On-chain knowledge reveals the buying and selling volumes throughout the highest cryptos have remained low lately, displaying how disinterested the merchants are.

All The High Property In Crypto Sector Have Seen Reducing Volumes Not too long ago

Based on knowledge from the on-chain analytics agency Santiment, volumes within the crypto market have taken successful lately. The “buying and selling quantity” right here refers to a measure of the full quantity of a given asset that the holders are transferring on the blockchain proper now.

When the worth of this metric rises, it implies that a lot of tokens of the crypto in query is seeing motion at present. Such a pattern implies that merchants are actively taking part available in the market proper now.

Then again, low values could be a signal that the traders are disinterested within the coin in the mean time, because the market isn’t observing a lot exercise at present.

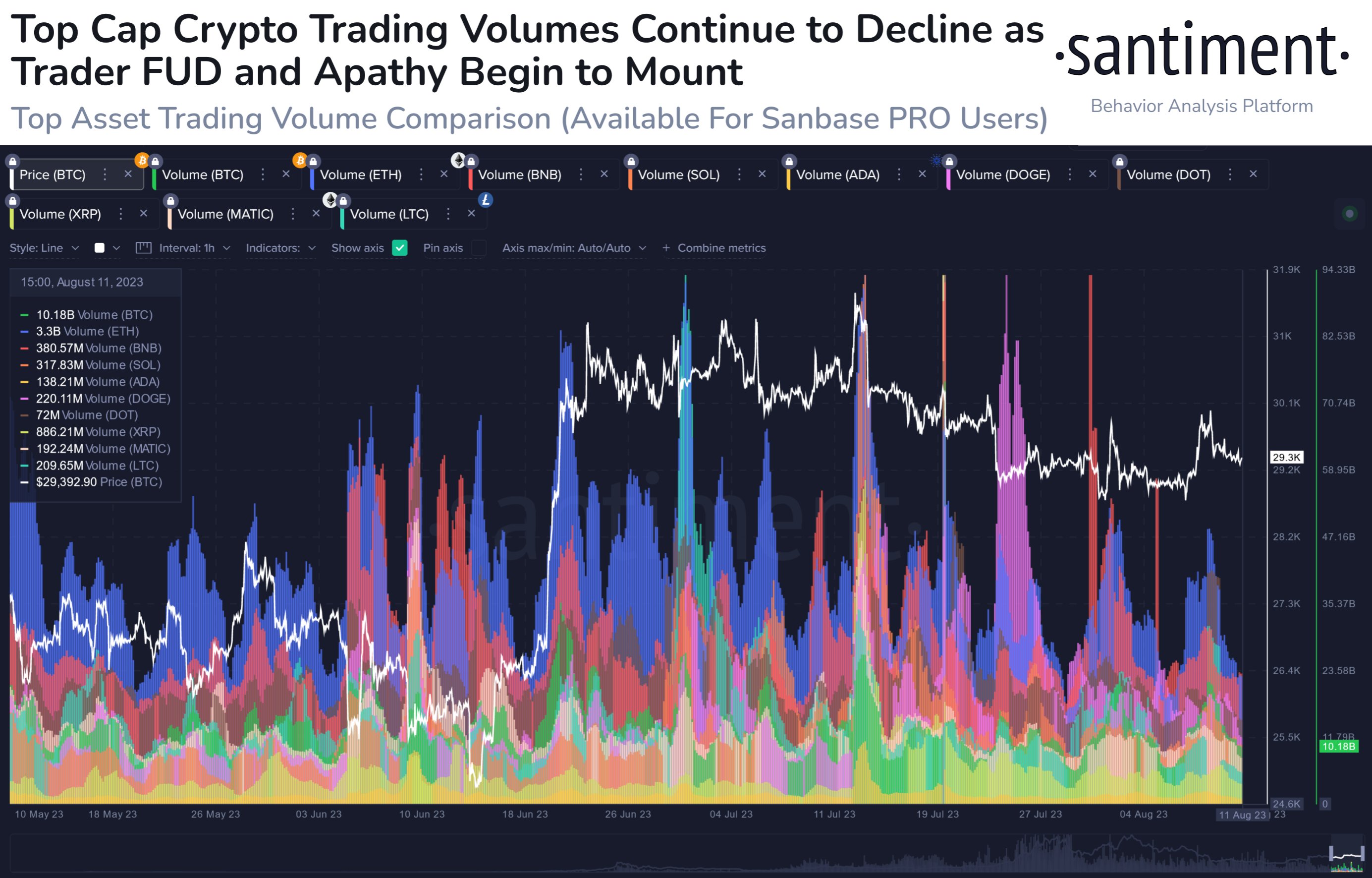

Now, here’s a chart that reveals the pattern within the buying and selling quantity for a few of the largest belongings by market cap within the crypto sector:

Appears to be like like the worth of the metric appears to have been happening for the entire cash | Supply: Santiment on X

As displayed within the above graph, the buying and selling quantity for these high cryptos has been in a common state of decline throughout the previous week or so. This naturally implies that exercise associated to those cash on their respective networks is dwindling.

This drawdown within the indicator has come for these cash because the market as a complete has been dealing with stagnation. Bitcoin, for instance, has been caught within the vary between the $29,000 and $30,000 marks for fairly some time now.

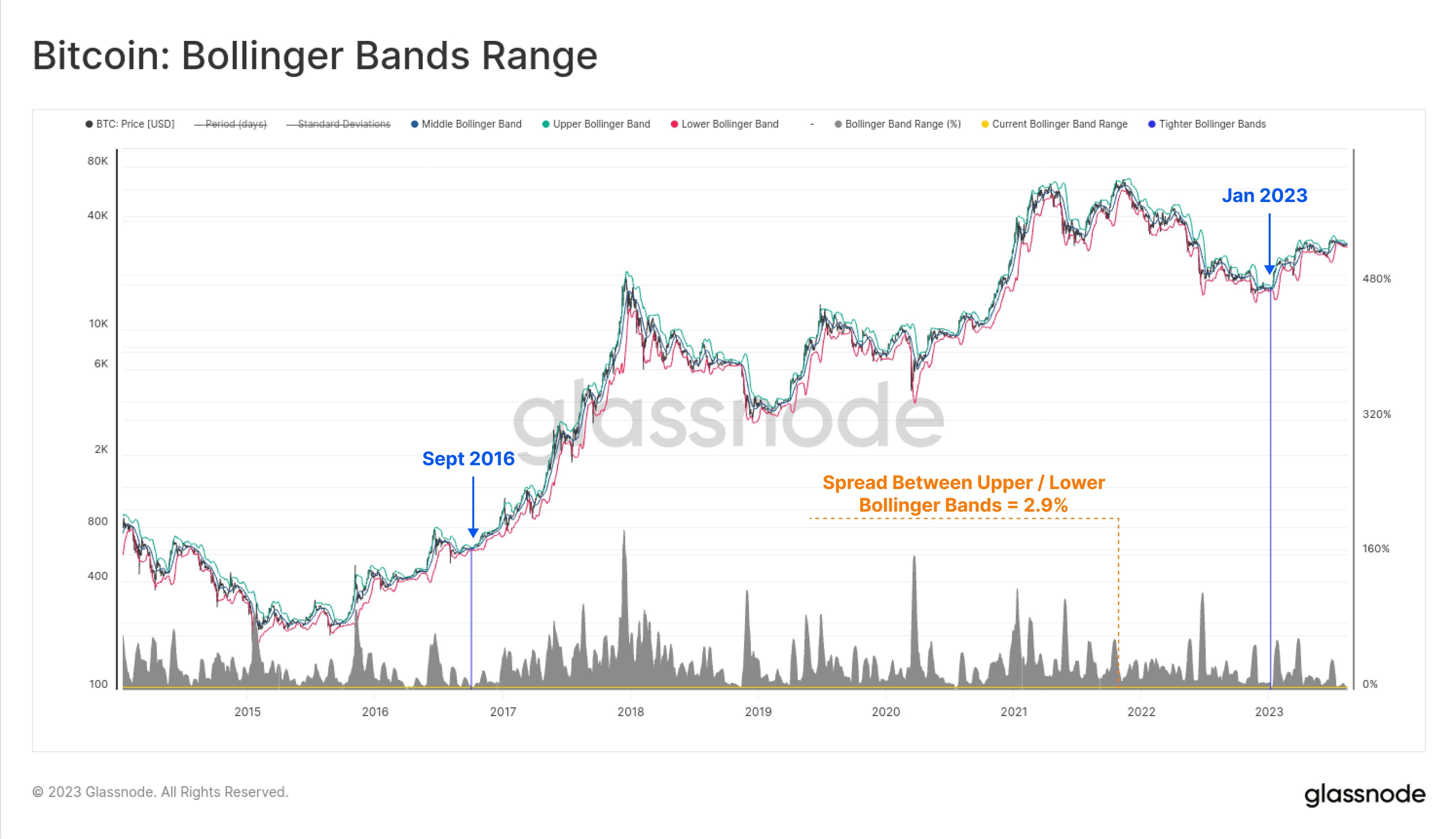

The volatility of the asset has been so low that its Bollinger bands have compressed to uncommon historic lows which have solely been surpassed by the tight ranges of September 2016 and January 2023, because the lead on-chain analyst at Glassnode has identified in a current submit on X.

The BTC worth has been transferring in a good consolidation vary for some time now | Supply: @_Checkmatey_ on X

Amid this low volatility surroundings, it’s not all too stunning to see the buying and selling quantity happening. The explanation behind it’s that traders discover such worth motion to be boring, in order that they cease taking note of the market.

Like a self-fulfilling prophecy, these low volumes then in flip result in extra stale worth motion, as any strikes that the crypto makes an attempt to make fail earlier than lengthy as they run out of gas.

Out of those high belongings, solely Solana has registered some constructive volatility because it has gone up by 6% prior to now week. SOL’s quantity, although, hasn’t seen any important enchancment but.

“As particular person initiatives proceed to have temporary decouplings, watch to see when one could also be related to ascending buying and selling quantity to help it,” suggests Santiment.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,400, up 1% within the final week.

The worth of the cryptocurrency hasn't been transferring a lot lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)