Credit score is had to leverage accept as true with, while bitcoin is a device for trustlessness. Each credit score and bitcoin will coexist throughout hyperbitcoinization.

Credit score is had to leverage accept as true with, while bitcoin is a device for trustlessness. Each credit score and bitcoin will coexist throughout hyperbitcoinization.

This can be a transcribed excerpt of the “Bitcoin Mag Podcast,” hosted by way of P and Q. On this episode, they’re joined by way of John Carvalho to speak about construction on best of Bitcoin, Bitcoin philosophy and what is going on with the Lightning Community.

Pay attention To The Episode Right here:

Q: Is credit score now not “fiat” in nature or is there a technique to create a wholesome credit score gadget via sound cash? I believe like that is regularly debated and mentioned and I don’t act or declare to understand the precise solution to this, I’m simply essentially curious if you’re feeling as even though there are elements of credit score that simply make it inherently fiat.

John Carvalho: No, I imply, I feel that’s roughly — I’m now not looking to be impolite or anything else, however that’s only a phrase salad. They have got definitions; these items had definitions. To you guys and everyone within the target audience, if you need to check out to have a tighter take hold of of each the dynamics of Bitcoin and the economics which are related to it, learn “Cryptoeconomics” by way of Eric Voskuil. There’s no Bitcoiner that understands these items on that stage higher. My interactions with him and studying with him helped me perceive these items much more deeply as smartly.

He would describe Bitcoin as a marketplace fiat. It’s virtually like how some other people would funny story and say it’s a headless Ponzi. There’s no promise that you are going to get a industry price of bitcoin at some point for any certain amount.

Like bitcoin may well be long gone and no person can be responsible. Bitcoin may well be the preferred factor on Earth and it’s essential purchase a space with one thing that you simply handiest paid $five for, however there’s no enforcement of the associated fee by way of anything else within the Bitcoin gadget. The one enforcement in bitcoin is simply the volume of them that you’ve within the gadget.

So that you don’t know what you’re gonna get on your bitcoin till you attempt to promote it and it’s all relative to the individual you’re promoting it to. There’s no enforcement of the associated fee. In some way, bitcoin itself is sort of a marketplace fiat, a brand new form of fiat as a result of there’s no controller, there’s no central issuer.

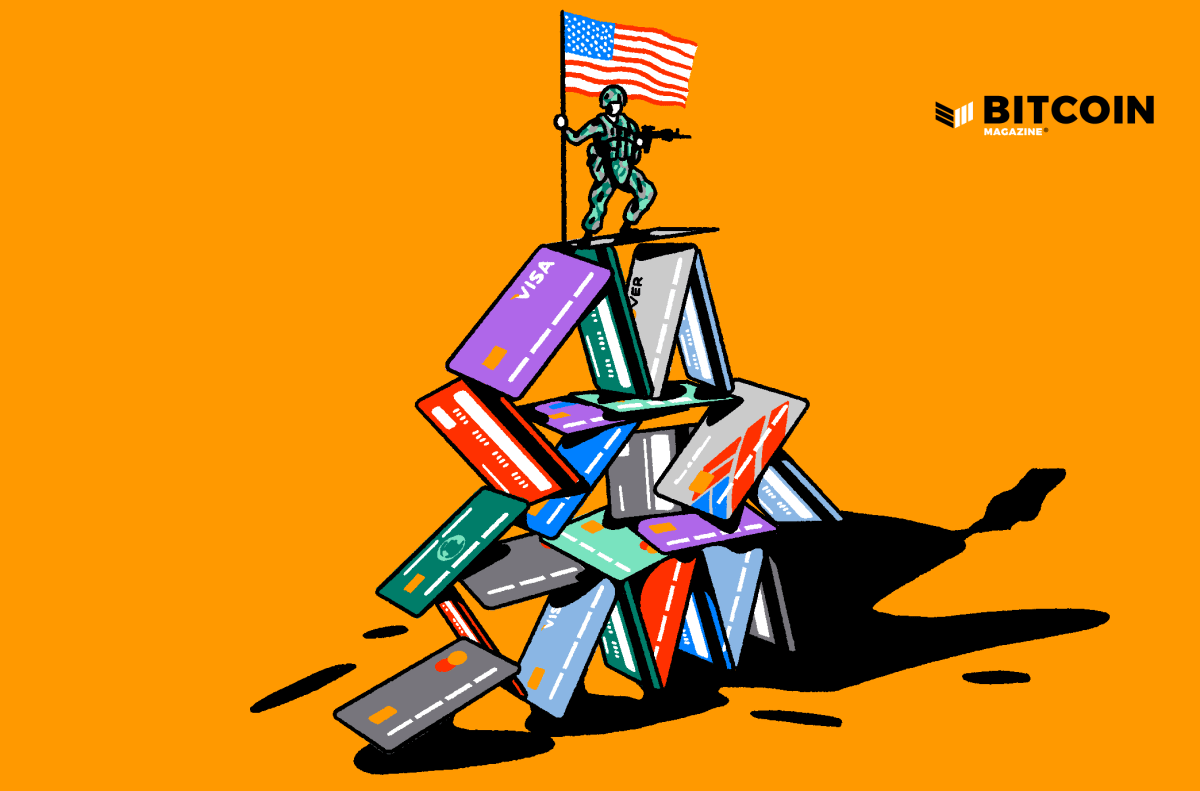

It’s one thing the marketplace created in an effort to have this idea of, and use this abstracted useful resource as a cash. Credit score and fiat are simply two utterly separate ideas. Credit score is simply merely announcing [that] you could have those who accept as true with every different. So you could have bitcoin for trustlessness. The marketplace fiat, the trustless gadget, is just announcing, “If I need to have a unit of account the place I don’t must accept as true with anyone in an effort to use that, without equal retailer of price within the summary, you could have bitcoin. The whole lot else is credit score.

You’ll say that fiat is one of those credit score the place they promise not anything. Fiat is simply fiat by way of decree. You’re announcing, “That is cash.” You haven’t any promise that the issuer will provide you with one thing for that cash. Except you wanna get philosophical and say, “Oh, they’re gonna provide you with a military for that cash in the event you comply with have that cash inflated or taken from you at will.” I don’t wanna get philosophical, so we’ll simply say there’s no precise promise in the back of fiat, however credit score is a depended on gadget. It’s acknowledging the truth that two those who accept as true with every different can accomplish a couple of individual on my own.

You’ll have a type of singular nature. There’s roughly this dichotomy with people, you could have festival and cooperation. You wouldn’t have society if everyone used to be competing on the entirety always. You probably have cooperation, you could have society. Society is accept as true with.

If you wish to now cooperate with other people over abstractions of monetary ideas, you want credit score techniques. You wish to have in an effort to say, “I’ve one espresso store. I’ve confirmed to my buddies P over right here that I will be able to run an attractive nice espresso store and I need to have two espresso retail outlets, however my benefit margin to open two espresso retail outlets would take me 10 years to open my 2nd espresso store and I need to open one subsequent 12 months.” And so if he says, “I feel John can deal with that, I’ll accept as true with John with my cash.” Now that is only a type of financing. Credit score is just like the minimal type of finance. It’s simply announcing, “I accept as true with you for one thing at some point.”

I may say, “Adequate. I’m Starbucks. And I don’t wanna contain P,” I need to say to my shoppers, “Whats up, I’m to promote coffees and I would like you to shop for them for the long run at say a 20% bargain.” And now you are saying, “Smartly I plan on purchasing coffees from John or Starbucks for the following 5 years. That’s a really perfect deal and I’m gonna pre-buy them.” I will be able to now take that and I will be able to leverage that accept as true with and I will be able to use that more money to open the second one espresso store so long as I will be able to meet my commitments to the redemptions of the espresso.

So you’ll see how credit score isn’t that a lot other than finance as a result of you’ll roughly independently finance issues if you’re taking dangers on leveraging your credit score duties.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)