A quant has steered that the rationale at the back of the hot unfavourable Coinbase Top rate may have been because of Tesla’s Bitcoin promoting.

Tesla Dumping 75% Of Its Bitcoin Holdings May Be At the back of Destructive Coinbase Top rate Hole

As defined by means of an analyst in a CryptoQuant post, the scoop about Tesla promoting off 75% of its BTC stash appears to be at the back of the hot unfavourable top rate hole on Coinbase.

The “Coinbase top rate hole” is a hallmark that measures the cost distinction between the Bitcoin listings on crypto exchanges Coinbase and Binance.

Since Coinbase is popularly utilized by US traders (particularly huge institutionals) whilst Binance has a extra world userbase, this indicator can let us know concerning the purchasing or promoting conduct from the US-based holders.

When the worth of the metric is unfavourable, it method the worth of BTC indexed on Coinbase is recently not up to on Binance. This implies there was some promoting happening from American traders.

Similar Studying | Bitcoin Hashrate Downtrend Leads To Largest Negative Difficulty Adjustment In A Year

Then again, the top rate hole’s price being more than 0 implies there may be purchasing taking place on Coinbase a the instant.

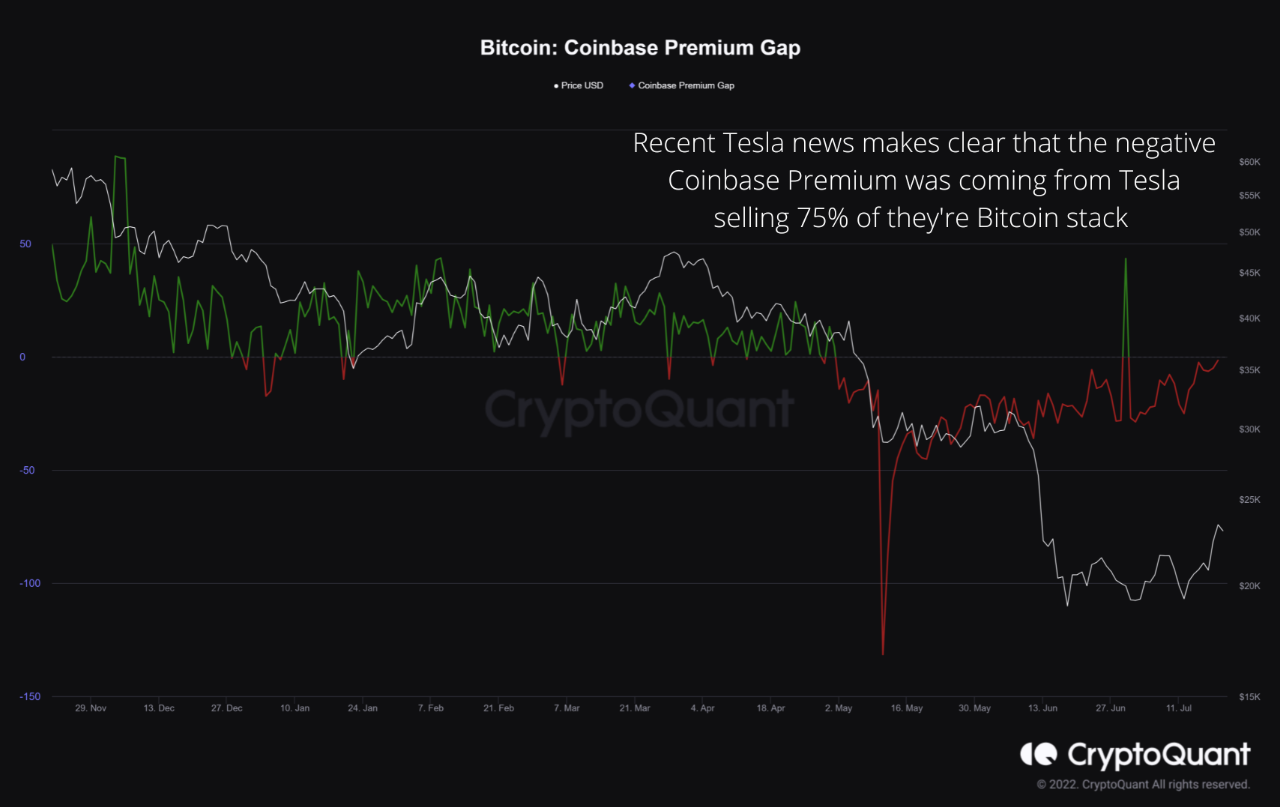

Now, here’s a chart that displays the fashion within the Bitcoin Coinbase top rate hole over the previous couple of months:

The worth of the metric turns out to were purple all over the previous couple of months | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin Coinbase top rate hole has been unfavourable for a just right whilst now, but even so one transient spike to inexperienced values.

The quant notes that this used to be a sign that heavy promoting used to be continuously going on from prime web value traders or institutionals founded in america.

Similar Studying | Uniglo (GLO) Brings Forth Fractionalized Asset Ownership, Overshadowing Bitcoin (BTC), Ethereum (ETH), and Cardano (ADA)

The most recent information about Tesla having dumped 75% of its general BTC holdings makes it obvious that the promoting supply used to be Elon Musk’s corporate.

Additionally, as is visual within the chart, the Coinbase top rate hole has advanced in contemporary days as the promoting force from Tesla has dropped off.

BTC Worth

On the time of writing, Bitcoin’s price floats round $22.6k, up 15% within the final seven days. During the last month, the crypto has won 10% in price.

The under chart displays the fashion in the cost of the coin over the past 5 days.

Seems like the worth of the crypto has proven some decline over the past 24 hours | Supply: BTCUSD on TradingView

A few days again, Bitcoin have been gazing some sharp uptrend, however during the last day the coin has dropped down as a response to the scoop about Tesla’s sell off.

Featured symbol from Shubham Dhage on Unsplash.com, charts from TradingView.com, CryptoQuant.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)