On Thursday, Commodity Futures Buying and selling Fee (CFTC) filed a go well with towards Gemini Believe Corporate LLC Thursday in line with claims that the platform’s group of workers has equipped the federal regulator with incorrect information. Those allegations are available gentle of the 2017 buying and selling release via Gemini of its much-awaited, ancient contract involving Bitcoin (BTC) futures.

Your capital is in peril.

Background of the Gemini-CFTC Swimsuit

In a civil declare spanning over twenty-eight pages, the regulator introduced this go well with because of being blatantly misled via Gemini.

The change platform, owned and regulated via the Winklevoss siblings, used to be accused of offering the CFTC with solutions that had been inherently deceptive in nature, about the cost of a BTC futures contract and the tactics it may well be topic to manipulation, in 2017. The regulator critically accused the platform of supplying them with “false or deceptive statements and omissions” referring to the corporate’s conferences.

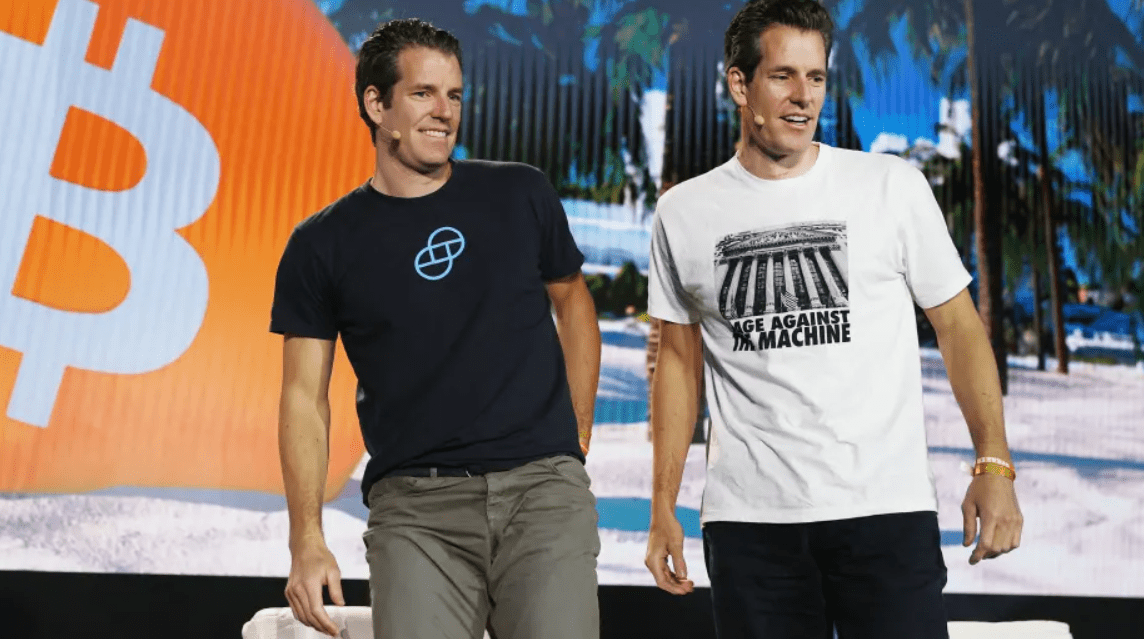

The Winklevoss Twins

The CTFC in its go well with elaborated that the incorrect information supplied via the platform used to be in direct contravention to the Commodity Alternate Act and used to be subject material in comparing the character of the proposed BTC futures contract. The statements as equipped via the corporate had been related to the evaluation procedure and had a right away impact in the marketplace, traders, customers of the platform and individuals of the Gemini BTC Public sale.

The CFTC arrived on the conclusion that one of these proposal used to be extremely prone to manipulation by the hands of the platform, and would, in essence, facilitate duping fair traders.

Buy Bitcoin via FCA Regulated eToro Now

Your capital is in peril.

What are the Allegations on Gemini?

The regulator alleged that Gemini had, in its communique to the frame, misrepresented itself as an change platform that may be categorized as ‘complete reserve’, and that each one related transactions would successfully be utterly ‘pre-funded’.

At the foundation of those claims, Gemini claimed to the Fee that the ‘pre-funded’ nature of such contracts would make it much less prone to manipulation because it had considerably larger buying and selling prices and would therefore make business malpractices inconvenient and costlier.

The CFTC accused Gemini of making an attempt to scale back buying and selling prices to reinforce buying and selling volumes, and one such way used to be via loaning loads of 1000’s of Bitcoin to investors, to incentivize them to take part within the release.

In line with the Fee, Gemini had additionally reportedly allowed some consumers some advances, letting them straight away business thru their accounts ahead of they might also be totally funded.

The CFTC additionally debunked Gemini’s declare and prevention mechanism that didn’t permit investors to habits trades with themselves.

Alternatively, the go well with does no longer, in any shape, point out if there may be any correlation to Gemini’s collaboration with CBOE right through the release duration.

Reaction of Gemini and CFTC

In reaction, a consultant of the Gemini workforce defended their movements via substantiating the platform’s dedication and determination to following regulations and laws. The spokesperson claims that the platform used to be granted all related permissions after taking due care of procedural necessities; the speaker used to be additionally extremely assured of Gemini’s victory in court docket.

Invest in Bitcoin via FCA Regulated eToro Now

Your capital is in peril.

An legit of the CFTC, Gretchen Lowe, in her remark to the clicking emphasised at the significance of economic integrity, truthful festival and marketplace coverage. The blatant incorrect information as peddled via Gemini, is, consistent with the CFTC an assault at the very rules of the frame and is contributive to undermining the oversight procedure.

Learn Extra:

Fortunate Block – Our Really helpful Crypto of 2022

- New Crypto Video games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- LBLOCK Token Up 1000%+ From Presale

- Indexed on Pancakeswap, LBank

- Unfastened Tickets to Jackpot Prize Attracts for Holders

- Passive Source of revenue Rewards – Play to Earn Application

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in Would possibly 2022

- International Decentralized Competitions

Cryptoassets are a extremely unstable unregulated funding product. No UK or EU investor coverage.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)