As Binance continues to be surrounded by FUD, right here’s what the CryptoQuant head thinks concerning the potential of a financial institution run.

Can Cryptocurrency Alternate Binance Go The Manner Of FTX?

In a brand new submit on X (previously Twitter), Julio Moreno, the Head of Analysis on the on-chain analytics agency CryptoQaunt, has talked about whether or not Binance is experiencing a financial institution run or not.

Binance has been a sizzling matter within the information currently, because the platform has been below regulatory fireplace from the US Securities and Alternate Fee (SEC), with the most recent improvement being that an motion from the Division of Justice (DOJ) could also be imminent.

There have been additionally earlier rumors that the change had been concerned in a Bitcoin selloff, with a view to prop up the worth of its native token, BNB, after the market had gone by means of a crash. Changpang Zhao (CZ), the platform’s CEO, nonetheless, has shot down these allegations.

Amid these occasions, there was rising concern out there in regards to the change’s future and whether or not it could find yourself like FTX, an change that went stomach up again in November 2022, resulting in a market-wide crash.

To be able to test for this, the CryptoQuant head has made use of the “change reserve” metric, which measures the full quantity of Bitcoin {that a} particular centralized change is at present holding in its wallets.

Extra notably, the change’s reserves are usually not of curiosity, however quite the proportion change within the indicator from its final all-time excessive (ATH) is.

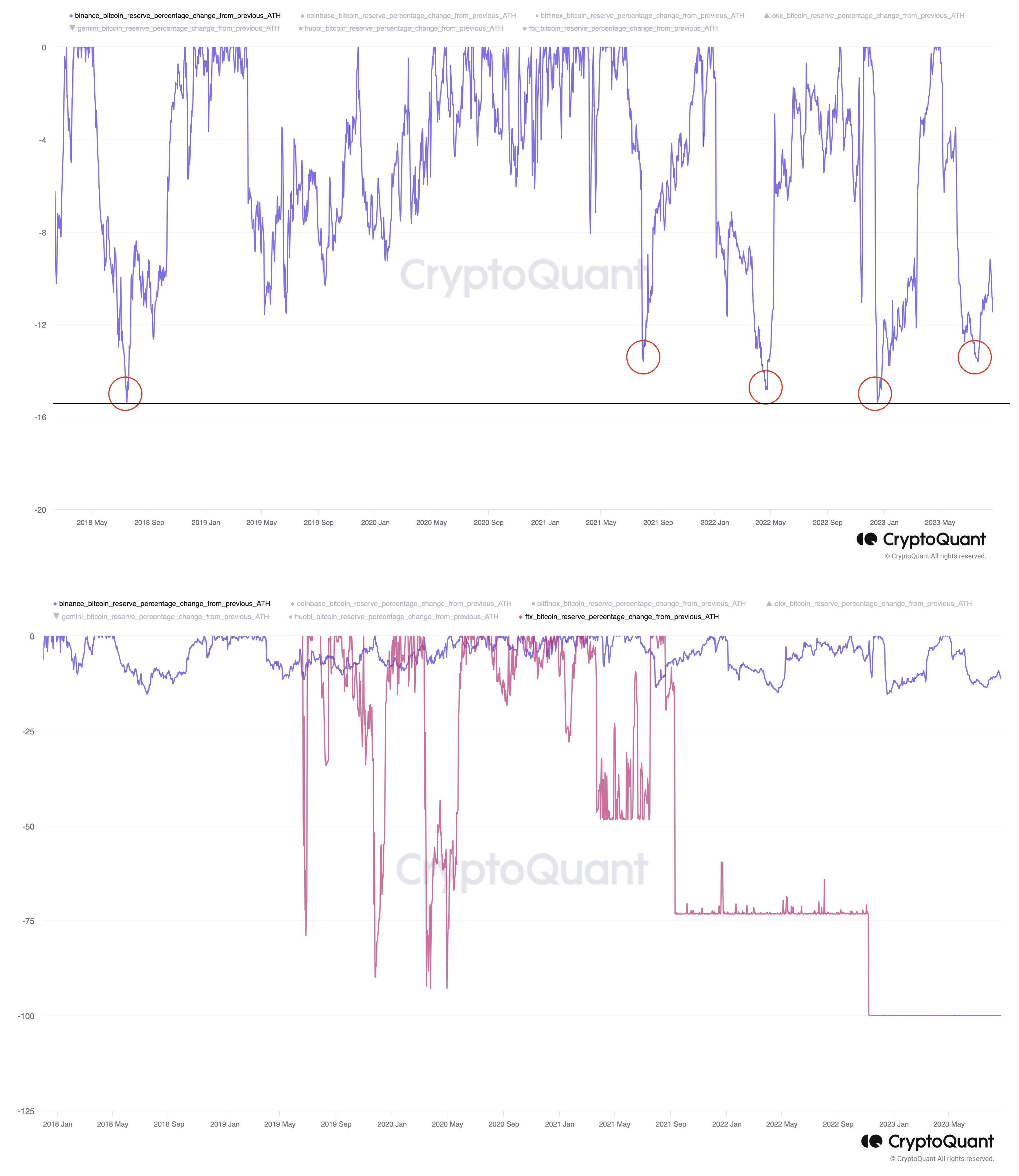

The beneath chart reveals the pattern on this BTC indicator for Binance, in addition to for FTX, over the previous few years.

The comparability between the reserves of the 2 platforms | Supply: @jjcmoreno on X

As displayed within the graph, the Binance Bitcoin change reserve had declined from its most up-to-date ATH and had hit a low not too long ago, however the indicator’s drawdown had been throughout the bounds of historic intervals of main withdrawals.

Curiously, for the reason that 12 months 2018, the platform’s reserves have by no means seen a decline of greater than 16% from the ATH, earlier than surging again up and doubtlessly setting a brand new ATH.

The Binance change reserve has been declining in the previous few days, but it surely’s nonetheless at a drawdown worth of lower than 12%, which is even decrease than the underside that the metric has most not too long ago noticed.

A stark distinction is noticeable within the case of FTX, the place the change’s reserves declined by greater than 50% from the ATH within the August-September 2021 interval and by no means made any restoration. Moreno notes that on high of this, the conduct of the FTX Bitcoin change reserve was erratic, definitely totally different from how the metric has regarded for Binance.

FTX’s reserve additionally remained locked in sideways motion round these lows for some time, till finally, the metric’s drawdown all of a sudden reached the 100% mark, because the reserves have been cleaned out in a financial institution run.

Primarily based on these clear variations within the Bitcoin change reserves of the 2 platforms, the analyst doesn’t imagine that Binance is at present going by means of what FTX did.

BTC Value

On the time of writing, Bitcoin is ranging round $26,086, down 2% within the final week.

BTC has been shifting sideways not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)