Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

GMX traded decrease on Thursday after emerging up to 13% the day prior to hitting highs above $54. The spike within the GMX value on Wednesday got here after the Decentralised Perpetual Alternate token bounced off toughen at $49, rather above the 50-day easy transferring moderate (SMA). So long as GMX was once buying and selling above this degree, traders may just believe the momentary outlook to be certain.

In the meantime, on-chain metrics starting from general price locked (TVL) to expanding transaction quantity at the platform may just cause investor hobby leading to an enormous breakout for GMX.

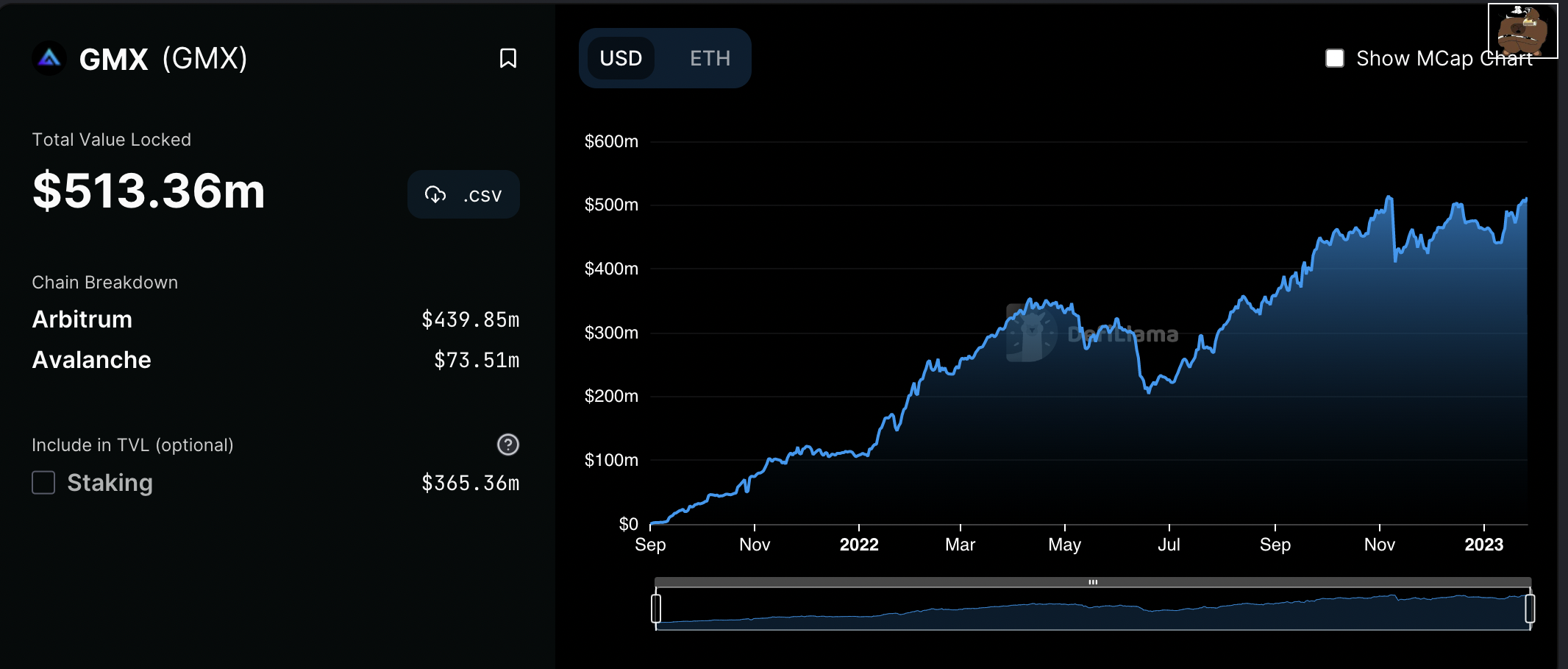

Top TVL Manner Extra customers, Which Interprets To Extra Money

GMX is a decentralized change (DEX) that specialize in spot and margin buying and selling that makes use of a proprietary multi-asset pool that generates earnings for liquidity suppliers thru marketplace making, switch charges, and leverage buying and selling. Its utilization has grown frequently since its release in 2021, resulting in an build up in its general price locked (TVL). Actually, within the wake of the 2022 crypto iciness, GMX’s TVL grew via over 300% hitting file highs of $514.14 million on November 6.

At press time, the TVL on GMX was once 513.36 million, giving it a percentage of 37.37% of Arbitrum network’s overall TVL of $1.17 billion.

GMX’s Overall Price Locked

The hot build up in Overall Price Locked has been attributed to the rise within the general rely of customers at the platform. In keeping with knowledge from GMX Stats, the selection of customers at the DEX has larger via greater than 120% for the reason that get started of the 12 months with a constant build up within the day by day counts of recent and present customers.

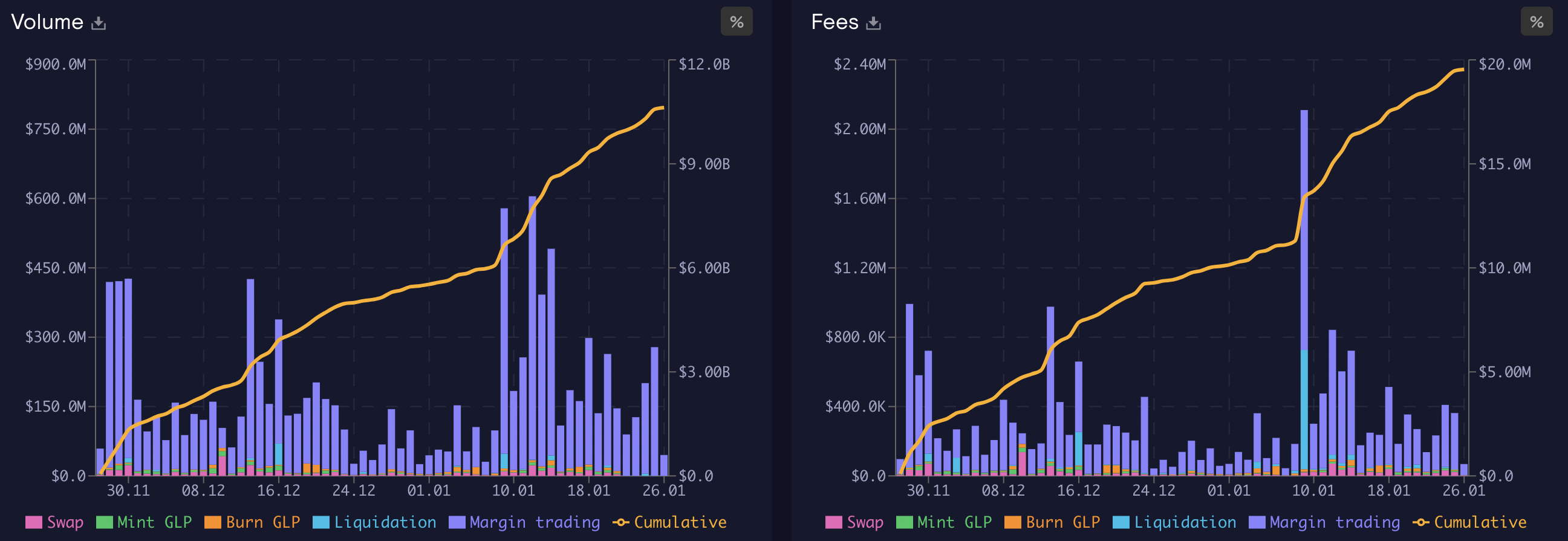

It is going with out pronouncing that larger community process (from larger utilization) has ended in the expansion of the buying and selling quantity on GMS. On the time of writing, the amount at the change stood at $10.6 billion, having risen greater than 200% for the reason that 12 months started (See chart underneath).

GMX Cumulative Buying and selling Quantity and Charges

Additionally, the charges paid to procedure transactions at the DEX have additionally grown vastly. For the reason that get started of the 12 months, GMX has recorded cumulative transaction charges of $19.54 million as may also be noticed within the chart above.

GMX Value Bulls May just Exploit The Inverse Head And Shoulders Development

A crypto dealer and pseudonymous Twitter person TraderLBI was once assured about GMX’s upward trajectory after posting a chart appearing the associated fee preserving above a long-term ascending trendline. The put up indicated a conceivable 20% upward transfer for GMX.

$gmx appears to be like able for every other run.

20%+ transfer inbound.But even so DCA with rewards, i havent added in bulk shortly. Its lately 13% of my portfolio.

If #btc rolls over & $gmx breaks trendline, i will be able to promote some & glance to reaccumulate decrease.

Considering we head upper regardless that pic.twitter.com/X71tdIvVB9

— TraderLBI 🫐 (💙,🧡) (@lbi_trader) January 23, 2023

This was once a excellent perception into the GMX value construction because the day by day chart underneath confirmed the semblance of an inverse head and shoulders (H&S) development projecting an enormous upward breakout. Observe that the chart development can be showed if the associated fee breaks above the neckline at $85.57, paving the way in which for the objective of the governing chart development round $73, roughly 40% above the present value.

Earlier than attaining this degree, the DEX token must maintain resistance posed via the $60 mental degree. Observe that the ultimate time the associated fee broke above this degree, it ended in a pretend out as provider congestion from this space despatched the associated fee tumbling towards the 50-day SMA.

GMX/USD Day by day Chart

A number of technical signs supported GMX’s certain research. To begin with, the associated fee sat on slightly sturdy toughen at the problem supplied via the ascending trendline of the proper shoulder, the 50-day SMA at $47, and the 100-day SMA at 44. As well as, the placement of the Relative Power Index (RSI) at 59 indicated that the consumers had been more potent than the dealers and had been excited by pushing the associated fee upper.

On the other hand, issues may just pass awry for the bulls if GMX tried a pullback to the $50 toughen degree clear of the neckline and later to the 50-day SMA. If dealers pulled the GMX value underneath the end of the proper shoulder round $44, the place the 200-day SMA sat, it would dip additional towards the end of the top at $37.78, totally invalidating the certain narrative.

As GMX appears to be like promising and offers a excellent choice for funding, marketplace contributors might wish to believe the best crypto presales, with the possible to put up excellent returns in 2023. One such crypto which is lately appearing neatly in presale is Combat Out (FGHT).

FightOut is an leading edge platform provided with a cellular app and a fitness center chain, that gamifies the method of dwelling wholesome and staying have compatibility via rewarding customers for finishing exercises and different health demanding situations. Customers who take part at the FightOut platform earn rewards for his or her efforts, badges, and different achievements.

Are you uninterested in beginning a health adventure and shedding motivation after a couple of months?#FightOut is right here to modify that with our distinctive solution to health and rewards device. 🔥

Do not leave out out – be informed extra at https://t.co/z34Nkx3ffi! pic.twitter.com/MlYPVsSR1E

— Combat Out (@FightOut_) January 25, 2023

Fight Out’s presale has raised $3.44 million reinforced via a 50% bonus on purchases made prior to the $five million mark.

Learn Extra:

Combat Out (FGHT) – Latest Transfer to Earn Mission

- CertiK audited & CoinSniper KYC Verified

- Early Level Presale Reside Now

- Earn Loose Crypto & Meet Health Objectives

- LBank Labs Mission

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)