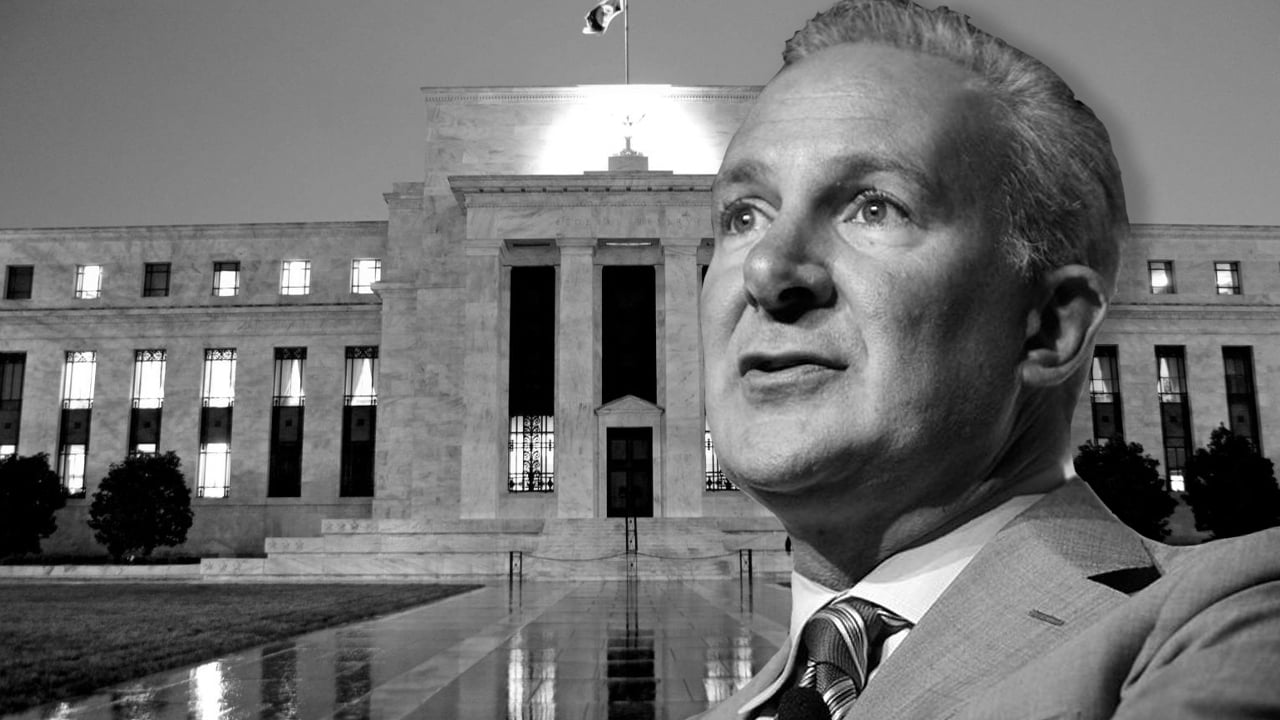

Following the Federal Reserve’s fee hike on Wednesday, economist Peter Schiff has had so much to mention for the reason that U.S. central financial institution raised the benchmark fee through part a share level. Schiff additional believes we’re in a recession and says “it’s going to be a lot worse than the Nice Recession that adopted the 2008 Monetary […]

Following the Federal Reserve’s fee hike on Wednesday, economist Peter Schiff has had so much to mention for the reason that U.S. central financial institution raised the benchmark fee through part a share level. Schiff additional believes we’re in a recession and says “it’s going to be a lot worse than the Nice Recession that adopted the 2008 Monetary Disaster.”

Peter Schiff Says ‘Fed Cant Win a Struggle Towards Inflation With out Inflicting a Recession’

Whilst many analysts had been stunned through the U.S. Federal Reserve’s transfer, because it was once the largest rate hike since 2000, a report through schiffgold.com says the rise was once hardly ever “competitive,” and comparable to a “vulnerable swing that appears extra like shadow boxing.” Additionally, the file explains Powell’s statement this week contained some “refined adjustments,” which recommend there could be “some financial turbulence at the horizon.”

Peter Schiff doesn’t suppose the Fed can beat the present inflationary force The us is coping with lately. “Now not handiest can’t the Fed win a struggle in opposition to inflation with out inflicting a recession, it may’t accomplish that with out inflicting a some distance worse monetary disaster than the only we had in 2008,” Schiff explained on Thursday. “Worse nonetheless, a conflict in opposition to inflation can’t be gained if there are any bailouts or stimulus to ease the ache,” the economist added.

I keep in mind how robust #StockMarket pundits and economists concept the U.S. financial system was once proper sooner than the 2008 Monetary Disaster, although we had been already in The Nice Recession on the time. It wasn’t robust, it was once a bubble about to pop. As of late’s financial system is a fair larger bubble!

— Peter Schiff (@PeterSchiff) May 5, 2022

Schiff’s feedback come the day after the Fed larger the federal price range fee to a few/four to at least one p.c. Following the velocity build up, the inventory marketplace jumped an ideal deal, absolutely recuperating from the prior day’s losses. Then on Thursday, equity markets shuddered, and the Dow Jones Commercial Reasonable had its worst day since 2000. All of the main inventory indexes suffered on Thursday and cryptocurrency markets noticed identical declines.

“If you happen to suppose the inventory marketplace is vulnerable now believe what is going to occur when buyers in spite of everything understand what lies forward,” Schiff tweeted on Thursday afternoon. “There are handiest two chances. The Fed does what it takes to struggle inflation, inflicting a some distance worse monetary disaster than 2008 or the Fed we could inflation run away.” Schiff continued:

The Fed created the 2008 monetary disaster through preserving rates of interest too low. Then it swept its mess beneath a rug of inflation. Now that the inflation chickens it launched are coming house to roost, it should create a fair larger monetary disaster to scrub up a fair larger mess.

Schiff Criticizes Paul Krugman, Fed Tapering Contains Per month Caps

Schiff isn’t the one one who believes inflation can’t be tamed, as many economists and analysts proportion the similar view. The creator of the best-selling ebook Wealthy Dad Deficient Dad, Robert Kiyosaki, lately said hyperinflation and despair are right here. The well known hedge fund supervisor Michael Burry tweeted in April that the “Fed has no goal of preventing inflation.” Whilst criticizing the U.S. central financial institution, Schiff additionally railed in opposition to the American economist and public highbrow, Paul Krugman.

“Again in 2009, [Paul Krugman] foolishly claimed that QE wouldn’t create inflation,” Schiff said. “Surroundings apart that QE is inflation, Krugman upfront took credit score for being proper as he didn’t perceive the lag between inflation and emerging client costs. The CPI is set to blow up upper.” Additionally, schiffgold.com creator Michael Maharrey scoffed on the Fed’s fresh tapering announcement as smartly. Maharrey additional detailed how the Fed plans to cut back the Federal Reserve’s securities holdings over the years.

“So far as the nuts and bolts of stability sheet aid move,” Maharrey mentioned, “the central financial institution will permit as much as $30 billion in U.S. Treasuries and $17.five billion in mortgage-backed securities to roll off the stability sheet in June, July, and August. That totals $45 billion per thirty days. In September, the Fed plans to extend the tempo to $95 billion per thirty days, with the stability sheet dropping $60 billion in Treasuries and $35 billion in mortgage-backed securities.”

What do you consider the hot statement from Peter Schiff regarding the Fed preventing inflation and the velocity hike? Tell us what you consider this topic within the feedback segment underneath.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)