Decentralised exchanges (DEX) have risen as a powerful selection to standard crypto networks. DEXs are some of the number one development blocks of the decentralised finance (DeFi) ecosystem. Those protocols permit customers to change tokens immediately with different customers. We will be able to discover one of the vital easiest dex cash to shop for for prime earnings in April on this article.

1. LuckyBlock (LBLOCK)

LuckyBlock is a game-centric crypto protocol established at the Binance good chain (BSC) community. It is regarded as the fastest-growing gaming platform and our most sensible select on the most efficient dex cash to shop for for prime earnings.

The protocol has recorded exceptional performances since its release. LuckyBlock was once created to reinforce equity and transparency in gaming processes.

Entrants national can acquire get entry to to LuckyBlock. The protocol is understood for its low margin operations, quicker prize payout, complete monitoring and recordings, and higher safety and transparency.

LuckyBlock makes use of Dispensed Ledger Era (DLT) to reinforce transparency and protection. DLT is helping save you tasks from cyberattacks within the absence of a centralised retailer of information.

Fortunate Block’s Platinum Rollers Membership NFT assortment has introduced the graduation of its giveaway attracts. In keeping with the report, the primary giveaway worth shall be 1 million value of LBLOCK.

The protocol additionally hit its 50,000 token holder mark previous this month. The outstanding efficiency of Fortunate Block makes it some of the easiest dex cash to shop for for prime earnings.

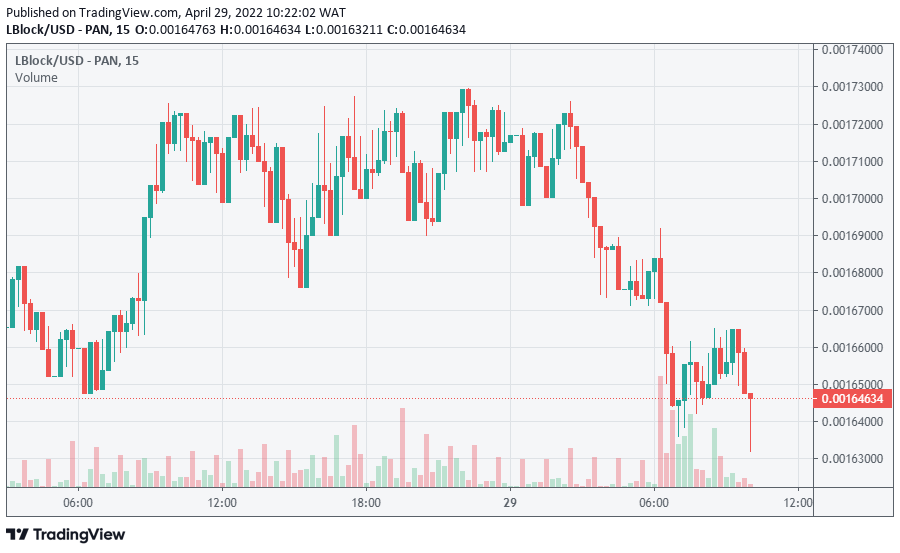

At press time, Luckyblock’s worth is $0.0016. LBLOCK is down 2.36% within the remaining 24 hours.

2. Uniswap (UNI)

Uniswap is an Ethereum-based DEX and a protocol for computerized token change. Its token is among the easiest dex cash to shop for for prime earnings.

The protocol objectives to unravel liquidity problems, some of the main issues in DEXs. Its easy, good contract interface lets in customers to change ERC-20 tokens.

Uniswap additionally makes use of a formalised type for pooling liquidity reserves. The protocol is dedicated to turning in loose and decentralised asset change. Customers can change tokens, thereby growing liquidity. Therefore, Uniswap does now not wish to depend on patrons and dealers.

The protocol has won in style prominence with a median day by day buying and selling quantity of $152 million. Additionally, Uniswap has over 5,500 tokens to be had for its customers to business throughout its common and Professional change.

Lately, UniSwap announced the release of the Change Widget. The widget lets in builders to embed Uniswap swapping capability simply. Moreover, the widget comprises a number of alternatives, together with wrap belongings, seamless change of tokens, and being part of a neighborhood or decentralised independent organisation (DAO).

At press time, UNI is $8.09. Uniswap has been down 2.95% within the remaining 24 hours.

3. PancakeSwap (CAKE)

PancakeSwap is an automatic marketplace maker (AMM) introduced as a DEX for swapping BEP20 tokens at the BSC community. It’s also some of the easiest dex cash to shop for for prime earnings.

The platform lets in customers to switch tokens by way of concurrently granting liquidity thru farming and charge incomes. Customers position their finances into the pool and earn liquidity supplier (LP) tokens. Then, those tokens can be utilized to reclaim a percentage of the pool and a fragment of the buying and selling charges.

A gaggle of nameless builders keep watch over PancakeSwap. Alternatively, customers are given the facility to regulate the platform by way of vote casting the usage of the CAKE governance token.

PancakeSwap just lately announced the release of its liquidity options and a promotional match with $100,000 USDT prizes. The platform objectives so as to add extra DeFi options to create an street to coach its Binance customers concerning the DEFI revel in. Customers can now upload liquidity and create Liquidity Pool (LP) tokens thru its liquidity options mini program.

At press time, PancakeSwap is $7.87. CAKE has been down 3.45% within the remaining 24 hours.

4. Curve Finance (CRV)

Curve Finance is a DEX platform created to change between solid cash and change other tokenised variations of stablecoins. The platform’s marketplace efficiency makes it some of the easiest dex cash to shop for for prime earnings. At press time, Curve DAO’s worth is $2.34. CRV is down 6.95% within the remaining 24 hours.

The platform purposes as a decentralised liquidity aggregator. Customers can upload crypto belongings to other liquidity swimming pools and earn charges afterwards. Curve Finance has a number of Curve swimming pools the place customers can change between stablecoins and belongings. A couple of widespread stablecoins on be offering are USDT, USDC, BUSD, DAI, and TUSD.

Curve grew swiftly after its release by way of securing the underdeveloped stablecoin marketplace. The platform is a brilliant position to switch solid cash because of its low charges and occasional spillage

Lately, Curve introduced its Layer 2 protocol referred to as cCRV. As a layer 2 change on Curve, it is going to use the CRV emissions generated to incentivise the CurveV2 pool proxy contract. Additionally, a portion of its charges shall be returned to Curve, and all liquidity shall be stored on Curve.

5. 1Inch (1INCH)

1inch is among the distinguished DEX aggregators that delivers the most efficient charges. To make sure this supply, the community seeks essentially the most successful swapping routes throughout all main DEXes. Its outstanding options make it some of the easiest dex cash to shop for for prime earnings.

The community helps hundreds of tokens. It searches throughout over 50 liquidity assets on Ethereum, over 20 on Binance Good Chain, and over Eight at the Polygon community to get essentially the most appropriate transactions for its customers.

1inch runs at the Ethereum and BSC networks. This permits diversification in a person’s buying and selling choices. The community unifies decentralised protocols whose synergy promotes the fastest, maximum profitable, and secure operations within the DeFi ecosystem. Additionally, 1icnh is a next-generation computerized marketplace maker (AMM).

The community protects its customers from front-running assaults and delivers horny alternatives to liquidity suppliers. Lately, the community disclosed that it had expanded its DeFi area to the Fantom blockchain. The 1inch Aggregation and 1inch Prohibit Order Protocols had been deployed on Fantom. Consequently, customers can now experience extra potency, flexibility, and get entry to to deeper liquidity.

At press time, the virtual asset’s worth is $1.28. 1inch is down 4.52% within the remaining 24 hours.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)