That is an opinion editorial by means of Andy LeRoy, the founding father of Exponential Layers which is a Lightning Community analytics platform and explorer.

This gorgeous three bedroom, 1.5 bath house in Charlotte, North Carolina, is a millennial’s dream. Whole with a yard and a porch for playing a espresso, it’s in a chief group simply down the road from a brunch spot with an all-day avocado toast particular. For simply $730,000, it may be all yours.

All of us acknowledge this area is costly. A $4,000 per thirty days fee, even after hanging $150,000 down, would constitute just about 70% of the median U.S. household income, and this area is ready 1.7 occasions upper than the U.S. median home price of $440,000.

Why Is This Area So Pricey?

The home was once inbuilt 1938, and its newest to be had information display its sale historical past, the earliest being for $88,500 in 1987.

This bounce from $88,500 to $730,000 is a 725% building up over 35 years, and displays a compound annual enlargement fee (CAGR) of 6.2%. That’s fairly an building up. Over the similar time the S&P 500 is up 465% at a CAGR of five.1%, so is it actually that gigantic of a bounce compared?

What about gross home product (GDP), the go-to for measuring financial output? GDP is up from $4.7 trillion to $24.eight trillion in nominal phrases, any other triple-digit building up of 427% over 35 years.

So the whole lot is up … it is smart, proper?

Charlotte’s population has grown from 424,000 to two.2 million over this similar period of time — 5% CAGR — and this home is in a perfect group, so provide and insist? Plus our economic system is extra productive, so the upward thrust in value is inevitable?

All of this assessments out on paper, aside from for one metric: calories.

U.S. energy consumption in 1987 was once 21,056 TWh of calories, which adjusted for inhabitants on the time represents about 87,000 kWh according to individual. Of this calories intake, electrical energy utilization was once round 11,500 kWh according to capita.

Evaluate that to lately — the newest figures in 2022 for the US display according to capita calories intake of 76,632 kWh, with a slight building up within the quantity fed on as electrical energy at 12,466 kWh according to individual.

For the entire communicate of “strolling uphill each tactics” in earlier generations, it if truth be told seems that extra calories was once fed on according to capita 35 years in the past within the U.S. than it’s lately.

The Power Breakdown

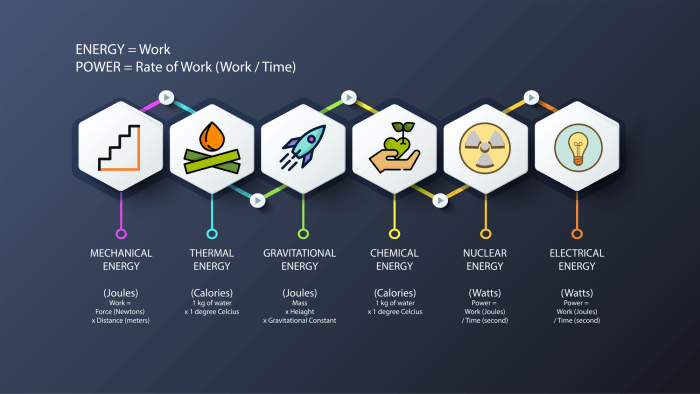

There are a number of forms for a way calories (after which electrical energy) is created.

In case you journey a motorbike at an affordable tempo, you’ll generate 100 watts. Stay this up for 10 hours and you’ll have generated 1 kWh value of calories. A load of laundry accomplished with a washing machine and a dryer will devour round 6 kWh of calories.

If we forget about the financial denomination of housing costs and simply have a look at the U.S. economic system because the output and intake of calories, we now devour much less according to capita than we did in 1987.

As we noticed in USD costs, this actual home is 8 occasions as dear, whilst calories intake according to capita is flat. By way of this good judgment, if it took you one month of using your motorbike for 10 hours an afternoon to generate the calories to shop for the home in 1987, you could possibly now wish to journey your motorbike for 8 months to shop for the similar area. 8 occasions as a lot calories for a similar product? Higher get out that Peloton subscription.

This can be a cherry-picked instance of 1 area in a rising town; it has most certainly been renovated again and again and is value the additional paintings, particularly taking into consideration Charlotte’s inhabitants and process enlargement.

Let’s zoom out and have a look at any other instance.

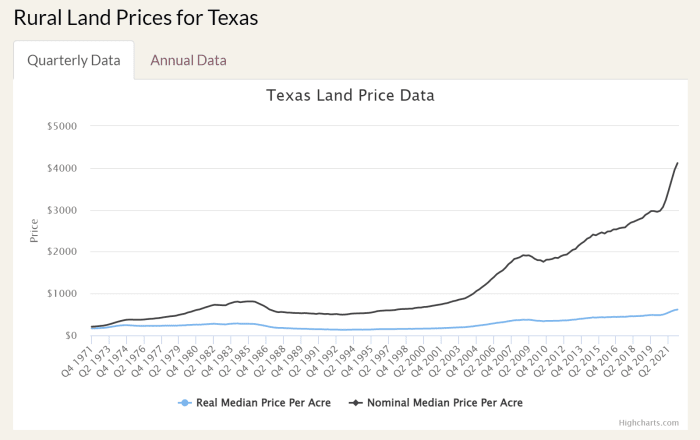

The Texas A&M Actual Property Heart publishes aggregated rural land prices. From their chart, we will be able to see that an acre of land in Texas in 1987 was once $553. That very same land in 2021 is now just about $4,000/acre (an eightfold building up over a 35-year length).

(Source)

An acre of land, without a enhancements, in the midst of nowhere, now calls for 8 occasions as a lot calories output to buy?!

Land can fortify in worth with upper inhabitants, application (farming or searching) or decrease tax charges and/or some roughly backed incentive. However a 362% value building up after adjusting for U.S. population growth? Texas perpetually, however one thing doesn’t upload up right here.

Is Power The Proper Metric?

The speculation of energy-based cash is not anything new. Henry Ford was once an early proponent of calories as foreign money, and as many Bitcoiners and Redditors have identified, he was once additionally a believer in reincarnation (H.F. anyone?). The speculation of a cash denominated in calories phrases, kWh for instance, held nice promise for buying us out of the fiat gadget.

We intuitively acknowledge the concept that of calories. We both paintings longer hours or we focal point efforts or use higher gear to leverage our output, and the abstractions merely move on. The company global is stuffed with interior fee of go back research, useful resource staffing, budgets and timelines. Income stories and fiscal statements be offering the scorecard to the marketplace, which weeds out companies that don’t generate financial worth over the years.

Our gadget of capitalism has labored fairly smartly. Due to the implausible ingenuity, output and paintings of everybody on the earth, and in spite of inflation, such a lot of issues now have lower prices.

In 1956, the ENIAC computer weighed 27 lots, fed on 150 kW, ran about 100,000 operations according to 2d and value the an identical of $6 million lately. Lately, a brand new Macbook weighs 3.5lbs, consumes round 40 watts, and cranks out 3.2 billion operations according to 2d — interested by $2,000.

Airliners have increased their fuel efficiency at a compound fee of one.3% between 1968 and 2014.

In lots of instances, we’re getting a lot more environment friendly with all of our calories intake, so issues will have to be getting much more reasonably priced?

What’s The Drawback?

So as to have a wealthy lifestyles and such a lot of enhancements whilst the use of the similar calories according to capita is a receive advantages to us all, however how that financial worth is measured is at risk of converting laws.

If we’ve got gotten extra environment friendly with our calories and feature higher era, how is it {that a} piece of rural land prices 8 occasions extra? That is the place the Federal Reserve’s increasing cash provide comes into play. For the entire discuss “transitory inflation,” the Fed (with the assistance of banks) has controlled to extend the M2 cash provide by around 680% over the past 35 years.

So whilst our nominal GDP is up 427%, it hasn’t outpaced cash provide enlargement, and we’ve got already observed that calories intake according to capita is flat over 35 years.

The issue here’s what all of us can tangibly really feel: The output of our paintings denominated by means of the calories we installed is value considerably much less over the years.

Once we as people or firms are not able to maintain the efforts of our calories output, we will have to frequently in finding tactics to maintain our buying energy via property like land, commodities and equities. If the tempo at which saved calories degrades is quicker than innovation and output, we’ve got issues. Bodily limits come into play: We will print the entire cash on the earth, however we will be able to’t pretend calories manufacturing and intake.

Sure, our calories is also fed on extra successfully — as evidenced previous by means of the plane requiring 45% much less gasoline for a similar travel — thus offering extra worth to society. If our society has been so environment friendly, why has debt to GDP risen from 47% in 1987 to 123% lately? How is it that we have got had to borrow towards the longer term such a lot in an atmosphere of higher productiveness? Someday this all breaks.

What Breaks?

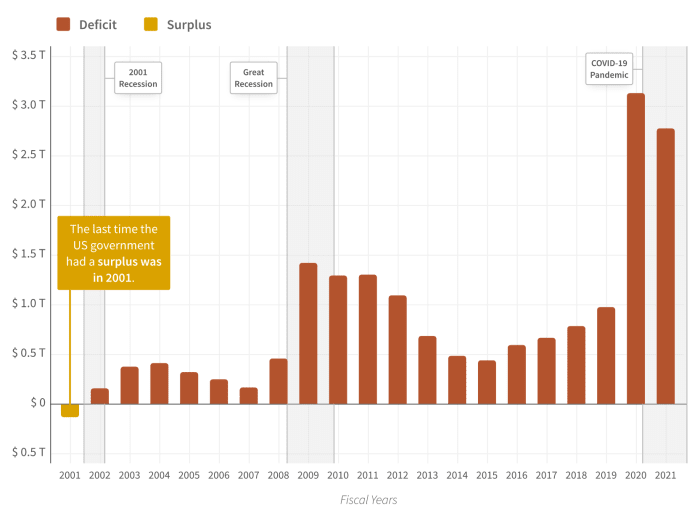

In contrast to with fiat or any proof-of-stake altcoins, you can’t pretend calories introduction. Doing extra paintings previously does no longer magically create new paintings someday. Alternatively, the cover-up in fiat cash printing, blended with each and every U.S. govt management’s propensity to spend, has left us in debt.

(Source)

Supposedly this is fine, as a result of we will be able to all the time print our method out of debt. However are we able to actually?

In 2021, the federal government introduced in $4.05 trillion in income with GDP at $22.Four trillion. It spent $6.82 trillion. The pandemic bills made up $570 billion on peak of different class staples reminiscent of social safety ($1.1 trillion), well being ($797 billion) and protection ($755 billion). Passion paid by means of the federal government was once $352 billion — 5% of general spending (in a virus 12 months).

Through the years, the federal government has spent extra as a percent of GDP — 32% in 1987 in comparison to 55% on the peak of the pandemic — and now to 34% in 2022. Even after taking pictures the price hidden in inflation a lot of these years!

In makes an attempt to quell document inflation (9.1% within the latest report), the Fed hiked rates of interest to two.5% in July; an building up of 75 foundation issues (.75%).

Whilst this will “sluggish” the economic system, it has two unwanted effects on having the ability to steadiness the price range. With a slower economic system, they have got a decrease tax income to attract from. The most recent 0.75% rate of interest building up additionally provides any other roughly $130 billion in passion expense to the cheap that already can’t be balanced. This comes within the type of added expense on debt rollover, and this great article from Allan Sloan walks via an estimated calculation.

The use of his rollover debt totals of about $7.1 trillion, each and every 100 foundation level building up within the federal price range fee that feeds via to marketplace yields on Treasuries provides any other $70 billion to required govt spending. If rates ever get up to a 5% range, that places passion expense (on simply present debt) at someplace just about $500 billion. Greater than transportation, schooling, coaching, employment and social products and services blended.

The Fed too can proceed their makes an attempt for quantitative tightening, however this has the similar downside: upper rates of interest (and passion expense), and a possibly decreased tax base given financial slowdown.

The remaining ultimate choice could be to chop federal spending or building up taxes. With names just like the “Inflation Relief Act,” we already see the federal government making an attempt to masks their higher taxation makes an attempt. Different “hidden” taxation makes an attempt will most probably come: expanding the age at which you’ll be able to start receiving social safety advantages, including further taxes for “rich” other people chickening out from their 401(ok) or IRA, putting in place carbon taxes underneath the guise of “ESG” (environmental, social and governance). Issues will wish to be inventive to offset the competing incentives of a surplus and (re)election.

Someday, this style breaks. We can’t lower calories manufacturing and intake, lower rates of interest to inspire enlargement and run endured deficits. The numbers don’t upload up and in the end no person — people, firms or governments — can pretend the calories output required to stay tempo. Now we have observed quite a lot of debt-ceiling showdowns during the last decade, however this time turns out other, particularly with 25% of the sector dwelling in nations with 10%-plus inflation.

What’s Subsequent?

Cash is only a software for valuing items and products and services over the years — and has key properties. It doesn’t create “yield” on its own. Handiest productive property, which give certain financial worth, can do that. When all of it breaks down, whoever holds the productive property can decide the function of cash, equipped they have got the assets and manner to put in force and protect the foundations.

However, as all of you’re smartly conscious, we after all have an alternate choice. As an alternative of it coming from top-down enforcement, sponsored by means of the army, Bitcoin is followed bottom-up — within the very order that its houses turn out to be really helpful to the folk and firms offering financial worth.

All we would like as millennials is a solution to maintain our paintings, calories and buying energy. And feature a excellent avocado toast whilst we journey our pelotons.

How Bitcoin adoption performs out shall be fascinating and thrilling to observe. Bitcoin is already used international, with a $410 billion market cap, settling some $60 trillion in worth.

Now, with the Lightning Community, Bitcoin will also be despatched peer-to-peer instantaneously, with out a government. July noticed the easiest per thirty days Lightning Network capacity, and each and every metric is up and to the best for offering a fee layer that provides endured application and is helping transparent the medium of change hurdle provide within the Bitcoin gadget.

Defining good fortune metrics depends on an entire host of things, and at Exponential Layers you’ll be able to check out initial Lightning Community metrics that give perception into community enlargement (amongst different knowledge), as Lightning strikes to take the function of Visa’s $10.Four trillion annually fee quantity.

This can be a visitor submit by means of Andy LeRoy. Evaluations expressed are solely their very own and don’t essentially replicate the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)