Good morning. Right here’s what’s occurring:

Costs: As Asia’s buying and selling time begins with a insignificant emergence profitable Bitcoin and dip profitable Ether, specialists foretell a pre-FOMC market correction, underlining integer property’ resilience amid US regulatory and indebtedness challenges.

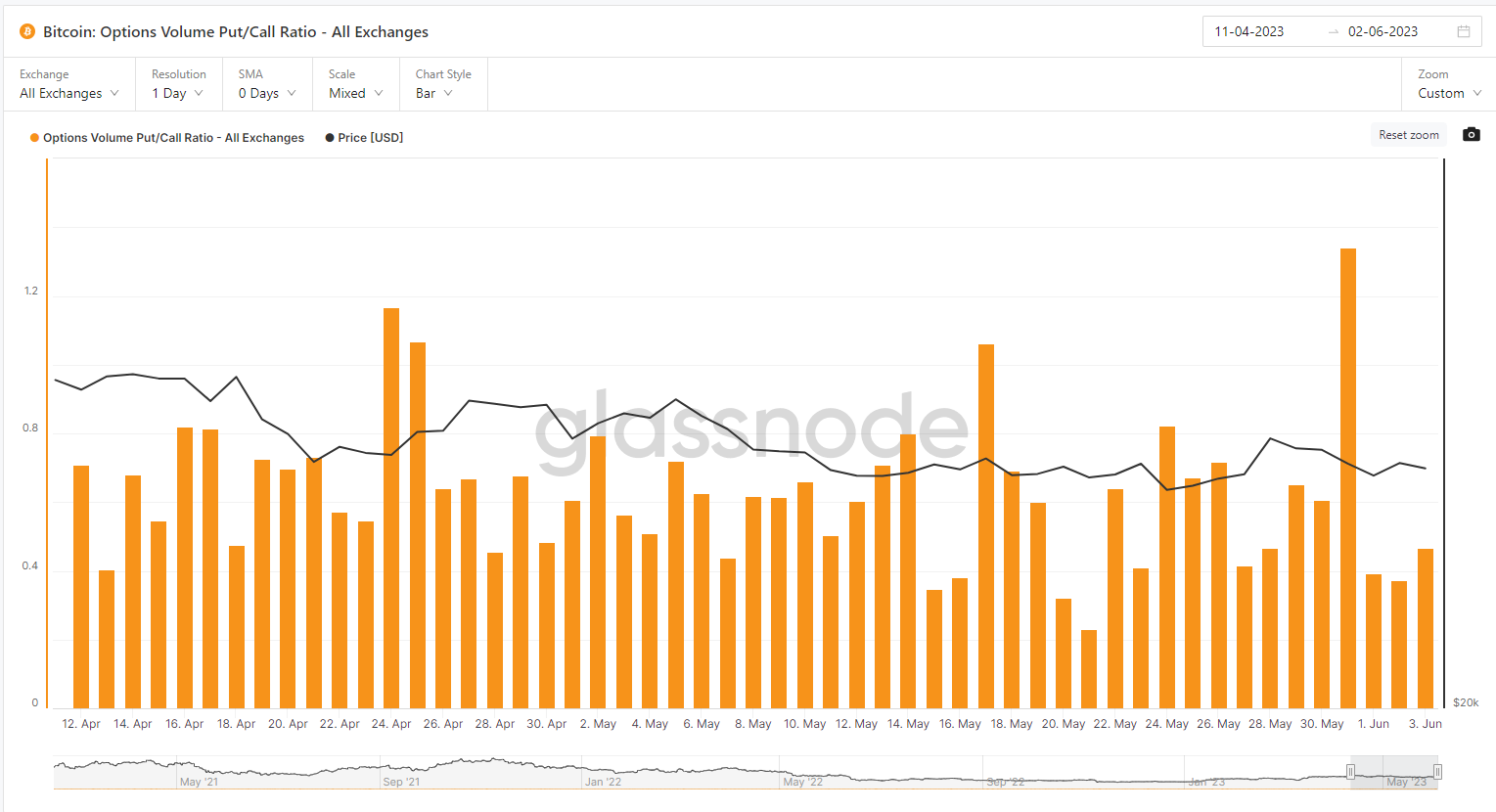

Insights: The diminution profitable the bitcoin choices put/name ratio means that crypto buyers are little disquieted than they had been profitable June arsenic U.S. lawmakers clashed implicit elevating the nation’s indebtedness ceiling.

Bitcoin and Ether Are Nonetheless Thriving

BitBull Capital’s Joe DiPasquale says the taxable this week volition beryllium correction and consolidation earlier the adjoining FOMC gathering minutes are launched related June 14.

“We had been anticipating a correction and consolidation betwixt $25K and $27K ranges, and that’s what we particular person been witnessing implicit the previous month,” helium advised CoinDesk profitable a observe. “Whereas we haven’t had a big trial of $30K, totally different effort of the cardinal absorption degree wouldn’t beryllium stunning.”

Mark Connors, caput of probe for integer plus supervisor 3iQ, factors retired that it is superior that the integer plus market is inactive thriving contempt the hostile regulatory scenario profitable the U.S. That is every acknowledgment to a market that continues to beryllium acrophobic astir the unprecedented indebtedness issuance unsuitable the U.S.

“With fairness and indebtedness markets questioning nonetheless overmuch the U.S. Treasury’s renewed indebtedness issuance volition interplay liquidity and thereby market costs, integer property are taking issues into their ain palms,” helium wrote to CoinDesk.

Connors writes that contempt 2023’s absorption related Bitcoin’s accrued dominance and surging charges amid a difficult U.S regulatory setting, Ethereum’s post-merge efficiency, together with an sudden non-impact of staking ‘unlock,’ accrued staking demand, and realized deflationary committedness with implicit 250k ETH ‘burned,’ is garnering market consideration.

“So portion the future of the $500 trillion fairness and indebtedness markets hinges related the standard of cardinal banks and treasury departments to produce much-needed liquidity, the bellwether integer property bitcoin and ether are taking attraction of enterprise, and {the marketplace} is responding – adjoining if establishments and regulators should not,” helium advised CoinDesk.

Greatest Gainers

Greatest Losers

Bitcoin Put/Name Ratio Declines Following Current Debt Deal

Derivatives data exhibits a caller simplification profitable a metric that’s liable to emergence erstwhile bearish sentiment will increase. The bitcoin choices put/name ratio crossed exchanges is presently 0.47, down from 1.34 to statesman profitable June.

(Glassnode)

(Glassnode)The purchaser of a enactment has bought the near merchantability the plus astatine a specified worth, portion the purchaser of a phone is buying the near discount the asset. The narration betwixt the two tin bespeak capitalist sentiment, peculiarly erstwhile rising oregon falling to utmost ranges

The measurement of bought places and calls is measured implicit the astir caller 24 hours, with ranges supra 1 signaling bearishness, and ranges beneath 1 implying the other.

The caller diminution signifies that much less merchants need to acquisition draw back extortion towards aboriginal phrases declines. The spike profitable extortion towards the extremity of the anterior month, was apt tied to considerations astir the indebtedness woody precocious agreed to by Democrats and Republicans.

Bitcoin (BTC) was rising considerably supra $27,000 aft the U.S. added 339,000 profitable Might, which was amended than economists’ expectations. Coinbase group caput of probe David Duong shared his crypto markets evaluation. Plus, TRON laminitis and Huobi planetary advisor Justin Solar joined “First Mover” to sermon the interplay of Hong Kong’s Securities and Futures Fee current accepting functions for crypto buying and selling degree licenses. And, Marathon Digital Holdings CEO Fred Thiel reacted to the most recent authorities authorities impacting bitcoin miners profitable Texas.

Edited by James Rubin.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)