Identical to the crypto marketplace, the recognition within the DeFi marketplace has exploded during the last few years, prompting a number of new entrants.

In keeping with DeFi Pulse, the overall price locked in DeFi protocols is greater than $78 billion, representing a tenfold building up since Might 2020. Additionally, the overall price locked in DeFi protocols is over $80 billion already.

Whilst such expansion signifies that traders can dive into the DeFi house in an instant, it additionally method they must be searching for alternatives and make well-informed purchases when the marketplace is down, and industry when it’s doing properly.

Within the final seven days, then again, Defi’s worth has dropped through 26.61 p.c. Within the final 24 hours by myself, the fee has dropped through 31.43 p.c. This turns out like an opportune time to put money into DeFi, despite the fact that you must additionally have in mind of the most productive belongings to position your stakes in.

Listed here are the 10 Most sensible DeFi cash as of late that you just must find out about.

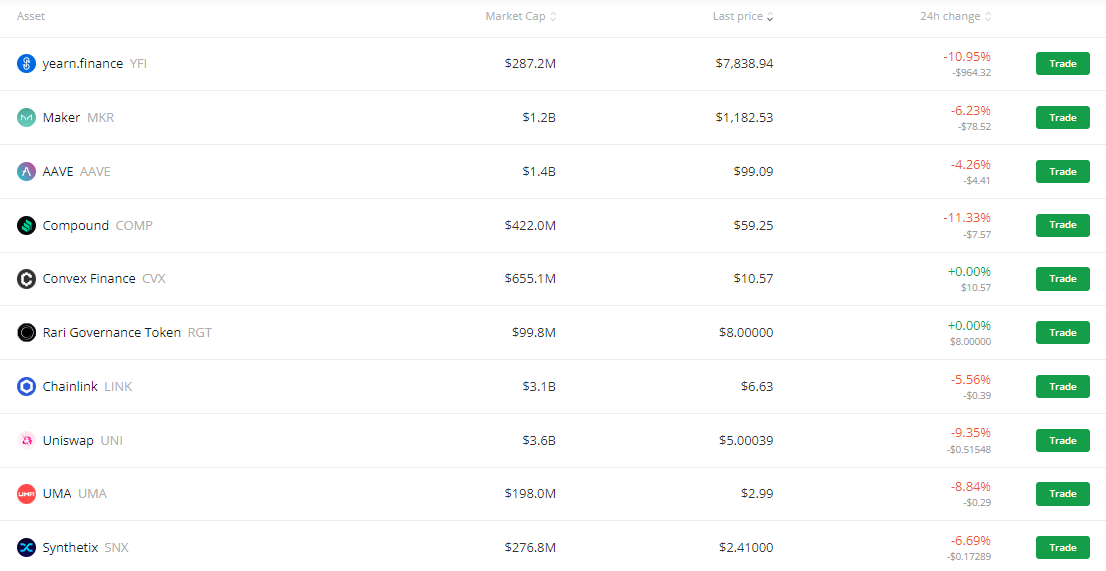

Most sensible 10 DeFi Cash As of late

1. yearn.finance (YFI)

yearn.finance is a number of Ethereum blockchain protocols that allow customers to maximise their profits on crypto belongings via lending and buying and selling products and services.

yearn.finance, one in all quite a lot of rising decentralized finance (DeFi) initiatives, supplies its products and services fully via code, getting rid of the desire for a monetary middleman comparable to a financial institution or custodian.

To perform this, it has created a device of automatic incentives in response to its YFI cryptocurrency.

The DeFi platform advantages from on “yield farming,” during which customers lock up crypto belongings in a DeFi protocol to earn extra cryptocurrency. The protocols award tokens to customers in response to the collection of belongings they lock in a platform.

The token YFI governs the yearn.finance platform as properly, that means through balloting on proposals, any individual who owns YFI tokens can affect the principles that customers will have to observe when the use of yearn.finance.

The present ground worth of YFI is $8,191.02 with a 24-hour buying and selling quantity of $93,787,968. It has a are living marketplace cap of $300,100,301. The DeFi coin has a circulating provide of 36,638 YFI cash and a most provide of 36,666 YFI cash.

Your capital is in peril.

2. Maker (MKR)

MakerDAO is an Ethereum-based decentralised credit score platform that helps Dai, a USD-pegged stablecoin. Any individual can use Maker to open a Vault, protected collateral like ETH or BAT, and generate Dai as debt towards that collateral.

A balance rate (i.e., incessantly accruing curiosity) is charged on Dai debt and is paid upon compensation of borrowed Dai. That MKR, along side the repaid Dai, is destroyed.

Customers can borrow as much as 66 p.c of the worth in their collateral (150 p.c collateralization ratio).

Vaults that fall underneath that price face a 13 p.c penalty and liquidation (through any individual) to deliver the Vault again into compliance. At the open marketplace, liquidated collateral is offered at a three p.c bargain.

Holders of MKR govern the device through balloting on chance parameters like the steadiness rate degree, as an example. Within the match of a black swan match, MKR holders function the final line of defence.

If the worth of the device’s collateral falls too low too briefly, MKR is minted and offered at the open marketplace to lift extra collateral, diluting MKR holders.

The present Maker worth is $1,211.89, and the 24-hour buying and selling quantity is $109,508,396. With a are living marketplace cap of $1,184,783,670, there are 977,631 MKR cash in stream, with a most provide of one,005,577 MKR cash.

Your capital is in peril.

3. AAVE

Aave is a protocol for decentralised finance (DeFi) that permits other folks to lend and borrow cryptocurrencies and real-world belongings (RWAs).

It was once first of all constructed on best of the Ethereum community, with ERC20 tokens allotted around the community. Aave has since expanded to incorporate Avalanche, Fantom, and Unity.

The protocol itself uses a DAO, or decentralised independent organisation. This is, it’s run and ruled through the individuals who personal and vote with AAVE tokens.

Aave lately has swimming pools for 30 Ethereum-based belongings, together with Tether, DAI, USD Coin, and Gemini greenback stablecoins. Avalanche, Fantom, Unity, and Polygon are some of the different markets.

Aave additionally provides real-world asset swimming pools comparable to genuine property, shipment and freight invoices, and cost advances.

Aave’s present worth is $103.84, with a 24-hour buying and selling quantity of $330,675,209. It has a are living marketplace cap of $1,440,119,074. There are 13,868,191 AAVE cash in stream, with a most provide of 16,000,000 AAVE cash.

Your capital is in peril.

4. Compound (COMP)

Compound is an Ethereum algorithmic cash marketplace protocol that permits customers to earn curiosity or borrow belongings towards collateral.

Any individual can give a contribution belongings to Compound’s liquidity pool and get started incomes incessantly compounding curiosity in an instant. Charges are robotically adjusted in response to provide and insist.

cTokens constitute the underlying interest-earning underlying belongings that function collateral for provided asset balances. Customers can borrow as much as 50% to 75% of the worth in their cTokens, however this is dependent at the high quality of the underlying asset.

Customers too can upload or take away budget each time they would like. That is matter to their debt no longer turning into undercollateralized. Upon liquidation, a 5% bargain on liquidated belongings is equipped as an incentive.

Compound first gave the impression at the mainnet in September 2018 and was once upgraded to v2 in Might 2019. BAT, DAI, SAI, ETH, REP, USDC, WBTC, and ZRX at the moment are supported through the protocol. Compound has passed through auditing and formal verification.

Compound’s worth as of late is $63.06 with a 24-hour buying and selling quantity of $81,314,549. It enjoys a are living marketplace cap of $449,278,559 and a circulating provide of seven,124,109 COMP. The coin’s most provide these days is 10,000,000 COMP cash.

Your capital is in peril.

5. Convex Finance (CVX)

Convex Finance allows Curve.fi liquidity suppliers to earn buying and selling charges and declare greater CRV whilst no longer locking CRV. Liquidity suppliers can get pleasure from greater CRV and liquidity mining rewards with little effort.

Curve LP tokens will also be staked without delay at the Convex Finance website online, which has a user-friendly interface. The platform allows CRV token holders and Curve liquidity suppliers to earn further curiosity and Curve buying and selling charges on their tokens.

Convex Finance’s present worth is $10.08, with a 24-hour buying and selling quantity of $10,062,270. The present marketplace capitalization is $625,714,575. There are 62,078,307 CVX cash in stream, with a most provide of 100,000,000 CVX cash.

Your capital is in peril.

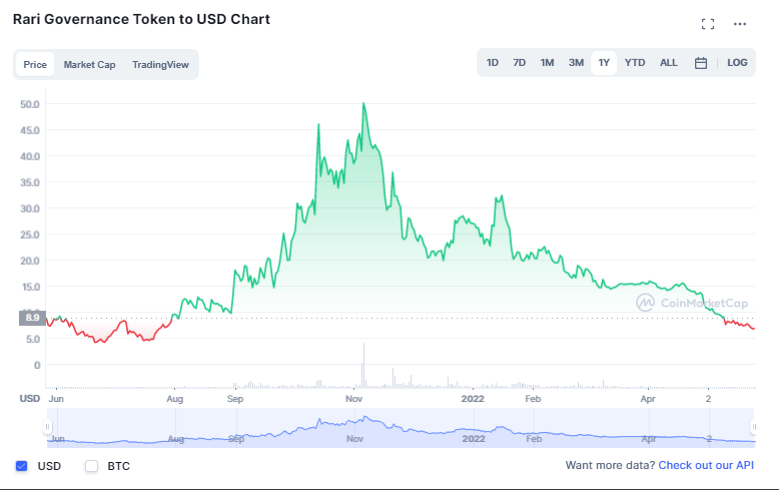

6. Rari Governance Token (RGT)

RGT is an Ethereum token that powers Rari Capital, a decentralised lending and borrowing protocol. The Rari Governance Token is used for rate discounts in addition to protocol governance.

Rari is a platform for decentralised finance (DeFi) that permits customers to lend, borrow, and farm cryptocurrency assets. In keeping with the mission’s weblog, Rari Wealth’s purpose is to create applied sciences that may permit the hundreds to benefit from their idle capital with out requiring person participation.

The important thing promoting level of the DeFi utility is its automated non-custodial fund, which is constructed at the Ethereum blockchain. By way of depending on underlying good contracts, customers can entrust cryptocurrency to the platform.

The pc then searches DeFi programs for the perfect yield-earning alternatives. Portfolios are robotically rebalanced the use of each cryptocurrencies and stablecoins.

The present worth of Rari Governance Token is $6.87, with a 24-hour buying and selling quantity of $258,707. RGT has a are living marketplace cap of $85,700,202, a circulating provide of 12,469,774 RGT cash, and the utmost provide isn’t identified.

Your capital is in peril.

7. Chainlink (LINK)

Chainlink is a decentralised oracle community that gives real-world information to blockchain good contracts. Sensible contracts are pre-specified blockchain agreements that assessment data and execute robotically when positive stipulations are met.

LINK tokens are the virtual asset tokens used to pay for community products and services.

Via oracles, the decentralised community of nodes transfers information and data from off-blockchain resources to on-blockchain good contracts.

This procedure, mixed with further protected {hardware}, removes the reliability problems that might stand up if just a unmarried centralised supply is used.

Contract holders are being requested to make use of LINK to pay Chainlink node operators for his or her efforts. Costs are set through the Chainlink node operator in response to call for for the knowledge and present marketplace.

The are living Chainlink worth as of late is $6.75 with a 24-hour buying and selling quantity of $394,434,686. The coin has a are living marketplace cap of $3,153,790,320 and a circulating provide of 467,009,550 LINK cash. The utmost provide is pegged at 1,000,000,000 LINK cash.

Your capital is in peril.

8. Uniswap (UNI)

Uniswap, which introduced in November 2018, was once one of the most first decentralised finance (or DeFi) programs to realize important traction on Ethereum.

A number of different decentralised exchanges have since introduced (together with Curve, SushiSwap, and Balancer), however Uniswap stays through a ways the most well liked.

Uniswap pioneered the Automatic Marketplace Maker type, during which customers give a contribution Ethereum tokens to Uniswap “liquidity swimming pools” and algorithms set marketplace costs in response to provide and insist (versus order books, which fit bids and asks on a centralised change like Coinbase).

Customers can earn rewards whilst enabling peer-to-peer buying and selling through supplying tokens to Uniswap liquidity swimming pools. Any individual, from anyplace, can give a contribution tokens to liquidity swimming pools, industry tokens, or even create and checklist their very own tokens (by means of Ethereum’s ERC-20 protocol).

Uniswap lately helps loads of tokens, with stablecoins comparable to USDC and Wrapped Bitcoin amongst the most well liked buying and selling pairs (WBTC).

The present Uniswap worth is $5.15, and the 24-hour buying and selling quantity is $211,085,099. It lately has a marketplace capitalization of $3,705,085,925. There are 718,889,312 UNI cash in stream, with a most provide of one,000,000,000 UNI cash.

Your capital is in peril.

9. UMA

UMA is an open-source infrastructure that permits for the deployment and enforcement of man-made belongings on Ethereum. The coin lets in builders to create artificial tokens that monitor the cost of the rest briefly and simply. UMA supplies helpful monetary contracts.

Within the match of a confrontation, beneficial monetary contracts simplest require an on-chain worth feed. Helpful contracts cut back reliance on oracles, making UMA contracts much less prone to cyber-attacks.

UMA’s Helpful contracts come with mechanisms to incentivize individuals who create artificial tokens (referred to as token sponsors) to make sure that their positions are adequately collateralized.

Taking a place involves making a fictitious token that may be repaid to near the location and go back the collateral.

UMA tokens are lately priced at $3.18 with a 24-hour buying and selling quantity of $26,733,816 as of as of late. The coin’s provide marketplace capitalization is at $211,408,386. But even so, it has a circulating provide of 66,420,391 UMA cash and a most provide of 101,172,570 UMA cash.

Your capital is in peril.

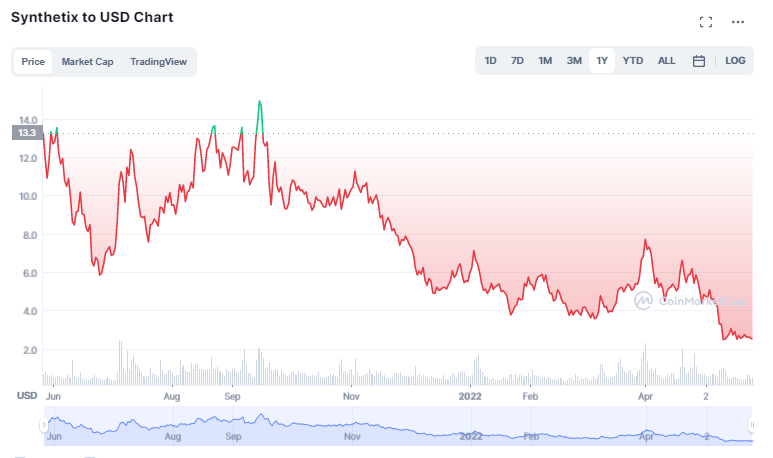

10. Synthetix (SNX)

Synthetix is a DeFi protocol for issuing artificial belongings that monitor and go back on some other asset with out requiring you to carry that asset.

Artificial commodities comparable to gold and silver, artificial cryptocurrencies, artificial inverse cryptocurrencies, artificial cryptocurrency indexes, and artificial fiat currencies are all supported through Synthetix. The platform introduces non-blockchain belongings into the crypto ecosystem, leading to a extra mature monetary marketplace.

The Ethereum-based protocol employs decentralized oracles. Those are good contract-based worth discovery protocols that mean you can monitor the costs of the belongings represented and grasp and change Synths as in the event you in fact owned the underlying belongings.

Synthetix is lately buying and selling at $2.50 with a 24-hour buying and selling quantity of $63,454,036. Synthetix lately has a marketplace capitalization of $287,194,479. It has 114,841,533 circulating SNX cash and a most provide of 212,424,133 circulating SNX cash.

Your capital is in peril.

The place to In finding Most sensible DeFi Cash?

DeFi investments have skyrocketed in recent years as a result of the emergence and recognition of the generation. To put money into DeFi, it’s important to stick to the best DeFi platforms that offer easy and dependable details about their efficiency and predictions. A few of them are indexed underneath.

eToro

As some of the standard Crypto platforms, eToro additionally provides further equipment for researching, buying, and managing DeFi investments.

The “good” DeFiPortfolio on eToro collects decided on crypto belongings from the DeFi revolution, comparable to Ethereum. This portfolio calls for a minimal funding of $500.

Your capital is in peril.

Binance

To put money into DeFi on Binance, first download the important tokens from the Binance Sensible Chain. To buy, you’ll want BNB (BEP20). You then’ll want a pockets with a dapp browser to industry tokens on platforms like Pancake Switch, Venus, Uniswap, and others.

After you have the tokens and the pockets, you’ll input the DeFi ecosystem with self assurance.

Your capital is in peril.

Coinbase

Coinbase is a hub of knowledge and sources with regards to buying the highest DeFi cash. It’s also a well-liked platform for researching upon them intimately.

Your capital is in peril.

Learn extra:

Fortunate Block – Our Really useful Crypto of 2022

- New Crypto Video games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- International Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Indexed on Pancakeswap, LBank

- Unfastened Tickets to Jackpot Prize Attracts for Holders

- Passive Source of revenue Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in Might 2022

Cryptoassets are a extremely unstable unregulated funding product. No UK or EU investor coverage.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)