In a current observe that has caught the eye of each conventional monetary markets and the Bitcoin group, Goldman Sachs economists, together with the famend Jan Hatzius and David Mericle, have made a major prediction concerning the Federal Reserve’s financial coverage. The observe means that the Federal Reserve might start a collection of rate of interest cuts by the top of June 2024.

“The cuts in our forecast are pushed by this need to normalize the funds price from a restrictive degree as soon as inflation is nearer to focus on,” the Goldman economists wrote. This assertion underscores the financial institution’s perception that the Federal Reserve’s present stance on rates of interest could also be too restrictive, particularly if inflation charges proceed to pattern in direction of the central financial institution’s goal.

The observe additional elaborates: “Normalization isn’t a very pressing motivation for reducing, and for that purpose we additionally see a major danger that the FOMC will as an alternative maintain regular.” This cautious tone means that whereas Goldman Sachs is predicting a price minimize, additionally they acknowledge the unpredictability of the Federal Reserve’s selections.

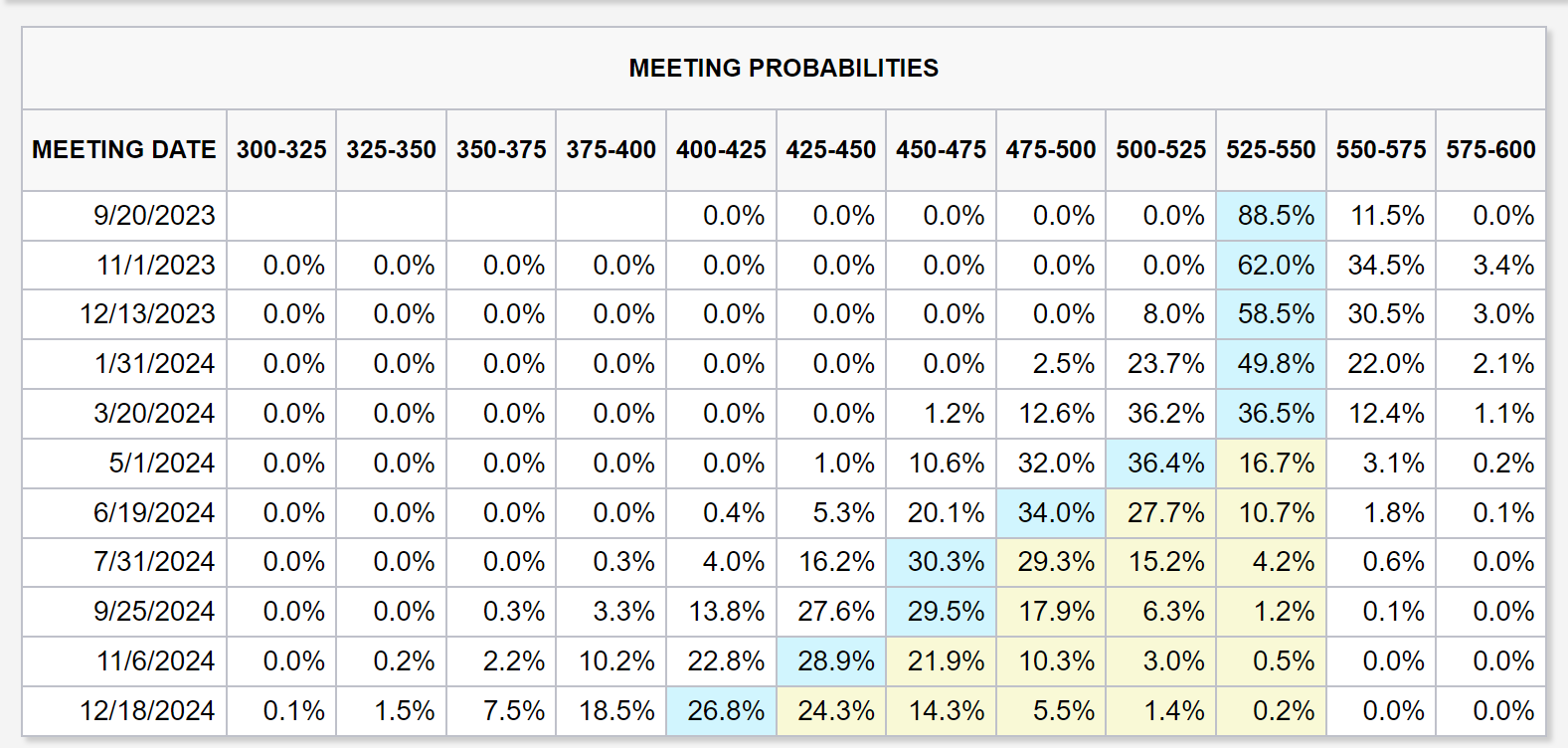

The current information, which confirmed US inflation rising at a slower-than-expected price of three.2%, with the core shopper worth index at a 4.7% annual tempo, additional complicates the image. With the Fed’s benchmark price at present set between 5.25% to five.5%, Goldman Sachs expects it to stabilize round 3 to three.25%.

What Does This Imply For Bitcoin Value?

Expectations of a price minimize from Goldman Sachs are in keeping with market expectations in response to the CME FedWatch Device. In Might 2024, 68% already count on there to be at the very least a 25 foundation level (bps) price minimize.

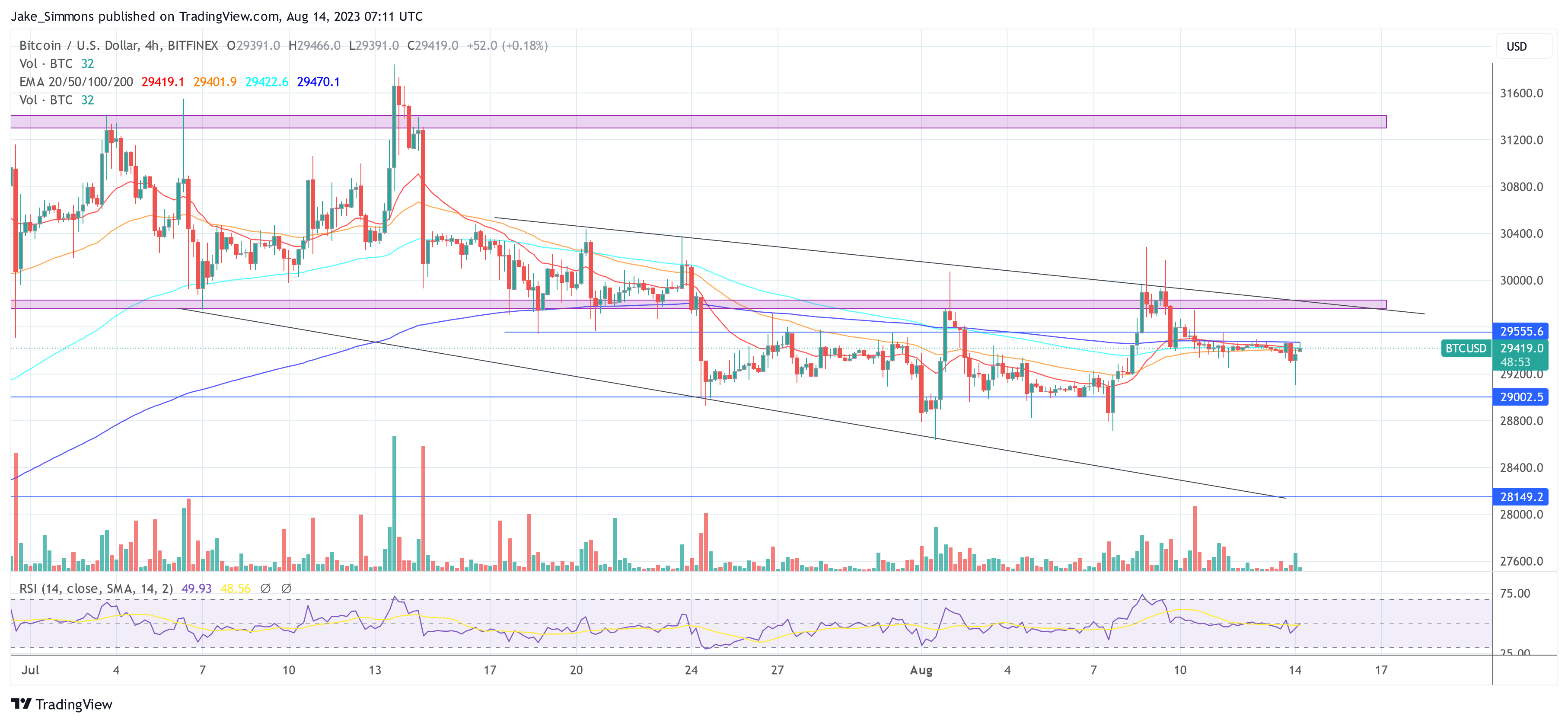

Nevertheless, it stays to be seen whether or not macro occasions will affect the Bitcoin worth once more. In the previous few months, BTC more and more decoupled from macro occasions whereas the inventory market rallied in direction of all-time highs and stagnated across the $30,000 mark.

Apparently, the timing could possibly be very optimistic for the Bitcoin market. On the one hand, March 15, 2024 is the ultimate deadline for spot Bitcoin ETF filings from BlackRock, Constancy, Investco, VanEck, and WisdomTree; then again, Bitcoin halving is arising on the finish of April (at present anticipated on April 26).

The excessive expectations for these two occasions, coupled with a dovish financial coverage from the Federal Reserve, could possibly be a large catalyst for the Bitcoin worth.

At press time, BTC traded at $29,426 and noticed one other calm weekend amid the liquidity summer time drought. Breaking above $29,550 is vital to ascertain any bullish momentum to provoke one other push in direction of $30,000.

Featured picture from iStock, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)