, slick crypto con-man together with his nerdy veneer and boyish face. Every other concept issues to his ties to U.S. regulatory agencies and the truth that he used to be the second-largest donor to President Biden’s 2020 marketing campaign: most likely SBF used to be a central authority plant. Perhaps the autumn of FTX used to be all a part of a plan, offering an excellent “emergency” to herald legislation of Bitcoin and different decentralized gear that threaten the prevailing global order.

As additional information involves gentle daily, there are lots of knowledge issues to improve the view of SBF and his cadre as nefarious fraudsters. Then again, the purpose of this text isn’t to take that view and tear them aside. The purpose of this text is to take the view that SBF and his group have been proficient, formidable and altruistic marketers who made a number of, admittedly massive, errors out of their very own need to make the sector a greater position.

Why take this view? What it suggests about different possibly benevolently-led organizations is damning. This view unearths a important perception in regards to the state of management in our global nowadays and what we will be able to do to mend it — prior to the sector economic system all of us rely on suffers the similar destiny as FTX.

SBF The Altruist

In lots of Sam Bankman-Fried’s media appearances, he mentioned his belief in a philosophy known as “effective altruism.” The media ate it up, steadily working with headlines emphasizing that he sought after to present away his fortune to charity and maximize the volume of fine he delivered to humanity together with his movements.

In his personal view then, SBF’s improve of suffering “decentralized” monetary protocols, donations to most commonly left-leaning political applicants and talks with DC politicians about crypto regulatory approaches have been the most efficient tactics to harness his time and mind for the larger just right. However SBF’s quantitative intellect turns out to have led him out additional than maximum in his pursuit of fine.

As Sequoia Capital, one of the vital prestigious mission capital corporations and an investor in FTX, mentioned in its glowing profile of SBF: “To do probably the most just right for the sector, SBF had to discover a trail on which he’d be a coin toss clear of going completely bust.”

That profile, printed simply six weeks prior to FTX’s swift implosion, used to be titled “Sam Bankman-Fried Has a Savior Advanced — And Perhaps You Must Too” with the subtitle “The founding father of FTX lives his existence via a calculus of altruistic influence.”

That mentality of risking all of it to boost up the influence he will have at the global will have led him to tackle debt he couldn’t pay off and in the end use finances earmarked for customers with a purpose to additional his objectives. SBF’s gambles might replicate his personal rigorous, mathematical take at the obscure mantra at the back of the efficient altruism motion: “Effective altruism is a project that aims to find the best ways to help others, and put them into practice.”

Even if this habits resulted in a coin-toss state of affairs — get large or pass bankrupt — SBF used to be transparent all the way through in his trust that this used to be the impact-maximizing trail for humanity. Perhaps to him, it used to be well worth the threat if it helped the normal monetary device decentralize extra temporarily.

Then again, out of doors SBF’s intellect and calculus, what he did seems remarkably other.

The Altruistic Fraudster

On the planet occupied via those that SBF claimed he sought after to lend a hand, we discover utter devastation from his reckless movements. Regardless of his intentions, hundreds of thousands of retail buyers have been left locked out of the FTX exchange overnight, simply after SBF publicly announced that “Belongings are advantageous.” No longer even 24 hours later, SBF deleted that tweet and changed it with a deceptive message that Binance agreed to obtain FTX to resolve “liquidity crunches.”

Over the next few days, the huge hollow in FTX and its related corporations changed into starkly obvious. A number of customers will have bribed FTX with a purpose to withdraw finances when FTX falsely claimed best Bahamian citizens may just withdraw. Later, data got here to gentle that SBF had a backdoor in to FTX’s accounting device, permitting him to transport finances with out alerting others.

The pedigree attained via SBF and FTX drew in buyers and lenders from around the monetary ecosystem, from primary VC corporations like Sequoia Capital to the Ontario Pension Fund. FTX’s failure thus led to painful markdowns for lots of of the ones buyers, and unquestionably numerous additional implosions in what might resemble a 2008-style contagion match. The crypto lender and financial savings account carrier, BlockFi, used to be the primary to halt user withdrawals of funds within the wake of FTX’s failure — however it is probably not the ultimate.

To many out of doors observers, all of this seems like insider fraud, transparent as day.

SBF lied thru his enamel, abusing accept as true with and perhaps in my view absconding with person finances because the trade used to be imploding. Then again, to SBF, the cave in of his empire would possibly appear to be merely deficient good fortune, a foul coin toss within the sport of leverage and misappropriation he used to be enjoying with a purpose to do probably the most just right as rapid as conceivable. For a standard particular person, it takes some severe psychological gymnastics to justify his movements, however to SBF they may have merely been the unpleasant method to a favorable finish for all humanity.

Once more, It’s not that i am endorsing this view of SBF as an altruistic particular person preventing for probably the most just right. All I’m looking to display is this view of him isn’t incongruent with the crimes he dedicated and the huge losses taken on via the purchasers and buyers that relied on him and his workforce.

If truth be told, this view of SBF tells us a lot in regards to the wider global of politics, and the dangerous monetary habits politicians have interaction in — it appears for the advantage of their constituents.

The Altruistic Flesh presser

SBF might truthfully consider dwelling at the razor’s fringe of chapter allowed him to maximise his sure influence at the global. Sadly, how we fund our governments nowadays presentations our legislators observe a an identical good judgment.

When you might consider the majority of politicians are nefarious ghouls, out to suck the existence blood out of the average guy to fund their personal jet flights and puppy initiatives, I will be able to think they’ve the most efficient of intentions. In all probability many politicians do consider the laws they need to go, taxes they need to modify or initiatives they need to fund will power sure alternate. This is immaterial to my argument.

What I will be able to argue is that because of their reckless investment means, the results of even altruistically-driven spending via politicians will lead to a large number indistinguishable from fraud, simply as we noticed in SBF’s case.

What is that this reckless investment means? Over the top executive debt.

The State’s Reckless Financing

SBF will have recklessly used buyer deposits and features of credit with a purpose to fund initiatives he believed would undoubtedly influence the sector — resulting in the swift cave in of his corporate and a near-total lack of buyer finances.

Sadly, our governments are doing the similar with our financial savings and wages, on a mind-bogglingly massive scale. How?

In executive, central planners pick out an finish they need to reach — the removal of poverty, or drug habit, or top healthcare prices as an example — and spend towards it. After we pay into that device by way of taxation, with the cash moving into equaling or exceeding the cash going out, there is not any accrual of debt, and due to this fact no threat of chapter.

Then again, our governments are lately hooked on debt. Since President Nixon ended the U.S. dollar’s tie to gold in 1971, all currencies all over the world changed into “fiat” — their worth no longer subsidized via anything else however accept as true with in that executive’s skill to pay down its money owed.

Since 1971, executive debt all over the world has ballooned in measurement. When a central authority takes on debt, it expands the liabilities aspect of its stability sheet. This creates threat — a duty to pay towards unsure revenues sooner or later.

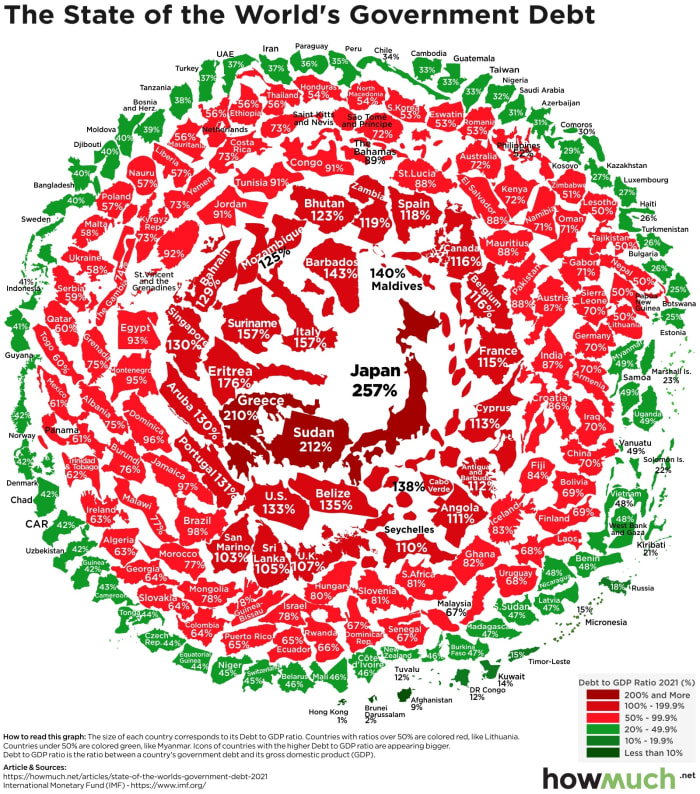

The debt of worldwide governments as a % in their GDP. The bulk are deeply in debt, with greater than a handful over 100%. Source.

Many governments nowadays lift debt burdens exceeding their complete GDP — together with the U.S. Despite the fact that politicians spent all of the cash raised via issuing that debt on systems they really idea would lend a hand voters, there’s now an enormous hollow within the stability sheet that must be paid again.

To a political candidate with just right intentions, many times taking over debt to pay for ongoing executive systems and servicing present debt would possibly appear to be merely doing probably the most just right for voters and the sector. Doing what’s important to take on the nice crises to hand, even if that ends up in an accelerating debt burden.

To out of doors observers, alternatively, this task must be indistinguishable from fraud.

So why are irresponsible governments nonetheless in industry?

Governments Are Particular

First, governments are identical to different companies in that their debt-fueled spending schemes continue to exist off accept as true with. Collectors should accept as true with that the federal government can pay down its money owed in the future. Then again, governments have a couple of additional gear up their sleeves than a regular company with a purpose to stay paying down their over the top money owed.

First, many governments can merely print cash to decrease their liabilities. When you and I’ve to paintings to repay our money owed, a central authority’s central financial institution can merely purchase the federal government’s debt and surrender billions with a few keystrokes. Different schemes like minting a trillion-dollar coin reach the similar ends. They all take worth from all holders of that foreign money — hurting the decrease finish of the socioeconomic spectrum which keeps a larger portion of its assets in cash — and provides it to the federal government.

Printing cash labored neatly from the 1980s up till 2021, when inflation in actual items took hang. Previous to 2021, inflation principally affected asset costs like equities and actual property whilst riding a wealth hole during the Cantillon effect. Put up-2021, shoppers are feeling sharp ache from unexpectedly emerging prices of staples — power and meals — and that suggests the pitchforks are popping out. Many central banks rightly perceive their over the top printing and occasional rates of interest resulted in this consequence, so the power to print more money is now restricted for the primary time in a long time.

With out the cash printer, how can governments proceed to retain the accept as true with in their collectors that they may be able to pay down their money owed?

Cue the second one software of governments to pay down their over the top money owed: violence and coercion. We’ve given governments a singular monopoly on violence, which they may be able to use to compel their voters to pay up. Simply the specter of fines and prison time is sufficient to intimidate many into complying with greater taxation or monetary controls, like the ones which might include a central financial institution virtual foreign money (CBDC). One best has to seem to China to look how a CBDC can be used to micromanage the finances of individuals in the name of the greater good — as outlined via the ruling elegance.

Executive use of cash printing and violent coercion imply voters, no longer politicians, finally end up footing the invoice for the cave in of state budget pushed via the reckless debt burdens taken on via politicians. The ones politicians can even improve the usage of violent coercion and cash printing to stay the investment going, believing the ache to others to be value it at the adventure to a better just right they’ve outlined. In a similar way, depositors at FTX will foot lots of the invoice for the trade’s reckless use in their finances.

To politicians and SBF, this will really feel like fair errors and tough patches at the highway to serving to others as successfully as conceivable.

To everybody else, it’s indistinguishable from fraud.

Are You Begging To Be Overwhelmed?

All of the international monetary device seems about as dangerous as FTX’s books presently, and the one factor that’s retaining it from unwinding is our accept as true with in it. From a citizen’s perspective, we’re trusting that our governments will successfully extract worth from us to pay for the misadventures and fiscal risk-taking of politicians.

The answer for voters is exceedingly easy — withdraw from the financial and fiscal device this is designed to weigh down you. That device can best continue to exist if we, jointly, accept as true with it sufficient to retailer our hard earned cash in it. If we withdraw from it in droves, all of the ruse vaporizes — identical to FTX.

If you’re one of the crucial first ones to withdraw from the prevailing monetary device, you might stay your worth intact — simply as those that have been fast to withdraw from FTX have been made entire, prior to the property dried up. Those that are too overdue to withdraw will probably be left with pennies at the buck, punished via the taxation, regulate and cash printing governments will wish to have interaction in simply to continue to exist.

What does it imply to withdraw in a global the place governments can freeze your bank accounts and take your property according to best suspicions of a criminal offense, even in probably the most evolved jurisdictions?

Retreating is ready distance: How are you able to put probably the most distance between your property and the fraud? I’ll depart it to you in finding the shape that takes to your state of affairs, as each and every people is totally distinctive. For me, it’s unforgeable virtual cash that strikes on the pace of sunshine, and lives in every single place and nowhere immediately: Bitcoin.

No matter it’s for you, I’m hoping you are taking motion quicker moderately than later.

This can be a visitor submit via Captain Sidd. Evaluations expressed are solely their very own and don’t essentially replicate the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)