The present Ethereum worth research is bearish because of a couple of circumstances over the day past of rejection for added upward. Because of this, we look forward to ETH/USD to drop underneath $1,900 after which retest $1,800 as improve.

Ethereum Rejects Upside

Since achieving a day by day top of $2012, Ethereum has corrected by way of 6.6%. The cost vary between $1700 and $1800 is the the most important improve degree, and it is necessary for ETH to take care of above it to prevent any longer falls.

Technically talking, Ethereum is advancing within a emerging wedge (in yellow), which is a bearish pattern. The business quantity on Binance may be declining similtaneously. This means that the collection of consumers is regularly losing.

Think that the bulls can save you the pair from breaking underneath the necessary improve within the $1,700–$1,800 area (proven in inexperienced). On this example, it’s expected that when a brief retreat, the emerging pattern will lift on with $2200 as the objective. Then again, if the cost drops underneath the indicated improve, bears may have an opportunity to hit $1350-1280. (in mild blue).

ETH/USD 4-hour chart. Supply: TradingView

For the reason that starting of August, when an important upper top was once recorded fairly underneath $1,600, the cost of ethereum has been transferring strongly within the path of the bulls. After some consolidation, the ETH/USD pair on Wednesday overcame earlier resistance at $1,800.

After that, sure momentum higher till it reached the $1,900 resistance, the place it in short stabilized all over again. Retracement, on the other hand, didn’t happen as a result of any other upward spike led to the present swing top being made at $2,000.

The day prior to this, because the $2,000 barrier was once momentarily surpassed prior to bearish momentum swiftly returned, the cost of ethereum attempted to upward thrust even upper. Some other decrease native top was once established in a single day to lately, resulting in a breach underneath the $1,900 improve over the previous couple of hours and paving the door for a lot more decline.

On-chain Information

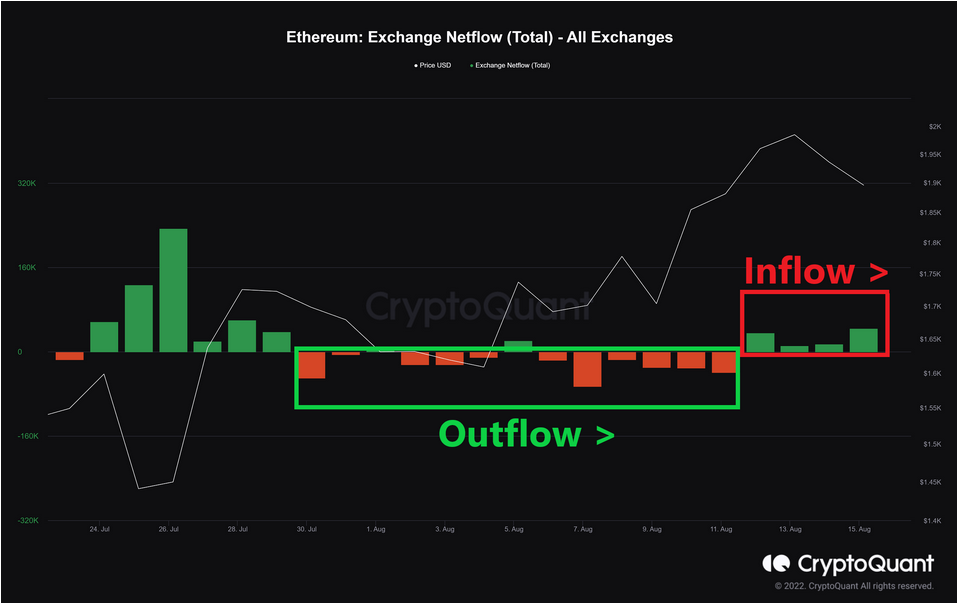

The graph underneath demonstrates how the decline in trade reserve has coincided with the rising pattern of ETH. The outflow is larger than the consumption, as noticed by way of the pink histogram bars. The histogram bars have modified colour to inexperienced all over the previous 4 days.

Supply: Cryptoquant

This means that buyers put their cash on deposit in anticipation of a possible selloff. Realizing that this inflow is attached to the spot marketplace is beneficial.

Featured symbol from Coinmarketcap, chart from TradingView.com, Cryptoquant

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)