For a couple of weeks now, bitcoin sentiment stemming from the Crypto Worry and Greed Index (CFGI) has been within the “excessive concern” vary. Whilst bitcoin amassed some beneficial properties on Monday, the CFGI remains to be within the “excessive concern” place with a score rating of 16 out of 100. Crypto Worry and Greed Index Stays […]

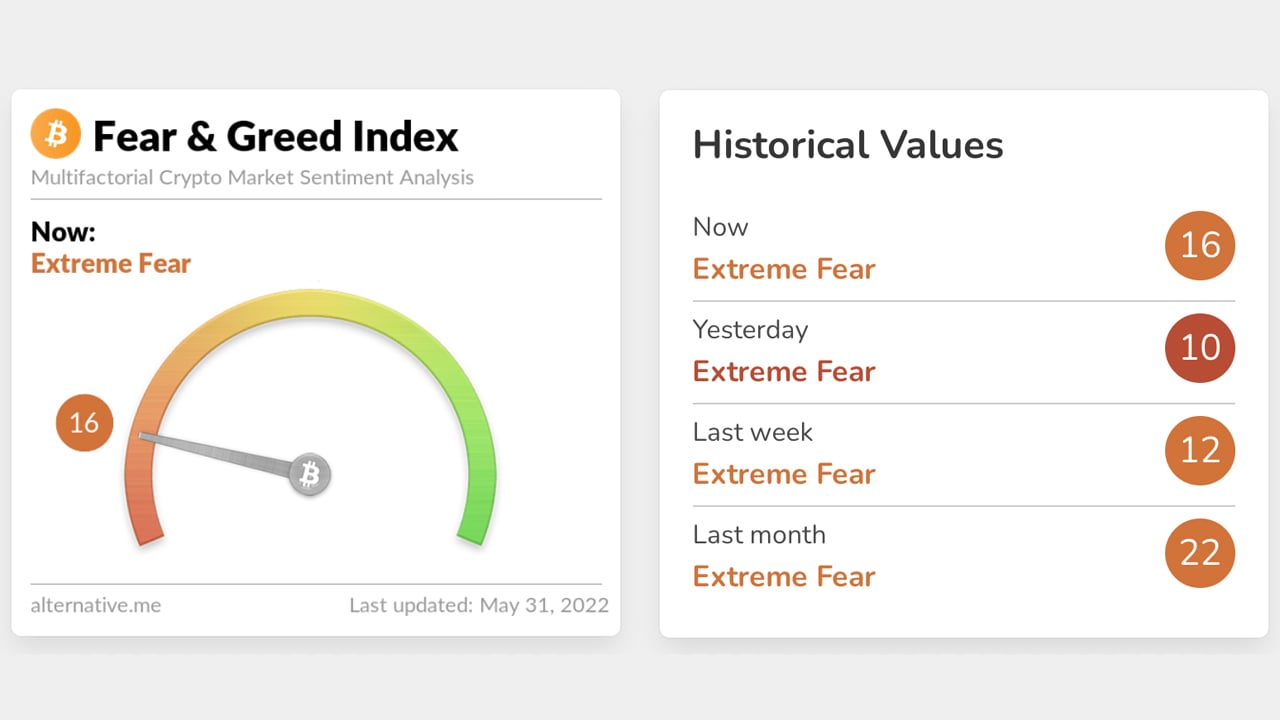

For a couple of weeks now, bitcoin sentiment stemming from the Crypto Worry and Greed Index (CFGI) has been within the “excessive concern” vary. Whilst bitcoin amassed some beneficial properties on Monday, the CFGI remains to be within the “excessive concern” place with a score rating of 16 out of 100.

Crypto Worry and Greed Index Stays in ‘Excessive Worry’

Roughly 45 days in the past, the Crypto Fear and Greed Index (CFGI) hit the “excessive concern” vary with a score of 22. That day, on April 15, the 24-hour bitcoin worth vary used to be between $39,823.77 and $40,709.11 in keeping with unit. Since then markets tumbled even decrease and on Might 12, the price of BTC tapped a low at $25,401, which used to be not up to the former backside closing summer season in July. If anyone bought BTC on Might 12, nowadays they might be up greater than 24% towards the U.S. buck.

Regardless of the beneficial properties right through the previous two weeks, the CFGI remains to be within the “excessive concern” zone and the score is even not up to it used to be on April 15. On the time of writing, the CFGI score rating is 16 out of 100, nevertheless it doesn’t essentially imply markets will stay gloomy. The CFGI hosted on choice.me measures marketplace sentiment and the site notes there are two easy assumptions:

- Excessive concern could be a signal that traders are too apprehensive. Which may be a purchasing alternative.

- When Buyers are getting too grasping, that implies the marketplace is due for a correction.

Alternatively, excessive concern too can result in extra capitulation and the so-called purchasing alternative could also be a lot decrease. Or one may just additionally suppose the present time period is a tiered purchasing alternative and individuals are pleased with buying BTC at the manner down. The CFGI’s easy assumptions are simply that, as they could also be approved as truths, however they would possibly not finally end up coming to fruition.

At the identical token, if “traders are getting too grasping,” because the CFGI says, it doesn’t essentially imply crypto markets will right kind. This implies if anyone took such recommendation they might be promoting BTC at a decrease level than what they might have made by way of ready. Alternatively, there’s all the time the age-old funding recommendation that claims there’s not anything improper with taking earnings alongside the best way.

Crypto marketplace sentiment, no less than consistent with the CFGI, has been within the “excessive concern” area for smartly over a month. The day gone by, on Might 30, the index tapped a score rating of 10, this means that the most recent CFGI rating of 16 is an growth. Google Traits metrics for the question “bitcoin” display passion has ticked up from the new Terra fiasco.

Apparently, Google Trends (GT) data worldwide signifies that passion in bitcoin used to be meandering for some time prior to the Terra LUNA and UST fallout. However right through that exact week (Might 8-14), GT knowledge presentations the hunt time period “bitcoin” skyrocketed to the perfect GT rating (100) since the second one week of June 2021. The week after the Terra LUNA and UST marketplace carnage, on the other hand, the GT knowledge rating for the time period “bitcoin” dropped by way of 45%.

What do you take into accounts the Crypto Worry and Greed Index tapping a rating of 16 and last within the “excessive concern” zone? Tell us what you take into accounts this matter within the feedback phase underneath.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)