Bitcoin’s worth is down kind of 70% from its newest all-time excessive, and the mining sector is feeling the overall weight of the continued endure marketplace. Plenty of concern, uncertainty and doubt (FUD) regularly unfold all over the place about miners all over endure markets, however the information about how those operators are affected and behave on this surroundings is modest. This newsletter outlines six key information units that illustrate the results of the endure marketplace on bitcoin miners and their operations.

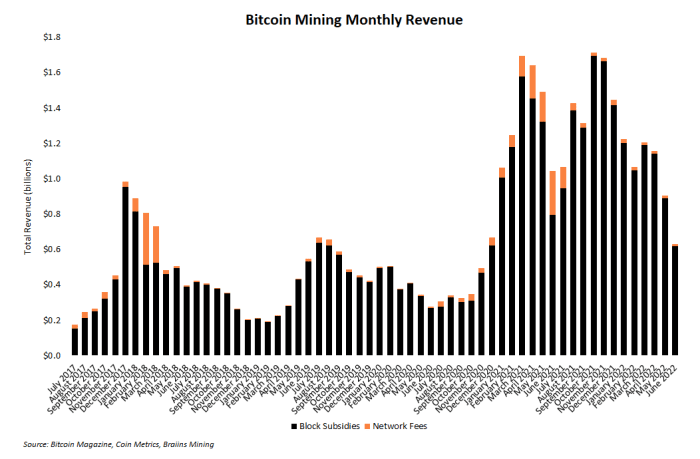

Per thirty days dollar-denominated income is a trademark metric that alerts the state of the mining sector. In bearish marketplace prerequisites, miners be expecting income to drop, and the under bar chart illustrates that is precisely what is going on. Essentially this metric is falling as a result of a less expensive bitcoin worth quoted in greenbacks. Actually, per 30 days mining income in June is ready to report its lowest degree in 18 months. From August 2021 to April 2022, additionally, miners loved a comfy nine-month streak of no less than $1 billion in overall sector-wide income. Would possibly ended that streak, and income continues shedding in June.

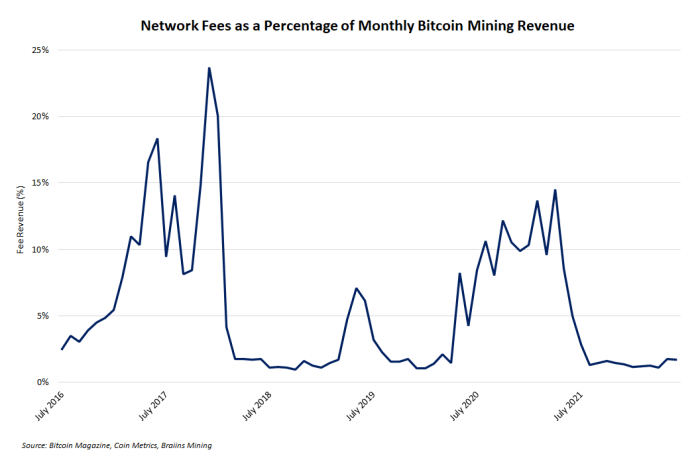

Digging deeper into mining income, transaction charges are crucial (and hotly debated) class of income. Many bitcoin advocates and critics alike argue {that a} sturdy price marketplace is significant for Bitcoin’s long-term luck. And all over bullish marketplace prerequisites, charges normally constitute a significant percentage of per 30 days mining income. However endure markets traditionally obliterate this income movement, and the present marketplace prerequisites are not any exception. From August 2021 to Would possibly 2022, charges represented kind of 10% to 15% of per 30 days income — however since August, that quantity has hovered round 1 %. Actually, since August, charges have no longer represented greater than 2% of per 30 days mining income as proven within the line chart under.

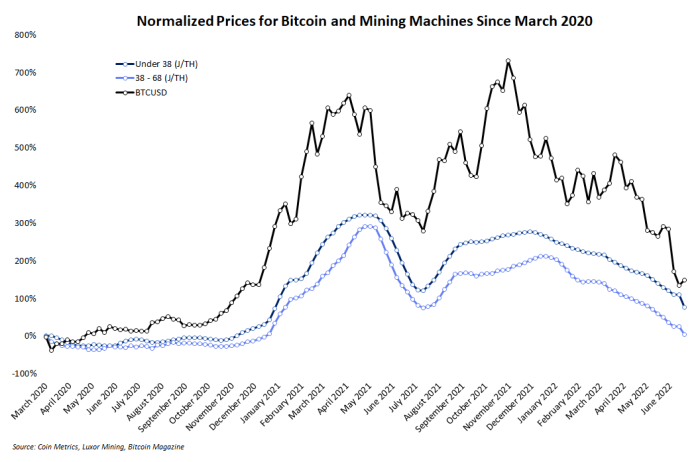

Mining machines have an overly sturdy sure correlation to the cost of bitcoin, and endure markets regularly reason costs for those machines to drop precipitously. There are a number of reasons for this courting, together with repricing in keeping with present income produced according to device and a few fundamental mental components distinctive to the mining sector. Apparently, device costs tend to lag behind bitcoin when the marketplace sells off, and the under line chart illustrates this dynamic. Yr-to-date, costs for mining machines throughout quite a lot of ranges of potency and profitability have dropped through 50% to 60% on the time of writing. If bitcoin’s worth continues to dip, the mining {hardware} marketplace will without a doubt apply.

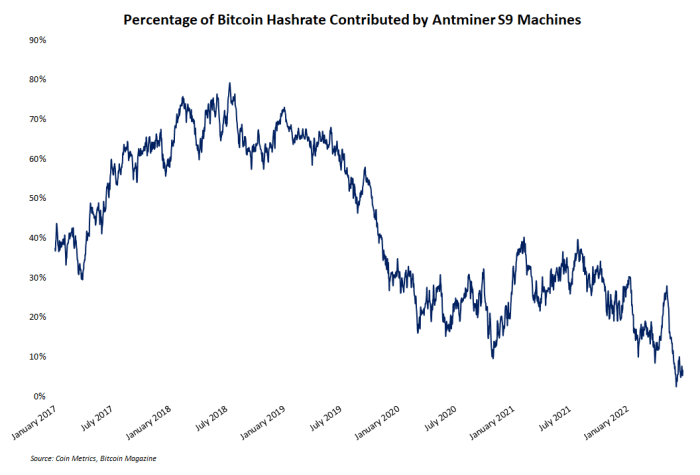

No longer simplest are {hardware} costs shedding, however older machines are being squeezed out of the marketplace altogether as economically rational miners are pressured to energy down less efficient hardware to steer clear of mining bitcoin at a worth upper than the marketplace is keen to pay for it. This impact is maximum obviously observed within the percentage of hash charge contributed through Antminer S9s, an outdated technology of device advanced through Bitmain. In comparison to a 35% percentage of hashrate coming from those machines three hundred and sixty five days in the past, S9s now give a contribution slightly 5% of overall hashrate, consistent with Coin Metrics information proven within the chart under. “At those BTC costs, the S9 as soon as once more looks as if scrap steel,” said Coin Metrics analyst Parker Merritt.

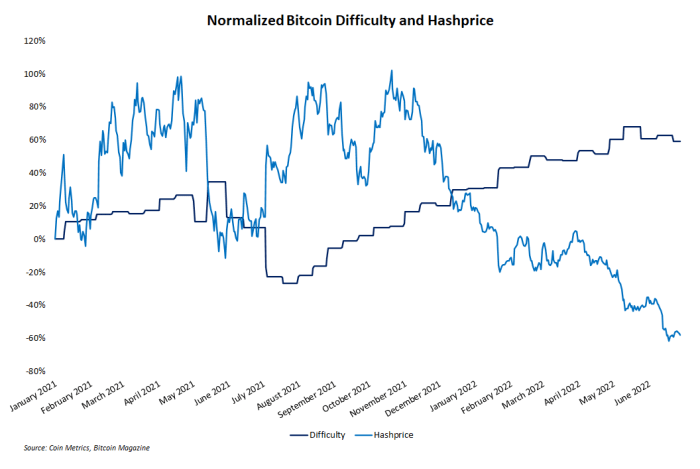

Essentially the most exact metric for monitoring mining income is hash price, which measures the dollar-denominated income according to unit of hashing energy energized according to 2nd according to day. This metric regularly fluctuates impartial of worth, and it will probably cross down even if the cost of bitcoin is going up. The chart under displays expansion in mining problem and plummeting hash worth since early 2022. Actually, past due June noticed hash worth drop under $0.10 for the primary time since past due October 2020. But every other symptom of bearish marketplace prerequisites making lifestyles harder and no more successful within the mining sector.

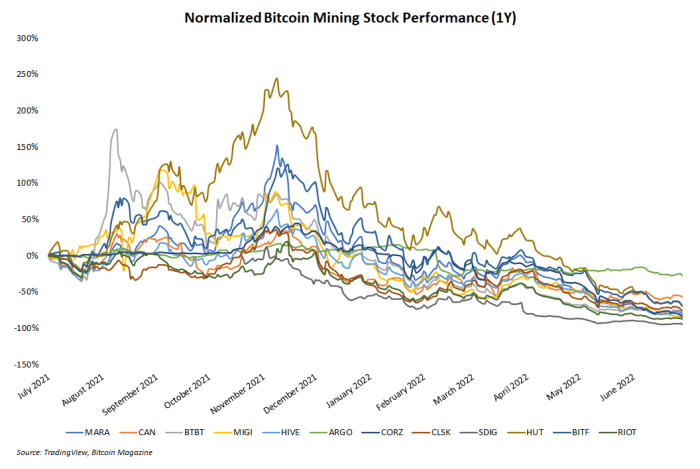

Collapsing percentage costs for publicly traded mining corporations is almost certainly the most powerful sign of present marketplace prerequisites. For all of the causes discussed above, maximum mining corporations are preserving considerably devalued bodily mining property, working with tightening benefit margins and incomes a miles less expensive virtual asset as bitcoin’s worth drops. However mining shares additionally generally tend to behave as a high-beta play to bitcoin’s worth, so when the bitcoin worth strikes both up or down, costs for stocks of mining corporations enjoy even higher strikes in the similar course.

The road chart under displays the normalized one-year efficiency of a dozen other mining corporations that industry at the Nasdaq. Nearly each and every corporate is down no less than 60% over that length, on the time of writing, with the worst performer — Stronghold Virtual Mining — down 94%. Instances are difficult for bitcoin miners … and their shareholders.

In bearish prerequisites, the bitcoin markets regularly glance to miners to gauge whether or not sentiment is stabilizing or worsening. Miners promoting cash, unplugging machines, or liquidating {hardware} are all indicators that, sure, prerequisites are unhealthy. However in the long run all this knowledge follows the cost of bitcoin as a substitute of affecting the cost of bitcoin. So, when any of the above information units will beef up is an open query — it will depend on when the bitcoin marketplace ranges out or turns bullish. Till then, miners proceed working consistent with their current plans for surviving every other lengthy endure marketplace.

This can be a visitor publish through Zack Voell. Evaluations expressed are completely their very own and don’t essentially mirror the ones of BTC Inc or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)