The under is a complete, unfastened article from a contemporary version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets e-newsletter. To be some of the first to obtain those insights and different on-chain bitcoin marketplace research immediately in your inbox, subscribe now.

The aim of this liberate in explicit will probably be twofold; the primary will probably be to replace readers on the most recent updates for publicly-traded miner hash charge, manufacturing, and bitcoin holdings. The second one will probably be to provide a framework for easy methods to means making an investment in bitcoin miners, with a focal point at the publicly-traded sector specifically.

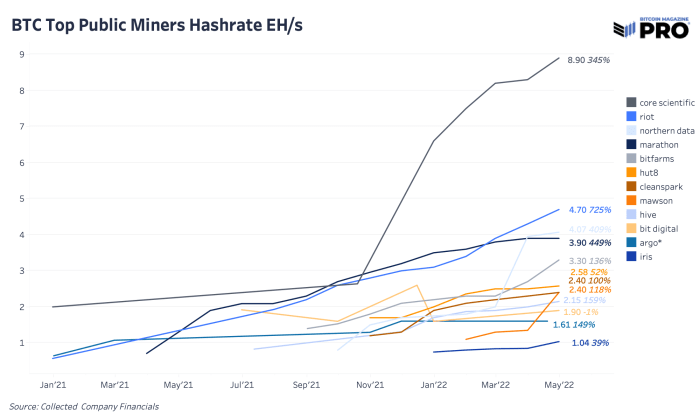

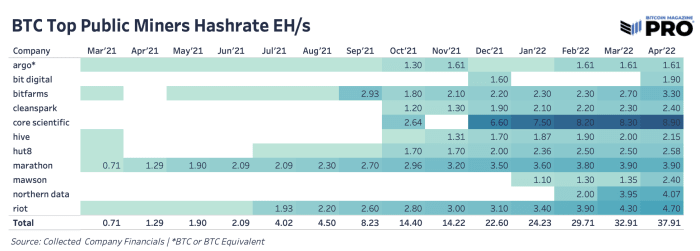

Public Miners Hash Charge Replace

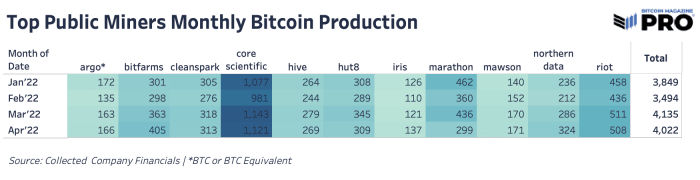

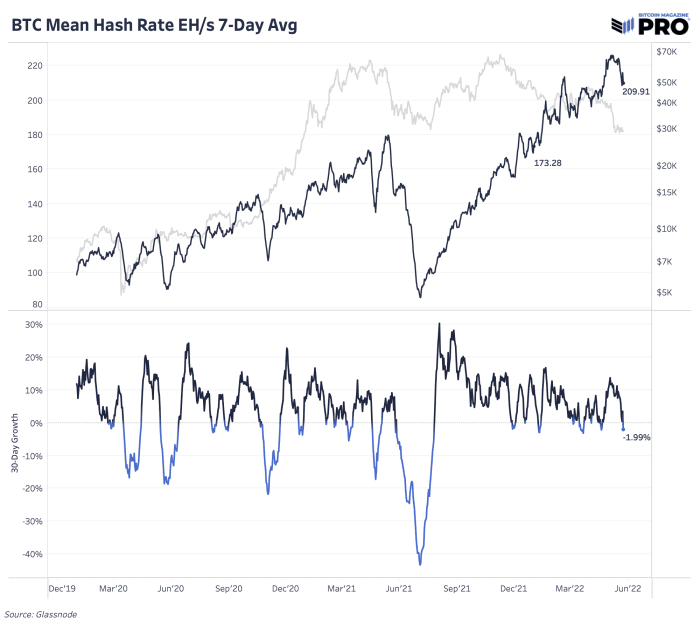

With the tip of the month close to, we will be able to have some other spherical of public miner manufacturing updates for all of Might 2022 in a pair weeks. With the most recent per 30 days manufacturing releases, April 2022 was once but some other month of rising hash charge and held bitcoin, in spite of a somewhat decrease manufacturing month. The crowd of public miners we’re monitoring under now make up kind of 18% of general community hash charge the use of their April numbers of 37.91 EH/s and the most recent decline in general community hashrate to 209.91 EH/s.

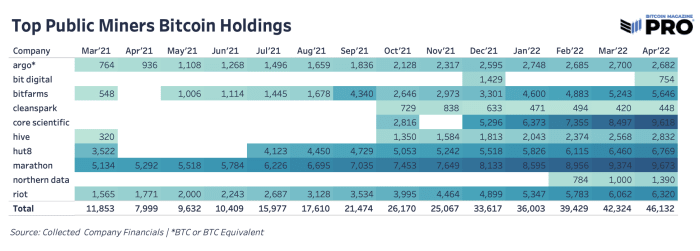

Bitcoin holdings throughout miners at the moment are as much as 46,132 bitcoin price over $1.three billion at a $29,000 value. That’s kind of a 7% per 30 days building up when together with miners with reported records for each March and April. All of this information is pre bitcoin’s marketplace fall from $40,000 so the following month of knowledge updates will probably be key to look if best public miners are cutting down their bitcoin holdings or hash charge in reaction.

Making an investment in Public Bitcoin Miners

Making an investment in publicly-traded bitcoin miners carries dangers that purchasing bitcoin itself does now not, because of the operational chance in addition to the truth that public equities business at multiples of long term anticipated profits. All through environments the place treasury yields upward thrust considerably, this reasons profits multiples to fall, which is why equities as a complete have carried out poorly over the process 2022.

Then again, the dynamics concerned with comparing publicly-traded bitcoin miners is just a little other. Not like different “commodity” manufacturers, bitcoin miners continuously try to retain as a lot bitcoin on their stability sheet as imaginable. Relatedly, the longer term provide issuance of bitcoin is understood into the longer term with close to 100% sure bet.

With this knowledge, if an investor values those equites in bitcoin phrases, vital outperformance in opposition to bitcoin itself is achievable if buyers allocate right through the proper time right through the marketplace cycle the use of a data-driven means.

When Is The Optimum Time To Make investments In Publicly-Traded Bitcoin Miners?

An very simple framework for buyers is:

Hash value bull marketplace = Bitcoin miners outperform bitcoin

Hash value endure marketplace = Bitcoin miners underperform bitcoin

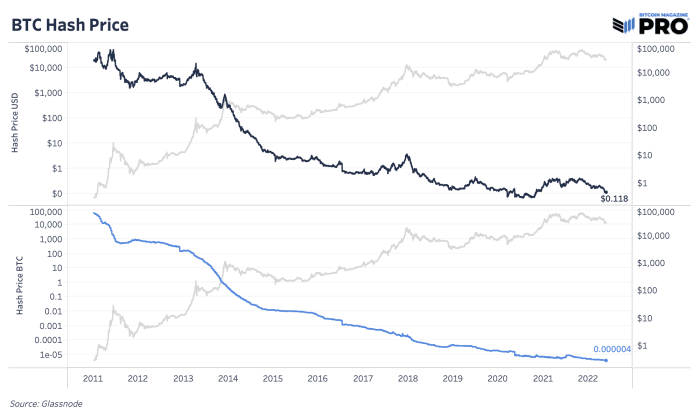

Hash value divides miner income via hash charge (day-to-day miner income in keeping with 1 TH/s, as first coined via the workforce at Luxor).

Whilst there are for sure different variables fascinated by valuing those corporations, together with the operational dangers and the competence of the control workforce to simply title a pair, it is a easy framework for buyers to internalize and make the most of going ahead.

To start out, let’s show hash charge because the get started of 2020, which hash value is in part derived from.

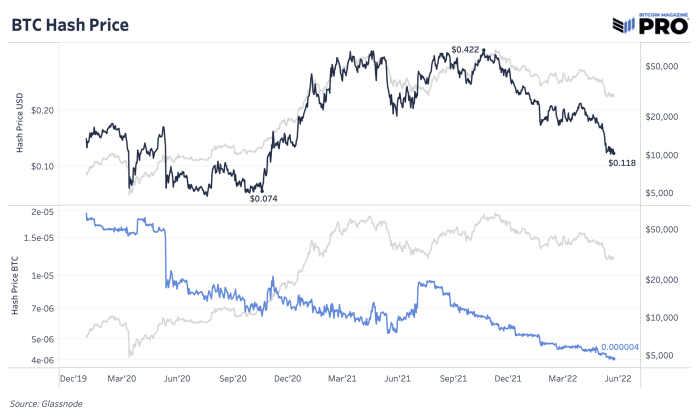

Beneath is the hash value (day-to-day miner income in keeping with TH/s) in each USD and BTC.

These days, hash value is $0.118, which is above the 2020 low of $0.074 however falling swiftly as hash charge (and due to this fact miner issue) proceed to extend as value falls/consolidates.

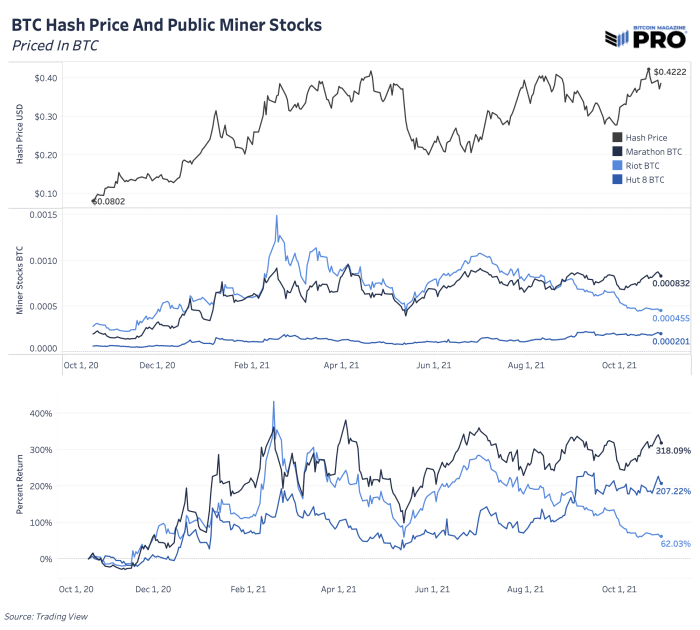

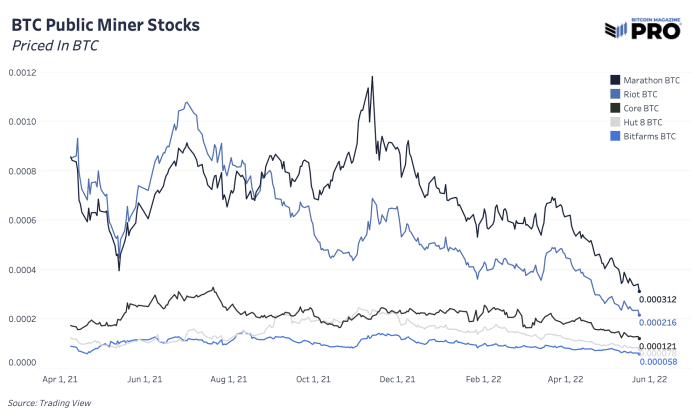

Let’s check out the most recent hash value bull and endure cycles and the way the publicly-traded miners carried out benchmarked now not in opposition to bucks, however as an alternative bitcoin (as this must be all of the goal of making an investment in a mining operation).

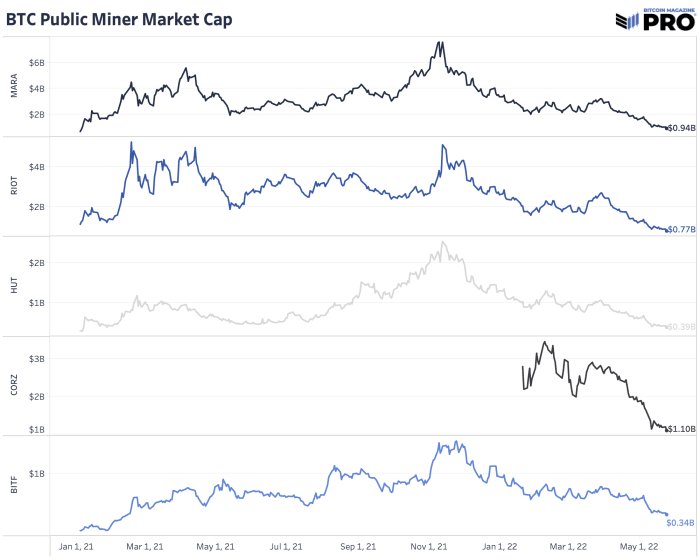

Beneath is the hash value from its 2020 low to its 2021 prime and the efficiency of a couple of publicly-traded miners ($MARA, $RIOT, $HUT) benchmarked to bitcoin. All through the hash value bull marketplace (the place value rises quicker than hash charge), those 3 names outperformed bitcoin via 318%, 207%, and 62% respectively.

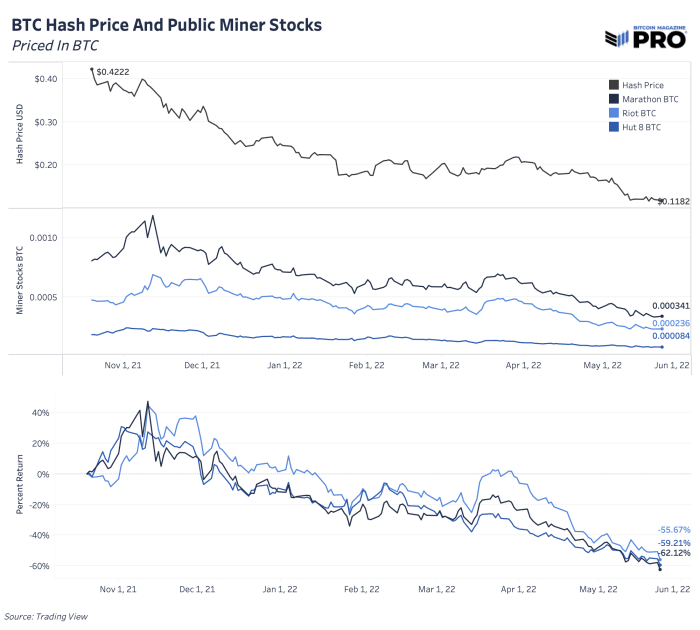

Following the hash value best in October at $0.4222 relationship the entire option to nowadays the place hash value is $0.1182, those identical names have returned the next in opposition to bitcoin:

- $RIOT: -55.67%

- $HUT: -59.21%

- $MARA: -62.12%

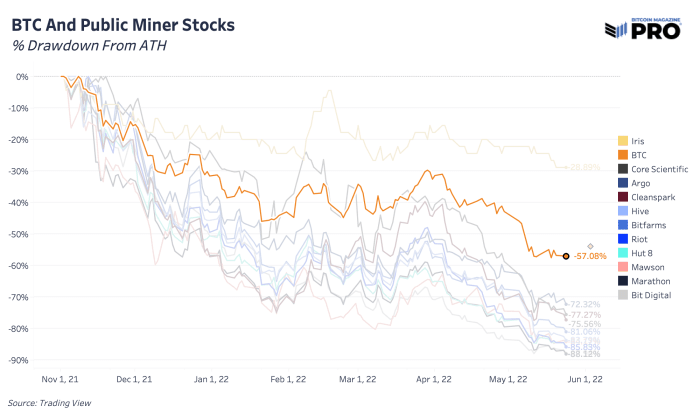

Whilst bitcoin itself has clearly drawn down considerably since its highs made within the fall of 2021 (down 57%), those publicly-traded miners have declined in price via considerably extra with maximum down over 70%.

The purpose of this newsletter is to dissect the cyclicality of the mining business, and the way to think about those securities when navigating the bitcoin marketplace cycle.

Some other vital reality of the bitcoin marketplace is that hash charge has endured to upward thrust in an exponential approach over the process its historical past, which in flip way hash value is in an earthly downtrend in each USD and BTC phrases.

To circle again to some extent made previous, all of the goal of making an investment right into a mining operation must be to get a go back on funding in bitcoin phrases. If you can’t succeed in a good ROI in BTC phrases, it was once most probably now not a just right funding within the first position.

Thus, as a result of the diminishing block praise and emerging hash charge, hash value in BTC phrases is falling in lockstep in programmatic style with every next sure issue adjustment and halving match.

In easy phrases, which means it’s turning into an increasing number of difficult to provide a marginal unit of bitcoin with a unit of hash, which may be why nailing the timing of making an investment in publicly-traded miners in addition to the ASIC rigs themselves will also be so profitable.

Remaining Word

Whilst not anything is ever positive, the use of a data-driven means, it’s imaginable to succeed in vital go back on funding in bitcoin phrases with bitcoin miners, in each the private and non-private sectors.

Whilst attaining fine ranges of relative efficiency calls for a justifiable share of research (and success) referring to each the bitcoin hash charge, the bitcoin value motion, and increasingly more the macroeconomic backdrop, we predict the chance to as soon as once more stand up for mining buyers to outperform within the not-so-distant long term.

Whilst that day will not be right here nowadays, our undertaking is to place ahead clear research across the bitcoin ecosystem, with an intention to assist people and establishments alike make knowledgeable choices referring to their financial savings/investments.

If you happen to loved the content material/research in nowadays’s unfastened factor, you’ll want to give this put up a like, proportion with a pal, and believe subscribing to our paid analysis tier

– The Bitcoin Mag Professional Crew

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)