The DeFi Pulse Index (DPI) is a blockchain monetary product designed to trace the efficiency of decentralized finance (DeFi) tokens. The protocol lowers the barrier to access for brand new customers and permits skilled customers to realize publicity to DeFi thru a unmarried asset. The DeFi Pulse Index chooses its tokens in step with a DeFi mission’s marketplace cap and re-weights its index at the first day of each month. The index contains blue-chip DeFi governance tokens, masking the key decentralized exchanges, lending protocols, and so forth. Learn on to be informed the whole thing you want to learn about DeFi Pulse Index (DPI) and the way to shop for DeFi Pulse Index on CoinStats in a couple of easy steps. Let’s get began! What Is DeFi Index DPI value on CoinStats Buying and selling within the cryptocurrency business is extremely sophisticated. Investors want to know about explicit cryptocurrencies and learn about all the crypto marketplace developments. That is why DeFi indexes have emerged as a very easy solution to get passive, various publicity to the marketplace. What Is DeFi Pulse Index The DeFi Pulse Index (DPI) used to be the primary non-derivative and non-synthetic index within the DeFi marketplace. DPI is an ERC-20 token that allows customers to realize publicity to a basket of DeFi protocols by way of a unmarried transaction. The DeFi Pulse Index started with 10 of the preferred Ethereum-based DeFi tokens and is weighted relying on every token’s capitalization. The DeFi Pulse Index considers the next components when comparing tokens for inclusion within the index: Tokens will have to have a connection to a DeFi protocol or DApp indexed on DeFi Pulse. Tokens can’t be man made or wrapped.The protocol or product will have to were introduced no less than 180 days sooner than having the ability to qualify to be incorporated within the index.Tokens will have to be regarded as bearer tools.Tokens will have to now not replicate tangible belongings, choices, or futures contracts in the true global.Tokens will have to be indexed at the Ethereum blockchain.Over the following 5 years, the token’s total provide will have to be fairly predictable.No less than 7.5% of the token’s five-year provide will have to be these days circulating.Tokens will have to now not replicate claims to different tokens on blockchains rather then the Ethereum blockchain. Underlying Tokens within the Dpi Index as of April 2022 Rebalance: Maker (MKR), Compound (COMP), Synthetix (SNX), Yearn Finance (YFI), Aave (AAVE), Kyber Community Crystal (KNC), REN (REN), Loopring (LRC), Balancer (BAL), Uniswap (UNI), Sushi (SUSHI), Farm (FARM), Badger DAO (BADGER), Tribe (TRIBE). The place Can You Purchase DeFi Pulse Index (DPI) The DeFi Pulse Index may also be bought on main cryptocurrency exchanges corresponding to eToro and Crypto.com, in addition to decentralized markets corresponding to Uniswap. It is also appropriate with Pillar, Zapper, and Dharma, amongst different DeFi techniques and protocols. DeFi Pulse Index has joined forces with the Set Protocol, which permits the advent, repairs, and buying and selling of “Units,” baskets of ERC-20 tokens representing a portfolio of underlying belongings. Methods to Purchase DeFi Pulse Index On CoinStats Some cryptocurrencies, such because the DeFi Pulse Index, can simplest be bought on decentralized exchanges with every other coin. To shop for DeFi Pulse Index, you will have to first purchase Ethereum (ETH) after which use ETH to shop for DeFi Pulse Index (DPI). You’ll purchase ETH on fashionable cryptocurrency exchanges corresponding to Coinbase, Binance, Bitfinex, Gemini, Bitstamp, Kraken, KuCoin, and so forth., with credit score/debit playing cards or financial institution transfers. Let’s learn to purchase DeFi Pulse Index on CoinStats: Step #1: Attach Your Pockets Cross to the coinstats.app and seek for the DeFi Pulse Index (DPI) Worth within the seek bar. Scroll right down to the “switch” options and fix the pockets the place you retailer the ETH token. DeFi Pulse Index attach pockets Via clicking at the “Attach” button, you’ll see the more than a few pockets choices supported by means of CoinStats. Seek for your pockets and fix it. Attach your pockets to shop for DPI You’ll attach it by means of scanning the QR Code by way of WalletConnect or manually including the Blockchain/Crypto and Pockets deal with on your internet or cell software. Step #2: Make a choice Token After effectively linking your pockets, make a choice the token you need to switch by means of coming into the main points in both cryptocurrencies or USD/EUR. As an example, we’re swapping ETH for DPI or purchasing DeFi Pulse Index (DPI) with ETH. Within the “From” box, make a choice the ETH token out of your pockets, and within the “To” box, make a choice “DPI.” how to shop for DPI Step #3: Click on Switch Click on on Complex Choices to regulate the slippage and gasoline settings. As soon as performed with customizing, scroll right down to the ground of your display and click on at the “Put up Switch” button. After filing the switch request, you’ll be requested to substantiate the switch. Overview the main points displayed in your internet or cell app display, and click on the “Verify” button to start up the switch. Your transaction is now being processed. The velocity of your transaction will range relying at the gasoline settings you select. You’ll hint

The DeFi Pulse Index (DPI) is a blockchain monetary product designed to trace the efficiency of decentralized finance (DeFi) tokens. The protocol lowers the barrier to access for brand new customers and permits skilled customers to realize publicity to DeFi thru a unmarried asset.

The DeFi Pulse Index chooses its tokens in step with a DeFi mission’s marketplace cap and re-weights its index at the first day of each month. The index contains blue-chip DeFi governance tokens, masking the key decentralized exchanges, lending protocols, and so forth.

Learn on to be informed the whole thing you want to learn about DeFi Pulse Index (DPI) and the way to shop for DeFi Pulse Index on CoinStats in a couple of easy steps.

Let’s get began!

What Is DeFi Index

Buying and selling within the cryptocurrency business is extremely sophisticated. Investors want to know about explicit cryptocurrencies and learn about all the crypto marketplace developments.

That is why DeFi indexes have emerged as a very easy solution to get passive, various publicity to the marketplace.

What Is DeFi Pulse Index

The DeFi Pulse Index (DPI) used to be the primary non-derivative and non-synthetic index within the DeFi marketplace. DPI is an ERC-20 token that allows customers to realize publicity to a basket of DeFi protocols by way of a unmarried transaction. The DeFi Pulse Index started with 10 of the preferred Ethereum-based DeFi tokens and is weighted relying on every token’s capitalization.

The DeFi Pulse Index considers the next components when comparing tokens for inclusion within the index:

- Tokens will have to have a connection to a DeFi protocol or DApp indexed on DeFi Pulse.

- Tokens can’t be man made or wrapped.

- The protocol or product will have to were introduced no less than 180 days sooner than having the ability to qualify to be incorporated within the index.

- Tokens will have to be regarded as bearer tools.

- Tokens will have to now not replicate tangible belongings, choices, or futures contracts in the true global.

- Tokens will have to be indexed at the Ethereum blockchain.

- Over the following 5 years, the token’s total provide will have to be fairly predictable.

- No less than 7.5% of the token’s five-year provide will have to be these days circulating.

- Tokens will have to now not replicate claims to different tokens on blockchains rather then the Ethereum blockchain.

Underlying Tokens within the Dpi Index as of April 2022 Rebalance:

Maker (MKR), Compound (COMP), Synthetix (SNX), Yearn Finance (YFI), Aave (AAVE), Kyber Community Crystal (KNC), REN (REN), Loopring (LRC), Balancer (BAL), Uniswap (UNI), Sushi (SUSHI), Farm (FARM), Badger DAO (BADGER), Tribe (TRIBE).

The place Can You Purchase DeFi Pulse Index (DPI)

The DeFi Pulse Index may also be bought on main cryptocurrency exchanges corresponding to eToro and Crypto.com, in addition to decentralized markets corresponding to Uniswap.

It is also appropriate with Pillar, Zapper, and Dharma, amongst different DeFi techniques and protocols.

DeFi Pulse Index has joined forces with the Set Protocol, which permits the advent, repairs, and buying and selling of “Units,” baskets of ERC-20 tokens representing a portfolio of underlying belongings.

Methods to Purchase DeFi Pulse Index On CoinStats

Some cryptocurrencies, such because the DeFi Pulse Index, can simplest be bought on decentralized exchanges with every other coin. To shop for DeFi Pulse Index, you will have to first purchase Ethereum (ETH) after which use ETH to shop for DeFi Pulse Index (DPI).

You’ll purchase ETH on fashionable cryptocurrency exchanges corresponding to Coinbase, Binance, Bitfinex, Gemini, Bitstamp, Kraken, KuCoin, and so forth., with credit score/debit playing cards or financial institution transfers.

Let’s learn to purchase DeFi Pulse Index on CoinStats:

Step #1: Attach Your Pockets

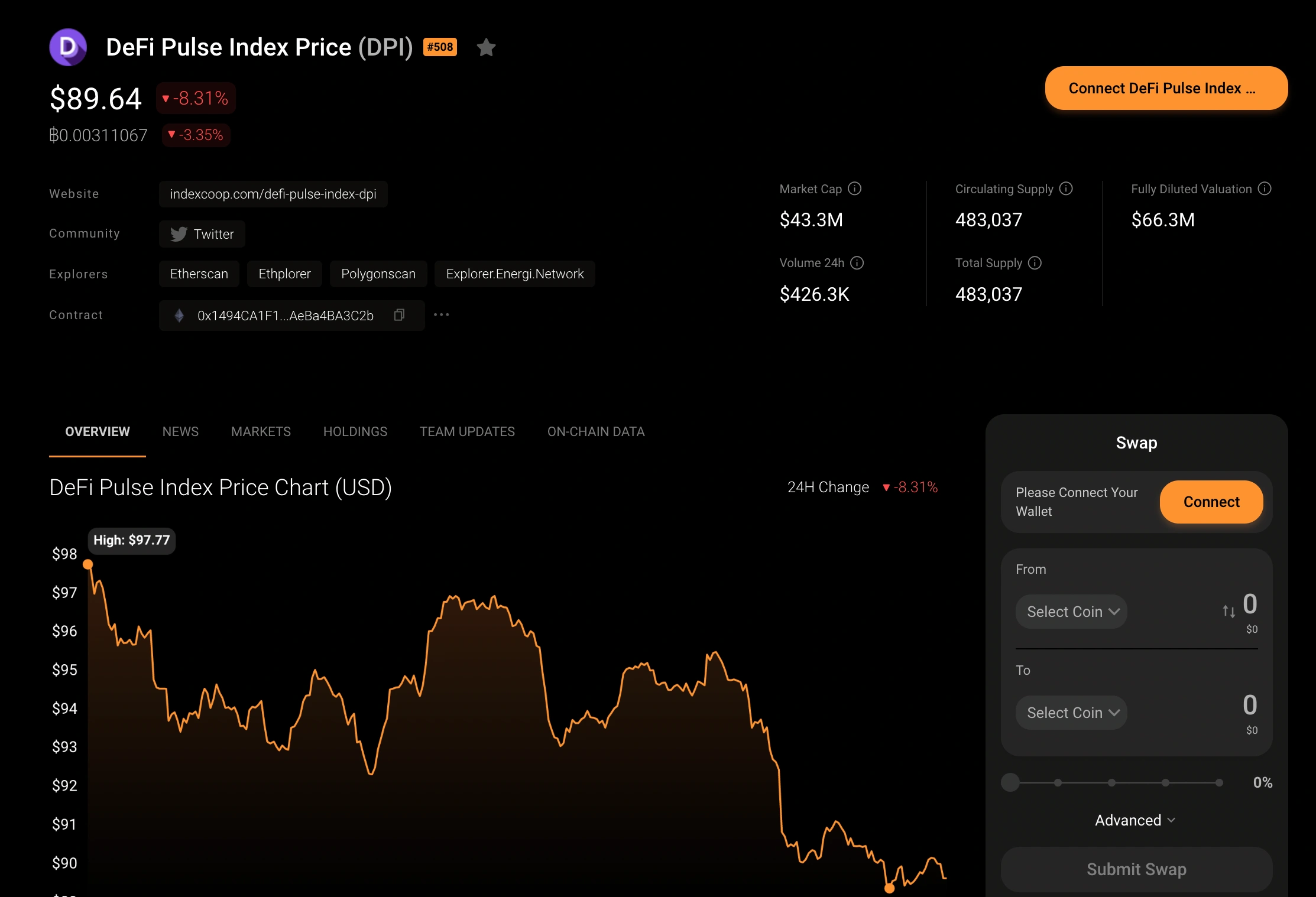

Cross to the coinstats.app and seek for the DeFi Pulse Index (DPI) Price within the seek bar. Scroll right down to the “switch” options and fix the pockets the place you retailer the ETH token.

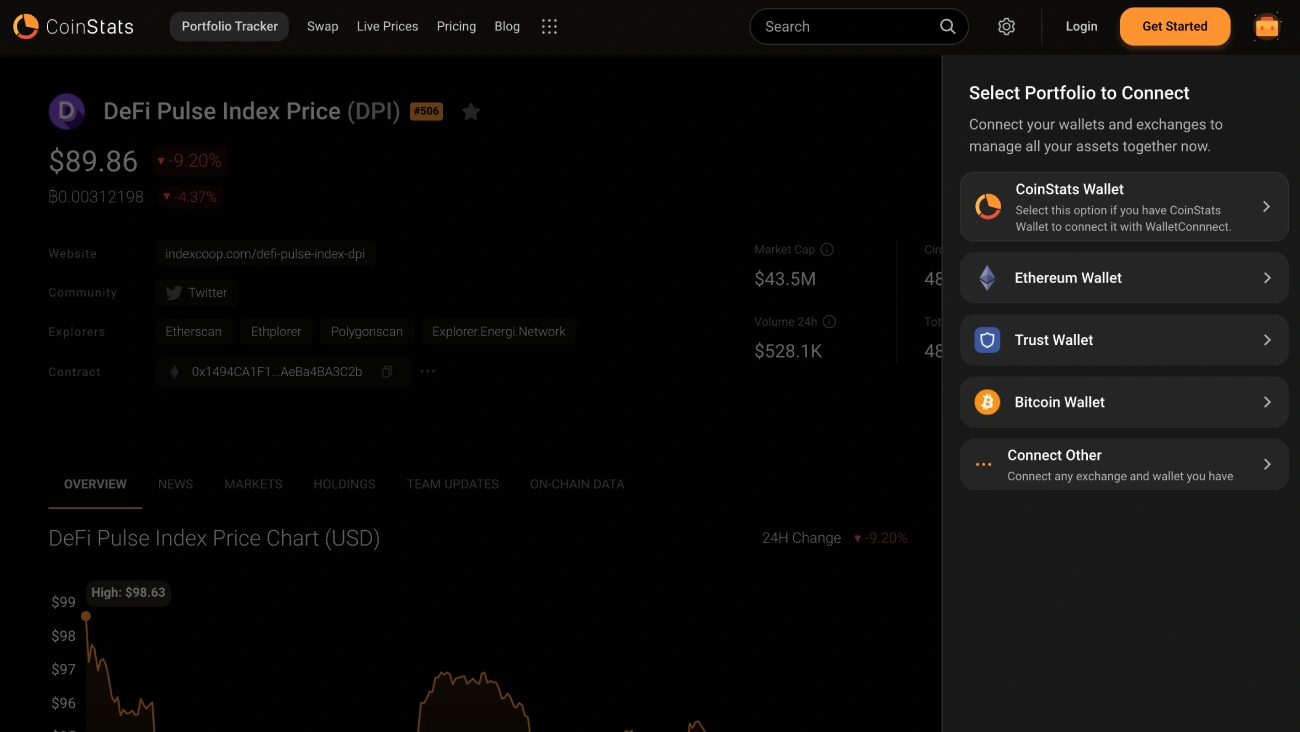

Via clicking at the “Attach” button, you’ll see the more than a few pockets choices supported by means of CoinStats. Seek for your pockets and fix it.

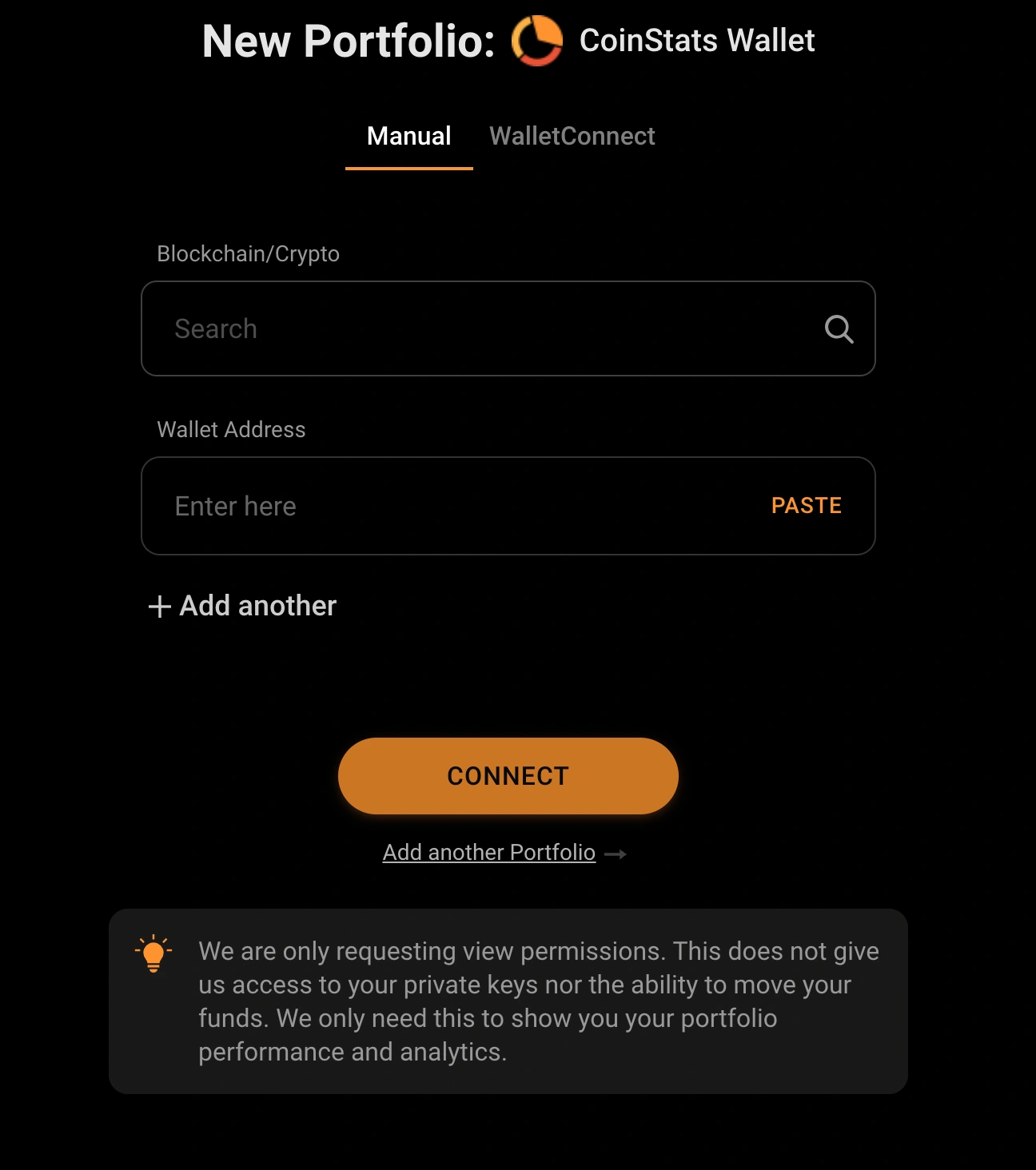

You’ll attach it by means of scanning the QR Code by way of WalletConnect or manually including the Blockchain/Crypto and Pockets deal with on your internet or cell software.

Step #2: Make a choice Token

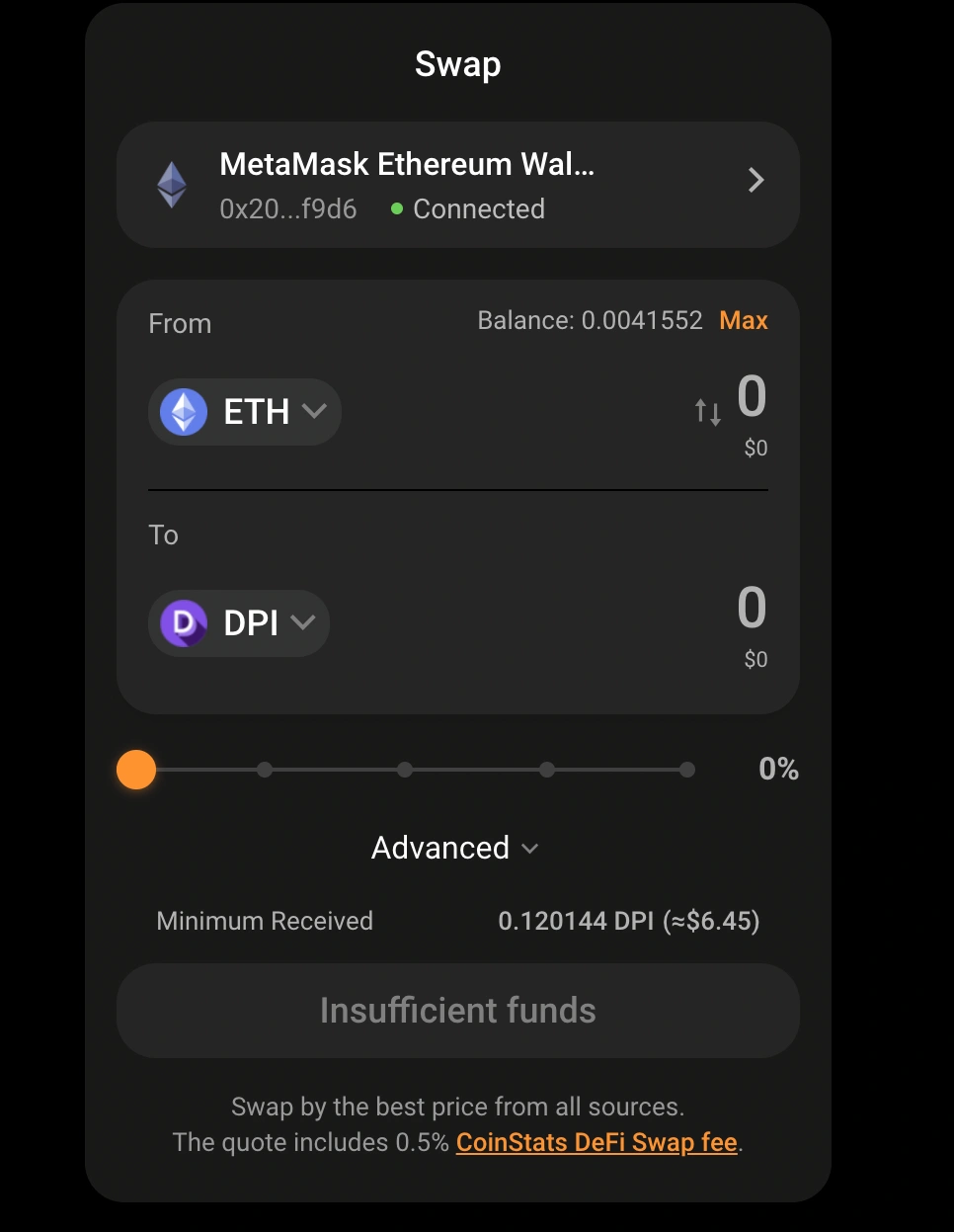

After effectively linking your pockets, make a choice the token you need to switch by means of coming into the main points in both cryptocurrencies or USD/EUR.

As an example, we’re swapping ETH for DPI or purchasing DeFi Pulse Index (DPI) with ETH.

Within the “From” box, make a choice the ETH token out of your pockets, and within the “To” box, make a choice “DPI.”

Step #3: Click on Switch

Click on on Complex Choices to regulate the slippage and gasoline settings. As soon as performed with customizing, scroll right down to the ground of your display and click on at the “Put up Switch” button.

After filing the switch request, you’ll be requested to substantiate the switch. Overview the main points displayed in your internet or cell app display, and click on the “Verify” button to start up the switch.

Your transaction is now being processed. The velocity of your transaction will range relying at the gasoline settings you select. You’ll hint your transaction from the loader on the backside proper nook or the pockets’s house web page.

NOTE: You’ll be charged Community Transaction charges, often referred to as gasoline charges. This refers back to the rate essential to finish a transaction at the blockchain. In essence, gasoline charges are paid within the local forex of the community, i.e., Ethereum for the Ethereum community. CoinStats additionally fees a small switch price along with the gasoline charges.

Step #4: Acquire a Pockets (Not obligatory)

After finishing your Metaverse Index Acquire, opting for a crypto pockets to retailer your cash safely is the next move. Your cash may also be stored on your brokerage change pockets, however we strongly counsel developing a non-public pockets with your individual set of keys. Relying in your funding personal tastes, you’ll select instrument or {hardware} wallets, the latter being a extra safe possibility.

A {hardware} pockets, often referred to as chilly garage, is a bodily tool that retail outlets the non-public keys essential to obtain and transmit cryptocurrency. {Hardware} wallets are ceaselessly considered the most secure solution to retailer your cryptocurrency since they provide offline garage, which decreases the chance of hacks. They’re password-protected and can erase all information after a couple of failed makes an attempt, combating bodily robbery. {Hardware} wallets additionally can help you signal and make sure blockchain transactions, including an additional layer of coverage towards cyber threats.

Ledger wallets are indubitably essentially the most safe {hardware} wallets to be had to customers of all ability ranges. The Ledger Nano X is preferably suited to skilled crypto buyers and will retailer more than a few belongings, together with DPI tokens.

A instrument pockets, however, is essentially the most user-friendly crypto pockets, permitting you to have interaction with a large number of decentralized finance (DeFi) packages right away. Alternatively, instrument wallets are at risk of safety breaches as a result of they’re hosted on-line. If you want to use a instrument pockets, habits due diligence sooner than deciding on one to keep away from safety breaches. As an added layer of coverage, we propose the usage of a platform that helps 2-factor authentication.

What to Search for When Buying DeFi Pulse Index

Novel financial proposition: Patrons of DPI tokens acquire get right of entry to to all the DeFi Pulse Index tokens with no need to possess any of the belongings in my view.

Without delay redeemable: DPI tokens may also be liquidated in change for a number of of the index’s tokens. This means that traders may have a stake in a basket of DeFi currencies through the use of a unmarried token, permitting them to unfold out their general financial chance.

Forged backing staff: Concourse, an impartial crypto neighborhood constructed from skilled virtual forex builders, fans, and lecturers, oversees the management of the DeFi Pulse Index.

Final Ideas

A protracted-term plan is very important when buying and selling in indexes; the DeFi Pulse Index is not the one token of its kind in the marketplace, as different indexes also are continuously rising. DPI’s primary opponents at the moment are the DeFi Best Five Index (DEFI5) and the PieDAI DeFi Huge Cap (DEFI+L).

Alternatively, the survival of indexes like DPI is determined by DeFi and the bigger crypto marketplace, which has just lately witnessed important losses. DPI is these days price $98.96, down 83.8% from its all-time prime of $612.08 in Might final yr. However it is not all unhealthy information; the token remains to be up 71.6% from its low of $57.66 in November 2020.

You’ll additionally discuss with our CoinStats blog to be informed extra about wallets, cryptocurrency exchanges, portfolio trackers, tokens, and so forth., and discover our in-depth purchasing guides on purchasing more than a few cryptocurrencies, corresponding to How to Buy VeChain, What Is DeFi, How to Buy Cryptocurrency, and so forth.

Funding Recommendation Disclaimer: The ideas contained in this site is supplied to you only for informational functions and does now not represent a advice by means of CoinStats to shop for, promote, or grasp any securities, monetary product, or tool discussed within the content material, nor does it represent funding recommendation, monetary recommendation, buying and selling recommendation, or another form of recommendation. Our data is in line with impartial analysis and might vary from what you spot from a monetary establishment or carrier supplier.

Investments are matter to marketplace chance, together with the imaginable lack of important. Cryptocurrency is a extremely risky marketplace and delicate to secondary process, do your impartial analysis, download your individual recommendation, and be certain by no means to take a position extra money than you’ll have the funds for to lose. There are important dangers eager about buying and selling CFDs, shares, and cryptocurrencies. Between 74-89% of retail investor accounts lose cash when buying and selling CFDs. You must believe your instances and procure your recommendation sooner than making any funding. You must additionally check the character of any services or products (together with its prison standing and related regulatory necessities) and seek the advice of the related regulators’ web pages sooner than making any determination.

Source link

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)