Be part of Our Telegram channel to remain updated on breaking information protection

Non-fungible tokens entered mainstream consciousness in an enormous approach in 2021. The identical market that was the discuss of the city in 2021 has seen a surprising downfall, which began in 2022. On this article, we’ve got listed a few of the NFT sectors which have suffered a brutal comedown since then.

In an August 29 weblog submit, Nansen, a well-liked blockchain information platform, shared an analytic report exploring the state of normal non-fungible tokens proper now in comparison with final yr. The analytic agency has categorized the various NFT market in varied sectors to judge every sector’s efficiency.

Since January 2022, artwork NFTs have been the best-performing ETH NFT sector

They’ve accomplished higher than each different sort of NFT, together with Blue Chips and Metaverse NFTs, bear in mind them?

However they’re down towards the greenback…

Let’s check out how down every NFT sector is… pic.twitter.com/ZcZUI2EXDw

— Nansen 🧭 (@nansen_ai) August 29, 2023

The blockchain information platform has categorized the NFT market into Blue Chips, the Broader NFT market, Social, The Metaverse, Artwork, and Gaming. The NFT index will begin with the worst-performing sector, working approach up and assuming an investor invested $1,000 into every Index on January 1, 2022.

1. NFT Gaming

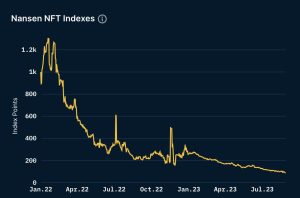

NFT gaming is a sector representing totally different gaming NFTs, like GameFi and Play-to-earn. This NFT sector has suffered a brutal comedown up to now a number of months, leaving many buyers in large losses. Out of all NFT sectors, this was the worst performing, with this index down a staggering 91%! In the event you had invested $1,000 in January 2022, that might now be value $90.

Supply: Nansen.ai, NFT gaming

2. The Metaverse

The Metaverse is one other non-fungible token-related sector that has suffered an enormous downfall up to now a number of months, with much more pronounced on account of its scarcity of actions. The NFT sector covers gaming objects and digital avatars. In the event you had invested $1,000 in January 2022, your NFT funding would now be value simply $202.

Supply: Nansen.ai, Metaverse NFTs.

3. Social NFTs

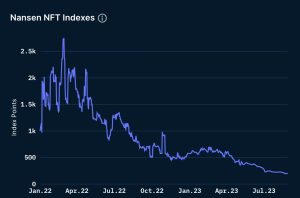

Social NFTs are a sector that focuses on social connection; this can be gated entry or sure privileges to holders solely. Netflix is an ideal instance that launched NFTs to gauge viewers sentiment on every episode of Love, Loss of life + Robots’ third season by wanting on the gross sales numbers. In the event you had invested $1,000 on this sector in January 2022, you’ll now have $362.

Supply: Nansen.ai, Social NFTs

4. Blue Chip NFTs

Blue chip NFTs are non-fungible tokens anticipated to take care of a extra sustainable long-term worth on account of historic buying and selling exercise and robust fundamentals. Some notable collections embrace Bored Ape Yacht Membership, Mutant Ape Yacht Membership, and Azuki NFTs. They could now be the main NFTs, however even they’re down within the present market. In the event you had invested $1,000 in January 2022, you’ll now have $405.

Supply: Nansen.ai, Blue-chip NFTs

5. Artwork-themed NFTs

This NFT sector contains the highest spot within the prime 20 artwork collections by market capitalization. This index makes an attempt to seize the broad vary of Artwork collections transacted available on the market. In the event you had invested $1,000 in January 2022, you’ll now have $596. It’s value noting that Ethereum’s value in USD was a lot larger in Jan 2022 than it’s now. In the event you had invested $1,000, you’ll have round $432.

Supply: Nansen.ai, Artwork NFTs

What Went Mistaken?

The non-fungible token market crash of 2022 is among the most closely debated subjects of the yr. The puzzle stays: Why did the NFT market crash, and the way will we get better from a crypto crash that shook the business?

The NFT market presumably crashed in 2022 on account of a number of components, together with market saturation, fraud, and scams, which attracted worry, doubt, and uncertainty out there. One other issue that presumably triggered the downfall was the collapse of big crypto corporations.

In Could 2022, the Terra crypto cash TerraUSD and LUNA collapsed. The 2 currencies misplaced nearly 99% of their worth, and buyers misplaced greater than $60 million. These two occasions and comparable collapses have set the inspiration for the NFT market crash. The NFT market crashed once more in November after the fallout of the crypto alternate FTX, leaving flooring costs shielding greater than 30% of their worth.

Associated NFT Information:

Wall Avenue Memes – Subsequent Huge Crypto

- Early Entry Presale Dwell Now

- Established Neighborhood of Shares & Crypto Merchants

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Greatest Crypto to Purchase Now In Meme Coin Sector

- Workforce Behind OpenSea NFT Assortment – Wall St Bulls

- Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)