A quant has identified the similarities between the 2017 and 2021 Bitcoin cycles, one thing that would trace at how the remainder of this endure marketplace would possibly play out.

Each 2017 And 2021 Bitcoin Cycles Noticed New Lows Round The 365-Day Mark Since The Best

As defined by way of an analyst in a CryptoQuant post, the 2 cycles are extra identical than one would possibly be expecting them to be.

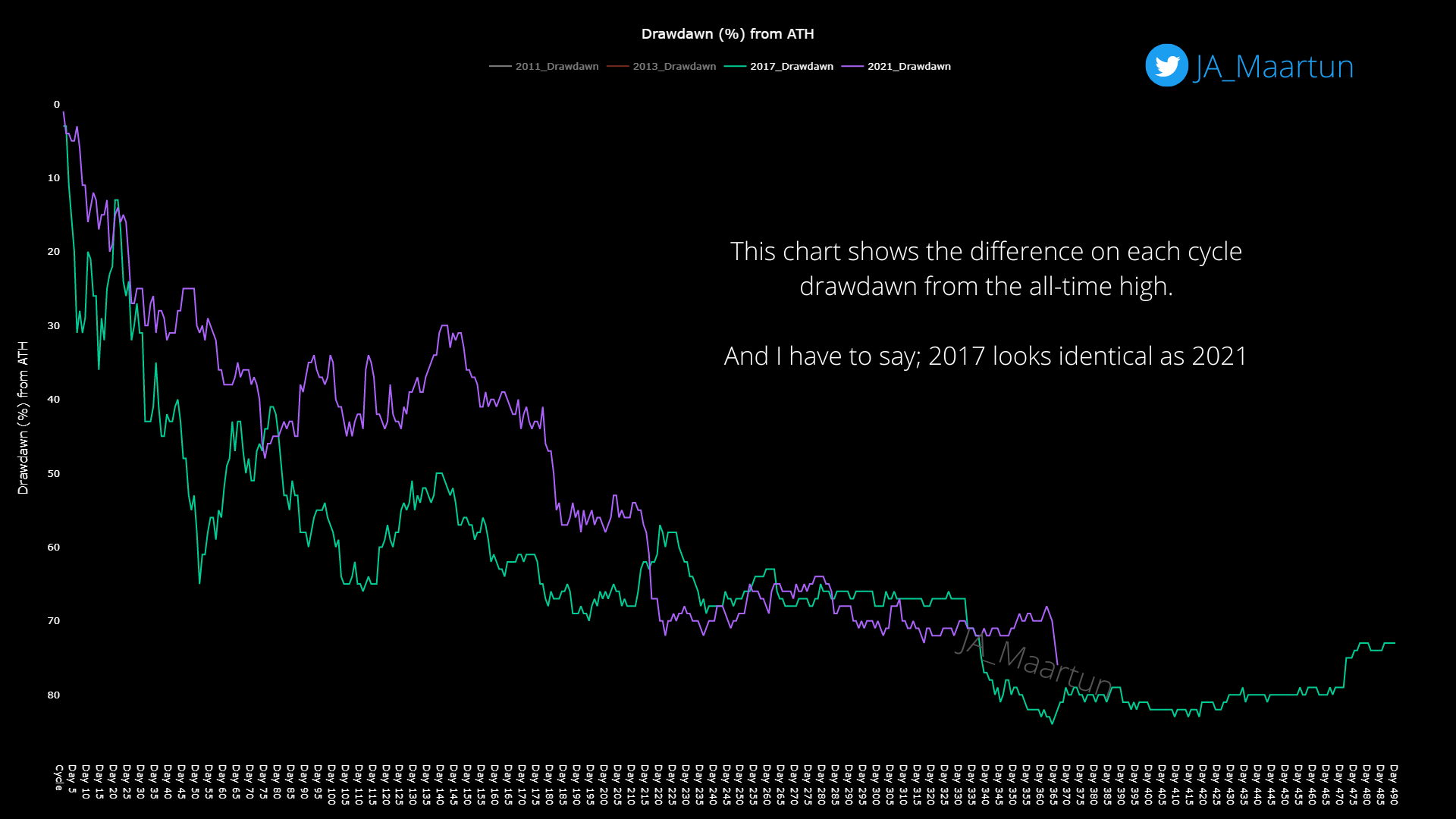

The indicator of relevance here’s the “drawdown from ATH,” which measures the proportion lower in the cost of Bitcoin following the best-ever prime all through every cycle.

Here’s a chart that presentations the fad on this metric for the 2017 and 2021 cycles:

Seems like the present cycle hasn't long gone as deep as the former one but | Supply: CryptoQuant

Within the above graph, the beginning level for the 2017 Bitcoin cycle drawdown is within the December of 2017, when the best-ever prime of the duration was once set.

Following this most sensible, the cost of the crypto took a pointy plunge till round when the drawdown from the ATH had reached a price between 65-70%.

After attaining those drawdown values, the cost began to stabilize, and ran sideways for roughly 110 days.

Then, alternatively, within the November of 2018 the price of Bitcoin collapsed, and saved declining till the ground was once reached round 365 days following the ATH.

As for the present 2021 cycle, the highest shaped ultimate November, and because then the cost has been losing off. The chart presentations the trail this drawdown has taken up to now.

Whilst the decline isn’t precisely the similar within the two cycles, there may be nonetheless a placing similarity between them.

Identical to within the earlier cycle, Bitcoin plunged onerous following the highest, till the drawdown from the ATH hit a price of 70%.

The crypto’s value then consolidated flat very similar to within the earlier cycle, after which at across the 365-day mark, BTC made a brand new low after plunging in a similar way to the November 2018 crash.

Thus far this cycle has resembled the former one, but it surely’s unsure at the present time whether or not it’s going to proceed to take action in the remainder of the endure or no longer.

If it certainly follows a identical pattern from right here on, then the quant believes there would nonetheless be every other 100 days of sideways motion left (through which the cycle backside will probably be shaped) ahead of the top of the endure.

BTC Value

On the time of writing, Bitcoin’s price floats round $16.5k, down 20% within the ultimate week.

The price of the crypto turns out to had been transferring sideways just lately | Supply: BTCUSD on TradingView

Featured symbol from Jonathan Borba on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)