ETH outperforms BTC with a rally of over 2%. GRT beneficial properties 44% for the week as AI cash acquire curiosity. Optimism boosted by Layer 2 transactions.

ETH

Ethereum was greater this week by 2.25% as traders flip to the subsequent improve for the venture.

Ethereum has lately seen a choose up in on-chain exercise, as traders flip their consideration to non-fungible tokens (NFTs). This has been sparked by the launch of a mini-game by Yuga Labs, creators of the Bored Apes assortment. Every day charges on Ethereum have greater than doubled for the reason that begin of the yr from round $2 million to round $5 million.

Bernstein analysts mentioned that ether inflation has remained adverse for over two weeks, with an expectation for additional deflation with extra on-chain exercise and demand.

“We do consider BTC [bitcoin] and ETH stay comparatively clear right here and can see gradual conviction-based spot positioning,” analysts Gautam Chhugani and Manas Agrawal wrote.

The subsequent huge driver for Ethereum curiosity is the Shanghai improve which is now due round mid-March, the place withdrawals of staked ether might be enabled. That would convey some warning as traders worry the potential for promoting as 70% of the ETH staked has been by means of liquid staking swimming pools comparable to LIDO.

The remaining ether has been immediately staked into the beacon chain and is unlikely to be short-term holders. Subsequently, there could also be warning approaching the occasion, “however improved conviction in holding in spot markets, because the fears recede,” Bernstein.

Ethereum was buying and selling at $1,622 after seeing resistance at $1,700 and the coin has help round $1,500.

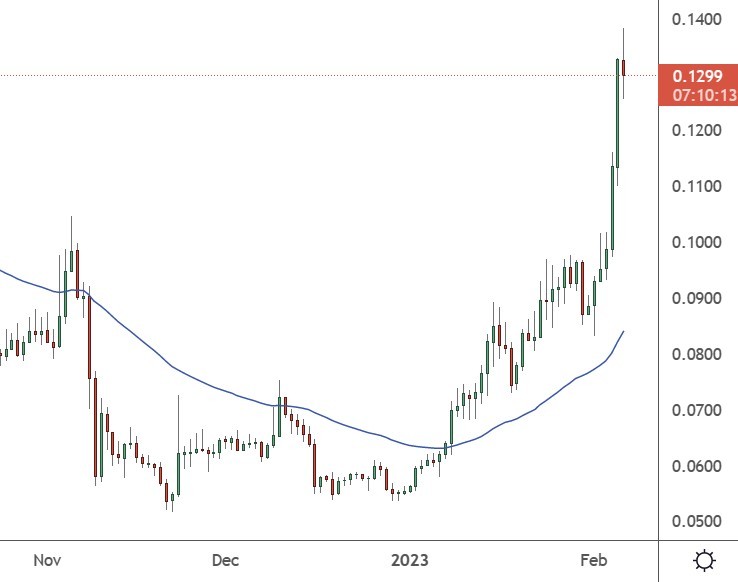

GRT

The Graph was buying and selling greater by 44% this week after synthetic intelligence tasks have been boosted.

The ChatGPT app, which is an AI language mannequin, has attracted hundreds of thousands of customers from its current launch and has led to elevated curiosity in AI tasks within the crypto house. The Graph and SingularityNET have been two of the crypto market leaders this week as traders look to new tasks.

An article from Kitco quoted a press release from Tradingbrowser.com which mentioned:

Following Crypto’s tumultuous journey within the earlier 12 months, many are trying to find a safer means of buying and selling and investing in Crypto, and that’s what A.I. brings to the sport, a prompter detection of fraud, threat safety, and autonomous buying and selling alternatives.

The Graph was launched two years in the past and permits builders to simply search, index, use and publish information from public blockchains. The venture reported sturdy developer adoption after a yr with the entire variety of builders rising by 145% to 38,000 from November 2021 to the identical interval in 2022. The Graph has additionally turn into the most-searched A.I. cryptocurrency in 2023, with a mean month-to-month world search whole of 8,100.

The value of GRT was buying and selling on the $0.133 stage with a market cap of $1.17 billion.

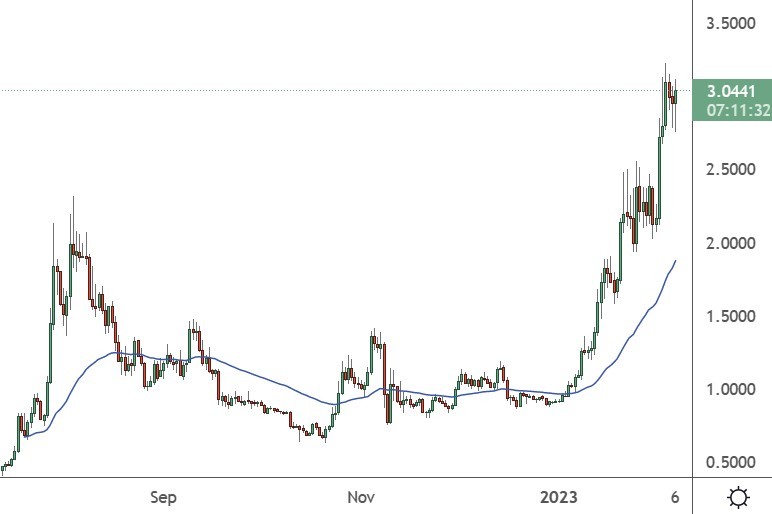

MAGIC

The value of Magic was greater by over 40% this week as traders embraced one other theme in metaverse tokens.

Buyers are beginning 2023 with a hunt for undervalued tokens that would be a part of the likes of Decentraland (MANA) and The Sandbox (SAND).

MAGIC is a utility token constructed on the Arbitrum blockchain and it’s used to purchase and promote NFTs on the Trove market. The token may also be staked and is seeing investor curiosity with renewed consideration on NFTs.

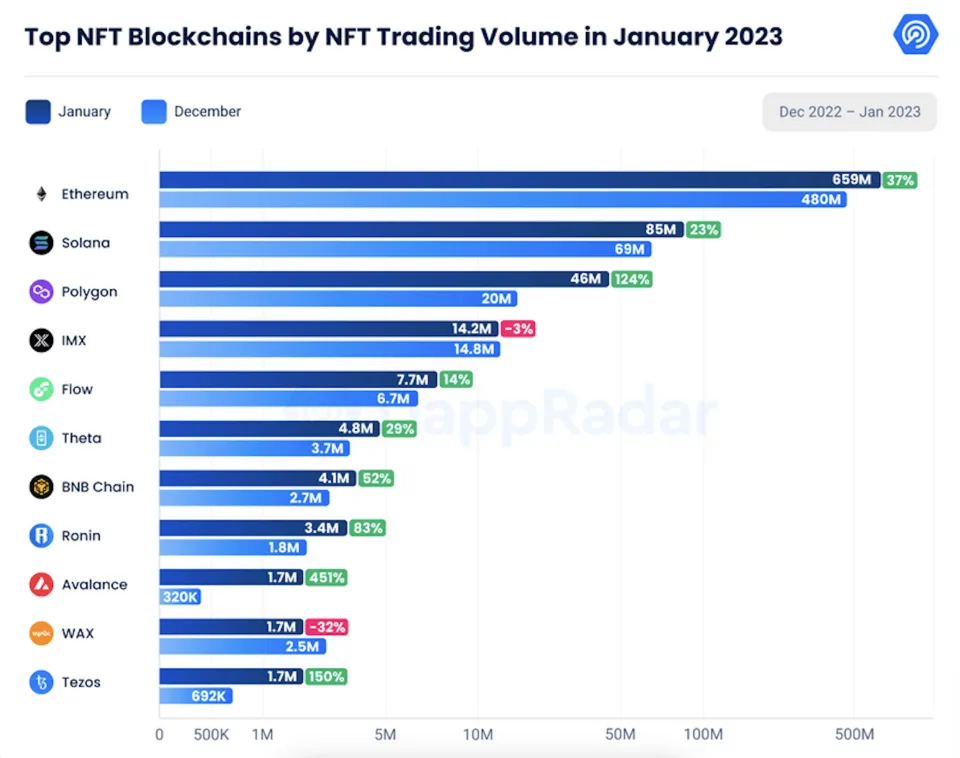

January noticed the best NFT volumes since June final yr, in response to the Dapp Trade Report: January 2023. The expansion in January marked an enormous distinction from current tendencies with October seeing buying and selling volumes dip to a low of $662 million.

Quite a lot of blockchains permit merchants to purchase and promote NFTs, however Ethereum has held the lead with over $36 billion in all-time gross sales, information from NFT aggregator CryptoSlam confirmed.

January was sturdy for each Ethereum and Solana, which noticed buying and selling volumes of $659 million and $85 million, respectively.

The value of MAGIC was buying and selling on the $2.00 stage on Monday with a rating of 94 within the record of crypto tokens by market cap.

OP

Optimism (OP) joined the bullish cash this week with a 22% rally.

Optimism (OP) has seen its significance rising on this planet of Ethereum Layer 2 because the venture now controls 80% of the TVL, alongside Arbitrum. In mid-January, the 2 protocols handed Ethereum’s every day transactions, highlighting their scaling potential. Optimism (OP) processed some 800,000 transactions alone in sooner or later throughout that month.

Arbitrum additionally gave up a few of its energy to Optimism (OP) with the launch of a service known as Odyssey. In line with DappRadar, Arbitrum had $1.2 billion in whole worth locked (TVL) in late 2022, nevertheless, its TVL crashed sooner or later later to $125 million. The venture has since struggled to recuperate that staking stage. Optimism (OP) continues to supply decrease charges than Ethereum and will proceed to see development in 2023.

OP is buying and selling across the $3.00 stage with a market valuation of just about $700 million.

Disclaimer: info contained herein is offered with out contemplating your private circumstances, subsequently shouldn’t be construed as monetary recommendation, funding suggestion or a proposal of, or solicitation for, any transactions in cryptocurrencies.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)