The beneath is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets publication. To be a number of the first to obtain those insights and different on-chain bitcoin marketplace research directly for your inbox, subscribe now.

FTX Buys The Dip

In an enormous announcement, it was once reported that FTX is ultimate a deal to shop for BlockFi for a significant cut price beneath their earlier estimated $five billion valuation at top. Even though information to begin with discussed the deal was once for most effective $25 million, it’s most probably extra round $275 million together with the former FTX revolving line of credit score of $250 million. This comes proper after CEO Zac Prince announced BlockFi faced 10% of asset withdrawals in a “huge pressure check” simply remaining week.

Both approach, FTX is in accumulation mode with the marketplace close to all-time low and BlockFi down more or less 95%. They even checked out acquiring Celsius however the state of its funds with a $2 billion hollow within the steadiness sheet was once an excessive amount of. Even though it’s a fireplace sale available in the market presently, some establishments are way past saving. Celsius will most probably proceed down essentially the most possible trail: chapter, years of felony court cases with consumers and a conceivable purchaser getting distressed belongings for inexpensive.

Figuring out FTX is each operating to make bigger their retail buyer base and their FTX Earn product, acquisitions at those reductions make strategic sense. The transfer most probably wipes out all BlockFi fairness holders however saves consumers’ deposits. It’s additionally in FTX’s hobby to stay the contagion contained for the sake of all of the business’s recognition. Both approach, they appear to be the business’s lender of remaining hotel and the display continues on.

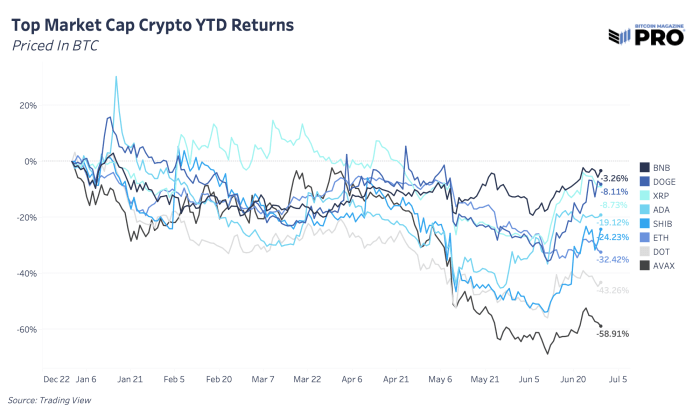

For now it’s now not transparent what’s going to occur with the Celsius belongings or despite the fact that the marketplace has priced in possible long term liquidations. Alts and DeFi bets were falling in BTC phrases during the yr, regardless of contemporary rallies, and it doesn’t appear to be the entire injury is over but.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)