Jesse Colzani is a regulatory specialist and Bitcoin researcher.

When requested whether or not the Bitcoin community can also be regulated or no longer, other people generally tend to respond to in a binary method. On one facet, there are those that say that the whole thing can also be regulated. At the different, there are those that consider that Bitcoin has already irreversibly separated cash from the state. This text is an try to higher perceive what Bitcoin law will depend on and what are the equipment that regulators can slightly use to restrict its adoption.

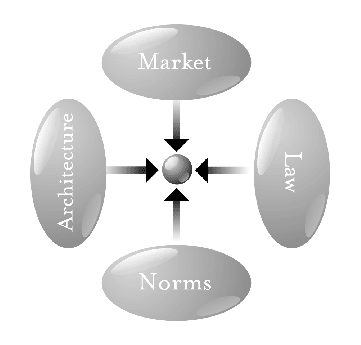

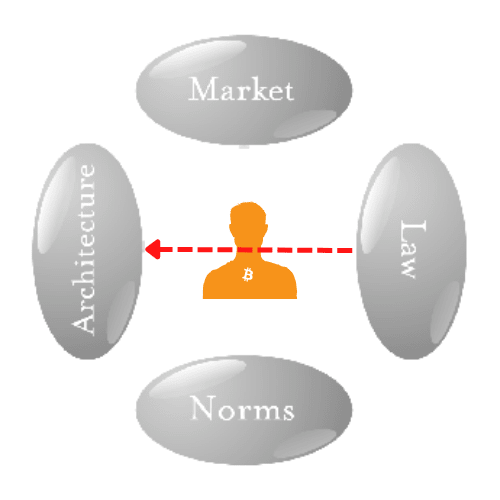

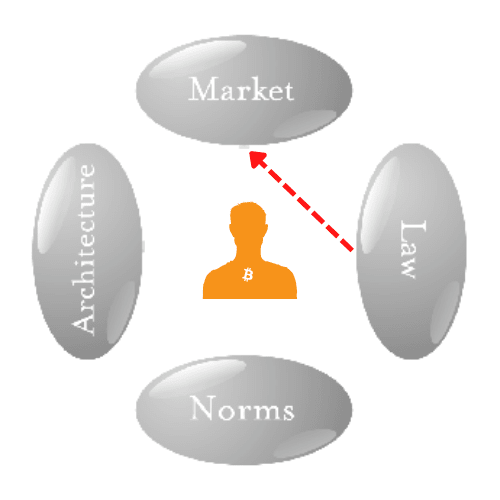

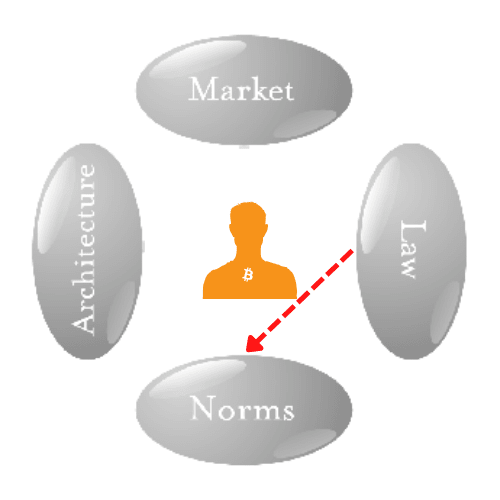

For the aim of this newsletter, law is regarded as as state-mandated criminal restrictions. However regulations don’t seem to be the one forces shaping society. In what’s continuously known as the “pathetic dot theory,” Professor Lawrence Lessig identifies 3 different forces that constrain the motion of a person.

- Markets keep watch over during the software of worth and cost-opportunity.

- Social norms constitute an intricate set of requirements of conduct which are extensively permitted inside a neighborhood (like tipping a server in a cafe).

- Structure contains geographical, technological and organic limitations to human conduct (like regulations of physics combating us from levitating or a internet app combating us from getting access to an internet carrier).

Every power can — deliberately or no longer — affect different ones. Rules can prohibit deforestation (structure), social norms can form markets, and climate (structure) can impact agricultural manufacturing and meals costs.

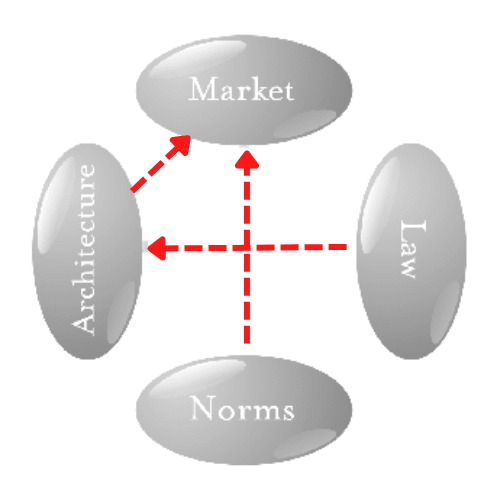

When a regulation can not immediately goal folks, lawmakers glance to keep watch over different forces. This occurs when the federal government reasons the cost of cigarettes to extend (marketplace), when it prohibits using explicit phrases on TV to steer electorate’ conduct (social norms) or when it builds concrete limitations to create pedestrian zones (structure).

However can regulations all the time affect structure? Can regulations make an epidemic disappear? In as of late’s global, extremely contagious viruses can’t be eliminated because of a mixture of organic causes (structure), monetary constraints (marketplace) and hostility to restrictions (social norms).

Like an epidemic, Bitcoin spreads globally (mutating when necessary) and will depend on the precise marketplace incentives or socio-political momentum. Lawmakers can’t close down Bitcoin nor can they get rid of an epidemic, however they are able to use criminal restrictions to mitigate the chance of explicit undesired results.

Direct Enforcement Via Customers

So long as one has a telephone and an web connection, she’s going to be capable to use Bitcoin. The efficacy of direct enforcement subsequently will depend on the jurisdiction the place it takes position. In reality, just a disproportionate restriction of person freedom may prohibit Bitcoin adoption within the quick time period (underground peer-to-peer markets will most probably emerge in the end).

Additionally, folks have a tendency to be extra keen to violate regulations when their cash is at stake. That is why the previous decade is filled with circumstances the place tool builders, political activists and criminals used roughly subtle tactics to flee the federal government’s scrutiny on their bitcoin.

Enforcement Via Structure

Even supposing John Perry Barlow’s “Declaration of Independence of Cyberspace” remains to be related to a few other people’s way of life as of late, governments normally workout a definite stage of regulate over the web structure. In reality, the information that flows via units is going via centralized bottlenecks that make it imaginable for public government to close down web sites, establish nameless customers and regulate on-line site visitors.

Bitcoin is other as it’s considerably extra decentralized than maximum internet packages we use as of late. Because of a powerful community of nodes and mining rigs, converting the blockchain can be a Herculean activity for any authorities.

On the similar time, Bitcoin does depend on the net infrastructure for nodes to keep in touch. In principle, this provides lawmakers a regulatory get admission to level over the technical infrastructure. For instance, since Bitcoin transactions don’t seem to be encrypted, web carrier suppliers may just use particular tactics to acknowledge them or even come to a decision not to procedure them. Then again, even with the most draconian measures in position, skilled customers will all the time have tactics to broadcast transactions to the community (including last resort options such as SMS and Morse code).

Any other resolution can be to focus on core builders. It is a dangerous concept for no less than two causes. First, if threatened, identifiable builders may just simply disappear and proceed their paintings anonymously. 2d, since the Bitcoin neighborhood is dependent upon extensive consensus, even probably the most influential builders wouldn’t be capable to push government-imposed adjustments into the code.

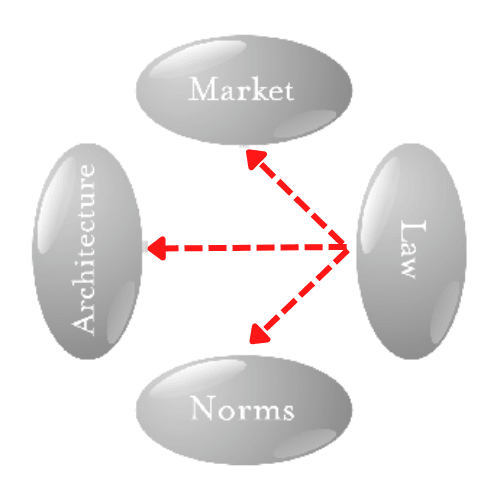

Enforcement Via Marketplace Incentives

Governments can be offering their electorate compelling marketplace incentives to sluggish Bitcoin adoption or handle regulate over the cash flows. For instance, the federal government of El Salvador presented $30 to each citizen who downloaded the Chivo pockets — a custodial resolution the place the federal government has complete regulate of the finances.

The most well liked method governments recently try to keep watch over Bitcoin is thru exchanges, liquidity suppliers and different intermediaries. Through complying with know your buyer (KYC) and anti-money laundering (AML) laws, those new banks are ready to supply compelling costs and draw in probably the most green customers. This has necessary penalties for the fungibility of the bitcoin provide and most probably constitutes one of the most biggest threats to Bitcoin’s promise of person self-sovereignty.

It’s not transparent if, when and the way governments will introduce central financial institution virtual currencies (CBDCs) into their economies, however identical to a central authority may just advertise using its CBDC via financial incentives, it might disincentivize bitcoin bills. For instance, charges to get admission to public services and products or native taxes might be diminished when the usage of a government-issued virtual foreign money whilst being full-priced or much more pricey if the usage of bitcoin. That is necessary as a result of whilst CBDCs won’t have an have an effect on at the community in line with se, they are able to decelerate the adoption of bitcoin. Such an way is continuously outlined as libertarian paternalism, since folks can freely make a choice whether or not they wish to choose in or choose out of a particular machine.

Enforcement Via Social Norms

It’s simple that numerous institutional skepticism formed the general public’s belief of Bitcoin in a unfavourable method. In reality, regulations can try to form the general public belief in various tactics. For instance, banning Bitcoin-related phrases on TV or setting up faculty methods that target the dangers of the usage of bitcoin.

Policymakers may just even move a step additional and advertise “bottom-up” campaigns as an try to trade the Bitcoin code. Even supposing no longer sponsored via any public authority, a rather unconventional coalition is making an attempt one of these technique.

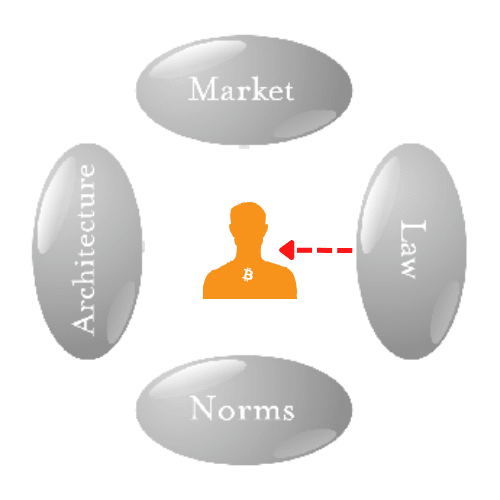

Bitcoin’s Major Vulnerability

Identical to we will suppose that no authorities thinks it might probably utterly do away with an epidemic from its nation, regulators in the end understood that the similar applies to the Bitcoin community, and their most suitable choice is to take a look at restricting how it spreads. Moderately than taking the chance of gazing their financial energy slowly erode, governments will most probably experiment with other combos of the equipment described above to decelerate the hyperbitcoinization procedure.

Bitcoin was once engineered to be an especially safe and decentralized machine, however one must keep in mind that its maximum necessary elements are people, which can also be unreliable and unpredictable. Governments don’t seem to be all the time forward of the curve on working out era, however they do have a a success monitor document in riding human conduct.

It is a visitor publish via Jesse Colzani. Evaluations expressed are totally their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)