Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

Blockchain tools don’t resemble by any means conventional belongings like equities, bonds, actual property, or different money equivalents. Subsequently, comprehending the alternate in marketplace conduct is an issue that can’t be approached the usage of the similar analytical tactics as for normal belongings. We require a brand new form of learn about that condenses knowledge from the open blockchain to supply distinct viewpoints, robust buying and selling ways and place control.

We will now extract massive knowledge units from the general public ledger of every asset due to on-chain research. In spite of the tiny pattern measurement, we’re however in a position to document each earlier on-chain motion. The collection of blockchain knowledge is very important for inspecting investor and marketplace sentiment. Whether or not you’re a seasoned cryptocurrency dealer or no longer, discovering undervalued/overrated cash calls for using simplified knowledge.

This put up will undergo each facet of on-chain research and lend a hand you in getting began with one of the crucial best on-chain sources and analysts to be had nowadays. Let’s get going.

On-Chain Research: What’s it?

On-Chain is a unique research that establishes a macro view of the cryptocurrency marketplace by way of taking into consideration an asset’s ledger and an immutable document of marketplace dynamics. On-chain analysts evaluation provide and insist dynamics, human conduct, purchasing/promoting tendencies, and miner job the usage of this radically clear knowledge.

We might in truth broaden doable viewpoints to realize this open marketplace by way of having a flawless recollection of each transaction, each business, and each timestamp. You don’t want to be a knowledge scientist or programmer to adopt on-chain research; all you want to learn about crypto networks is how they paintings and the way customers have interaction with them.

On-Chain Research’s Previous

Whilst the vast majority of the complex on-chain equipment have been created during the last 3 to 4 years, one of the crucial measures nonetheless in use nowadays date again to 2011. We have been in a position to decide when cash have been destroyed due to the bitcoin valuation metric for indicating the age of bitcoin addresses. The Community Price to Transaction (NVT) ratio, one of the crucial popular measures, used to be created in 2017 by way of Chris Burniske and Jack Tatar.

We will exactly calculate a cryptocurrency’s application worth the usage of the NVT ratio, and it additionally aids in figuring out the blockchain’s transactional application.

We continuously examine the NVT ratio to the price-earnings ratio, which is said to equities and could also be utilized in a identical method to spot firms and cash that build up worth. To beef up the accuracy of this actual statistic, a number of iterations have been carried out. Take the Community Price to Transaction ratio Sign (NVTS), a statistic created by way of taking the 9-day shifting reasonable, as an example.

The latest build up to this statistic used to be made by way of Coinmetrics, one of the crucial largest on-chain equipment within the business, who additionally hired loose flow provide to spice up the ratio.

There are a large number of metrics you’ll make use of to broaden quite a lot of views available on the market, and probably the most of them are in keeping with the theory of UTXOs (Unspent Transaction Outputs). On the other hand, for the reason that account fashions for those networks are tough to control, now we have hassle growing metrics for Ethereum and ERC-20 tokens.

Although the on-chain neighborhood has observed a large number of new traits, no longer a lot has remained the similar. The sphere of blockchain archaeology continues to be in its infancy. Now we have a small selection of specialist roles that may generate distinctive ideas and concepts in addition to analyze and translate microdata into macrometrics.

Highest on-chain metrics you’ll use

No on-chain analyst adheres to any pointers or buildings. To forecast marketplace motion, every dealer makes use of a distinct set of on-chain measures, however nearly all cryptocurrency buyers depend on a small selection of key indications. Right here, we’ve integrated a choice of probably the most insightful on-chain measures that provide a much broader view of the marketplace:

Marketplace cap

An asset’s marketplace capitalization establishes its total community value and aids in our figuring out of alternative elements like adoption, marketplace measurement, and chance. Even though there will not be an immediate correlation, it’s applied to spot quite a lot of community houses. The cost of an asset and its complete circulating provide are merely multiplied to decide the overall community worth.

Learned Capitalization

Because the transaction outputs are most effective valued on the payment at which they have been closing modified, this can be a variation of the unique marketplace cap statistic. The coin’s present value isn’t taken under consideration. All cash which are idle within the community are got rid of when the marketplace is totally capitalized. Any explicit chain’s economics could also be impacted by way of this. If the idle cash have been used, their worth could be restored to marketplace worth, significantly elevating the discovered ceiling.

Levels of the Marketplace & Cyclical Bottoms

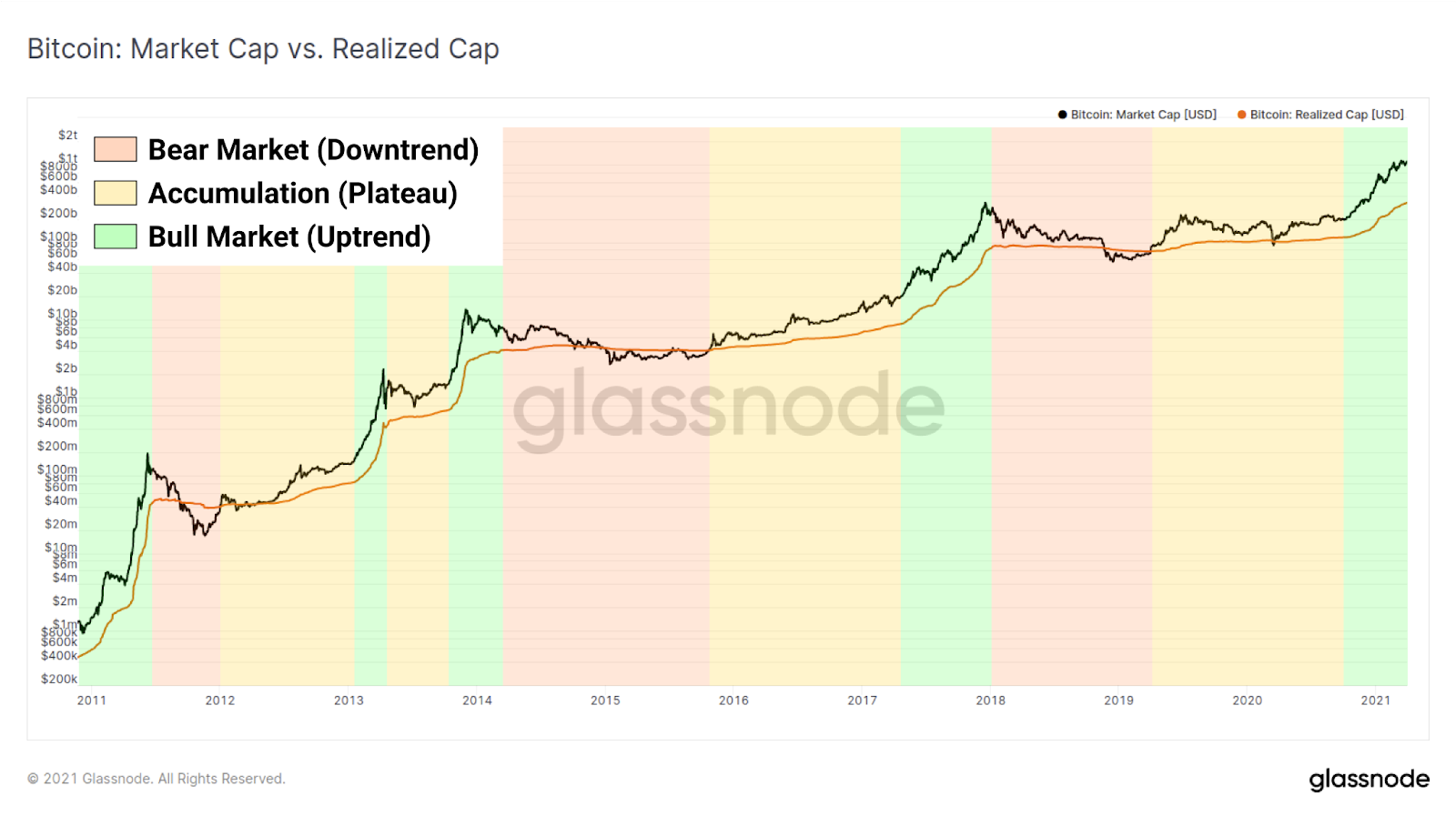

In lots of scenarios, the discovered cap is used to realize marketplace levels and forecast accumulation sessions. In line with discovered cap knowledge, now we have highlighted the next 3 marketplace sessions for you to pay attention to:

Bull Marketplace: The definition of a bull marketplace is unassuming: If the discovered cap helps to keep emerging, the marketplace is claimed to be in a bull section. Technically talking, this implies cash that have been bought for some distance not up to their present value are used.

Undergo Marketplace: Very similar to this, a marketplace is claimed to be in a undergo section if the discovered cap continues to say no. This usually happens when brand-new avid gamers input the marketplace by way of buying cash via off-chain exchanges.

Accumulation Levels: Lengthy-term holders and sensible buyers purchase as many cash as they are able to all through those stages, which in the end serves as strengthen and illustrates an upward development out there cap.

We all know a cycle has bottomed out when the marketplace cap is buying and selling beneath the discovered cap. We noticed that the discovered cap coincided with the undergo marketplace ground in 2011 and once more in 2013. All through the marketplace bottoms and accumulation stages, the discovered cap served as each resistance and strengthen on this example.

Ratio of Marketplace Price to Learned Price

MVRV ratio is an easy statistic used to spot marketplace peaks and troughs. We will inform when a worth is overrated or undervalued in keeping with the ratio of marketplace worth to discovered worth.

The MVRV-Z rating is used to decide an asset’s valuation, and it’s calculated as follows:

MVRV-Z Ranking = Marketplace Cap – Learned Cap

The LTH-MVRH and STH-MVRV complex measures have been created through the use of the unique MVRV ratio. We might evaluation the movements of long-term buyers and momentary buyers, respectively, by way of using those signs.

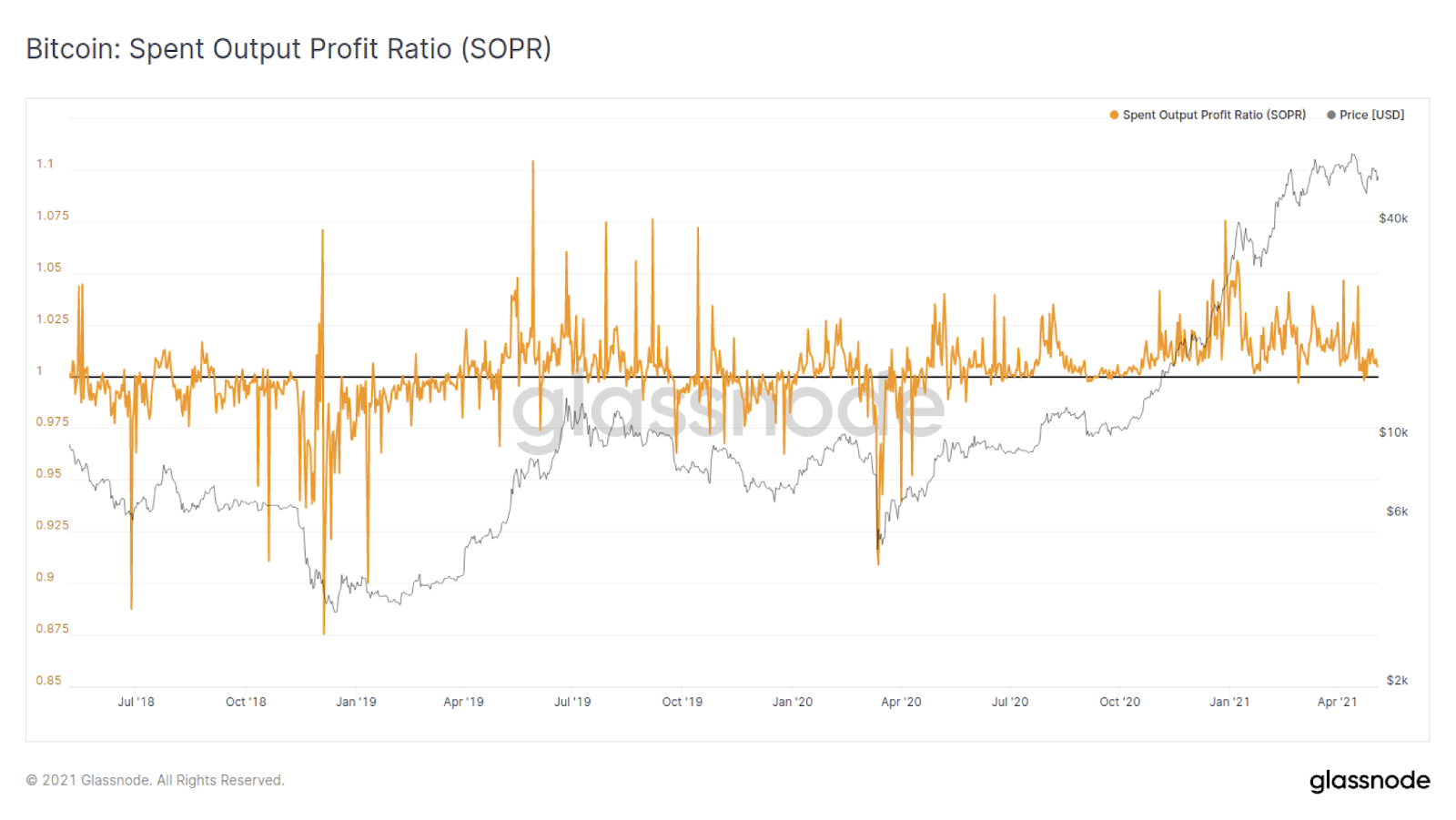

Spent to Output Benefit Ratio (SOPR)

SOPR is without doubt one of the hottest metrics for figuring out macro marketplace sentiment and profitability through the years. The ratio is created by way of evaluating the coin values discovered and nowadays of UTXO era. For any on-chain investigation, SOPR is an important because it clarifies day-to-day and hourly marketplace conduct.

You must take into accout the next patterns and frameworks when the usage of SOPR:

- When SOPR exceeds 1, marketplace individuals earn a living (on reasonable), indicating they’re promoting their items for greater than they paid for them. Conversely, when SOPR is not up to 1, marketplace individuals (on reasonable) enjoy losses, which presentations they’re promoting for not up to they paid.

- Promoting cash at a break-even payment when SOPR reaches precisely 1 (on reasonable).

- Property that constitute an illiquid provide are lately in circulate whilst the SOPR helps to keep emerging.

- When the SOPR helps to keep falling, it’s indicating that cash which are winning don’t seem to be being traded or that marketplace individuals are struggling losses.

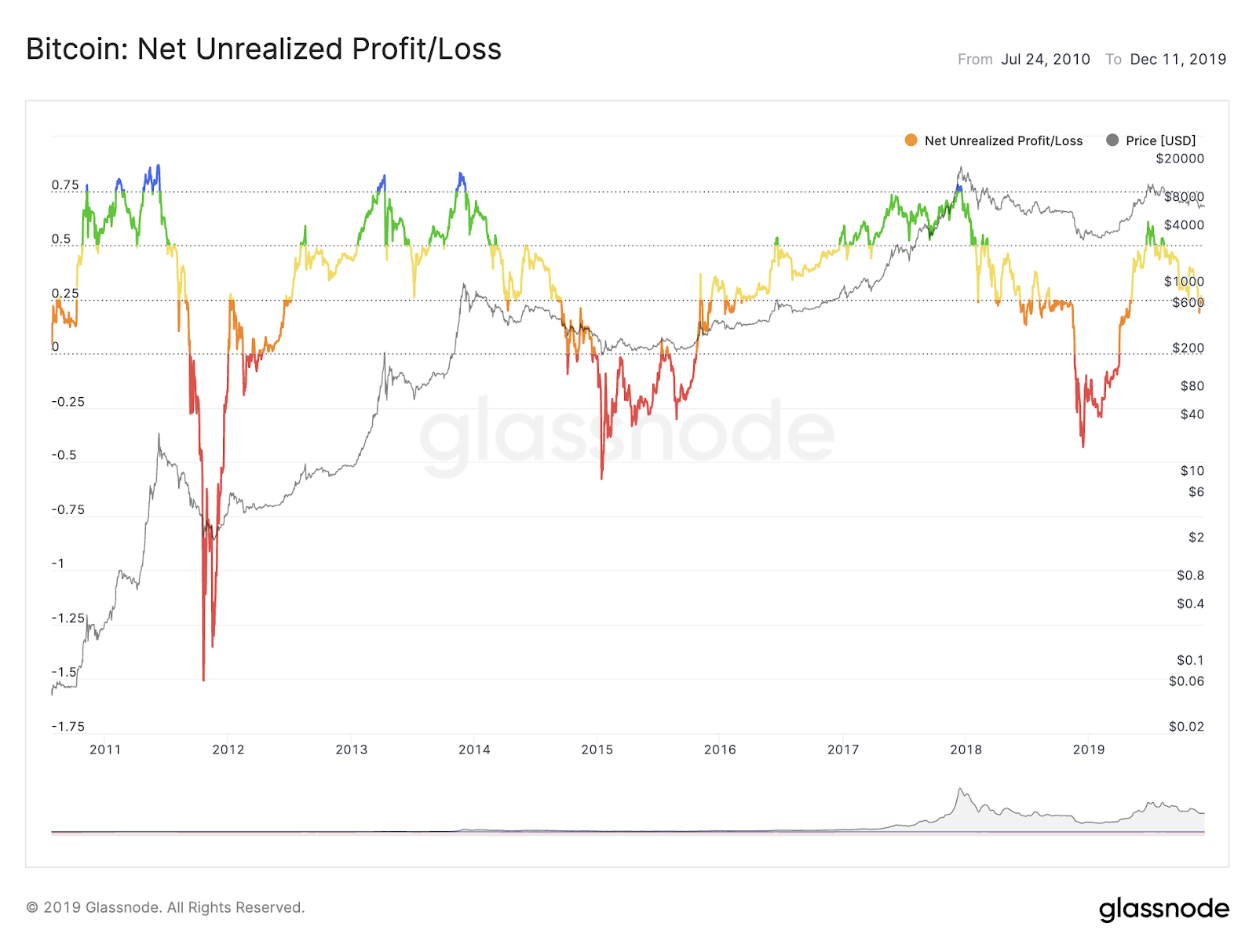

Web unrealized cash in or loss (NUPL)

The NUPL is used to evaluate the community’s situation. We will decide the community’s profitability by way of computing the variation between discovered revenue and losses. The community is in a profit-making state if the NUPL worth is bigger than 0, and it’s in a loss-making situation if the price is decrease. Whilst you input the blue segment, you’ll go out and guide revenue. Whilst you input the crimson area, you’ll go back.

This statistic additionally is available in Unrealized loss, LTH-NUPL, and STH-NUPL bureaucracy. Those can be utilized to realize a definite marketplace area of interest or to concentrate on a definite funding demographic.

Puell Mutiple

By means of contrasting day-to-day coin issuance and the 365-day shifting reasonable of day-to-day coin issuance, the Puell A couple of is created. This indicator is valued by way of many on-chain analysts because it determines miner profitability and source of revenue pressure.

Profitability of Miners

With the intention to pay for ongoing running bills, new miners should promote their cash. Established mining operations counteract this sell-pressure by way of maintaining further cash of their treasuries. In consequence, we follow that higher capital is soaking up small miners’ promote strain.

The Puell A couple of will likely be emerging when earnings are discovered and can temporarily surpass the once a year reasonable. We concluded from inspecting ancient knowledge that values more than 4.Zero point out marketplace tops.

Marketplace Bottoms

Puell A couple of is used to evaluate mining actions and decide marketplace bottoms. It is vitally tough for miners to show a cash in and pay for overhead all the way through a chronic undergo marketplace. By means of turning off their {hardware}, the marketplace stipulations pressure them off the community. The fundamental purpose of that is to eat much less energy. They’re going to promote fewer cash and lift their proportion of the income in massive mining communities. Mining profitability has reduced by way of 50% all the way through the previous few cycles, and at the moment, the Puell A couple of used to be not up to 0.5. It’s now measured to be not up to 1.0.

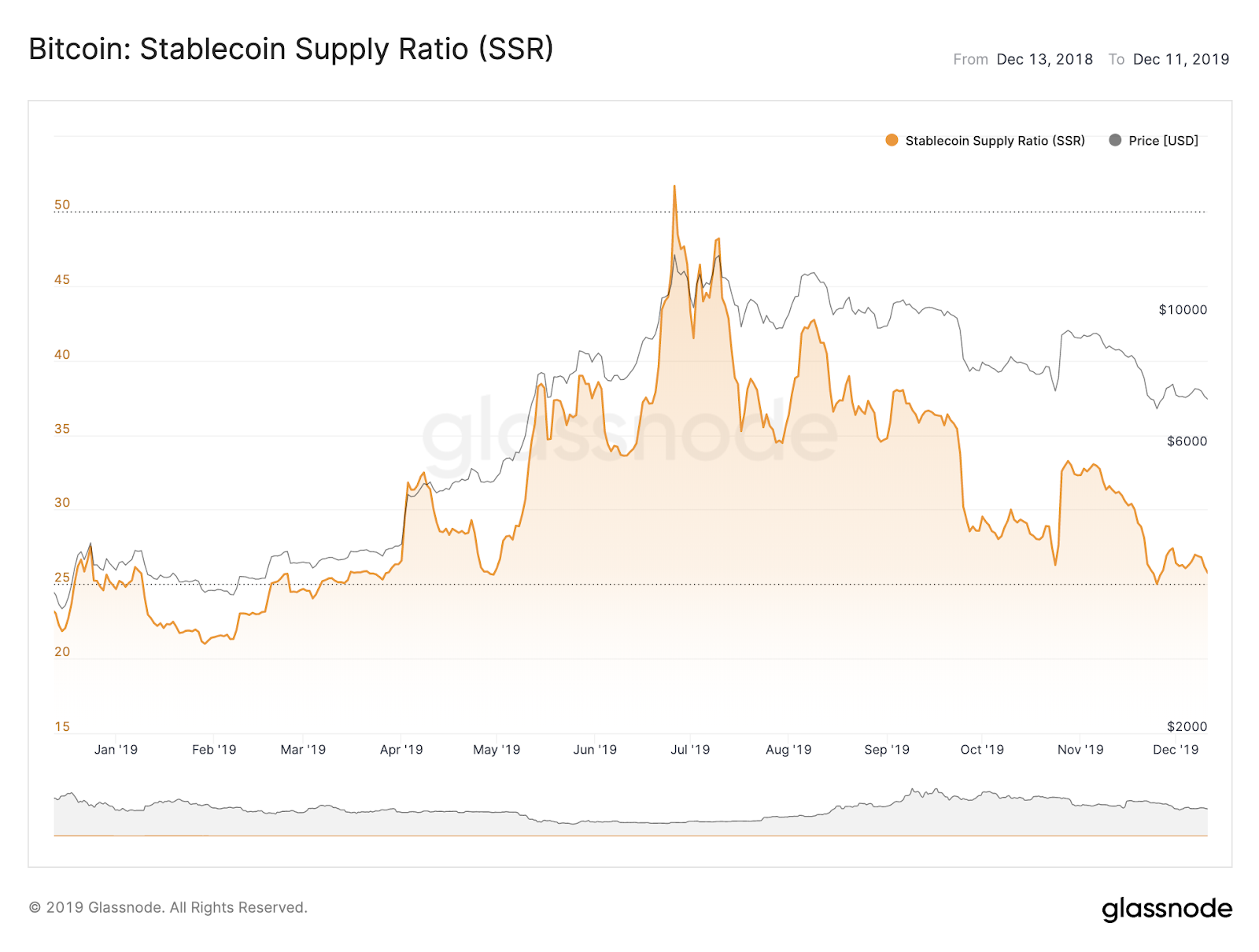

Stablecoin Provide Ratio (SSR)

The stablecoin provide ratio turns out to be useful for figuring out how a lot BTC is value. SSR ranges beneath a definite threshold point out larger purchasing. Merely mentioned, it serves as a stand-in for the dynamics between BTC and USD.

Community Enlargement

Even though community enlargement is an easy statistic to calculate, it supplies a extra complete view of the marketplace. It’s used to identify belongings which are gaining or dropping traction and represents the adoption of cryptocurrencies through the years.

Ethernet community enlargement

Bitcoin Correlation

This measure is most commonly visual on intotheblock. The Correlation to the BTC indicator allows us to guage how quite a lot of belongings are impacted by way of adjustments in bitcoin’s payment. We will see the statistical hyperlink between two variables the usage of this metric. It’s not directly proportional to bitcoin whether it is smaller than one. We see a good hyperlink if the quantity is closer to 1. Correlation to BTC aids buyers in lowering chance. When the cost of BTC plunges sharply, we will take the suitable movements to restrict losses to belongings related to it.

Highest Five On-Chain Equipment

You’ll experiment with the numerous on-chain equipment which are lately out there now that you’ve got a elementary figuring out of on-chain research and the metrics used to guage the marketplace. The highest 5 on-chain equipment are given beneath:

Glassnode

Some of the best on-chain knowledge and intelligence answers, Glassnode provides a reside knowledge explorer in addition to quite a few analytical metrics for quite a lot of belongings. On glass node insights, they post a weekly factor that provides each a qualitative and quantitative review of the marketplace. Moreover, they supply in-depth articles about well known blockchains and virtual belongings, which can be helpful to check to be able to comprehend markets the usage of ancient knowledge. At the moment, you’ll open a loose account and acquire get entry to to quite a lot of signs. The complex plan ($39) and the pro plan ($799) are your two funding possible choices.

Santiment

Santiment is an cutting edge on-chain resolution this is out there to each builders and buyers. Builders get get entry to to technical documentation about good judgment, algorithms, and several other different Santiment measures, whilst buyers have get entry to to another set of use instances and tutorials. Moreover, the website online supplies quite a few answers to lend a hand buyers with crypto analytics. For spreadsheet plugins and asking for knowledge batches, you’ll use Sansheets and SanAPI, respectively. Unusually, Santiment introduced SAN tokens as properly to counteract the prevailing payment projections, and so they intend so as to add stalking and burning options.

Coinmetrics

One of the dependable on-chain techniques for knowledge and insights is Coinmetrics. It used to be began in 2017 as an open-source initiative with the purpose of giving public blockchains financial worth. They now be offering quite a few services and products to strengthen their project and imaginative and prescient and lend a hand consumers in making well-informed crypto funding possible choices. The 4 number one services and products supplied by way of Coinmetrics are chance control, indexes, community knowledge, and marketplace knowledge. With the intention to enable you observe knowledge and cryptocurrency values, they actually have a smartphone utility.

Cryptoquant

The use of many measures, together with alternate flows, miner flows, financial institution flows, community knowledge, and marketplace knowledge, Cryptoquant analyzes bitcoin, ethereum, stablecoin, and altcoins as a complete and offers an outline of community state. You’ll make a selection from their 4 plans: elementary, complex, skilled, and top class. Customized notifications are the important thing difference between those systems. Every measure has quite a lot of indicators that buyers might set as much as notify them when it rises or falls out of doors of predetermined obstacles. All metrics are to be had within the loose version, however there aren’t any customized notifications or top class options.

Intotheblock

Intotheblock produces correct studies and provides marketplace perception for the cryptocurrency sector through the use of knowledge science and AI. It provides customers directional payment forecasts, Defi marketplace statistics, and marketplace sentiment research along with blockchain analytical equipment. Any newbie cryptocurrency dealer might simply navigate in the course of the quite a lot of monetary and community knowledge due to the appliance’s user-friendly design.

You must practice those 3 on-chain analysts on Twitter

Relating to sifting via blockchains to search out funding alerts, Willy Woo is one of the greatest within the business. In 2016, he started operating as an on-chain analyst and become desirous about the technological facets of the bitcoin community. He lately writes forecasts each two to a few weeks for his paying subscribers. Willy Woo has an engineering stage with honors and two decades of enjoy as a tech entrepreneur, which make him an expert on on-chain.

Checkmate, one of the crucial outstanding on-chain analysts on Twitter, collaborates with Glass Node to supply newsletters and weekly problems. The entirety you want to learn about on-chain research is roofed in his masterclass, and the best phase is that you just’ll sign up for a neighborhood of like-minded crypto fanatics this is repeatedly increasing.

Will Clemente, a 19-year-old East Carolina College finance primary, provides insights into other on-chain analytics. Each week on his YouTube channel, he and Anthony Pompliano, with whom he works, talk about the state of the marketplace. Will is moderately lively together with his subscriber newsletters and writes for over 27,000 buyers. He assists new buyers in getting a normal figuring out of what transpired day-to-day and weekly and essentially employs Glassnode for his analysis.

In conclusion

On-chain generation would be the basis of finance sooner or later, thus it’s right here to stick and supply marketplace knowledge to crypto buyers international. On-chain continues to be in its infancy, however we will be expecting a ton of developments within the years yet to come. Extra customers will get started the usage of on-chain metrics as an additional device for deal confirmations as extra ancient knowledge is added and saved there. It’s nonetheless steered to make use of the equipment discussed above and have a look at all metrics, despite the fact that you might be new to crypto and on-chain research. As soon as the fundamentals are understood, you’ll delve additional, correlate quite a lot of measures, and broaden your personal standpoint available on the market. You’re going to at all times be at a aggressive benefit over different avid gamers within the bitcoin marketplace in case you do that.

Comparable

Tamadoge – Play to Earn Meme Coin

- Earn TAMA in Battles With Doge Pets

- Capped Provide of two Bn, Token Burn

- Presale Raised $19 Million in Two Months

- Upcoming ICO on LBank, Uniswap

Sign up for Our Telegram channel to stick up-to-the-minute on breaking information protection

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)