4 days in inflation-ravaged Lebanon with “The Bitcoin Usual” writer Dr. Saifedean Ammous.

4 days in inflation-ravaged Lebanon with “The Bitcoin Usual” writer Dr. Saifedean Ammous.

This text at first seemed in Bitcoin Mag’s “Moon Factor.” To get a duplicate, visit our store.

“What must the time desire of my mag article be?”

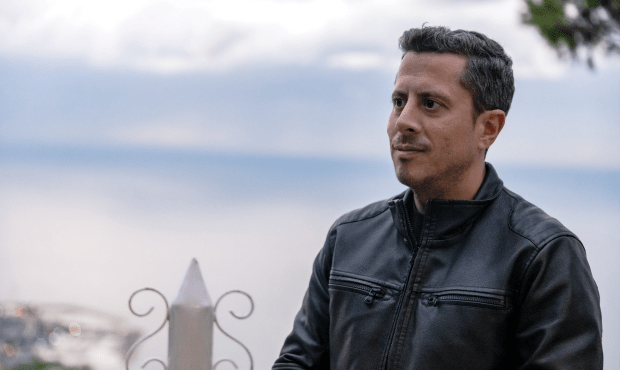

It’s a query I first pose to writer Saifedean Ammous as we stroll a darkened town sidewalk, the one mild attaining us from within sight eating places the place smiling diners idle.

Gazing what may well be any busy suburban meals court docket, my preliminary impact of Lebanon is that it sort of feels undisturbed, even commonplace, a a long way cry from the headlines heralding a once-in-a-century financial disaster outlined by way of annual inflation that’s now the absolute best on the planet at 140%.

But when busy Beirut doesn’t seem desperate to play poster kid for the ills of the fiat monetary gadget, Saifedean is short to notice the streetlights out above us, a casualty of presidency price range cuts.

“The marketplace,” Saifedean says, “is solely discovering some way.”

It’s the beginning of a sequence of discussions to happen over days as we discover town, believe his newly revealed paintings, “The Fiat Usual,” and probe the mysteries on the center of Bitcoin that stay because the calendar yr turns to 2022 and past.

Of widespread debate is what I assert is a generational divide forming between Bitcoin’s old-guard technologists and an ascendant meat-eating, family-first, Bitcoin-asa-lifestyle motion for whom Saifedean’s paintings has grow to be one of those dogma.

Finally, it wasn’t way back that Bitcoin dialogue used to be outlined by way of early coders who noticed it only as a instrument, an making improvements to protocol for shifting virtual cash. Nowadays, it’s the ironclad economics of Bitcoin that dominate discourse, in no small phase because of Saifedean (pronounced Secure-e-deen) and his 2018 e-newsletter, “The Bitcoin Usual.”

It’s no longer an exaggeration to mention extra other people now purchase bitcoin after studying the ebook than they do on finding Satoshi Nakamoto’s 2008 white paper or by way of reviewing its code on-line.

So nice has been the fanfare across the paintings, CEOs of public firms now proudly boast they’ve spent billions adopting a “bitcoin usual,” the latest being an Australian baseball group that tweeted photographs of coaches instructing the ebook each off and on the sector.

The writer’s keen readers will for sure to find a lot to love in “The Fiat Usual,” a self-published sequel that’s arguably much more expansive in its statement that central financial institution cash printing is a smart societal evil stretching a long way past financial coverage.

Incorporated amongst its chapters are positive to be fan favorites like “Fiat Lifestyles,” “Fiat Meals” and “Fiat Science” that body state companies just like the U.S. Meals and Drug Management and problems like local weather exchange as signs of presidency interference in freedoms, business and family members existence.

Nonetheless, for his phase, Saifedean pushes again on assertions he’s forging an affiliation between Bitcoin and choice existence, or that his place and affect make him chargeable for adjustments in sentiment a number of the motion.

He’s choosing the bones from a coal-grilled fish, its eyes charred and blackened into its sockets, when he in spite of everything solutions my extra opposed questions without delay.

“Those concepts are well-liked as a result of they fit the place Bitcoin suits on this time and position,” he says. “That is what Bitcoin is right here to rescue us from, inflation and all of the trappings of inflation.”

Our adventure in Lebanon will be offering context to the statement.

THE FIAT SAIFEDEAN

Saifedean’s street to Bitcoin is an extended one, outlined by way of denial, acceptance and fateful encounters. It’s a meandering story, relayed as we weave the various parked vehicles and site visitors bollards that squeeze us ceaselessly and tightly towards Beirut’s straining conserving partitions.

The son of a health care provider, Saifedean explains he grew up in “a type of households” the place you had to enroll in the vocation or else you’re branded a failure. Nonetheless, he can be keen to damage from custom.

Saifedean, now 41, refers to those early years because the “prime time desire” duration of his existence, the word (denoting a bias towards temporary decision-making) now colloquial as a critique towards fiat finance due to its use in “The Bitcoin Usual.”

Drugs gave the impression of an excessive amount of paintings, so he selected to review mechanical engineering on the American College of Beirut (AUB). We’ll spend a lot of our time circling this gated portion of town, its tranquil, cedar tree gardens and football pitches walled off from the city sprawl.

As soon as at the outskirts of town, AUB is these days besieged by way of quick-service eating places and retail outlets, its clinic serving as the middle for what Saifedean calls the “COVID ritual,” and he wastes no alternative to say the virus is being abused to exert new types of draconian regulate.

If he seems to start with intent on appearing me round his loved alma mater, that hobby ends after we’re beset by way of guards intent on making him put on a “muzzle.” “It’s a disgrace,” he says, scratching graying hair with an annoyed hand. “It’s an attractive campus.”

It’s some other ordinary theme — that for Saifedean, Lebanon is one thing of a loved 2d house. “It used to be the hedonistic capital of the sector,” he remembers. “Should you sought after to celebration, revel in your self, have nice meals, nice wine, there used to be not anything love it up till 2019.”

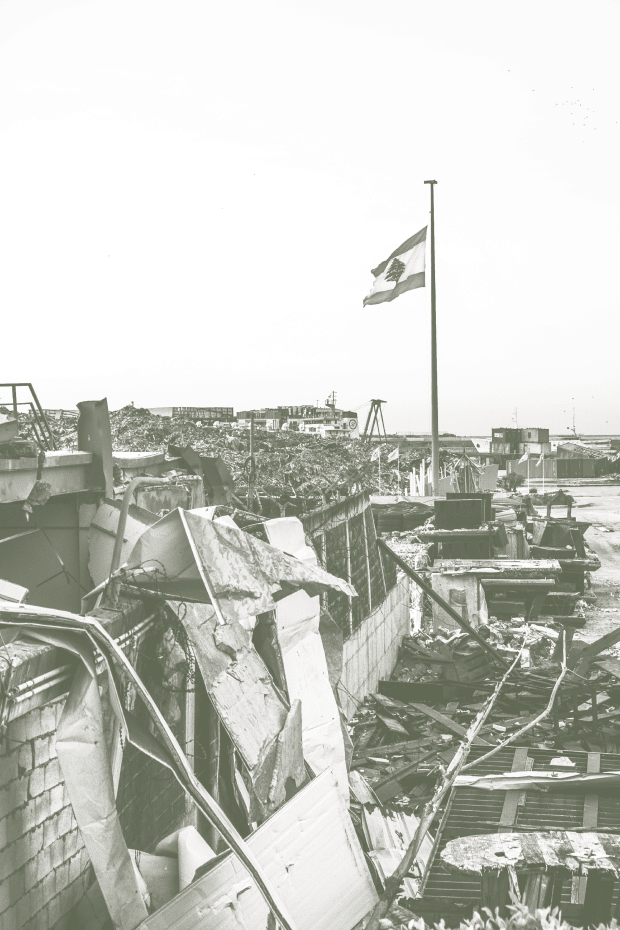

That’s when the present disaster started, turning “the Switzerland of the Heart East” into a rustic recognized for energy outages and a diaspora that’s more and more looking for refugee standing out of the country.

It’s arduous to piece in combination an actual timeline for when the problem — specifically, the decoupling of the black marketplace alternate fee (then 27,000 Lebanese kilos to the U.S. greenback) from the central financial institution fee (nonetheless formally 1,500 kilos to the U.S. greenback) — started, or why what adopted would so strongly counter the narrative Lebanon used to be a “resilient” country, at all times ready to borrow and refinance its debt regardless of home demanding situations.

Born to a family members that had its land confiscated by way of Israel in Palestine, Saifedean sees the State and its penchant for central making plans as without equal perpetrator for the disaster in Lebanon, and as we stroll, he proves eloquent in figuring out the various results of presidency intervention.

“There’s a holdout tenant caught there who’s paying one thing like $7 a yr for hire,” he explains, pointing at a browning development he believes is the sufferer of faulty hire controls. “They’re ready to receives a commission off. Far and wide town those residences are falling aside.”

There’s a undeniable disappointment to the narration, because it’s amongst those constructions the place Saifedean found out his hobby in economics as an undergraduate at AUB.

Again then, his perspective used to be other. “I believed the sector wanted making plans. I had that roughly statist immaturity that we wish to have somebody in authority to let us know what to do for the reason that global is a horrifying position,” he says. “I selected to head the trail of fiat.”

It’s a trail that will subsequent take him to the London Faculty of Economics (LSE), the place he’d have his first come upon with the outsider Austrian economists his paintings has revitalized, and in spite of everything to the Lebanese American College (LAU) in Beirut, the place he’d write “The Bitcoin Usual.”

There, he says, Bitcoin stored his existence.

HYPERINFLATION IS HERE

We’ve settled into the nook of a brightly painted café when our communicate turns to Saifedean’s emerging profile and the way it would impair his relationships within the town. He freely admits he’s misplaced contacts from his former existence as a result of his stances on COVID-19 and Bitcoin. Every now and then, despite the fact that, Saifedean turns out reluctant to make the placement worse.

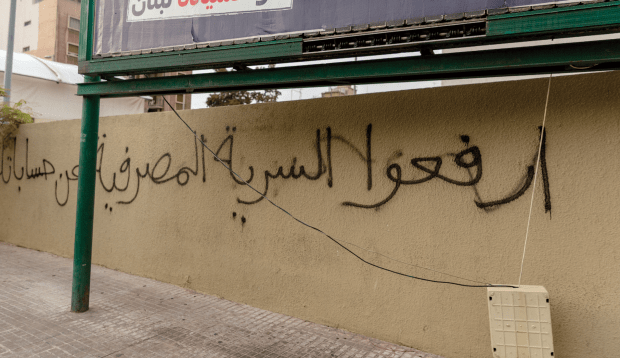

In spite of the encouragement of our photographer Ibrahim, he isn’t to begin with desperate to pose in entrance of the Banque du Liban, the central financial institution whose graffiti-strewn and barricaded development bears the marks of frustrations aimed on the financial downturn.

SAIFEDEAN:

It’s rubbing salt in wounds.

IBRAHIM:

You’re discussing economics.

You don’t suppose Salim [Sfeir, head of the Association of Banks in Lebanon] owns bitcoin?

If the offhand observation makes it appear to start with as though there’s a well-liked consciousness of Bitcoin and the way it may well be an answer for the disaster in Lebanon, we’ll to find this isn’t precisely the case.

Saifedean places the blame on native monetary establishments that experience for years burdened Bitcoin with restrictive insurance policies. A central financial institution directive, he says, has been a hit in turning away hobby even though it’s no longer transparent if purchasing and promoting bitcoin is banned.

No arrests had been made, however there’s been an implied pressure Saifedean skilled firsthand when he would try to fail to put in a Bitcoin ATM at a neighborhood buying groceries heart in 2017. That isn’t to mention others haven’t been a hit.

“I do know other people whose banks would shut their account until you signed a paper pronouncing you wouldn’t take care of cryptocurrencies,” he says. “They have been preventing it each step of the best way.”

That isn’t to mention others haven’t been a hit since, particularly within the wake of the cave in of agree with within the native banking sector.

We discover a Bitcoin ATM at a close-by foreign money alternate, and it’s transparent the operators see application in bitcoin. They don’t need to be known (for worry of reprisal), however they’re open about how bitcoin is permitting native Lebanese to retailer worth safely amid attempting instances.

“We now have hundreds of greenbacks in our homes,” the operator explains. “They’re stealing the cash each time they print new notes.” You get the sense he’s dressed in his wealth, his tan leather-based jacket appears new and it’s embellished liberally with gold chains.

The landlord estimates the ATM will get about 15 shoppers an afternoon, nevertheless it’s a a long way cry from what chances are you’ll be expecting in a town of hundreds of thousands the place the foreign money is depreciating day by day.

But, outdoor the store, existence amid hyperinflation carries a undeniable facade of steadiness. Window after window on stylish Hamra Boulevard options the most recent fits and streetwear from Nike, Gucci, Rolex and the like. Beneath the outside, despite the fact that, locals say the tension is rising.

Ibrahim is keen to provide an explanation for how hyperinflation has impacted his existence. He rents two properties, the results of a up to date marriage. Each are equivalent in measurement and site, however he can pay 1 million lira per 30 days (or about $35) for the primary, and 500 euros (about $600) for the second one.

Those prices are set by way of the contract and so don’t accomodate adjustments within the worth of the native foreign money. “You’ll be able to argue for each events [of the contract],” Ibrahim says, the Canon apparatus of his business jostling in a saddlebag. “I can’t pay 500 euros. However the proprietor, it’s no longer his fault the foreign money devalued.”

Already, he has noticed two categories of employees emerge — those that receives a commission by way of international companies in U.S. greenbacks and those that obtain salaries in Lebanese kilos. For emphasis, he issues to a close-by site visitors guard pacing away his afternoon.

“His wage is lower than $50. He used to get $800 and now he will get $50. You’ll be able to believe how this affects his possible choices of meals, his excitement time,” he says.

There are losers in hyperinflation, to make certain, however there also are winners. As Saifedean explains, the placement isn’t all that unhealthy for the rich. “They simply were given a 95% bargain on their [mortgage],” he says amid dinner at a hectic upscale grill.

It’s a delicate revelation that can set in over the approaching days, that inflation isn’t a humanitarian disaster however a bone most cancers — malignant perhaps however virtually undetectable at the floor.

“The individuals who can find the money for to devour right here,” Ibrahim provides, “nonetheless devour right here.”

BITCOIN BEGINNINGS

As Saifedean’s adventure displays, it isn’t at all times simple to acknowledge financial fact — even he would spend years skeptical of the theory bitcoin used to be changing gold and turning into world cash.

Certainly, Saifedean’s early educational paintings remained steeped within the concept some authority, if handiest correctly knowledgeable and inspired, used to be able to enacting financial and political exchange.

As a grasp’s pupil, Saifedean would first make a reputation in columns penned for Columbia’s college newspaper, The Columbia Spectator, which addressed the Palestinian battle and the quite a lot of hypocrises printed by way of the Western establishments that tried to intrude and help it.

As highlighted by way of the New York Observer in 2007, Saifedean used to be already adept at taking an assertive stance on political problems, sparking an issue at a campus celebration celebrating the beginning of Israel and “taking on” communicate at a Hillel debate on whether or not Zionism is racist.

“Chances are you’ll as neatly base citizenship at the horoscope. No Scorpios are allowed, and my family members are Scorpios,” Saifedean argued, the hyperbole stunning the pro- Israel foyer in attendance.

His 2011 PhD thesis, “Choice Power Science and Coverage: Biofuels as a Case Learn about,” would mark the purpose at which he would start channeling his antagonism towards its provide goals.

Nowadays, it reads as a prelude to “The Fiat Usual,” arguing executive subsidies for biofuels in reality harmed the surroundings. His new ebook revives the theory, saying that oil and different hydrocarbon fuels must be known for his or her historical past of making improvements to human existence.

An try to unite his undergraduate engineering paintings along with his new hobby in economics, the paper discovered its writer to start with making an attempt to type how biofuel mandates may succeed in local weather targets, a route that will sharply shift within the wake of the 2008 Nice Monetary Disaster.

As the worldwide markets teetered at the fringe of cave in, Saifedean started to peer himself within the teachers who justified bailouts for billionaires with equivalent spreadsheet fashions. That’s when, he says, he started to embody the “Austrian point of view.”

“I found out that folks have recognized that the sector is a long way too difficult, that I wasn’t by myself.”

Empowered, he would stay on writing his PhD thesis, naively pondering he’d be embraced as a debatable, impartial philosopher. As an alternative, this flip towards libertarianism used to be met with resistance by way of the Columbia brass, and he stays sour concerning the rebuke.

“I left out how their whole highbrow approach of coming near the sector is dependent upon their very own statist, socialist central making plans,” he says. That the reaction feels pointed is in all probability as a result of his folks flew to New York for his commencement handiest to seek out his PhD protection were canceled over issues about its content material. He would wait some other yr prior to receiving his doctorate.

Saifedean’s first brush with Bitcoin would happen quickly after.

Arriving in New York in the summertime of 2011, he had informed himself he would purchase 100 bitcoin for $100, however as the associated fee temporarily spiked above $30, he used to be became away because of the expense and his smug conviction that Bitcoin would virtually undoubtedly fail.

All of the whilst, he would stay satisfied gold used to be the solution to problems within the monetary gadget, even making an attempt to discovered a startup to permit customers to switch the valuable steel with the benefit of well-liked virtual apps like PayPal. (He would move to Switzerland to scout for bodily vaults and claims to have had hobby amongst provisional traders.)

But, Saifedean used to be then a long way from by myself in pondering actively and thoughtfully about choice finance, and he’d quickly grow to be extra outspoken in airing his mistrust within the legacy gadget.

Dated from overdue 2011 and early 2012, his preliminary appearances on “The Keiser Record” exhibit what would grow to be the following topic of his ongoing educational paintings — the concept that the USA used to be not a loose marketplace capitalist gadget.

Max Keiser, the display’s host, remembers seeking to get Saifedean to peer Bitcoin’s possible on the time however claims his makes an attempt have been rebuffed. (“He hated it,” Keiser says now.) Saifedean doesn’t commit it to memory precisely that approach however admits he remained “uninformed” at the topic till 2013. (He vaguely remembers the Keiser dialogue however isn’t precisely positive it came about.)

Both approach, as the cost of bitcoin rose towards $1,000 that yr, Saifedean started to reconsider his skepticism, sending a sequence of emails to Keiser looking for recommendation on how to shop for. In a while after, he would make his first acquire and start courting his spouse in the similar week.

It’s in all probability as a result of this non-public adventure that Saifedean more and more sees his monetary and home steadiness as intertwined.

“The profound center of all of that is that it’s the hardness of the cash that displays at the time desire. That’s what Bitcoin allowed me to find in myself and allowed me to place it within the ebook. You probably have a approach to retailer worth for the long run, you’ll supply to your long term.”

“I do know numerous individuals who have finished the similar factor,” he continues, “they get into Bitcoin and get married. They began to take into accounts the long run.”

THE COVID HYSTERICS

Nonetheless, if the legacy of “The Bitcoin Usual” is the readability with which it described the industrial issues Bitcoin solves, debate stays at the extent of the societal have an effect on of its answer.

Available to emphasise the divide is Bitcoin Mag’s personal Aaron van Wirdum. A era reporter within the box since 2013, his interactions with Saifedean temporarily disclose how claims core to “The Fiat Usual” can really feel taboo for the ones to whom Bitcoin is extra science than politics.

Certainly, arguments temporarily flare round whether or not putting off executive cash from economies will have downstream affects on healthcare, wellness and conservation, with dialog turning stressful across the concept those topics have any area in Bitcoin in any respect.

Amid one dialogue on how outlooks amongst customers have obviously advanced at the topic, it’s Saifedean who makes use of the ground to assert Bitcoin critics all “need to devour insects [and] put on a masks.”

Aaron calls the observation a pivot of topic, and Saifedean wastes no time in punching again.

SAIFEDEAN:

Oh yeah, you have been probably the most [COVID] hysterics in the future. Oh god.

AARON:

Smartly, it must had been tackled early and difficult.

The dialog temporarily escalates, with Saifedean arguing those that suppose like Aaron are not more than gullible cowards who’ve been manipulated by way of the Chinese language Communist Birthday celebration, large pharmaceutical firms and mainstream media into turning into fashionable fascists.

The alternate is laced with grievance towards accomplices all over, from podcaster Peter McCormack and Microsoft founder Invoice Gates (it’s no longer transparent which precisely is a part of what he calls “the manboob squad”) to Nassim Taleb (the Lebanese writer who wrote the creation to “The Bitcoin Usual” and with whom he’s now engaged in a public feud).

Within the span of a few mins, he’ll argue the media has been complicit in developing fashionable trust in what quantities to incorrect information concerning the virus and its transmissibility, all of the whilst admonishing governments for the use of totalitarianism to battle a illness that may successfully be countered with “wholesome dwelling, diet, and elementary hygiene.”

“There’s cash in authoritarianism, there’s cash to be produced from surveillance, and the TV audience move alongside,” Saifedean says, by way of now ignoring the cooling meals in entrance of him.

As time is going by way of, Aaron is in a position to interject much less and no more, his ultimate remark one thing alongside the strains of, “Will we agree that there’s a plague?” Makes an attempt to discover a center floor handiest appear to make Saifedean extra irate as he builds to his crescendo.

“What number of years and what number of pictures is it going to take so that you can see this isn’t concerning the pictures or the mask? You’ve been suckered into turning in generations of freedoms that your kids are by no means going to get again.”

“I appreciate your proper to be gullible and keep at house. Why are you able to no longer appreciate my proper to chance my existence? It’s no longer about well being, it’s about regulate. Wake the fuck up! Wake the fuck up!”

The talk is one that can reoccur over the four-day go back and forth however by no means with moderately the similar hobby. Saifedean later refers to Aaron’s insistence on “poisoning” him with the vaccine as a “war of words amongst pals,” the remark providing a extra muted however no much less acerbic take.

If Aaron is indignant by way of the dialog, he’s adept at hiding it. Whilst you’ve labored throughout the sour portions of Bitcoin’s adolescence, getting yelled at is solely a part of the business. Nonetheless, it’s value noting this habits is a goal for Saifedean’s critics, who concern it politicizes dialogue of a impartial era and not using a relating broader everyday life possible choices.

AN UNSTABLE EQUILIBRIUM

However at the same time as he wields it as a weapon, it’s arduous to not recognize the keenness with which Saifedean embraces the freedoms Bitcoin has afforded him. Should you’re no longer the objective of his animosities, he’s stress-free corporate with a deep hobby in meals and track, and Beirut brings out his internal aficionado.

This sentimentality is comprehensible whilst you believe he’d revel in a profession renaissance right here in 2015, when again once more in Beirut, he’d post a breakout paper that argued bitcoin used to be the one cryptocurrency more likely to revel in long-term adoption.

“The coexistence of bitcoin and executive currencies is an volatile equilibrium: the longer bitcoin exists, the much more likely it’s to proceed, and the extra sexy it turns into in comparison to conventional currencies,” it reads.

But, if that paintings appeared tepid now and then (together with an necessary passage about how inventions are ceaselessly outdated), extra assertive paintings would quickly practice. “Blockchain Generation: What Is It Excellent For?” and “Can Cryptocurrencies Satisfy the Purposes of Cash?,” bolder papers that extra forcefully argued for Bitcoin as an agent of exchange, would seem in 2016.

However at the same time as those works unfold his message amongst teachers, Saifedean says they did little greater than inspire him to spend time “arguing on Fb.” That’s when his spouse satisfied him to buckle down and write a ebook. Penned in two-and-a-half months thereafter, “The Bitcoin Usual” used to be an try to set the file instantly, and the gross sales recommend it did.

For Saifedean, it’s the marketplace reception that he unearths maximum validating. Some distance from existence within the fallow college gadget outlined in “The Fiat Usual,” the place paper turbines compete for state handouts, he’s increasing his books into a brand new web page, Saifedean.com, for an international buyer base.

“I needed to take some of these implausible concepts concerning the global and check out to put in writing this disgusting drivel that would get previous the journals no one reads that managed my profession,” he says and not using a small delight. “Now, I will be able to get at the keyboard and write.”

In his thoughts, that is how all industries must function, with creators giving worth to shoppers, no longer a chairman who has get right of entry to to the cash printer. As an alternative, he sees his former career (and the sector at massive) as stuffed with depressed individuals who “don’t get to do anything else of worth in any respect.”

“You notice numerous tales of people that really feel numerous vacancy, and also you don’t see that with Bitcoiners,” he continues. “[In Bitcoin], you’ve settled in this cash that’s the ultimate type of cash and you’ll reserve it, and you understand that it’s there.”

It’s those statements that in all probability perfect provide an explanation for how Saifedean has influenced outlooks on the way forward for Bitcoin itself. I argue there’s a fashionable self belief now, absent from previous instances, that Bitcoin is an inevitability requiring not anything greater than passive acceptance.

It’s some extent we debate from side to side, with Saifedean saying, as he has in his paintings, that it’s just a secure building up in worth over the years that can make Bitcoin extra mainstream. If this sounds “unidealistic,” he’s prepared to say he’s no longer an evangelist, nor does he suppose Bitcoin wishes any roughly activist outreach to boost up its adoption.

“Laborious cash can’t keep area of interest,” he says. “If quantity move up, everybody goes to wish in.”

ORANGE PILLING THE KING

This debate will resurface once more in microcosm at a meetup later, when it turns into transparent even Beirut’s Bitcoiners don’t precisely see it as a way to the disaster. Views range, however at the same time as dialog slips between English and Arabic, analysis stay as dim because the pub lights.

Wrapped in a banker’s shawl and blue blazer, Gabor sits bespectacled as he argues why the native coverage institute he works for believes the most productive path is to determine a foreign money board that may inspire the central financial institution to again its deposits with complete U.S. greenback reserves.

Quickly, Saifedean is careening into our dialog from around the room, desperate to play Bitcoin defender. “If it’s a committee, it’s central making plans, however in case you name it a board, it’s no longer,” he says amid protests. “Should you’re no longer fixing the issue, the cash printer, you’re simply jerking off.”

On the center of the talk is Saifedean’s central thesis from “The Bitcoin Usual” — politicians that get pleasure from inflation don’t have any incentive to forestall it, an issue that Bitcoin, by way of putting off executive from cash control, solves by way of design.

“Inform them to forestall bitching and moaning and get started purchasing bitcoin!” he roars.

Nonetheless, for his phase, Gabor turns out set on impressing the practicalities of the topic. “In the event that they give up printing, who can pay the salaries?” he says. “Should you get started at this stage, you haven’t any likelihood of convincing them.”

Marco, a former pharmacist and the founding father of the meetup team, can’t assist however agree, no less than out of Saifedean’s earshot. As he explains it, native Lebanese imagine the disaster to be political in nature. “They are saying that it may be solved with a snap of a finger. There’s at all times an excuse,” he says. “It’s The us, or Iran, or Hezbollah, no matter you wish to have.”

Others say Lebanon has weathered equivalent storms prior to: Within the 1980s, the lira inflated wildly towards the U.S. greenback handiest to sooner or later stabilize. “Other people nonetheless imagine that this can be a very equivalent scenario,” Marco continues. “They don’t see the wish to use a parallel choice marketplace but.”

Maximum imagine the near-term answer is for the rustic to formally undertake the U.S. greenback, however no longer as a result of they see any defect with bitcoin. Slightly, they appear to imagine it simply wouldn’t accumulate well-liked give a boost to right here, even though the rustic took the similar revolutionary steps as El Salvador.

“We now have a physics professor going live to tell the tale TV, pronouncing it two times in the similar interview, that the answer for preventing the lira’s scenario is shutting down the fucking web,” Marco provides. “You inform me we will be able to persuade those other people to shop for bitcoin?”

A foreign money broker who trades with locals over Telegram and Binance sees eye to eye, noting lots of the gross sales he conducts are in reality for the U.S. greenback stablecoin Tether. He says Lebanese need the security of the U.S. greenback, and that to many, crypto stablecoins are the following perfect factor.

Gabor provides that that is how he even grows his personal bitcoin place, purchasing USDT and promoting it on an alternate when the associated fee dips. “Lots of the native Bitcoiners don’t need to promote,” he provides.

Amid the talk, the gang activates me to check the idea by way of accomplishing a business over Telegram, so I submit a message providing to promote $250 value of bitcoin for U.S. greenbacks. Inside of a minute, I’ve gained a answer from somebody desperate to habits the sale.

What follows is a atypical come upon the place I shuffle right into a black Mercedes handiest to learn by way of our broker he “by no means touches bitcoins.” He continues to suppose I would like Tether, asking “ERC-20 or Tron?” till we sooner or later abandon the poorly translated business.

Once we go back to the bar, we discover the debate has taken its personal sudden flip, with Saifedean denouncing the screw ups of republican governments within the area. The theory will really feel acquainted to Saifedean readers who know his stance on monarchies as the most popular, low time desire type of state rule. However even in a bar the place everyone seems to be longing for a duplicate of “The Fiat Usual,” his imaginative and prescient for a extra non violent Heart East in all probability comes off as extra polarizing than supposed.

“Take a look at Jordan, they have got safety, infrastructure that works, and a completely livable, civilized nation. Plus, the Hashemites can get you 24-hour electrical energy,” he says, chiding the desk.

To the amazement of attendees, he is going on to signify Jordan’s ruling family members may even cling the keys to resolving broader regional strife. Despite the fact that they’re Sunni Muslim, they’re direct descendants of the prophet Muhammad, which makes them well-liked amongst Shia Muslims.

Since all of the Sunni–Shia schism, he causes, comes from Shia anger at Sunni betrayal of the home of Hashem after the prophet’s loss of life, handiest the Hashemites can mend the breach, which has became more and more bloody and sour in fresh a long time.

“However Jordan isn’t precisely a loose marketplace economic system,” items Michael, an ex-student of Saifedean.

“We simply wish to orange tablet His Majesty so he shuts down the parliament and ministries and all of the central planners, leaving handiest the military and the royal court docket!” he exclaims, including: “The remainder of the area will need to enroll in the Hashemites.”

CEDARS OF THE GODS

Again within the automotive, days of debate seem to have in spite of everything piqued Ibrahim’s hobby in Bitcoin.

We’re on our approach to the Shrine of Our Girl of Lebanon, preventing stop-and-go site visitors en path to the within sight nationwide monument when his questions start to pour forth. Must he do anything else with the “different cryptocurrencies?” What does it imply after we say “China banned Bitcoin”?

He’s been busy Googling since we met, and whilst he used to be previously inspired by way of a speech Saifedean gave in Might, he’s at the sidelines and not using a cash invested in bitcoin.

Ibrahim’s admission is made all of the extra unexpected when he relays that the majority of his cash is caught in his checking account, all however inaccessible because of withdrawal limits.

It’s one thing Saifedean simply can’t appear to know. On leaving college existence in 2019, he’d instantly convert his severance pay into bitcoin. (He even despatched his sister-in-law to the financial institution without delay along with his broker, in order to not waste any time.) Factoring capital controls, he’d take a 40% minimize at the cost, however says the good points in bitcoin have made up for it.

“It’s like [the GIF of] George Clooney when he’s strolling clear of the explosion,” he remembers. “It hit 3,000 [liras to the dollar], then the numbers tumbled one after some other.”

Later, we’re passing the biggest Christmas tree in Lebanon because the dialog resumes.

Aaron continues to be probing Saif about his emotions on Giant Oil, making an attempt to get him to confess there’s this kind of factor as “unfavourable externalities” that people want governments to assist remedy.

SAIFEDEAN:

They exist in eventualities the place assets rights don’t seem to be neatly outlined.

AARON:

Proper, however who owns the ozone layer?

IBRAHIM:

(quietly) What’s fiat?

The query is so blameless it virtually doesn’t check in, and I take the bullet as Saif and Aaron flip again, misplaced in a combat of egos working deep. The record of speaking issues that follows looks like a largest hits of Saifedean’s paintings — the mobility drawback with gold, how and why paper notes changed it, and why bitcoin is now one of the simplest ways to transport worth throughout time and house.

It’s a testomony to his affect, but additionally to the trouble of ever in reality explaining Bitcoin totally. The deeper you move, the extra questions at all times appear to stay.

IBRAHIM:

My cousin informed me not too long ago there used to be a safety improve… who does that?

RIZZO:

[Turning back] Yeah Saif, who does that?

SAIFEDEAN:

Should you’re working the code, you make a decision what code you wish to have. You’ll be able to make a decision anything else, however the factor handiest works in case you don’t exchange anything else.

AARON:

But it surely did exchange…

The dialog feels worn now, such a lot in order that as potholes rattle the auto, the circulate of Arabic cursing that follows turns out virtually like a healing smash.

Within the surprise to the senses that follows, I will be able to’t assist however marvel about our time desire, if we’ve lapsed too a long way into our personal complacency, too positive some climax used to be certain to occur.

In harmony with the sentiment, I make a decision to override my very own central making plans, asking Saifedean how he’d like to finish the thing. “Hookers, cocaine, gunfight? You need to observe drug sellers battle in Bakka?” he responds.

Destiny intervenes when, simply down the road from our vacation spot, he asks me all of a sudden, “Oh, so did you promote your bitcoin the day prior to this?”

I flip again and inform the story. The surprise is visual on Saif’s face, his eyes huge, mouth ajar.

SAIFEDEAN:

That’s a tragic approach to finish the tale.

We’re at our vacation spot now, all of a sudden swapping handshakes.

It’s an empty feeling as the auto rolls alongside. As though after such a lot of manic sword swings, the good bull had in spite of everything bled, and we have been left sitting with some nice and sobering unsuitable.

NO SAD ENDINGS

It’s no longer quickly after that we’re once more on the resort, and I’m misplaced taking a look at waves lapping into mist as Ibrahim turns to the topic of cost.

I’m out of greenbacks by way of now however determine an ATM may well be close to. If not anything else, it may well be the arrange for some other finishing, some other caper, a last quest that would tie the ragged ends of a go back and forth that has gave the impression to finish all of a sudden, the false observe struck within the automotive nonetheless ringing.

I virtually don’t pay attention the phrases as he in spite of everything breaks the silence.

“I will be able to do it,” Ibrahim says, 1/2 as though he’s nonetheless convincing himself. The phrases are short, hushed, paired with one of those stowaway smile.

Some mins later he’s marveling as bits fly thru our on-line world, and Bitcoin, that groovy central financial institution within the sky, reassigns our personal keys, the comfortable magic making what used to be mine his, forever, perpetually, or so long as we will be able to cling it.

It’s a tiny rise up towards the fiat global, to make certain.

Available in the market within the evening, there stay the large banks, self-important squaddies, and all of the tentacles of the increasing, encroaching world state. But it surely’s those moments the place it’s transparent it may well be our aspirations greater than our solutions that in reality topic maximum.

“Wow,” Ibrahim says, taking a look down on the comfortable glow of his telephone.

You’ll be able to see it for a 2d — the mirrored image on all of the ATMs, the broke central banks, the arguments over ripped expenses — the figuring out that it might all be so simply wiped away.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)