“If you wish to make an apple pie from scratch, you should first invent the universe.” – Carl Sagan

Some of the first objections that get up for someone who has simply discovered about Bitcoin is “that is too difficult to know.” And it’s true; personal keys, block instances, problem changes, UTXOs, uncensorable CoinJoin transactions, hash-one thing — the educational curve is steep and, for many, the explanations to ascend it appear few and a long way between.

The primary time I used to be offered to Bitcoin in follow (no longer in concept — techno-babbling libertarians had unsuccessfully pitched me the theory for years), the intimidatingly tech-savvy man who did so botched the method.

First, he had me obtain some shady-looking app — which I didn’t have area for on my telephone, and so, sarcastically, I first had to take away a couple of podcasts on financial economics. 2d, he had the app generate some random phrases, and within the absence of pen and paper, had me sort them into my telephone’s (cloud-saved!) note-taking app. 3rd, he attempted to ship me 100,000 sats, however the spotty web on his telephone saved interrupting the method.

Obviously, I wouldn’t transform a satisfied Bitcoiner that night; the hardships of the method gave the impression altogether needless — the treatment worse than the central banking illness it supposedly attempted to resolve.

After he had gotten his shit in combination, and my well mannered endurance having run out a half-dozen instances, he in the end controlled to ship the sats — and triumphantly expressed “See, see! This transaction came about with out any one understanding! And no one may forestall it!”

No longer inspired, I pulled out a $five greenback invoice, passed it to him and paradoxically imitated his triumph: “See, see! That came about with out any one understanding, and no one may forestall us from doing it!”

Bearer assets are not anything new within the historical past of cash and all he had satisfied me of used to be that bitcoin used to be some difficult virtual manner of doing that. But when the tech-raptured can’t easily do it, what hope is there for you and me? And also you’re disintermediating a banking gadget, the aim of which is to successfully and securely make bills, and to make lending and borrowing possible. No one used to be seeking to forestall any one’s bills — what used to be this man on about?

It could be years before I would see the ones troubles of the present fiat fee networks.

What’s Wonderful About Bitcoin Is No longer That It’s Virtual

At the Bitcoin 2021 stage, Alex Gladstein sought after for instance the simplicity of the usage of bitcoin through sending sats in genuine time to Strike’s fundraising marketing campaign for Bitcoin construction. It used to be eerily very similar to the Bitcoin zealot I described above:

Gladstein: “So I’m at the Strike web page, proper right here, and I’m going to head forward and donate, you understand, two greenbacks’ price of bitcoin, to Strike … It will cross … and it’s long gone. That’s a bearer asset that has simply moved right away around the globe. And, I did not ask permission from any one.”

Gladstein succeeded significantly better in illustrating a (Lightning) fee than the fellow who first attempted to ship me bitcoin all the ones years in the past. Naturally, the target audience “woah”-ed and applauded, however the knowledgeable critic may similarly neatly have answered with “Sure, and? Venmo does that too.”

In an episode for the “Bitcoin Mag Podcast,” Mark Maraia defined his way to “onboarding boomers” — that demographic with cash, time and a wholesome concern of presidency overreach, but no longer precisely identified for his or her complex technological technology. “Put out of your mind the entire concept,” Maraia says, pointing to on a regular basis pieces like computer systems or iPhones — do you truthfully know the way they paintings? “I’ve completely no clue,” he says, and provides crucially that “That’s OK!”

His quip is sweet and comforting: no one understands generation X, and that’s tremendous, as a result of we see what generation X does and we will use it. In a similar fashion, in the event you don’t perceive Bitcoin, that’s nonetheless OK.

Excluding that it’s no longer.

Working out what Bitcoin can do for you — its use case — calls for you to know the incumbent financial gadget. In contrast to a telephone, a automotive or a pc, there is not any visual value-add in the usage of bitcoin for a middle-of-the-road Westerner who hasn’t ever been sanctioned, by no means accomplished the rest unlawful, by no means attempted to shop for items or products and services {that a} payment processor or government disapproves of, has their salaries (and financial savings!) listed to inflation, don’t perceive why recessions occur and (on a central authority payroll a minimum of) don’t be afflicted by them, or what central banks do or the place cash comes from.

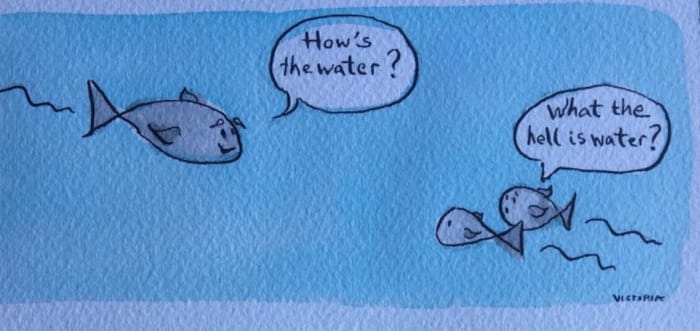

I don’t wish to perceive any of the underlying tech in a telephone to look how I would possibly use it and the way it will lend a hand my lifestyles. Against this, Bitcoin’s value-add is tied up with its “compared-to-what” selection within the incumbent financial gadget that 99% people by no means take into accounts, by no means purpose us any payment-related troubles and we as a result pay no consideration to.

(Source)

A Visa card in Apple Pay can “right away” pay for issues midway the world over too. For global transfers, Smart or Revolut or a plethora of fintechs can transfer financial institution cash the world over in seconds.

Tech isn’t the object. Virtual isn’t the value-add.

After all, maximum Bitcoiners know that the Visa-Smart-Apple-Pay analogy is faulty. And my man will have made Saifedean Ammous’ argument that bitcoin has salability throughout area, which my $five invoice lacks. However to know a lot of what units bitcoin aside you want to head neatly into the financial plumbing weeds. What occurs once we make a bank payment? What’s money?

Global transfers or bank-issued Visa playing cards require identity in some way bitcoin doesn’t; they don’t supply ultimate agreement (bills will also be revoked later); financial institution transfers are ceaselessly deferred internet settlements (even though real-time gross agreement bills are rolled out in increasingly central financial institution fee networks). Price range in Venmo or PayPal or different lower layers of the greenback banking gadget are permissioned, within the sense that any of the half-dozen entities required for a fee to achieve success may block it — for blameless technical causes or extra malign keep an eye on/authoritarian causes.

Pondering that an easy Venmo payment is comparable to an on-chain bitcoin switch as a result of they appear and “really feel” the similar, is a fairly basic error to make. They’re each virtual; they each contain “cash,” no matter that suggests; they each permit for switch of price from one position to some other. However to be able to perceive why they’re other, you — just like the Carl Sagan quote above — should first give an explanation for the entire financial gadget: the place it may possibly cross mistaken, what it depends upon, how new cash enters into it, what banks do, which entities have the ability to dam, lengthen, check up on or rate charges for transactions, what you’re risking through passively maintaining a repeatedly depreciating foreign money.

To Gladstein’s credit score, he has an working out of the banking realities of the bottom billion that dwarfs any fee troubles that almost all Westerners have ever encountered. However the moderate nocoiner doesn’t. Which is why we robotically get news articles the place some clever-by-half monetary journalist lumps in combination bitcoin with stablecoins, with non-fungible tokens (NFTs) and central financial institution virtual currencies (CBDCs). Or when the chairman of the Federal Reserve Board says that CBDCs make the desire for bitcoin or stablecoins out of date: they’re the entire similar, truly — new, hip, virtual techniques of storing and shifting what appears to be treasured issues.

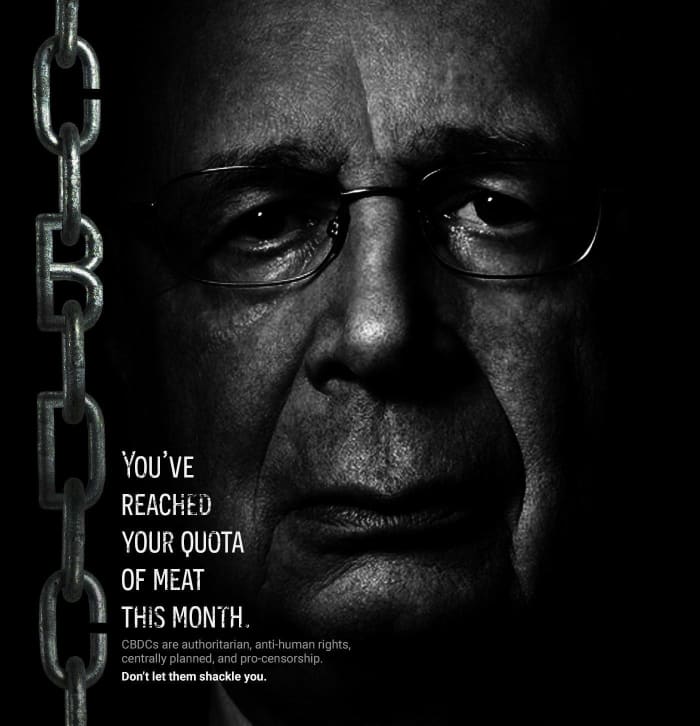

The Fed is right here to lend a hand steward the greenback gadget, so as soon as its personal fancy-sounding technical answer is in position, there may well be no use for private options. And “programmable cash” sounds wonderful — a minimum of till the programming of the not-so-kind programmer stops you from buying what you require.

(Source)

From Gita Gopinath at the IMF, we be informed that the Russia-Ukraine debacle “would additionally spur the adoption of virtual finance, from cryptocurrencies to stablecoins and central financial institution virtual currencies.”

What concerning the war might be able to spur the rest however bitcoin? Finance is already virtual. Fiat financial institution cash is already virtual. The Fed adjusts the financial base, digitally, via purchases and gross sales of belongings by the use of its New York Fed department. The greenback is already discretionary and permissioned, managed, regulated and surveilled. What does a central financial institution virtual foreign money (CBDC) convey to the desk?

If the rest, it could make the politicization of banking-related issues on both sides of the Donetsk battlefield worse, with much more keep an eye on through authoritarians who need to mandate what other folks might or won’t do with “their” cash. You don’t want a blockchain or a token to do 99% of what cryptocurrency initiatives try to do — and those that seem to do one thing helpful, don’t do this higher than Bitcoin.

Past the primary few hours and days, earlier than global transfers may conveniently arrive to Ukraine’s banks in bulk, there used to be not anything that “cryptocurrencies” extensively talking may do for Ukraine; its downside used to be genuine, no longer financial. Assist fleeing refugees smuggle out their financial savings towards a adversarial banking gadget? Positive, bitcoin always excelled at that, however how would a CBDC, issued and ruled through the Nationwide Financial institution of Ukraine fare? Or worse, Ripple, whose CEO proudly stated:

“To transparent any confusion – RippleNet (whilst having the ability to do a lot more than simply messaging a los angeles SWIFT) abides through global legislation and OFAC sanctions. Duration, complete forestall.”

As an alternative of being the permissionless, uncensorable, F-U cash that bitcoin aspires to, its cryptocurrency “competition” proudly uphold censorship and government sanctions:

“RippleNet, as an example, has at all times been – and stays nowadays – dedicated to NOT operating with sanctioned banks or international locations which can be limited counterparties. Ripple and our consumers fortify and put into effect OFAC rules and KYC/AML.”

Complying with authoritarian sanctions is the other of what freedom money does.

I repeat: Tech isn’t the object. Virtual isn’t the value-add.

The price-add of Bitcoin is the freedom and independence that includes maintaining your individual cash outright — unencumbered through a financial institution, a fee processor, a monetary regulator or a tax guy. It’s now not being matter to the whimsical calls for of your authoritarian ruler, democratically-elected or no longer. It’s to now not undergo the asinine penalties of the financial excesses that the greenback’s present stewards have so catastrophically botched.

Bitcoin is freedom cash for a century of liberty. However to in point of fact clutch why this is, you want to look what’s mistaken with the gadget it makes an attempt to overthrow.

Working out how the fiat financial gadget works is prime to working out Bitcoin.

This can be a visitor put up through Joakim Guide. Critiques expressed are solely their very own and don’t essentially mirror the ones of BTC Inc. or Bitcoin Mag.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)