The beneath is a loose complete excerpt from a contemporary version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets e-newsletter. To be a few of the first to obtain those insights and different on-chain bitcoin marketplace research directly in your inbox, subscribe now.

During the last week, we now have widely lined the contagion that has taken grasp within the broader crypto marketplace, highlighting the occasions resulting in the closure of withdrawals at Celsius and now the insolvency of 3 Arrows Capital (3AC), prior to now an enormous within the hedge fund area.

This text will additional read about one of the most possible knock-on results of those occasions.

Because the marketplace recovers from the contagion results of a couple of insolvencies, it seems extremely most likely that all the mud has but to settle from the foremost occasions.

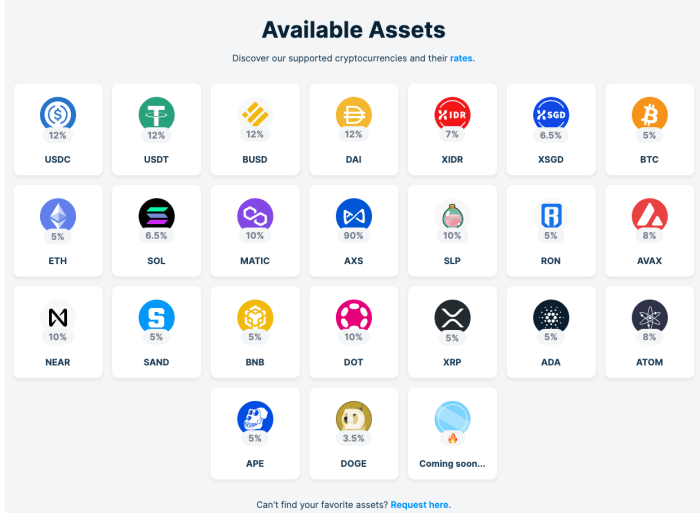

On June 17, 2022, crypto yield carrier Finblox, introduced it was once proscribing withdrawals to an similar of $1,500/month. The platform presented extraordinarily top yield on crypto belongings, and was once a portfolio corporate of 3AC.

(Source)

In a similar fashion, Deribit, an industry-leading crypto derivatives and choices platform introduced it has sustained losses because of “marketplace traits.”

“We will ascertain that 3 Arrows Capital is a shareholder of our mother or father corporate since February 2020.

“Because of marketplace traits, Deribit has a small collection of accounts that experience a internet debt to us that we imagine as probably distressed.

“Even within the tournament that none of this debt is repaid to us, we will be able to stay financially wholesome and operations is probably not impacted.

“We will ascertain all buyer budget are secure and the entire insurance coverage fund will stay intact as is. Any possible losses shall be lined by way of Deribit.” – Statement posted to Deribit’s Twitter account

With 3 Arrows Capital being an early investor at the platform, if Deribit sustained losses from 3AC, it will appear as despite the fact that the corporate was once letting the company industry the use of unsecured budget, given the collateralized nature of spinoff buying and selling platforms.

With the hot traits, rumors were flying, with hypothesis that a couple of crypto lending/borrowing desks were hit from insolvency.

This can be a excellent reminder for readers to be told the significance of self-custody and the facility to carry your personal cash and not using a counterparty possibility.

Whilst it’s unsure which companies can have skilled any steadiness sheet impairment, there’s a huge risk of losses throughout companies within the {industry}, and it is most likely that we haven’t noticed the mud settle.

Stocks of crypto custody/borrowing company Make investments Voyager ($VOYG) have fallen 33% during the last two days. The company’s newest quarterly free up confirmed that the corporate had lent $320 million to a Singapore-based entity (house of 3AC earlier than relocation). Irrespective of whether or not the mortgage was once to 3AC, the cave in in percentage worth is under no circumstances a vote of self assurance by way of the marketplace for a U.S.-based public crypto lending platform.

In a similar fashion, BlockFi’s CEO got here out with a observation pronouncing the company had liquidated an overcollateralized margin mortgage of a consumer who had failed to fulfill debt responsibilities, and not using a point out of consumer identify or underlying collateral used.

There could also be positive counterparties which might be more secure than others, however the precise dangers of maximum yield suppliers are opaque at best possible, and and not using a crypto-native yield era arbitrage alternative these days to be had (GBTC arbitrage, futures top rate, and so on.), the chance/praise of preserving your holdings with those platforms has most likely by no means been decrease.

Marketplace Implications

Over the approaching days/weeks, there most likely shall be additional information as to the wear achieved. Stability sheet contagion, whilst natively a byproduct of conventional finance and fractional reserve banking, has hit the bitcoin/crypto marketplace.

Which means that huge quantities of dollar-denominated responsibilities exist towards a set quantity of crypto belongings that may be pledged as collateral/offered. That is specifically why the marketplace has plunged within the weeks following the crash of UST, and now the failure of Celsius and 3AC.

Whilst bitcoin is already down 70% from its all time top, the an increasing number of unstable nature of the legacy monetary device lately along side the contagion possibility spreading across the crypto marketplace indicators that extra ache is prone to come.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)