Through the years, the crypto marketplace has maintained a detailed dating with the inventory marketplace. Ethereum, the second-largest cryptocurrency, rose in lockstep with U.S. shares for the primary time in February. In consequence, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Regardless of the brake fearful buyers have placed on worth process previously week, the Ethereum (ETH) worth is poised to upward push over the weekend. Even supposing buying and selling quantity has higher over the past week, and thus must have resulted in additional constant fluctuations, worth responsiveness has been suffering from geopolitical information, income, and inventory marketplace whipsaws.

Ethereum Value Witnesses Turbulence

The cost of Ethereum has had a grueling week for buyers and investors, with massive swings in line with income, geopolitical occasions, and buyers turning from risk-on to risk-off like a mild transfer. However with volatility comes alternative, and as all of those occasions wind down against the weekend, bulls could have the playground to themselves and will force the cost as much as $3,500 in the event that they select the precise access ranges. Be expecting the RSI to upward push over 50 once more, with plenty of room earlier than buying and selling into overbought territory.

In keeping with statistics from Santiment, a crypto marketplace habits research instrument, Ethereum has a robust (+ve) correlation with the S&P 500 index. Following a 1.Eight % drop within the S&P 500 index’s figures, the cost of ETH higher via 3%.

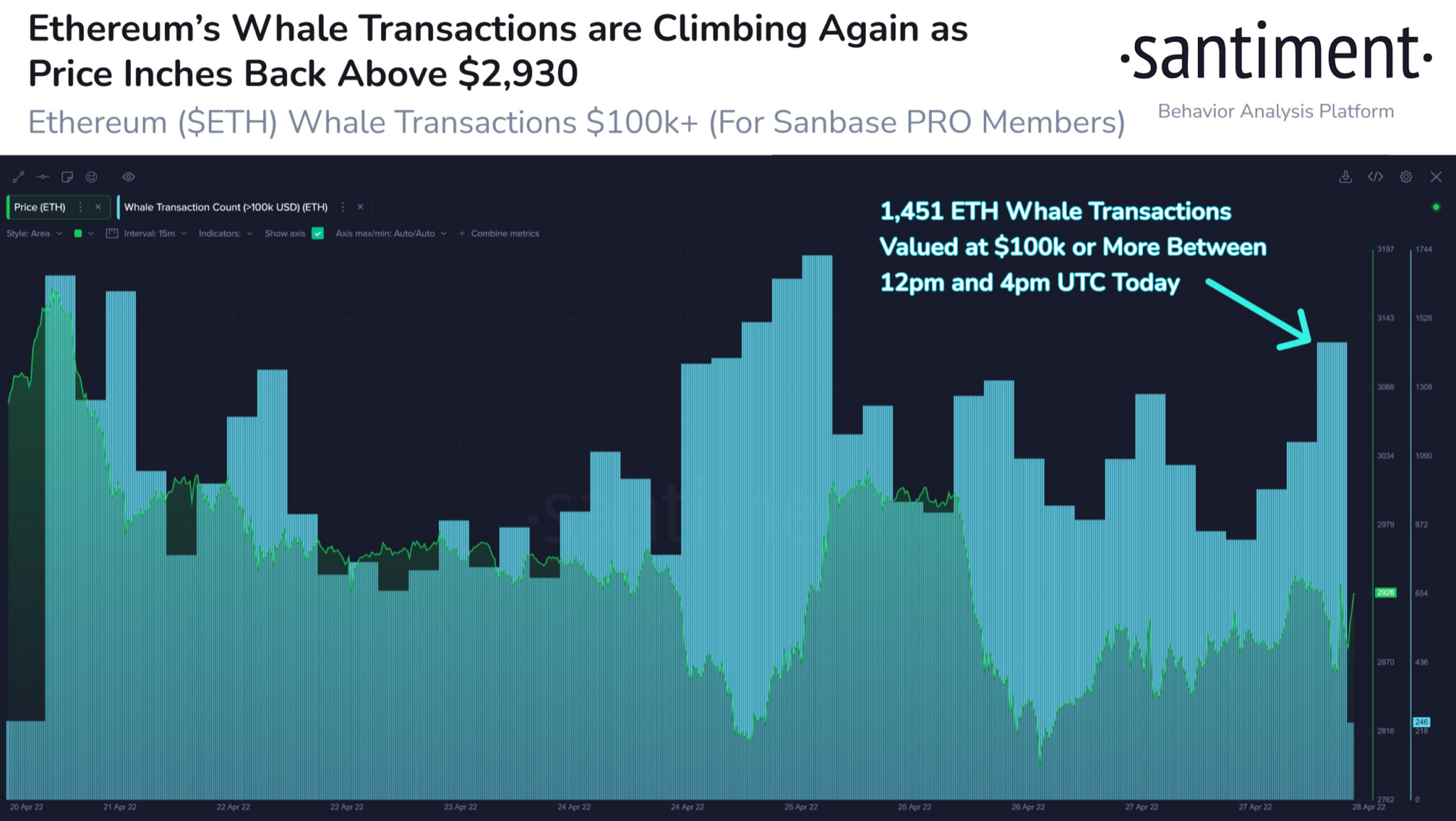

Supply: Santiment

The tweet from April 29th added,

“Aided via a +1.8% day within the SP500, Ethereum has jumped again above $2,930 with its tight correlation to equities markets.”

Now, as noticed within the graph above, ETH’s maximum robust patrons, the whales, have retaliated via purchasing further ETH. On that day, the collection of whale transactions price greater than $100,000 surged dramatically.

In a four-hour duration, 1,451 such transactions had been documented. The soar, in step with Santiment, instructed that key stakeholders had been taking note of the cost build up.

Urged Studying | Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Is Equities Marketplace Correlation Just right For ETH?

This wasn’t the primary time ETH had proven indicators of a growing dating with the inventory marketplace. The 2 sank in combination on March 31st, as reported 3 weeks previous, however started hiking once more after April 1st. Ether surged in tandem with the SP500 since mid-March.

Each and every sure state of affairs within the crypto-verse is accompanied with a adverse counterpart. This is, in any case, a truth. This situation is not any exception. Crypto’s robust affiliation with equities, particularly, would possibly paintings wonders. Other respected entities, alternatively, have censored cautionary scenarios for a similar.

ETH/USD has remained underneath $3k. Supply: TradingView

Arthur Hayes, the previous CEO of BitMex, raised caution flags about this hyperlink on this example. Unusually, the inventory marketplace seems to be headed for an enormous drop thru 2022 because the Federal Reserve tightens financial coverage to struggle inflation.

Similar Studying | Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Featured symbol from Pixabay, Santiment, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)