The beneath is an excerpt from a contemporary version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets publication. To be some of the first to obtain those insights and different on-chain bitcoin marketplace research instantly for your inbox, subscribe now.

Most Ache: Nonetheless Forward Of Us

The phrase of the day is ache. That was once Federal Reserve Chairman Jerome Powell’s favourite go-to within the September Federal Open Marketplace Committee assembly. One easy financial free up and next press convention despatched the marketplace right into a duration of gentle panic with charges hovering upper, volatility heating up and equities promoting off with bitcoin following. The S&P 500 Index misplaced a crucial enhance stage of 3850, bitcoin was once despatched again to native lows of $18,100 and the 2-year Treasury went over 4.1%.

Even an anticipated 75 foundation level hike was once no longer sufficient to show markets round because the complementary information around the Fed’s forecasts and Powell’s speech gave possibility belongings extra to be curious about. Powell reiterated time and again that extra financial ache (task losses, housing marketplace declines, and so on.) is coming consequently to resolve the inflation drawback handy. He cited a loss of disinflation of their favourite “core PCE” (non-public intake expenditures) measure and reiterated his Jackson Hollow hawkish speech, noting that they received’t forestall till the task is finished.

It’s now do or die for possibility belongings with the choices to look a direct reduction rally this week or most likely extra downward continuation in valuations and costs around the board.

Our thesis right here at Bitcoin Mag Professional, as long-term bull-biased bitcoin proponents, is that the macroeconomic headwinds are within the motive force’s seat, and given the cost motion in world foreign money and bond markets, without equal panic second has but to reach. We’re open-minded and versatile to switch that stance, however as goal marketplace analysts, we see and file what’s in entrance folks. Extra in this later.

On-Chain

Despite the fact that on-chain cyclical metrics can turn out helpful for assessing long-term worth purchasing (or promoting) alternatives and Bitcoin’s financial conduct, we’ve highlighted much less of them over the previous couple of months as we felt they had been much less related to temporary worth motion in comparison to present macro headwinds.

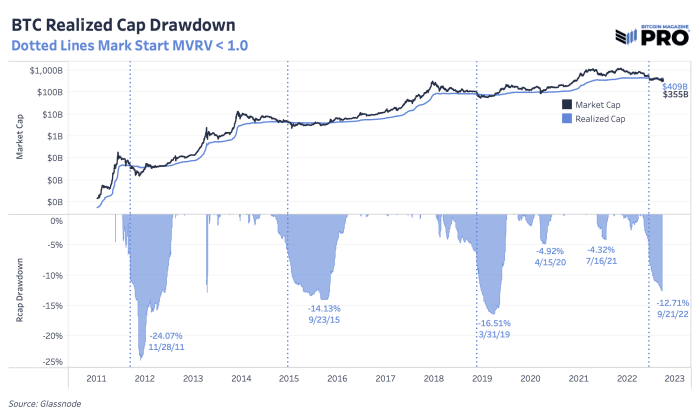

Taking a look on the historical past of bitcoin marketplace cycles, when diving into on-chain information, one in an instant notices the consistency wherein the bitcoin worth falls beneath its discovered worth (moderate price foundation of all bitcoin as in keeping with their remaining motion on-chain) all over the depths of a undergo marketplace. In earlier cycles, that’s no longer been a one-off tournament however quite one that still comes with period. We’ve been emphasizing for months that this undergo marketplace can last more than maximum be expecting and that the period part is extra painful than the share drawdown.

“As the common holder is underwater, maximum marginal dealers have already bought their holdings, and whilst additional problem is conceivable, the ‘ache’ marketplace members really feel is within the type of a chronic time period spent underwater quite than swiftly declining costs that characterised the beginning of the undergo marketplace.” – When Will The Bear Market End? July 11, 2022

The BTC/USD day-to-day change price is ready totally on the margin and, given the expanding macroeconomic headwinds, marginal dealers have and most likely proceed to dominate marginal consumers till a definite exchange in liquidity stipulations happens.

A extra zoomed-out view displays that this drawn-out technique of capitulation transfers the cash into more potent, and extra well-capitalized fingers.

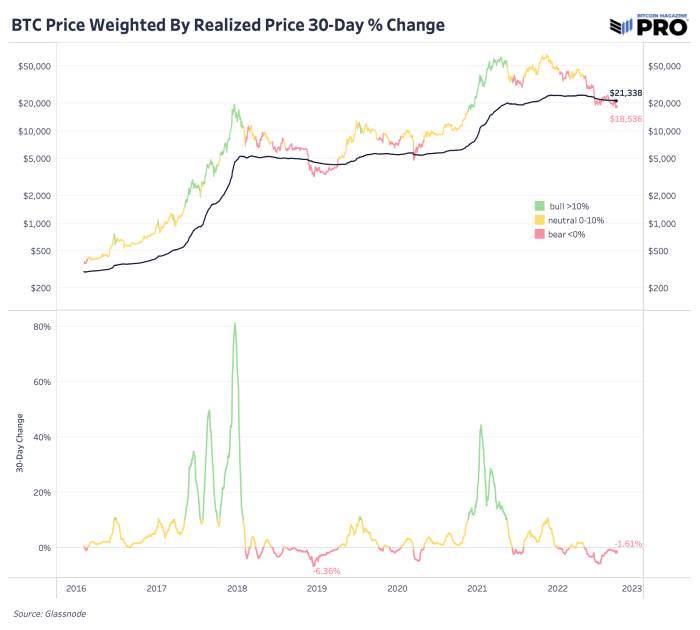

Bitcoin worth weighted by means of the discovered worth displays that we’re in undergo territory however nonetheless have room beneath.

For those who see this because the time to get long-term undervalued bitcoin, the discovered marketplace cap is an assuring chart which displays the log expansion of bitcoin’s price foundation over the years. The price foundation has most effective dropped a most of 24.07% from cycle highs and is these days down 12.71%. That is the chart which we expect maximum “non-bitcoin” buyers don’t snatch. Even within the “the whole lot speculative” bubble, which bitcoin is part of, the associated fee foundation of the community is ever expanding or marginally declining in spite of the wild day-to-day change price volatility.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)