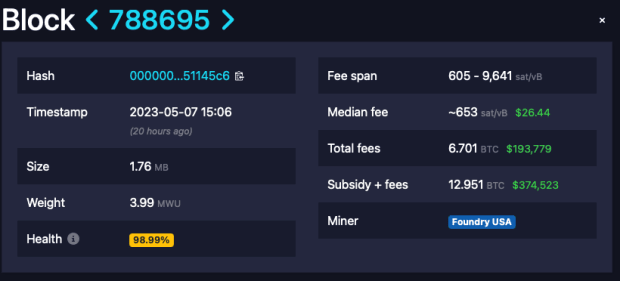

The charges collected in a single block of Bitcoin transactions have surpassed the block reward, a testomony to the rising demand for block house on account of Ordinals and BRC-20. Provided that that is the primary time this has occurred with out the value of bitcoin being in a major bull market, it’s a milestone within the evolution of Bitcoin, because it reinforces the rising potential for transaction charges to maintain the community’s operations.

In keeping with Dustin Trammell, CEO of Trammell Enterprise Companions, the primary time that the charges in a block surpassed the block reward was in block 500,521 in 2017.

The rise in transaction charges might be attributed to the introduction of Ordinals and BRC-20. Inscriptions, units of information inscribed using the Ordinals protocol, already pumped up the price market and started impacting mempools inside the final couple of months. However BRC-20, a recently-introduced token commonplace which permits tokens to be tied to the Bitcoin blockchain, has created an financial incentive with minting, most frequently accomplished on the smallest UTXO measurement potential, resulting in the latest competitors for block house.

This has led customers to pay greater and better charges to make sure that their transactions are processed quicker, as miners naturally prioritize bitcoin transactions with greater charges to maximise their earnings.

On high of that, the latest rise in Bitcoin’s value has additionally contributed to a rise (though small) in transaction charges, as customers are keen to pay extra to maneuver their bitcoin holdings round. The mix of those components has resulted in a major improve within the income earned by miners from transaction charges, which is now exceeding the mounted block reward in sure blocks.

The rise in charges has had a measurable affect on companies that make the most of each on-chain bitcoin and Lightning. Binance, the world’s largest cryptocurrency change, has needed to halt and restart bitcoin withdrawals twice, claiming community congestion was the explanation. Because of this, the agency has acknowledged that it’s trying into integrating Lightning with the intention to higher facilitate small withdrawals throughout excessive price environments. Francis Pouliot, CEO of Bull Bitcoin, a Canadian, bitcoin-only non-custodial change, took to Twitter, saying “I believe it is essential for bitcoiners to understand how elevated charges w/o elevated tx quantity and value pumps have an effect on enterprise like ours.”

It’s not simply companies, both — residents in international locations that depend on bitcoin are seeing difficulties, because the charges for on-chain transactions are important sums of cash for a lot of — and Lightning is not at all times out there but.

Bitcoin’s safety market has lengthy been a heart of debate, as, save for value bull runs, block house has largely remained low-cost since Bitcoin’s inception.

Whereas the mounted block reward is about to lower over time, the rise in transaction charges can offset this discount and be certain that miners proceed to be incentivized to course of Bitcoin transactions. However many people on Bitcoin Twitter seemingly disagree with Ordinals and BRC-20 fulfilling Bitcoin’s price market safety function, calling the flood of transactions a “DoS assault.”

Anita Posch, a Bitcoiner centered on international adoption, additionally highlighted challenges with adoption on Twitter, asking, “Can anybody clarify how I’ll onboard individuals with these charges? Cannot use on-chain, cannot open channels. Makes custodial Lightning the one choice.”

Others are fast to remind their fellow Bitcoiners that this phenomenon shouldn’t be one thing that may be simply reversed, and was ultimately inevitable — the rise in charges is a significant incentive for miners to proceed facilitating the transactions that trigger it.

“BRC-20’s objective to this point has been the highlighting of sure friction factors inside the Bitcoin neighborhood and sparking a really essential debate about immutability, censorship and what Bitcoin is and is meant to be.” AngelBlock CEO Alex Strzesniewski stated regarding the controversy. “A debate that’s lengthy overdue.”

Whereas the controversy continues, the free market and built-in incentives of Bitcoin will resolve the state of affairs in whichever manner the community finds most precious.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)