That is an opinion editorial by way of Kudzai Kutukwa, a passionate monetary inclusion suggest who used to be known by way of Rapid Corporate mag as one in every of South Africa’s top-20 younger marketers underneath 30.

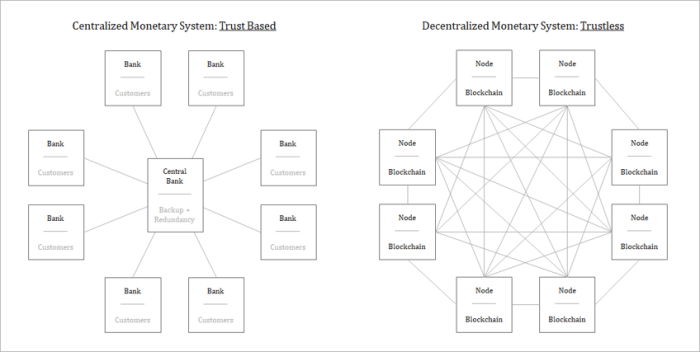

Satoshi Nakamoto brilliantly laid out in a couple of quick sentences the main downside with the present monetary device; it’s dependency on believe. “The foundation downside with standard forex is all of the believe that’s required to make it paintings. The central financial institution should be depended on to not debase the forex, however the historical past of fiat currencies is stuffed with breaches of that believe. Banks should be depended on to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with slightly a fragment in reserve.” In different phrases what actually drives the fiat financial to an ideal extent is believe, as a result of with out it the device as we realize it wouldn’t be useful, on the other hand the believe is being positioned in untrustworthy people and establishments. The Bitcoin financial device is trustless and decentralized by way of design and is reliant on cryptographic evidence as an alternative, thus doing away with altogether the will for “depended on intermediaries” in each and every monetary interplay, from the central financial institution all of the means right down to transactions between people.

The Blocksize War of 2015-2017 is among the most important occasions in Bitcoin’s historical past. This used to be actually a combat between those who liked centralization of the protocol by way of a handful of builders, exchanges and miners (comparable to what you may have in Ethereum as of late) as opposed to those who liked decentralization, safety and resilience over the long run. For the primary time in its lifestyles Bitcoin confronted a possible adverse takeover engineered by way of robust company entities that sought after to seize and impose their will on Bitcoin. What began out as a war of words on methods to scale Bitcoin, whether or not the scale restrict of the blocks that make up the Bitcoin blockchain must be greater or no longer, ultimately morphed right into a two yr lengthy tug of struggle over the very soul of Bitcoin itself. Two camps emerged; the “large blockers”, who had been in desire of accelerating the block size as their precedence used to be making sure quicker and less expensive transactions on the base layer thus making Bitcoin into a world bills device that may rival Visa (i.e. company keep an eye on); and the “small blockers” who had been extra excited by Bitcoin being a brand new type of cash, which needed to stay absolutely decentralized if it used to be to reach the function of setting apart cash and state (i.e. person keep an eye on).

Jan3 CEO, Samson Mow, who used to be on the frontlines of the block dimension struggle, in a contemporary article made the next observation in regards to the small blockers, “They prioritized integrity, resilience and safety, arguing that if blocks was large, it might change into pricey for customers to run a node and would thus incentivize webhosting nodes in knowledge facilities; a one-way boulevard against centralization and keep an eye on by way of a couple of, no longer a lot other from different methods like banks. This may imply the loss of life of the dream of an apolitical, incorruptible, decentralized cash.” The small blockers foresaw a state of affairs wherein extra time it might be pricey for customers to run complete Bitcoin nodes which might have ended in additional centralization and thus recreating the depended on 0.33 events in any other shape; the very middlemen that Bitcoin used to be designed to disrupt. Satoshi designed Bitcoin with the aim of it closing a technically and socially tough peer-to-peer (P2P) community which must by no means be “corrupted” via centralization. He summarized it this way, “Virtual signatures supply a part of the answer, however the primary advantages are misplaced if a depended on get together remains to be required to stop double-spending.”

To ensure that Bitcoin to stay user-controlled, each and every try or type of centralization needs to be fiercely resisted, particularly given the innate human tendency to lean extra against centralized methods with a pacesetter. If a handful of commercial entities and builders may drive one of these important trade with out consensus would that no longer be comparable to how the Federal Reserve plans the economic system by way of dictating rates of interest and keeping up “worth balance?” As said previous, it wasn’t almost about block sizes anymore nevertheless it used to be now an ideological conflict about keep an eye on. Who had keep an eye on, used to be it the customers or the miners or the builders that may steer the protocol? Within the e-book, “The Blocksize War,” the writer as it should be described this phenomenon and the way it used to be an underlying motive force for the massive blockers when he famous;

“In some folks’s minds, the theory of a device managed by way of finish customers is simply too tricky to grab. As a substitute, they search for anyone or some entity who controls the device. Some folks can’t fathom the theory of a device which has world consensus, however lacks a pacesetter…As for whether or not Bitcoin actually is the leaderless device it publicizes to be and whether or not this may at all times stay the case, the jury remains to be out. Then again, after the drama and shenanigans of the blocksize struggle, something is apparent: there’s nonetheless hope that the declare is right.”

In the end, it used to be the small blockers that prevailed and because of this Bitcoin remained firmly within the customers’ keep an eye on.

On the subject of Bitcoin many of the consideration is excited by bitcoin the asset and no more at the infrastructure required to take care of this world, decentralized peer-to-peer (P2P) community. Whilst the small blockers’ victory within the blocksize struggle secured Bitcoin’s trail against long term mass adoption, it nonetheless stays unclear to most of the people why working a node is so vital that it used to be price preventing for. Let’s get started by way of defining what a node is. A complete node is any laptop that maintains and shops all the Bitcoin blockchain; as a way to test and report new transactions as they occur, in keeping with a commonplace set of community consensus laws. Within the absence of a central get together, it’s those nodes that act as referees of the Bitcoin community by way of independently validating all transactions and blocks; and filtering out invalid transactions. That is how the Bitcoin community eliminates believe in any centralized entity and guarantees the integrity of its 21 million provide cap.

Whilst working a complete node is vital, it’s nonetheless non-compulsory to take action. Operating a complete node, grants any person the power to broadcast transactions (or blocks) on a permissionless foundation. The extra nodes there are at the community, the extra decentralized Bitcoin turns into. This no longer most effective will increase redundancy, nevertheless it ends up in Bitcoin being extra safe by way of making it more and more more difficult to deprave or censor. Every complete node executes the consensus laws of the community, a very powerful part being Bitcoin’s fastened provide. Bitcoin Core developer, Luke Dashjr, perfectly summarized it this manner, “All of Bitcoin’s benefits — together with its safety from outright robbery and the 21 million BTC cap — stem from the idea that almost all of the economic system are the usage of their very own complete nodes to ensure bills to them. Centralized verification and third-party/custodial wallets are a larger danger to Bitcoin than the rest.” In different phrases, nodes are essential portions of the Bitcoin community’s protection mechanism in relation to processing transactions, and they’re the final defensive position towards centralization and malicious actors. Additional info referring to working your personal node may also be discovered here.

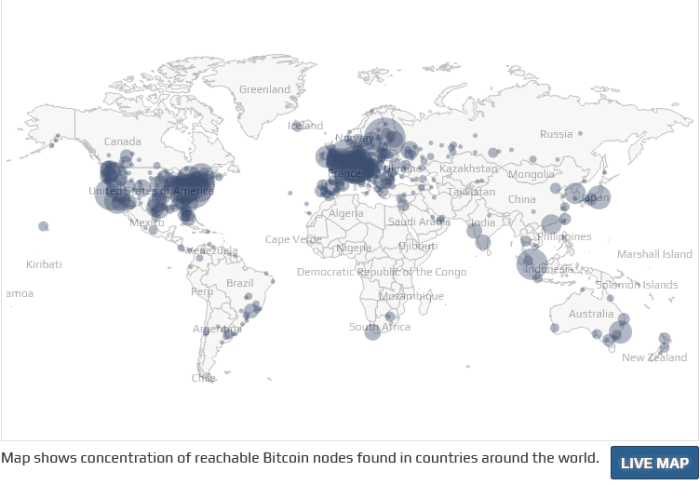

In spite of the important position that nodes play within the Bitcoin ecosystem, it’s estimated that the collection of Bitcoin nodes has dropped significantly from a top of 200,000 in 2018 to not up to 45,000 as of late as of time of writing in keeping with Dashjr’s knowledge. Given the truth that customers having the ability to run complete nodes used to be probably the most largest elements that culminated within the blocksize struggle, it’s unquestionably of serious fear that we’re seeing a discount of nodes at the community in 2022 when put next with 2018. This may probably make the Bitcoin community much less safe and a lot more vulnerable to centralization. Moreover from a geographical viewpoint, 32.8% of Bitcoin nodes globally are situated in simply seven nations — the USA, Germany, France, the Netherlands, Canada, Finland and the UK, as of time of writing in keeping with data from BTC nodes analytics platform Bitnodes.

Sarcastically within the world south the place there’s a large want for Bitcoin from a monetary inclusion standpoint, there’s a paucity of Bitcoin nodes in that a part of the arena. There are a lot of causes that may provide an explanation for the lower of Bitcoin nodes or the shortage thereof in different areas; initially there are a large number of folks that aren’t skilled in regards to the significance of working a complete Bitcoin node, particularly given the present obsession with quantity pass up. Secondly, because of the numerous bandwidth utilization of Bitcoin complete nodes particularly because the community scales, the prices of doing so are prohibitive; particularly in puts with subpar web connectivity. That is the place Erlay is available in. Erlay is a brand new environment friendly transaction relay protocol that goals to seriously decrease the bandwidth utilization required to glue Bitcoin complete nodes.

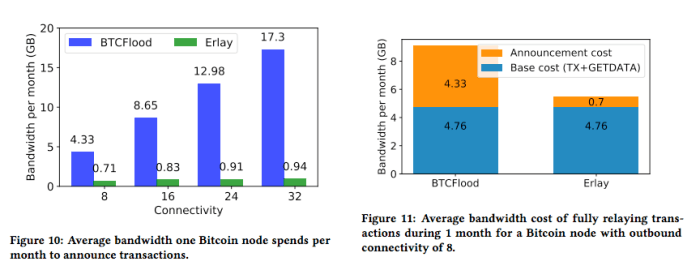

Roughly 50% of the bandwidth required to run a Bitcoin node is used only for pronouncing transactions. When a brand new bitcoin transaction is broadcast, it’s despatched to all nodes on Bitcoin’s p2p community and this happens in two techniques. At first, after receiving a transaction, a node sends a transaction identifier (i.e. transaction ID) to all the friends it’s hooked up with. This transaction ID is due to this fact verified by way of a lot of these friends to make sure that they haven’t gained the transaction in query from any other peer. If no longer, the entire transaction is asked from the node that despatched the transaction ID. This procedure repeats frequently and the result is that there’s a plethora of redundant messages being shared at the Bitcoin community, thus unnecessarily eating a large number of bandwidth. It’s estimated that 44% of general bandwidth used between nodes is composed of those redundant messages. The lengthy and in need of it’s that this way has prime redundancy and deficient bandwidth potency. The bandwidth prices subsequently change into an enormous obstacle for some customers to run a complete node, which significantly limits the level of decentralization of the community.

Secondly, the decentralized nature of the community provides upward thrust to any other important factor in relation to Bitcoin’s node connectivity, which is that it additionally makes use of huge quantities of bandwidth to stay the relationship open with all of the different nodes. In different phrases the present protocol will increase bandwidth intake because the collection of connections between nodes will increase. This additionally will increase the prices to run a Bitcoin complete node because the community scales, which might make the community extra vulnerable to centralization. Over and above that, for the reason that safety of the Bitcoin community is closely reliant at the connectivity between nodes (i.e. upper connectivity ends up in a extra safe community) fewer connections between nodes could be bandwidth environment friendly however would lead to a much less safe and borderline centralized community. In line with the white paper that used to be co-authored by way of Gleb Naumenko, Bryan Bishop, Pieter Wuille, Greg Maxwell, Alexandara Fedorova and Ivan Beschastnikh; Erlay will scale back the volume of bandwidth required to take care of present ranges of connectivity between Bitcoin nodes by way of 40%, whilst concurrently keeping up bandwidth utilization because the connectivity between nodes will increase. To position this in standpoint, recently a connection to 32 nodes makes use of roughly 17.3GB per 30 days to relay transactions and Erlay significantly reduces this to a meager 0.94GB per 30 days! This can be a large quantum jump for bandwidth potency as proven by way of the diagrams under:

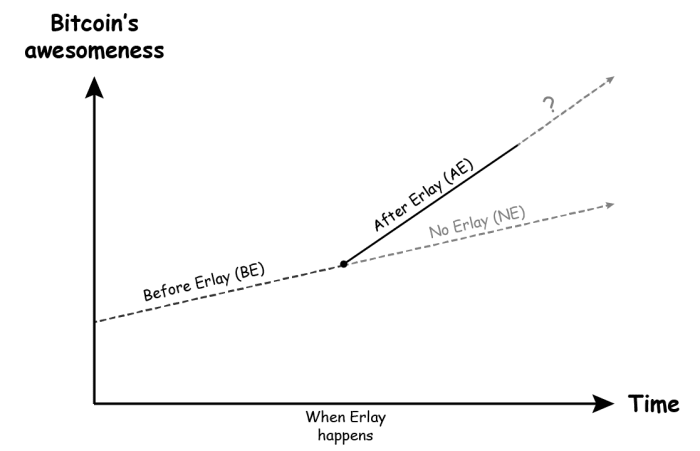

The paper additional states that; “By way of permitting extra connections at a small price, Erlay improves the safety of the Bitcoin community. And, as we display, Erlay additionally hardens the community towards assaults that try to be told the foundation node of a transaction.” In different phrases Erlay considerably improves bandwidth potency by way of decreasing bandwidth used for transaction relay in addition to scalability of connections between friends thus making the community extra immune to partitioning attacks and fortifies unmarried nodes towards eclipse attacks. Whilst Erlay protocol enhance signaling has effectively merged into Bitcoin core, this used to be a building that took 3 and a part years to materialize, given the in depth overview and checking out that needed to be accomplished previously, as a result of balance and safety on the base layer are the whole lot.

Whilst Bitcoin is an important step forward in making a trustless and decentralized financial device with awesome financial houses, its good fortune isn’t assured except we the customers stay dedicated to protecting the rules upon which it’s anchored. The victory by way of the small blockers within the blocksize struggle wasn’t passed to them on a silver platter nevertheless it happened via relentless dedication to the function of separation of cash and state. It used to be all or not anything. Many extra makes an attempt to keep an eye on Bitcoin on the protocol stage can be introduced, on the other hand they’ll be doomed to fail if we stay resolute and unwavering in maintaining the community’s core tenets; of which decentralization is leader amongst them, in my humble opinion. By way of retaining the prices of working a node as little as conceivable,extra person customers from around the globe are ready to take part in validating the community, that is what Erlay represents. It’s a protection towards centralization of the community by way of better avid gamers thus maintaining Bitcoin’s identification as a completely decentralized, permissionless and trustless peer-to-peer financial device.

This can be a visitor publish by way of Kudzai Kutukwa. Critiques expressed are totally their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)