Whilst bitcoin has misplaced greater than 16% in price towards the U.S. buck all the way through the previous 30 days, the cryptocurrency’s marketplace capitalization remains to be the sector’s tenth-largest asset via marketplace valuation. With $603 billion in marketplace price, bitcoin is above Meta’s (officially Fb) capitalization and slightly below Berkshire Hathaway’s general valuation. Regardless of Dropping Over 16% […]

Whilst bitcoin has misplaced greater than 16% in price towards the U.S. buck all the way through the previous 30 days, the cryptocurrency’s marketplace capitalization remains to be the sector’s tenth-largest asset via marketplace valuation. With $603 billion in marketplace price, bitcoin is above Meta’s (officially Fb) capitalization and slightly below Berkshire Hathaway’s general valuation.

Regardless of Dropping Over 16% in a Month, Bitcoin Is Nonetheless the 10th Maximum Precious Asset International

The main crypto asset bitcoin (BTC) has had a coarse few weeks in the case of marketplace costs losing. A month in the past these days, BTC used to be 16.4% upper in USD price as the new inventory marketplace carnage and the Terra LUNA and UST fiasco contributed to bitcoin’s losses. Then again, in the case of marketplace dominance, BTC’s marketplace capitalization amongst greater than 13,000 cryptocurrencies is now over 44% of the $1.36 trillion crypto economic system.

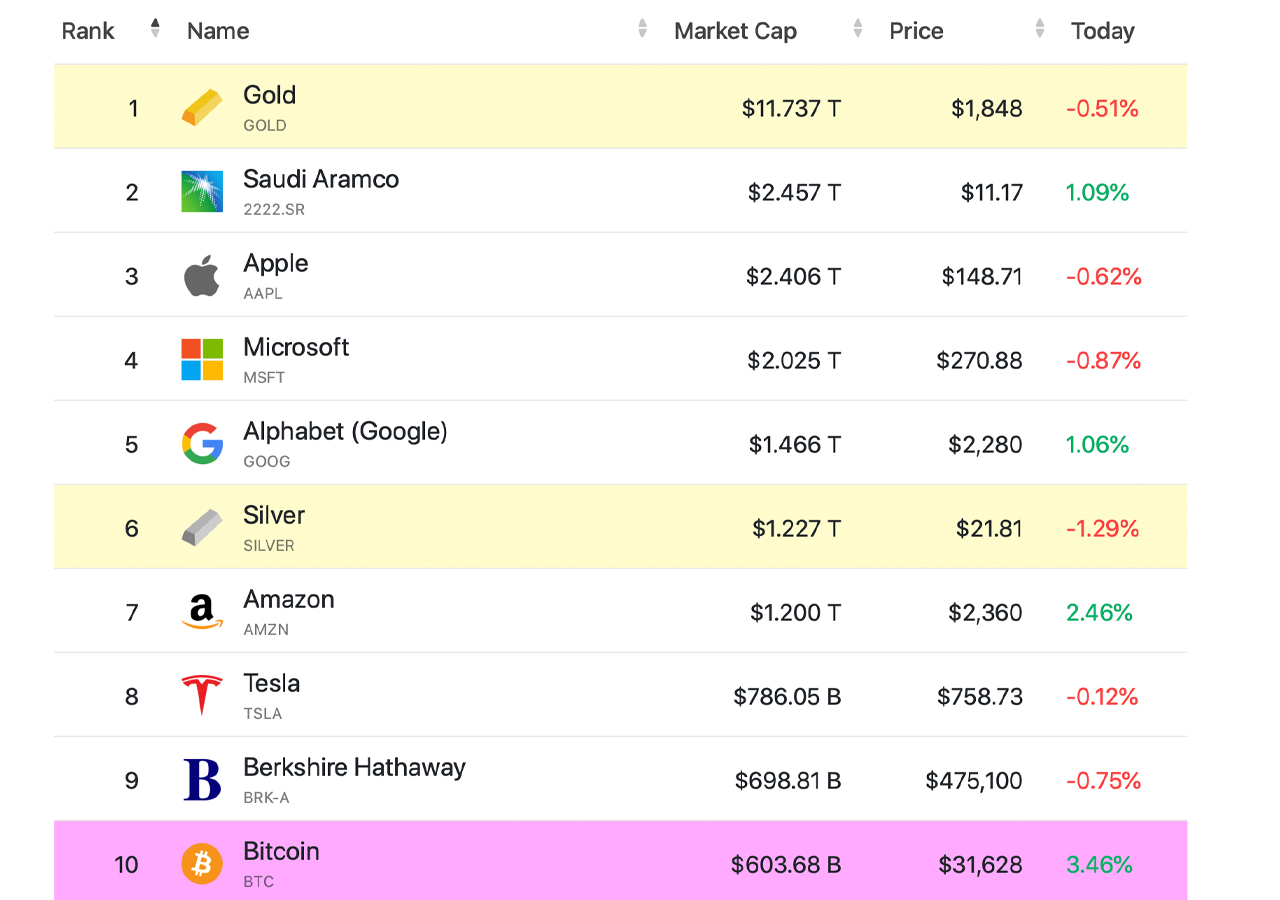

Whilst BTC is the #1 main crypto asset these days in the case of marketplace valuation, the crypto asset’s marketplace cap makes it the tenth-largest in the case of all of the main marketplace capitalizations stemming from the likes of businesses like Apple and Amazon, along valuable metals like gold and silver.

These days, gold is the biggest marketplace capitalization a number of the 6,265 commodities and firms that make up $86.516 trillion in USD price. One ounce of excellent gold these days is exchanging fingers for $1,848 in step with unit and it has an general valuation of $11.737 trillion. Companiesmarketcap.com metrics recently display bitcoin’s $603 billion marketplace cap equates to five.13% of gold’s general marketplace capitalization.

The second one-largest asset is Saudi Aramco, which is price $2.457 trillion and it eclipses all of the $1.36 trillion crypto economic system. The third-largest international asset in the case of commodities and corporate stocks is Apple with $2.406 trillion. Whilst bitcoin equates to simply 5% of gold’s web price, BTC represents 25.06% of Apple’s marketplace valuation.

Following Apple comprises belongings like Microsoft, Alphabet (Google), Silver, Amazon, Tesla, and Berkshire Hathaway respectively. Berkshire Hathaway rests above bitcoin (BTC) as the corporate’s marketplace capitalization these days is $698.81 billion. Which means BTC’s marketplace cap equates to 86.28% of Berkshire Hathaway’s web price. Bitcoin’s marketplace cap used to be a lot upper at one time and it as soon as surpassed Fb’s marketplace valuation.

In February 2022, BTC used to be the ninth-largest crypto asset in line with companiesmarketcap.com metrics. After losing to a low lately, BTC held the 11th place in the case of the sector’s most respected belongings. The crypto asset’s newest positive aspects has allowed it to recapture the 10th place in the case of the marketplace capitalizations of 6,265 commodities and firms.

What do you take into accounts bitcoin being the 10th most respected asset international? Tell us what you take into accounts this matter within the feedback segment underneath.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)