Be part of Our Telegram channel to remain updated on breaking information protection

Decentralized Alternate Degree Finance has confirmed that its good contract has skilled a safety breach that resulted within the lack of $1 million price of the change’s utility token, $LVL.

Good Contract Assault Results in Theft of Over 214,000 $LVL Tokens

On Monday, Degree Finance Alternate introduced the lack of greater than 214,000 $LVL tokens, approximated to be $1.01 million, attributable to an assault on its good contract.

The nameless attacker manipulated a number of bugs within the change good contracts and drained and swapped hundreds of tokens into 3,345 Binance Cash (BNB).

An exploit focused our Referral Controller Contract.

– 214k LVL tokens drained to exploiters tackle.

– Attacker swapped LVL to three,345 BNB

– Exploit was remoted from different contracts.

– Repair to be deployed in 12 Hrs.

– LP’s and DAO treasury UNAFFECTED.Extra particulars to observe.

— LEVEL Finance #RealYield (@Level__Finance) Could 1, 2023

At press time, the decentralized change asserts that the good contract doesn’t look like altered because the assault occurred.

Nonetheless, a brand new implementation of the good contract might be deployed within the subsequent 12 hours to avert a recurrence sooner or later.

Moreover, Degree Finance additionally iterated that the safety compromise didn’t have an effect on its various liquidity swimming pools and associated decentralized autonomous organizations (DAOs).

Because the official announcement, some respected blockchain safety platforms have share insights on the compromise, notably Peckshield.

The revolutionary chain safety iterated that the Degree Finance good contract, “LevelReferralControllerV2,” contained a bug that enabled “repeated referral claims” from one interval.

It appears the @Level__Finance‘s LevelReferralControllerV2 contract has a bug that permits for repeated referral claims from the identical epoch. To this point 214k LVLs have been drained and swapped into 3,345 BNB (~1M)

Right here is an instance hack tx: https://t.co/isqHhzFk1Z https://t.co/ikOWx2ezf6 pic.twitter.com/wlr5bFFf0R

— PeckShield Inc. (@peckshield) Could 1, 2023

Degree Finance has verified the knowledge by Peckshield on Discord. The decentralized change additional acknowledged that the exploits had been remoted and implored customers to “stand by for a full autopsy.”

Affect of Good Contract Compromise: $LVL Worth Slumps

At its core, Degree Finance is a decentralized perpetual change deployed on the BNB chain that delivers extremely efficient threat administration and facilitates seamless market entry to programmatic liquidity swimming pools.

Since its debut in December 2022, the decentralized platform has soared in reputation and utility.

Degree Finance permits capital-effective hedging with minimal market influence for traders and merchants searching for to guard their income. It additionally creates yield-bearing alternatives for asset homeowners to earn passive industrial ventures on their digital asset holdings.

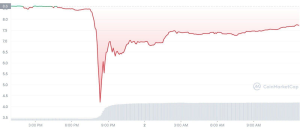

Nonetheless, the current assault on its good contract has impacted the worth worth of its native token, $LVL.

Because the official announcement on Twitter yesterday, the native token has been all the way down to 10.21% in worth worth.

At press time, 1 $LVL trades at $7.73, indicating a downtrend of 31.09% from its all-time excessive of $11.22 recorded on April 21 – 11 days in the past.

Technical evaluation signifies the crypto asset price $7.73 is buying and selling beneath the 50-day easy transferring common (SMA) worth of $8.14, which indicators the asset is bearish.

The relative energy index (RSI) sits at 42.90, indicating the $LVL is barely above the underbought zone of 30.

Monetary consultants assert that the downtrend of $LVL was anticipated as the general crypto market is influenced by information and social media traits.

With the event crew working to mitigate the results of the safety breach and integrating extra safety features, the Degree Finance challenge is anticipated to be on the rise once more.

Decentralized Finance (DeFi) Assaults Proceed in 2023

Decentralized Finance has revolutionalized the traditional finance sector by way of the facility of blockchain know-how to avert intermediaries.

This improvement has led to quicker, extra environment friendly, and extra inexpensive monetary providers distributed to world purposeful ecosystems like well being, know-how, finance, and plenty of extra.

Nonetheless, regardless of its limitless benefits, the safety of DeFi protocols has been lower than fascinating because of incessant hacks, lack of funds, and belongings recorded throughout the nascent sub-sector.

A few of the hottest hacks are Ronin Community’s $656M exploit, Nomad Bridge’s $150M hack, and Wintermute’s $160M breach, with Degree Finance being the newest assault of 2023.

The staggering monetary loss suffered from DeFi hacks has triggered widespread uncertainty over the longevity of the ecosystem, with regulatory our bodies now poised to step in and incorporate frameworks to stop reoccurrences.

Associated Information

Ecoterra – New Eco Pleasant Crypto

- CertiK Audited

- Doxxed Skilled Staff

- Earn Free Crypto for Recycling

- Gamified Environmental Motion

- Presale Reside Now – $2M+ Raised

- Yahoo Finance, Cointelegraph Featured Challenge

Be part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)