That is an opinion editorial by means of Stanislav Kozlovski, a device engineer and macroeconomic researcher.

Many Bitcoiners have heard of Bitcoin’s “loss of scalability” — it is among the maximum not unusual reviews waged in opposition to the undertaking by means of each gluttonous cryptocurrency competition and incumbent established order actors.

Some oldtimers would possibly keep in mind the heated, bathed-in-controversy Blocksize Wars of 2015 to 2017 which, aided by means of trade insiders, maximum shallowly aimed to make Bitcoin scale to extra transactions by means of expanding the utmost block measurement and by means of doing so, virtually set precedent and altered Bitcoin’s future course forever.

Either one of those problems will in the long run turn out to be left at the improper aspect of historical past. On this piece, we’re going to display how the Lightning Community addresses Bitcoin’s scalability issues and definitely proves that the small-block resolution was once in the long run the appropriate one.

Base Layer Obstacles And Alternatives

Ahead of we perceive what the Lightning Community is fixing, we will have to first perceive what the inherent drawback is. Merely put: You can’t scale a blockchain to validate all of the global’s transactions in a decentralized means.

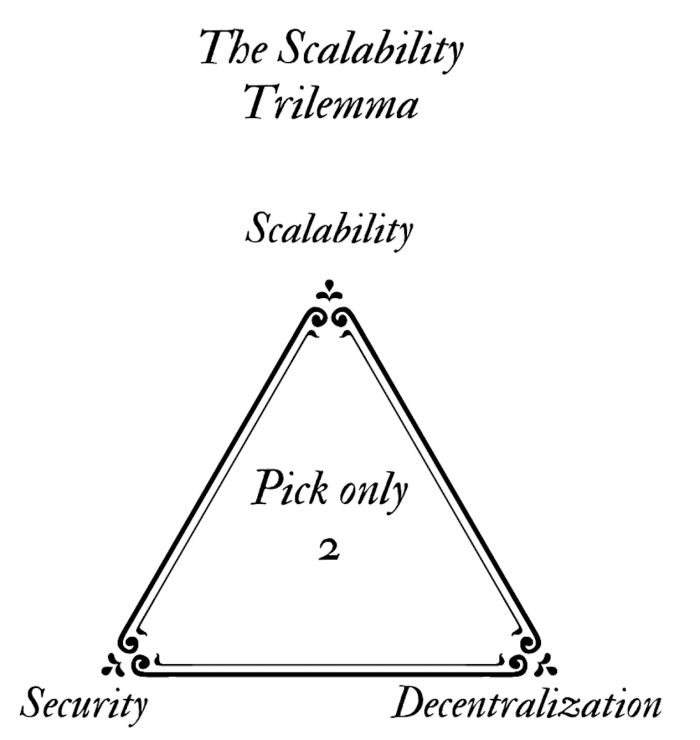

Blockchains be afflicted by an inherent limitation which forces them to business off between 3 qualities — one high quality in their gadget has to head for the opposite two. As pictured above, a blockchain can handiest reliably have two of those 3 qualities:

- Decentralized: no longer managed by means of any unmarried celebration or a small selection of elites

- Scalable: scale to a enough selection of transactions

- Safe: no longer be simple to assault and wreck its invariants

It’s value noting that each one of those traits sit down on separate, complicated spectrums. For instance, you don’t turn out to be “safe” over a undeniable threshold, it is extremely dependent on the use case and many different characteristics.

Bitcoin is sluggish for a reason why. It explicitly picked to optimize the “safety” and “decentralization” sections of the trilemma, leaving “scalability” (transactions consistent with moment) at the sideline.

The important thing realization is that, similar to these days’s web and monetary gadget, it’s extra optimum to contain the entire gadget of separate layers, the place every layer optimizes for and is used for various issues.

Bitcoin, the bottom layer, is a globally-replicated public ledger — each transaction is broadcast to each player within the community. It’s obvious that one can’t nearly scale the sort of ledger to deal with all of the global’s rising transaction fee. Excluding being impractical and privateness harmful, its drawbacks hugely outweigh its insignificant advantages.

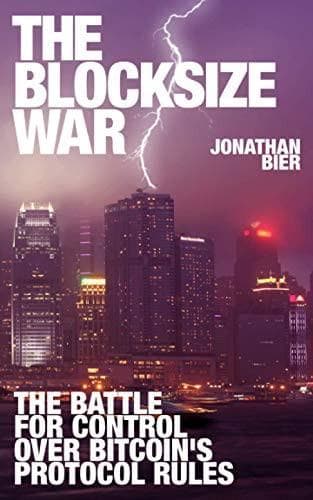

Again within the day, there was once a big civil struggle between the net group in what Bitcoin will have to do to extend its transaction throughput capability. There’s major, infuriating controversy in this story and is largely what formed Bitcoin to stay what it’s these days — a grassroots, bottom-up motion the place the average people (plebs), in combination with one any other, dictate the foundations of the community.

“The Blocksize War” by means of Jonathan Bier illustrates the struggle between the decentralized community supporters short of what’s very best for the long-term viability of the community and the greed and propaganda perpetuated by means of main avid gamers and companies to additional their very own power-gaining and profit-seeking agendas.

Lengthy tale brief, Bitcoin was once forked right into a failed fork named “Bitcoin Money.”

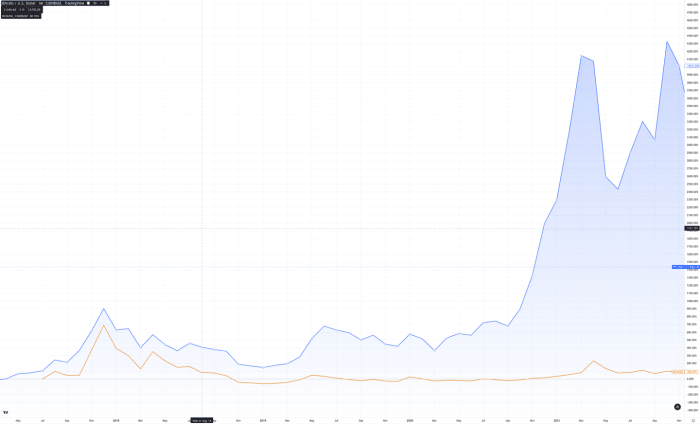

Bitcoin (blue) worth in comparison to Bitcoin Money (orange). The fork can also be noticed originally of the chart. Supply: tradingview.com.

The little man ultimately gained — Bitcoin didn’t rush any dangerous design alternatives that will come to compromise its decentralization, safety or censorship resistance. The verdict was once successfully made to scale Bitcoin thru layers, introducing moment layers that paintings one after the other from Bitcoin and checkpoint their state to the principle, slower-but-more-secure community.

In stark distinction, the evidently-unsuccessful fork Bitcoin Money sacrificed all hopes of decentralization by means of expanding its block measurement to 32 megabytes, 32 times more than Bitcoin, for a trifling most of 50 payments per second at the base chain.

Block Dimension

Each and every Bitcoin block has a cap on its measurement and this denotes the higher sure on what number of transactions can exist within a block. If call for grows to outpace the volume of transactions a block will have, the block turns into complete and transactions get left unconfirmed within the mempool. Customers start to outbid every different by the use of the adjustable transaction charge with the intention to have their transaction be incorporated by means of the miners, who’re incentivized to select the highest-paying transactions.

A naive way to this may be to easily building up the block measurement prohibit — this is, permit extra transactions to be incorporated in a block. The adverse negative effects of this are adequately subtle that even intellectuals like Elon Musk make the mistake of suggesting it.

Expanding the block measurement has second-order results which lower the decentralization of the community. Because the block measurement grows, the price to run a node within the community will increase.

In Bitcoin, every node has to retailer and validate every transaction. Additional, stated transaction must be propagated to the node’s friends, which multiplies the community’s bandwidth necessities for supporting extra transactions. The extra transactions, the extra the community’s processing (CPU) and garage (disk) necessities develop for every node. As a result of working a node yields no monetary advantages, the inducement to run one disproportionately decreases the extra pricey it’s.

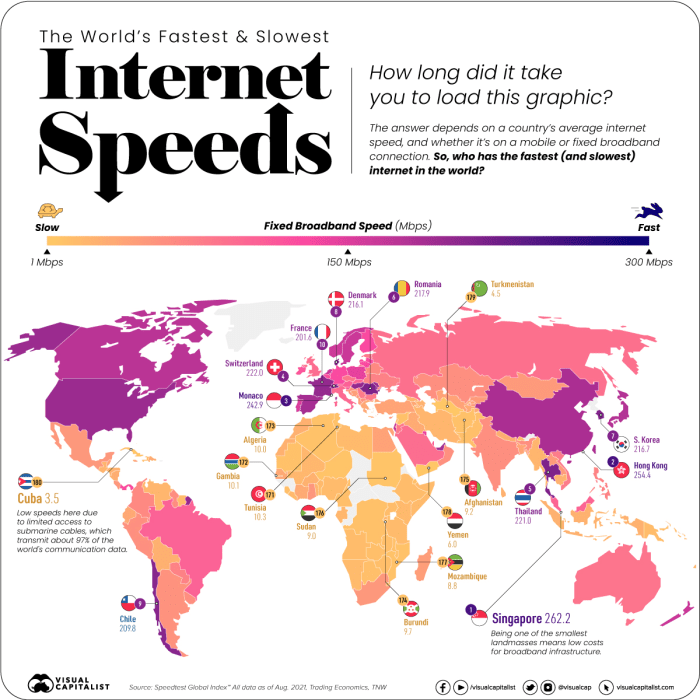

To position it into numbers, if Bitcoin is to ever scale to Visa’s purported top capability ranges (24,000 transactions per second) a node would need 48 megabytes per second simply to obtain the transactions over the community. The next is a map appearing the typical web velocity on the earth:

As you’ll be able to see, a large a part of the sector’s moderate velocity would exclude them from the facility to run a node below those prerequisites. Notice that moderate velocity signifies that many are even less than stated threshold. Moreover, it doesn’t account for the truth that a person would produce other makes use of for his or her bandwidth — few selfless folks would commit 50% in their web bandwidth for a Bitcoin node.

Extra importantly, the volume of information this may generate would make it unattainable for any one to nearly retailer it — it could lead to 518 gigabytes of information consistent with day, or 190 terabytes of information a yr.

Additional, spinning up a brand new node will require one to obtain all of those petabytes of information and test every signature — either one of which might make it in order that a brand new node would take a very long time (years) to spin up.

And to make issues worse, 24,000 transactions consistent with moment doesn’t make for a in point of fact distinctive international bills community in and of itself. Visa isn’t the one bills community on the earth, and the sector is rising extra interconnected each day.

Lightning Community 101

The Lightning Community is a separate, second-layer network that works on most sensible of the principle Bitcoin community. Merely stated, it batches Bitcoin transactions.

To get right of entry to it, you want to run your individual node or use anyone else’s. The community has two ideas value working out for the needs right here:

- A Lightning node: separate device that communicates with every different and constitutes a brand new peer-to-peer community.

- Channels: a connection opened between two Lightning nodes, bearing in mind bills to waft between them.

A channel is actually a Bitcoin base layer transaction, anchoring the channel to the safe chain.

As soon as two nodes open a channel between one any other, bills get started flowing between them. Each and every next fee modifies the channel’s state, cryptographically revoking the outdated one and checkpointing the brand new one in reminiscence and on disk of each nodes, yet seriously, to not the bottom chain.

Channels can and in my view preferably will have to keep open for a very long time (e.g., a yr or extra). If the nodes ever make a decision to near down their channel, their newest steadiness in spite of everything the off-chain bills is restored to their authentic wallets. That is cryptographically-secured by means of hashed timelocked contracts (HTLC) and virtual signatures, which we gained’t get into element for the needs of this newsletter.

This permits one to batch billions of bills into two on-chain transactions — one for opening the channel and one for ultimate it. As soon as a fee is whole, it’s indeniable what the newest steadiness is between all events (assuming nodes redundantly retailer their channel checkpoints).

Significantly, one needn’t be immediately hooked up to any other celebration with the intention to pay them — channels can be utilized by means of different nodes within the community with the intention to building up their reachability. In different phrases, if Alice is hooked up to Bob and Bob is hooked up to Caroline, Alice and Caroline can seamlessly pay every different thru Bob.

Lightning Scalability

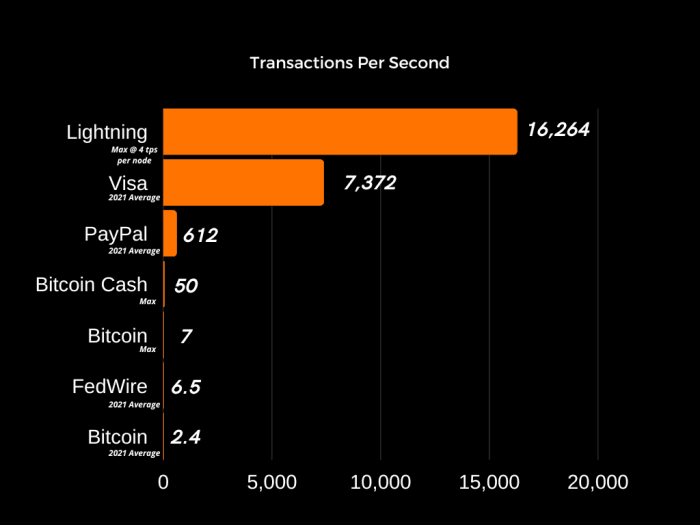

As we will be able to now turn out, the Lightning Community already scales to strengthen 16,264 transactions a moment these days and subsequently solves the scalability drawback whilst conserving the entire advantages Bitcoin has to provide — permissionlessness, shortage, person sovereignty, portability, verifiability, decentralization and censorship resistance.

For a fee to make its means in the course of the community, it most often has to head thru a couple of fee channels. To reply to what number of bills the community can do in a moment, we want to know how many a median channel helps.

Statistics display that the typical fee is going thru round three channels.

The benchmark numbers we will be able to use for this research have per-node throughput capability, no longer per-channel. Subsequently, we will be able to inaccurately think that every node has only one channel. The default LND node is claimed so as to do 33 bills consistent with moment with a good device (eight vCPUs, 32 GB reminiscence) in step with the benchmark.

With 16,266 nodes in the network (as of November 2022), assuming every fee has to head thru 3 channels (4 nodes), the community will have to have the ability to reach round 134,194 bills consistent with moment.

This is, every fee has to head thru a gaggle of 4 nodes, and there are 4,066 such distinctive teams within the community. Assuming every node can do 33 bills a moment, we multiply 4,066 by means of 33 to succeed in 134,194.

Now, to be lifelike: Now not each node is working a device like the only within the benchmark — many are simply running on a Raspberry Pi. Fortunately, it doesn’t take a lot so as to beat the present fee programs.

Lightning Vs. Conventional Bills

Discovering original numbers in regards to the top capability of conventional fee programs is tricky, so we will be able to depend on their moderate fee fee during the 2021 monetary yr. We can evaluate that to the theoretical capability of Lightning, as a result of conversely, getting the typical fee of bills in Lightning is unattainable because of its non-public nature, and may be no longer revealing of capacity since the call for for Lightning bills continues to be quite low. This comparability will give us an concept of what number of bills a Lighting fixtures node must be able to routing with the intention to out-compete conventional finance.

Visa noticed 165 billion payments in 2021, PayPal noticed 19.3 billion payments throughout its entire platform and FedWire noticed 204 million. Respectively, those quantity to 7,372, 612 and six.five bills consistent with moment on moderate for 2021. To position into standpoint, Bitcoin did 2.44 payments per second in 2021 and scales as much as a most of 7 consistent with moment.

The numbers are promising — it takes every Lightning node to be able to doing simply 4 bills a moment with the intention to beat the present fee networks by means of a minimum of two instances. At that fee, 4,066 distinctive four-node teams can reach 16,264 bills consistent with moment — 2.2 instances that of the most important competitor, Visa.

To make issues worse for standard fee networks, the typical Lightning transaction charge is 13 instances much less that of Visa — 0.1% in comparison to 1.29%.

It’s value remembering that one may all the time proceed to scale the Lightning Community by means of developing new nodes. Since it’s peer to look, its scalability is theoretically limitless so long as nodes within the community develop.

Additional, the aforementioned benchmark by means of Bottlepay makes the case that there aren’t any actual technical blockers for Lightning node implementations to ultimately achieve 1,000 bills consistent with moment. At the sort of quantity, the community’s present throughput could be nearer to 4 million consistent with moment, to not point out what it could be with an building up within the selection of nodes.

And finally, it’s value remembering that the Lightning Community continues to be very a lot immature device and has a good quantity of long run optimizations to be accomplished, each within the protocol and its implementations. Assets when it comes to builders are the one temporary constraint to expanding scalability, which has rightfully come moment to extra vital issues like reliability.

To offer a way of the growth there, River Financial recently shared that its fee good fortune fee is 98.7% at a median measurement of $46, which is astonishingly higher than the earliest publicly-available data it could find from 2018, the place $five transactions have been failing 48% of the time.

Conclusion

On this piece, we uncovered all the adverse drawbacks of scaling the Bitcoin blockchain thru expanding the bottom layer’s block measurement, maximum particularly critically compromising its decentralization and in the long run failing to succeed in its intention of attaining the immense scalability wanted for the calls for a world bills community has and can proceed to more and more have one day.

We confirmed that the Lightning Community, as a second-layer answer, maximum elegantly solves the scalability drawback by means of each conserving all of Bitcoin’s advantages whilst on the identical time scaling it means past what any base-layer answers promise.

This can be a visitor publish by means of Stanislav Kozlovski. Critiques expressed are completely their very own and don’t essentially mirror the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)