The under is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top rate markets e-newsletter. To be a few of the first to obtain those insights and different on-chain bitcoin marketplace research instantly in your inbox, subscribe now.

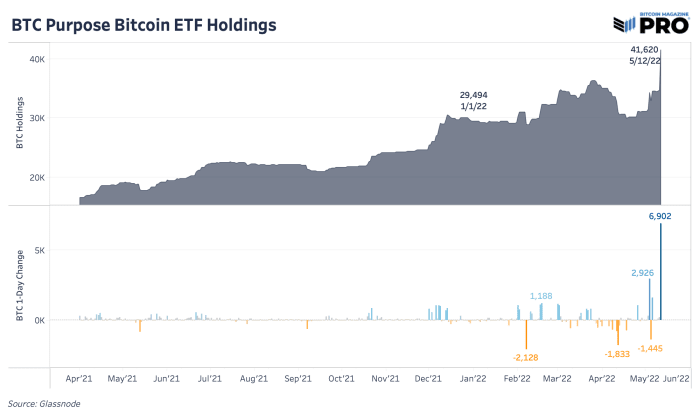

Thursday, Might 12, 2022, was once one of the thrilling and lively days within the bitcoin/crypto marketplace in months, without a scarcity of volatility and worry from marketplace contributors. At the bitcoin aspect of items, the cost plummeted to a low of $25,300 on huge quantity, ahead of temporarily rebounding and shutting the day-to-day candle at $28,900. With the autumn got here a powerful reaction from opportunistic traders taking a look to shop for the dip, as proven via the Canadian Goal Bitcoin ETF, which noticed its greatest day of inflows ever, including 6,902 BTC price just about $207 million.

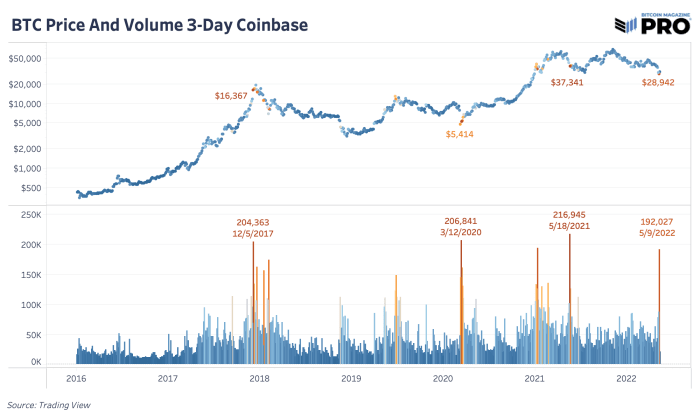

In a similar way, Thursday noticed the most important quantity of bitcoin quantity traded in an afternoon on Coinbase since Might 19, 2021, signaling {that a} important quantity of bitcoin modified arms on america’ maximum dominant spot alternate. Having a look at Coinbase 3-day quantity bars for bitcoin, huge spikes are usually alerts of inflection issues close to native bottoms or tops. Whilst there may be clearly a complete confluence of variables that want to be taken into consideration when searching for absolute marketplace bottoms, a big quantity spike in spot markets and next jump above $30,000 for bitcoin is a promising signal.

This aligns with our macro view that the U.S. financial system is in the middle of a big stagflationary slowdown, which damages asset costs and results in diminishing liquidity in monetary markets because the Federal Reserve tightens financial coverage. As customers proceed to get their wallets squeezed, the slowdown of financial job will compound in a favorable comments loop of diminishing expansion and financial job.

Our core thesis is that this may inevitably result in further fiscal and fiscal stimulus, as the worldwide financial system can’t deal with a sustained financial slowdown because of the mechanics of the debt-based financial gadget we discover ourselves in these days, with a file quantity of debt that must be serviced and refinanced.

Subscribe to get right of entry to the total Bitcoin Mag Professional e-newsletter.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)